Trading

The best way to understand the crypto world is to trade cryptocurrencies. At Gate Learn, you will find the most useful tutorials to help you embark on a journey into the crypto world.

Articles (907)

Advanced

What is the Volume-Weighted Average Price(VWAP)?

The Volume-Weighted Average Price (VWAP) is a technical analysis tool for measuring the average price weighted by volume. When the price is above the VWAP line, the market is in an uptrend, and when the price is below the VWAP line, the market is in a downtrend. Lots of traders and institutions use VWAP as a key indicator to judge buying and selling points.

2023-02-13 10:43:27

Beginner

How to manage risks in cryptocurrency investment

Risk management is vital to perform an informed investment. Developing risk management awareness and mastering necessary risk management skills are vital for crypto investors.

2023-02-12 05:38:22

Intermediate

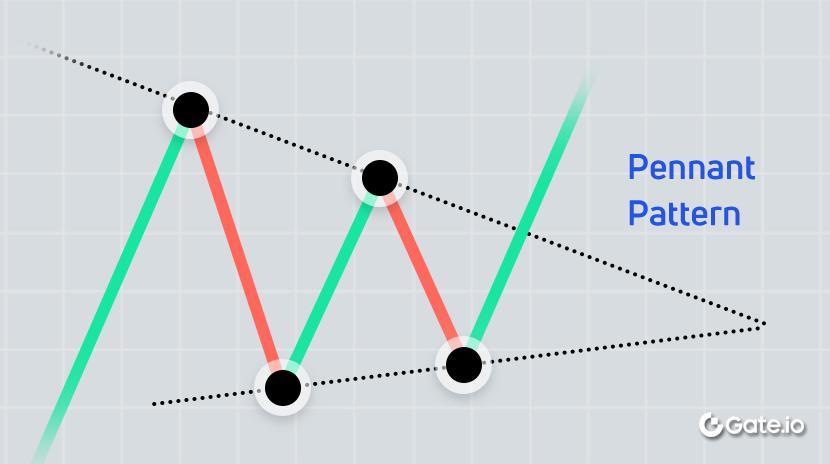

What Is a Pennant Pattern?

A Pennant is a trend continuation pattern, which follows price trends, either bullish or bearish. It helps traders monitor price trends.

2023-02-03 10:05:44

Intermediate

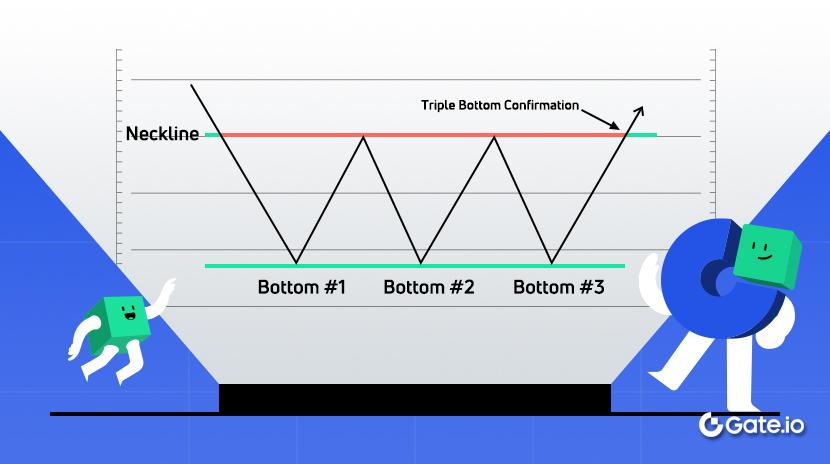

What are Triple top and Bottom Signals?

The triple top and bottom patterns are used to identify trend reversals on a chart. When learned well, both patterns can help you know when to exit a trend.

2023-01-16 16:07:27

Intermediate

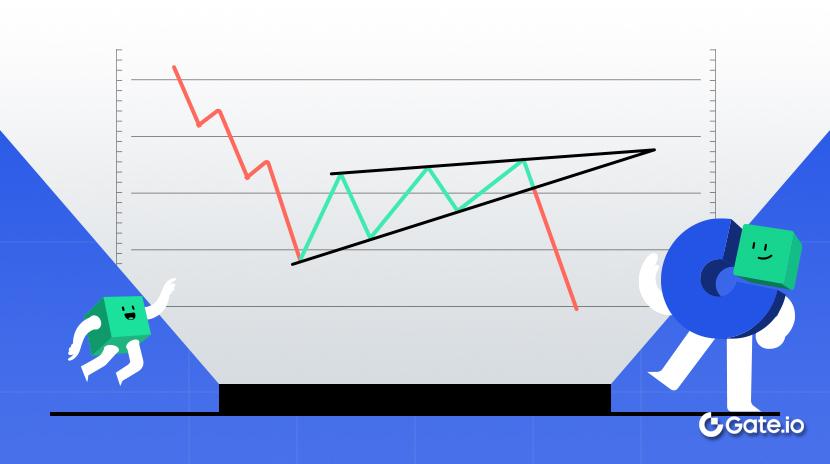

What is the Rising Wedge Pattern?

A rising wedge pattern is a popular technical indicator. It indicates a reversal seen in a bear market. Learn everything about this pattern in this article.

2023-01-16 15:54:27

Beginner

What Is Price Action?

Price action refers to the way prices change over a period of time. It helps you to make good trading decisions like when to enter and when to exit a position.

2023-01-16 15:09:08

Beginner

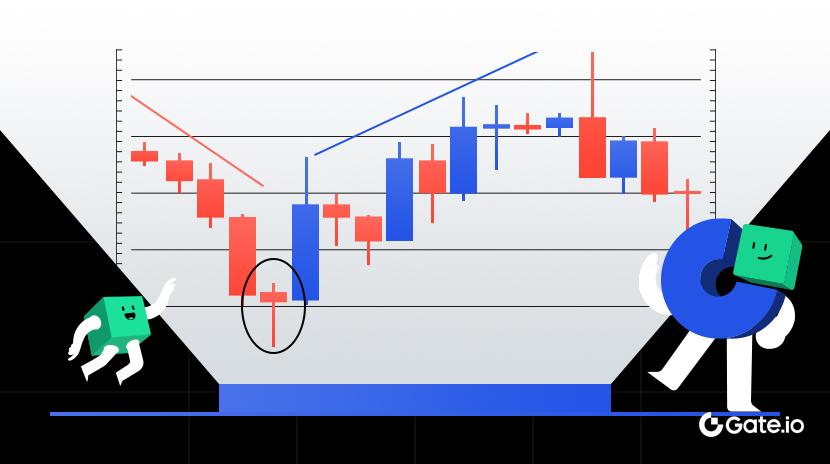

How to Draw Trendlines?

Trendlines are lines drawn on a chart to identify the direction and strength of a trend. It helps traders make more informed decisions about their positions.

2023-01-16 13:08:31

Beginner

What is Kusama Coin (KSM)?

Kusama coin (KSM) is the native token of the Kusama Network with on-chain governance capabilities for users. KSM offers a wide range of use cases such as staking, governance, and parachain auction.

2023-01-16 12:40:12

Beginner

What is Short Selling in Financial Markets?

In the financial market, whether it is traditional stock trading or crypto trading, short selling is a clear-defined and ubiquitous behavior. Basically, short selling and going long are counterparts in market operations. Opposite to long selling, short selling generally refers to the process of borrowing first and then selling, and then buying to repay later.

In short selling, there are usually market makers serving as an intermediate lending platform, similar to credit transactions. Using this trading mode, investors can often profit when prices continue to fall.

Let’s take stocks as an example. Investors borrow stocks from a brokerage firm when the stock price is high, and then sell them. When the stock price keeps falling, investors can buy stocks in the market and repay the brokerage, during which investors will earn the spread.

2022-12-28 09:34:16

Intermediate

What are Bollinger Bands?

In the trading market, investors not only use the basic K-line, but also use the trend technical indicators to predict the price movement, thus choosing trend trading. To put it simply, trend indicators can help investors lock in gains in the upward band and avoid certain risks in the downward band, to "go with the trend". The Bollinger band indicator is a very simple and practical trend indicator.

2022-12-28 09:02:07

Beginner

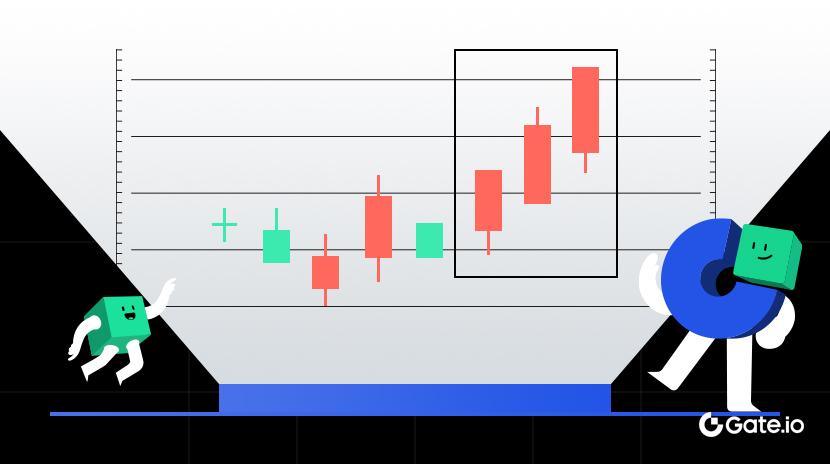

What is a Three White Soldiers Pattern?

As a common combination pattern in the trading process, the three white soldiers pattern indicates that the future market is very likely to rise.

2022-12-26 08:46:50

Beginner

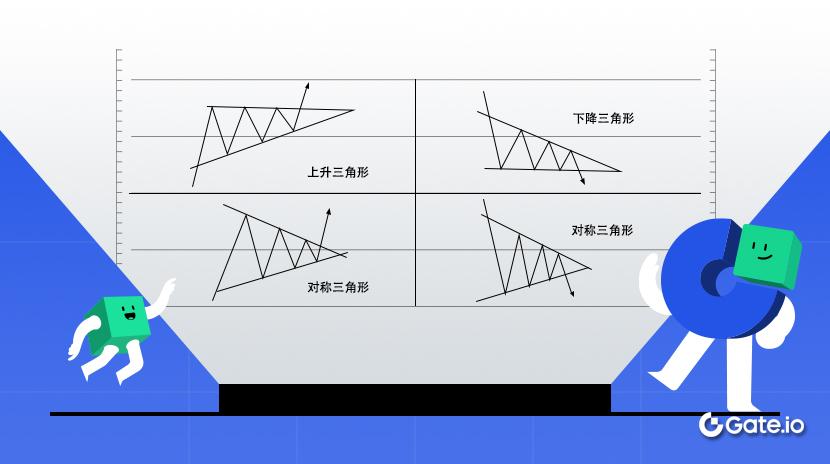

A Triangle Pattern and Its Different Forms

A triangle pattern, often mentioned in crypto trading, is a general term for stock trading, currency pairs, and crypto asset trading.

It is often used to predict market trends caused by price changes. In various price charts, the direction of movement within a narrow range between two trend lines can form an upward or downward trend. This is called a triangle pattern.

A triangle pattern can be used to predict the price movement of a currency in the market.

2022-12-26 03:40:06

Beginner

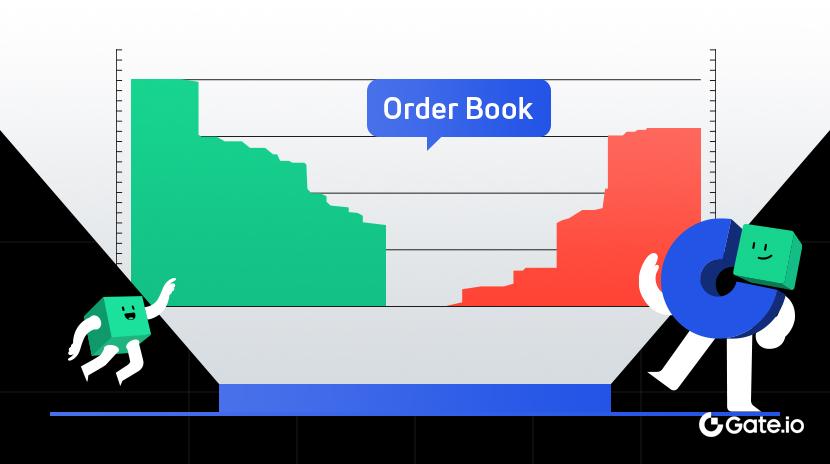

What Is an Order Book?

An Order Book is a list of open or outstanding orders for trading pairs. All order books typically share price, amount, the buy side, and the sell side.

2022-12-23 10:00:44

Intermediate

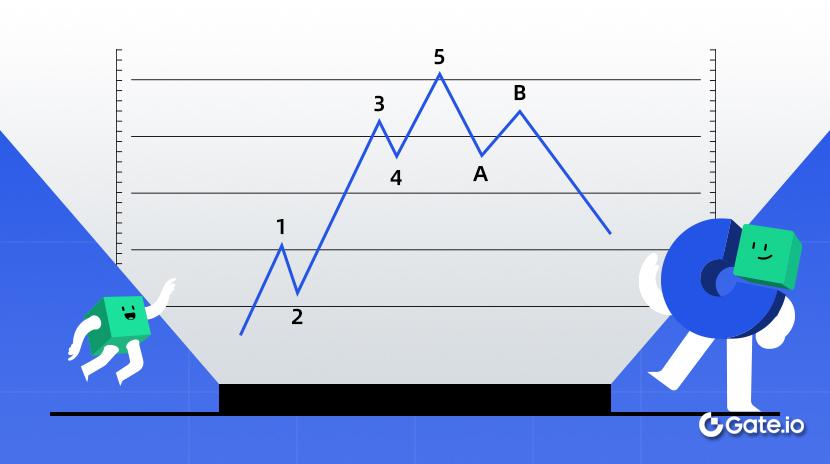

What Is the Elliott Wave Theory?

The Elliott Wave theory is a technical analysis technique that is used by technical analysts and mathematicians to make profitable market price predictions.

2022-12-23 09:51:28

Beginner

Top 5 Crypto Research Tools You Should Know

Crypto research tools are important for investors and traders and are needed to minimize risk involvement and trading losses.

2022-12-23 08:16:24