Why Were They Able to Acquire Farcaster After It Raised Over $100 Million?

In the Web3 world, protocol ideals are often the most overvalued, while real usability tends to be underestimated.

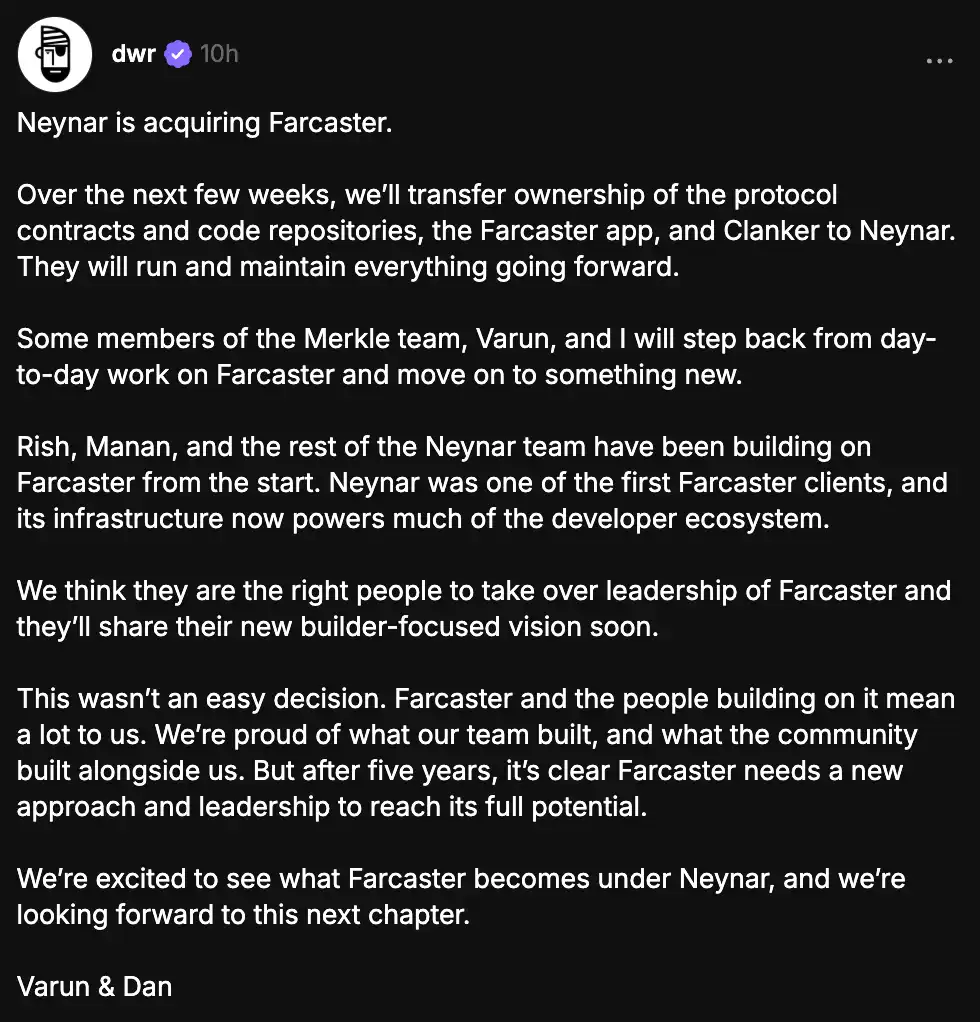

On January 21, Farcaster co-founders Dan Romero and Varun Srinivasan—whose protocol was previously backed by top investors like A16Z and Paradigm and valued at over $1 billion—announced that Neynar would acquire Farcaster. In the coming weeks, Farcaster’s protocol contracts, code repositories, official client, and Clanker will be transferred to Neynar, which will take over operations and maintenance. Some members of the founding Merkle team, along with Dan and Varun themselves, will step away from daily management to pursue new ventures.

This acquisition follows a period of dramatic volatility for Farcaster. The protocol reached a $1 billion valuation in 2024, but suffered significant revenue decline and user attrition in Q4 2025. While there were previous rumors that Coinbase might acquire Farcaster, the outcome is now clear: Neynar—the largest middleware and developer tool provider in the Farcaster ecosystem—has completed its transformation from “shovel seller” to “mine owner,” achieving vertical integration across the protocol, application, and infrastructure layers.

After an open protocol completes its five-year trial, its future growth depends less on narrative, community, or vision, and more on who can operate it reliably as a sustainable product and platform.

Who Is Neynar: Farcaster’s Cloud Service Layer and the Most “Alchemy-like” Company in the Ecosystem

If you think of Farcaster as an open social protocol, Neynar’s role is not front-end content distribution but foundational infrastructure. Neynar provides developers with hosted hubs, REST APIs, signer management, new account creation, and webhooks, enabling external teams to read and write Farcaster social data (users, relationships, casts, interactions, etc.) without building their own nodes or indexing systems.

As a result, Neynar has long played a pragmatic role in the Farcaster ecosystem, transforming the cost of building a social app from DevOps-heavy labor into a paid service. Many applications default to Neynar as their data gateway; even Dune’s Farcaster data tables are structured as dune.neynar.datasetfarcaster*. Some third-party analytics explicitly note that Dune’s Farcaster table data is regularly supplied by Neynar.

This helps explain a subtle misconception in the community: Neynar seems like a tool built around Farcaster, but in reality, it’s much closer to being the infrastructure’s primary distributor.

Neynar’s leadership is deeply rooted in the Coinbase network—a highly influential Web3 entrepreneurial circle formed by former employees of the largest US crypto exchange, Coinbase. This background not only shapes Neynar’s corporate culture but also served as a key connection for this acquisition.

Rishav (Rish) Mukherji (CEO/Co-Founder): Rishav Mukherji is a Harvard graduate and previously served as Group Product Manager at Coinbase. There, he gained substantial experience scaling crypto products and building compliance infrastructure.

Manan Patel (CTO/Co-Founder): As technical lead, Manan Patel is also a Coinbase alumnus, formerly Engineering Manager and team leader. He brings additional experience from Uber and game development, with deep expertise in high-concurrency, real-time data processing—critical for social network infrastructure.

To understand this acquisition, it’s essential to recognize a commonly overlooked fact: Neynar was not a late-stage third-party entrant—it’s been closely tied to Farcaster since the beginning.

Neynar started by building applications on Farcaster, gradually evolving into a developer platform—a growth trajectory repeatedly emphasized in Fortune’s funding reports, where tools originate from frontline developer needs, not arbitrary design.

Capital structure is even more crucial. In May 2024, Neynar announced a $11 million Series A led by Haun Ventures and USV, with follow-on investments from a16z CSX and Coinbase Ventures. Early investors also include Farcaster’s two co-founders. CypherHunter’s pre-seed summary confirms Dan Romero and Varun Srinivasan as early Neynar investors and supporters.

This relationship means Neynar is less an outsourced protocol team and more a product of a classic Silicon Valley crypto trajectory: Coinbase talent network, top-tier fund backing, and a developer tools business model. Neynar is naturally better at building paid products, APIs, and platform services than running a purely idealistic “decentralized social movement.”

As a result, Neynar and Farcaster function more like ecosystem symbionts: the protocol supports infrastructure, and as infrastructure grows, it becomes the protocol’s default gateway. As Farcaster enters a stage demanding stronger operations and commercialization, this structure naturally converges.

Why Now?

Before the acquisition, Farcaster had already undergone a major narrative shift.

In December 2025, Farcaster shifted its strategic focus from “social-first” to “wallet-first.” Dan Romero stated that after 4.5 years of prioritizing social, the team had not found a sustainable growth mechanism, while wallet and trading tools showed greater product-market fit.

Farcaster is no longer just a social protocol; it is increasingly positioned as a potential financial gateway. The social feed is just an interface—the true commercial closed loop lies in asset activity, transactions, subscriptions, and payment pathways.

This is precisely where Neynar is closest to revenue. As developers and users shift their core actions from “posting” to “transacting and distributing,” infrastructure-layer access control, real-time events, signing, and account systems become the network’s heart—and Neynar is already in that position.

In Neynar’s own acquisition announcement, they did not present the deal as “territory expansion,” but stated their clear goal: maintain the protocol, operate the client, run Clanker, and help builders turn ideas into recurring revenue.

Providing core infrastructure for an ecosystem over time gives you call volume, data pathways, and developer mindshare. Yet you remain subject to protocol direction, product priorities, and official client strategy. If the protocol pushes more aggressively toward wallets, transactions, and subscriptions, the infrastructure company’s “outsourced identity” only increases friction.

This acquisition is a vertical integration, upgrading infrastructure’s de facto control to formal responsibility for both protocol and client. This reduces internal friction and clarifies property and decision rights for future commercialization.

What’s Next for Farcaster

Neynar states that Farcaster will not suddenly shut down or undergo drastic changes. They emphasize “no immediate changes” and will first prioritize tasks. The focus will be on building a network for builders, enabling easier creation, smoother distribution, and more direct revenue cycles. Farcaster’s goal may increasingly resemble a programmable social economic operating system: the social graph provides distribution, wallets and transactions offer pricing tools, Frames/mini apps enable in-content actions, and the infrastructure layer standardizes, productizes, and monetizes these activities.

Dan and Varun did not reveal their next steps in the announcement, only saying they would leave Farcaster’s daily operations to pursue new projects.

From a business perspective, this is straightforward. As Farcaster moves from protocol exploration to operations and product management, it needs stronger execution and commercial discipline, not ongoing idealistic storytelling about open social networks. Turning the reins over to a team skilled in developer tools, commercialization, and operations essentially transitions Farcaster from an experimental project to a viable asset.

The founders’ departure is not an exit, but a role shift. They scaled a paradigm to a deliverable stage, then handed the system to those who can run it as a business, while seeking the next major structural opportunity themselves—a common occurrence in Silicon Valley tech entrepreneurship, and especially in crypto.

Statement:

- This article is reprinted from [BlockBeats]. Copyright belongs to the original author [BlockBeats]. If you have any objections to this reprint, please contact the Gate Learn team, which will handle your request promptly according to established procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Unless Gate is mentioned, do not copy, distribute, or plagiarize the translated articles.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?