Why Trump’s WLFI Is Dressing Up as a “National Bank” — Even as a DeFi Platform

On January 12, World Liberty Financial (WLFI), a project affiliated with the Trump family, launched its lending platform, World Liberty Markets.

Previously, on January 7, WLFI announced that its subsidiary, WLTC Holdings LLC, had submitted an application to the Office of the Comptroller of the Currency (OCC) to establish World Liberty Trust Company, National Association (WLTC)—a national trust bank designed specifically for stablecoin operations.

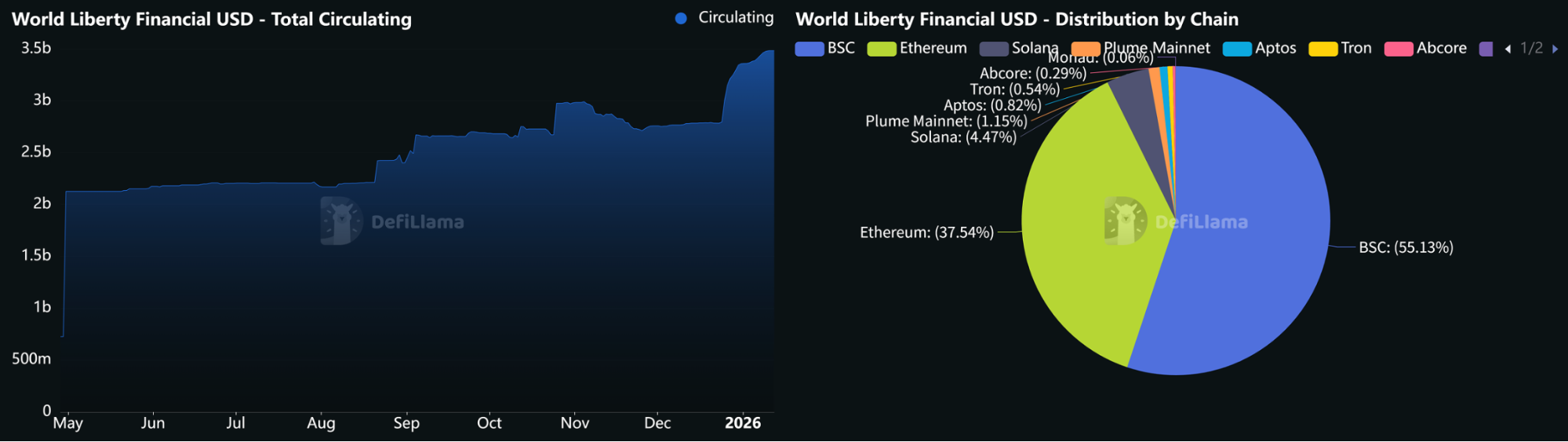

WLFI’s USD-pegged stablecoin, USD1, surpassed $3.4 billion in circulating supply within a year (per CoinMarketCap), making it one of the fastest-growing USD-pegged stablecoins.

Leveraging federal regulatory frameworks and liquidity lending markets, WLFI is not only seeking new use cases for USD1, but also working to bridge the divide between TradFi and DeFi.

USD1 total market cap and chain distribution | Source: DeFiLlama

DeFi Lending Platform World Liberty Markets: Real-World Application of USD1

Just five days after submitting its license application, WLFI launched World Liberty Markets, marking the operational debut of its DeFi business. Built on the Dolomite protocol and first launched on Ethereum, the platform signals plans for multi-chain expansion.

World Liberty Markets is positioned as a lending marketplace centered around USD1. Users can deposit assets to earn interest, or use their holdings as collateral to borrow other tokens.

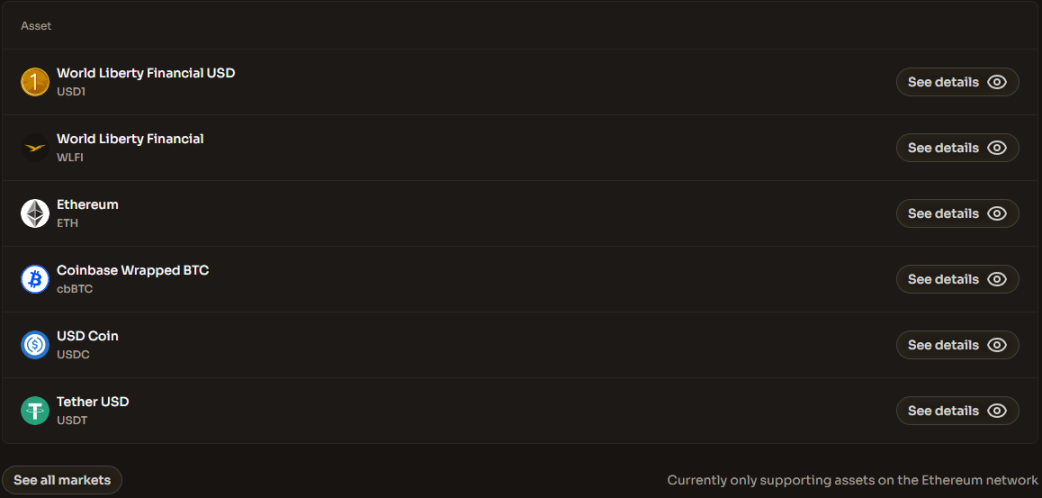

The lending system is anchored by USD1 and supports collateral types including ETH, USDC, USDT, WLFI, and cbBTC, covering major crypto assets and protocol-native tokens. This structure supports demand for USD1 accumulation and establishes its liquidity foundation within DeFi.

Supported coins on WLFI Markets | Source: WLFI Official Website

For governance, WLFI token holders have proposal and voting rights, enabling them to decide on critical matters such as adding collateral assets, adjusting interest rate parameters, or setting user incentives.

The platform’s launch immediately sparked market reaction. Dolomite, the underlying protocol provider, saw its native token DOLO surge 71.9% on the day.

DOLOUSDT daily chart | Source: Bitget

WLFI also introduced early incentive programs, boosting USD1 deposit yields to attract initial users. According to the WLFI Markets page, USD1 lending incentives are powered by Merkl, with annualized rates fluctuating in real time.

While its regulatory application remains under review, the launch of World Liberty Markets enables WLFI to proactively establish business use cases. Regardless of the final outcome of the license, USD1 has already evolved from an issuance concept to an on-chain lending utility, entering direct competition in the mainstream DeFi ecosystem.

National Trust Bank License Application: Stablecoin Operations Enter the Regulatory Framework

WLFI’s planned subsidiary, World Liberty Trust Company (WLTC), is seeking a national trust bank charter from the OCC. If approved, USD1’s operations would shift from third-party partnerships to a “full-stack” model under direct federal oversight.

WLTC’s proposed business includes: direct minting and burning of USD1 without external intermediaries; direct USD–USD1 exchange services; and regulated custody for USD1 and related assets, gradually replacing third-party providers such as BitGo.

The significance of this license goes well beyond business integration. OCC approval would bring the project under federal regulation, profoundly impacting user trust and institutional adoption.

Binance has already played a major role in USD1’s creation and added trading pairs, while Coinbase has listed the asset. Regulatory endorsement further reduces user concerns, and direct federal oversight positions WLFI to better comply with requirements like the GENIUS Act.

WLFI also aims to eliminate potential conflicts of interest through its organizational structure. To address possible political scrutiny, CEO Zach Witkoff stated that the trust company is designed to avoid conflicts—neither Trump nor his family members will serve as executives or exercise daily control.

USD1 is also gaining institutional support, showing increased market penetration. Abu Dhabi investment firm MGX used USD1 to purchase $2 billion in Binance shares, providing notable external validation.

Despite rapid progress, WLFI faces significant uncertainties. The OCC’s review will focus on potential conflicts of interest. Although Zach Witkoff emphasizes that the Trump family holds no executive or voting power, the politically sensitive environment leaves the outcome uncertain.

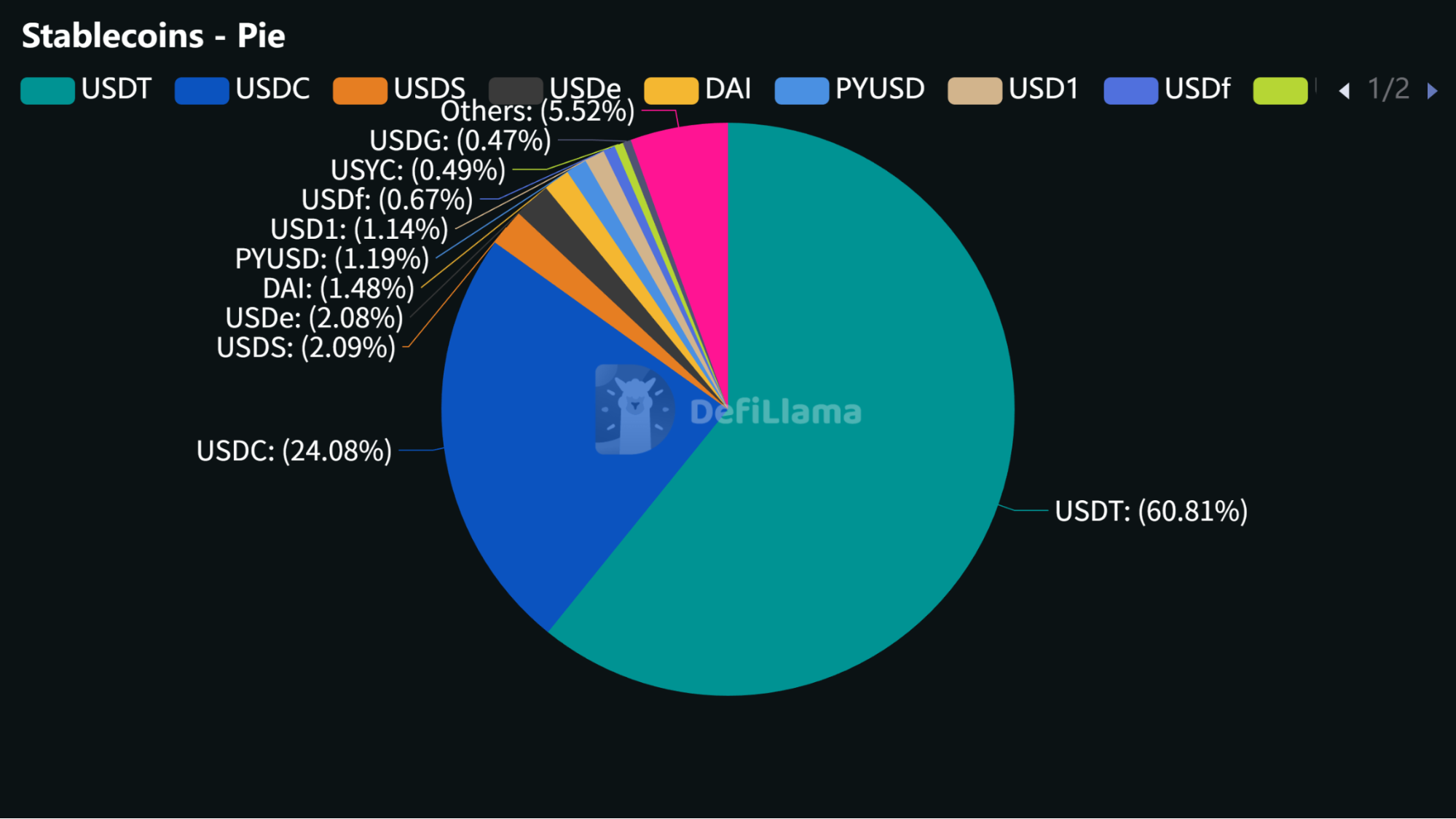

Additionally, while USD1 is expanding quickly, it still trails USDT and USDC—the leading stablecoins—in liquidity depth and use cases. To keep growing, WLFI must prove its advantages extend beyond regulatory support and endorsements, delivering technical performance, capital efficiency, and DeFi composability that match or surpass mainstream competitors.

Stablecoin market share | Source: DeFiLlama

License and DeFi Lending: Indirect Yet Strategically Complementary

As the OCC continues to grant similar licenses to companies like Circle, Ripple, BitGo, Paxos, and Fidelity, a regulated crypto banking system is emerging.

There is no direct regulatory linkage between a national trust bank license and DeFi lending, but the indirect benefits are substantial.

Federal regulatory status boosts USD1’s credibility and liquidity in DeFi. This credit endorsement draws more capital into liquidity pools, increasing lending market depth and stability.

Licensing bridges TradFi and DeFi, lowering entry barriers for traditional users to participate in DeFi lending via fiat onramps.

It also enables a fully closed-loop business model. WLFI plans to launch a mobile app, USD1 debit card, and RWA integrations (such as tokenized real estate collateral)—all benefiting from regulatory clarity and credit endorsement.

Disclaimer:

- This article is republished from [Foresight News], with copyright belonging to the original author [Sanqing]. If you have concerns about this republication, please contact the Gate Learn team; your request will be processed promptly according to established procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Unless Gate is explicitly referenced, do not copy, distribute, or plagiarize the translated article.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

Sui: How are users leveraging its speed, security, & scalability?

Dive into Hyperliquid

What Is a Yield Aggregator?

What is Stablecoin?