Trading

The best way to understand the crypto world is to trade cryptocurrencies. At Gate Learn, you will find the most useful tutorials to help you embark on a journey into the crypto world.

Articles (907)

Intermediate

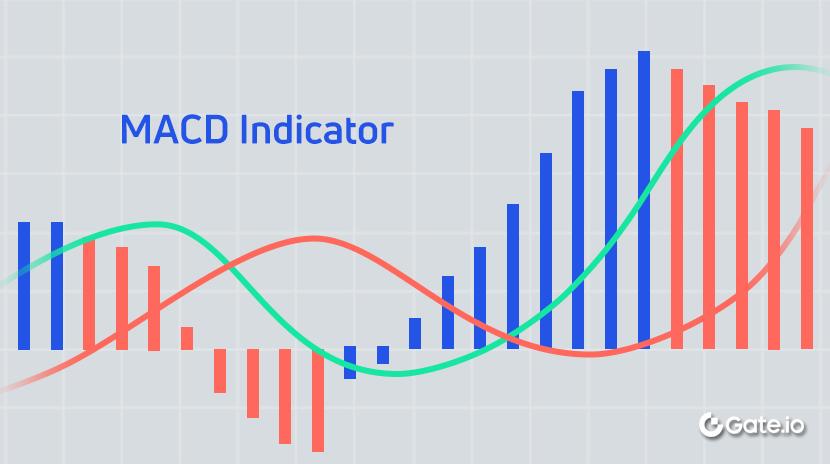

What is the MACD Indicator?

The MACD indicator is a technical analysis tool used to measure momentum and trend strength. This article will help you understand how to read and interpret the indicator on a chart.

2023-03-15 16:30:50

Intermediate

What is a Crypto Index Fund?

Crypto index funds track the performance of a specific basket of assets, providing investors with more diversification through a single asset.

2023-03-07 14:26:51

Advanced

What is the Commodity Channel Index (CCI)?

The Commodity Channel Index (CCI), also known as the momentum indicator, is one of the most common technical indicators used to measure whether market prices have exceeded the normal distribution range. It is a unique overbought/oversold indicator.

2023-03-07 13:15:03

Intermediate

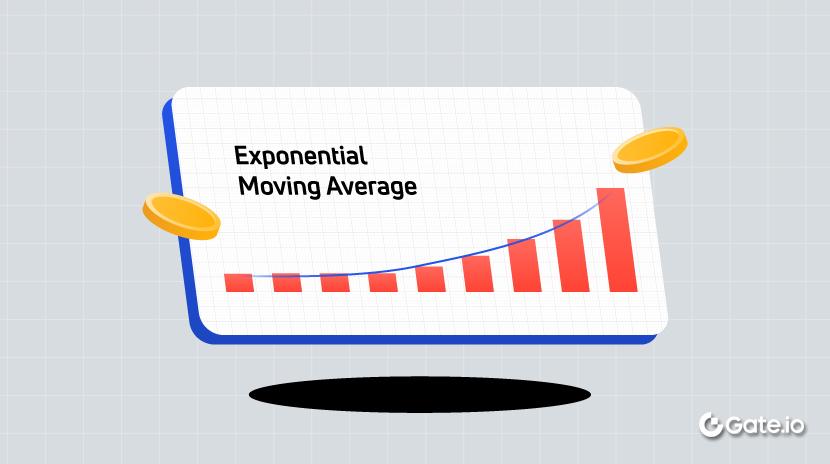

What is the Exponential Moving Average (EMA)?

The Exponential Moving Average (EMA) is a trend-based technical indicator. In most cases, investors use the EMA as a support or resistance line in trading and a combination of short-period and long-period EMA indicators to forecast price movements.

2023-03-02 09:41:10

Beginner

The Fundamentals of Support and Resistance

Support and resistance are two of the most commonly used K-line technical analyses in trading, looking at resistance on an uptrend and support on a downtrend. However, the levels of support and resistance are not absolute. Typically, the level of support and pressure will change in response to repeated changes in market conditions. In some cases, the price support may become the resistance.

2023-03-02 09:03:59

Intermediate

What is a Crypto Whitepaper and How to Analyze it?

As a crypto investor, you should understand the relevance of crypto whitepapers and especially how to analyze them before making allocation decisions.

2023-03-02 08:28:57

Intermediate

How to Trade with the Quasimodo Trading Strategy in 2025?

The Quasimodo trading strategy is a unique strategy used to spot potential buy and sell regions. In 2025, it has evolved significantly with AI-powered pattern recognition, new variations like nested and fractal QMs, and integration with DeFi platforms. The QM strategy remains highly profitable for trading cryptocurrencies, now featuring enhanced risk management techniques and impressive performance metrics such as a 72% win rate for continuation patterns. Modern traders leverage QM patterns for optimizing liquidity provision, yield farming, and arbitrage opportunities in the ever-evolving crypto markets.

2023-03-02 07:43:02

Intermediate

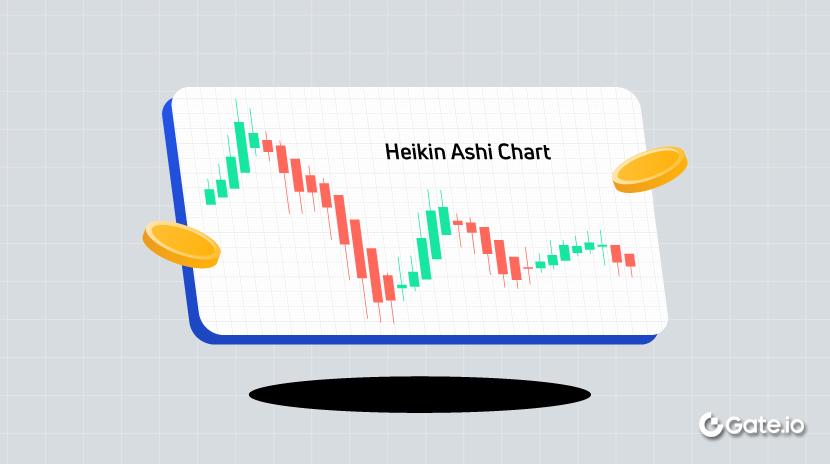

What is the Heikin Ashi Chart?

The Heikin Ashi Chart is a type of candlestick chart that provides a smoothed visual representation of price action, helping to eliminate market noise and identify trends in the market.

2023-03-02 07:20:13

Intermediate

The Wyckoff Method Explained

The Wyckoff Method is a technical analysis-based trading strategy devised in the early 1900s by the successful stock trader Richard Wyckoff.

2023-02-24 06:01:29

Beginner

What is the Dow Theory?

The Dow Theory is a technical analysis theory created by Charles H. Dow that recognizes upward and downward trends in the stock market.

2023-02-19 09:19:12

Beginner

What is the FTX Token (FTT)?

FTX Token, FTT is the native token of the FTX ecosystem that grants access to the features and services of the trading platform and generates utility by incentivizing users to hold and use the token.

2023-02-19 09:06:48

Intermediate

What is Auto-Deleveraging (ADL) and How Does it Work

Auto-deleveraging (ADL) is a risk management mechanism deployed by centralized exchanges to cancel pending orders from a user with a higher ADL ranking.

2023-02-19 07:37:00

Intermediate

What is a Donchian Channel?

A Donchian Channel is a trading technique used as an indicator by traders to identify bearish and bullish points within the financial market, and when to take a long or short position.

2023-02-14 16:06:39

Beginner

What is KuCoin Token? All you need to know about KCS

KuCoin is a user-friendly crypto exchange service that allows users to buy, sell, and trade various cryptocurrencies.

2023-02-14 15:55:23

Intermediate

What is the Parabolic SAR Indicator?

The Parabolic SAR indicator is a technical indicator that highlights the price direction of an asset.

2023-02-14 15:48:20