Why Are More and More Traders Choosing to Trade Gold and Silver Perpetual Contracts on Gate?

1. As the Market Strengthens, Trading Methods Become Critical

As gold and silver repeatedly hit new highs, market conversations often center on price. But for active traders, the real question is how to participate—and where.

Traditional precious metals trading is constrained by limited trading hours, rigid account structures, and complex processes, making it difficult to support high-frequency adjustments or flexible hedging. This is precisely why Gate introduced perpetual contracts for precious metals.

2. Why Trading Precious Metals on Gate Lowers the Barrier to Entry

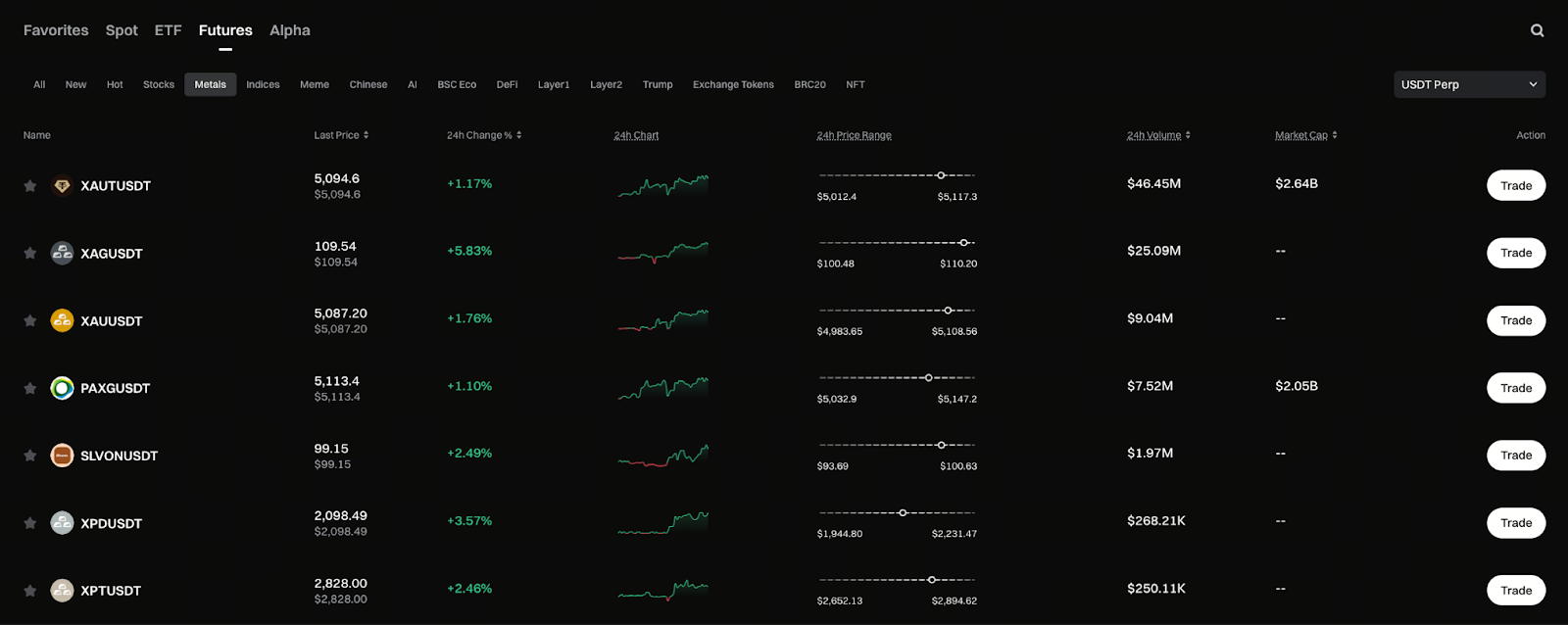

Chart: https://www.gate.com/price/futures/category-metals/usdt

Gate integrates gold and silver into its existing contract system, so users don’t need to switch accounts or learn new rules.

- Trading interface matches that of crypto contracts

- USDT-margined for more intuitive fund management

- No physical delivery, making the process more streamlined

For users already trading contracts on Gate, the precious metals section is an almost seamless, zero-learning curve expansion.

3. What 24/7 Trading Means for Precious Metals Traders

Macroeconomic events don’t follow exchange opening hours. The inability to adjust positions when key data drops or sudden events occur is often the greatest risk. Gate’s precious metals perpetual contracts offer 24/7 continuous trading, allowing users to:

- Set stop-loss or take-profit orders

- Adjust position direction

- Respond quickly to sudden market moves

This flexibility is especially crucial for gold and silver during periods of high volatility.

4. The Role of Precious Metals Perpetual Contracts in the Gate Ecosystem

Within Gate’s trading ecosystem, precious metals perpetual contracts aren’t “alternative assets”—they’re strategic assets.

- Serve as a risk buffer in crypto portfolios

- Enable macro event-driven trading

- Support multi-asset strategies alongside other contract types

Gate’s unified risk control and clearing mechanisms make it easier to coordinate strategies across asset classes.

5. Why Gate Is the Ideal Platform for Precious Metals Contract Trading

Precious metals contracts demand exceptional liquidity, robust pricing mechanisms, and strong risk controls. Gate’s experience in crypto derivatives enables it to deliver these capabilities for traditional financial assets.

- Mature contract risk management system

- Stable matching and clearing mechanisms

- Unified framework for multi-asset management

That’s why so many users choose Gate for precious metals contract trading.

6. Conclusion: Selecting Assets Means Choosing the Right Platform

Whether gold and silver will continue to rise is up to the market. But your trading experience and risk control depend on the platform you choose.

With its precious metals perpetual contracts, Gate gives traders a more efficient and flexible way to participate, making traditional safe-haven assets truly tradable, manageable, and strategy-ready on a crypto platform.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About