XRP Price Prediction: Ripple Achieves 40 Billion Valuation With Strong Institutional Outlook

Preface

After five years of regulatory headwinds, Ripple has continued to show exceptional resilience and a clear long-term strategy. John Deaton, legal counsel for XRP holders, expressed strong admiration for Ripple’s achievements in 2025, noting that even critics must recognize the company’s outstanding results amid challenging circumstances.

Behind the $40 Billion Market Cap Surge

In 2025, Ripple completed several strategic acquisitions, including Ripple Prime and GTreasury. The GTreasury deal, valued at $1 billion, was aimed at enhancing cross-border payment liquidity, settlement speed, and transaction costs. These moves, together with Ripple’s global business expansion, drove its market capitalization past the $40 billion mark.

Ripple also resolved its five-year lawsuit with the U.S. Securities and Exchange Commission (SEC) in 2025, agreeing to a $125 million penalty. The court simultaneously ruled that XRP does not qualify as a security. This milestone not only provided Ripple with a solid legal foundation but also reinforced its standing in the digital asset market.

XRP and Institutional Adoption Strategy

Ripple CEO Brad Garlinghouse emphasized that the company will prioritize the real-world utility of XRP and its stablecoin, Ripple USD (RLUSD), instead of pursuing short-term market trends. The recent approval of a UK electronic money license has further strengthened Ripple’s global compliance framework for 2026, enabling it to provide regulated crypto infrastructure to institutional clients.

(Source: JohnEDeaton1)

Ripple executive Reece Merrick forecasts that with accelerated legislation and policy initiatives like the GENIUS Act, crypto assets will increasingly become part of institutional portfolios. He identifies 2026 as a pivotal year for XRP’s institutional adoption.

Looking Ahead

As regulatory pressures stabilize and global expansion continues, Ripple’s long-term strategy and focus on utility position it as an ideal choice for institutional adoption. Investors should monitor XRP’s development in global payment infrastructure and the stablecoin sector, as these factors will directly influence its future price and market impact.

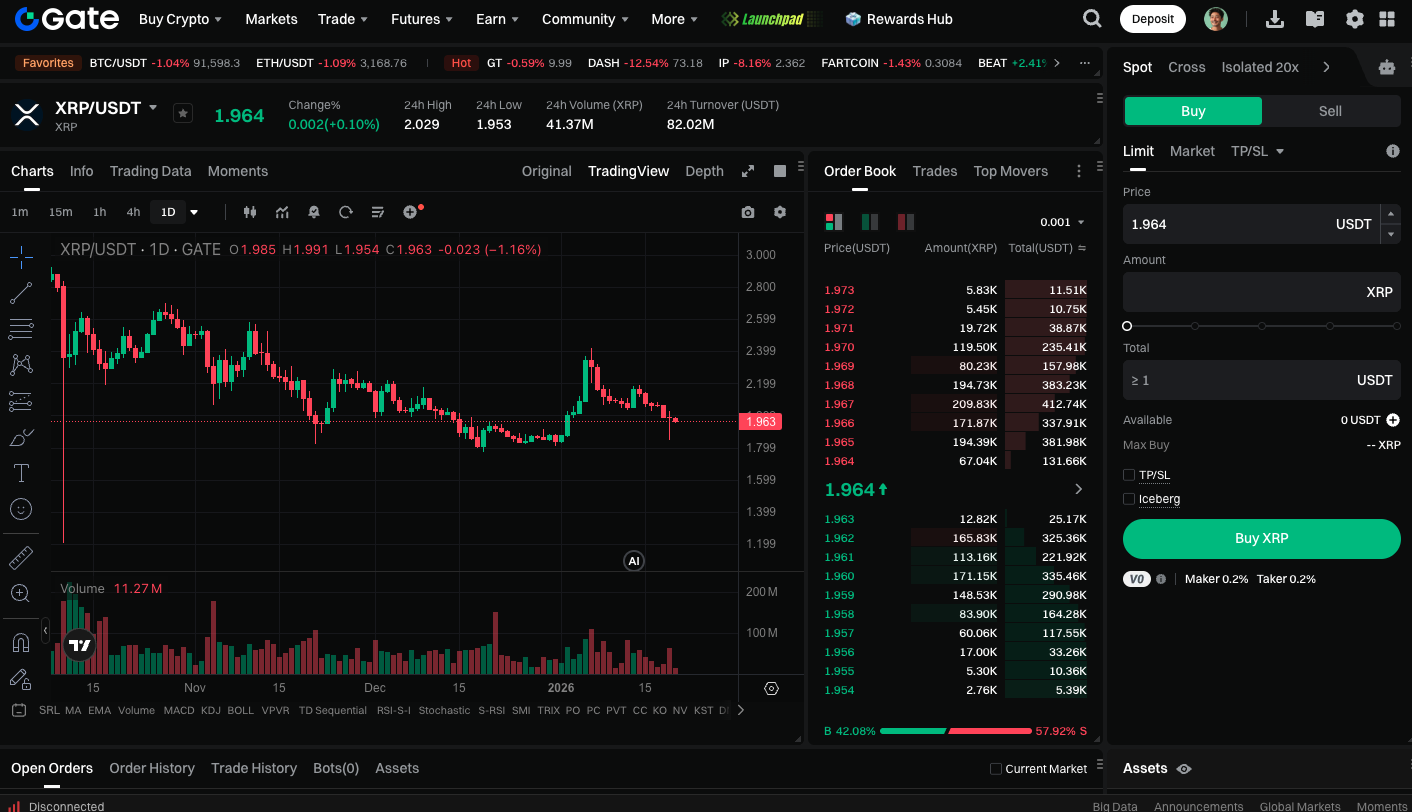

Begin trading XRP spot now: https://www.gate.com/trade/XRP_USDT

Conclusion

Having overcome prolonged regulatory challenges, Ripple has driven its market capitalization to $40 billion and enhanced its cross-border payment capabilities through acquisitions and global expansion. XRP’s utility-focused strategy and robust compliance framework provide a clear advantage for institutional adoption. With growing policy support and market demand, 2026 could mark a major inflection point for XRP’s long-term value.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Gate Alpha Launches Points System: Trade On-Chain, Earn Points, Unlock Airdrops

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?