Where DeFi Goes From Here

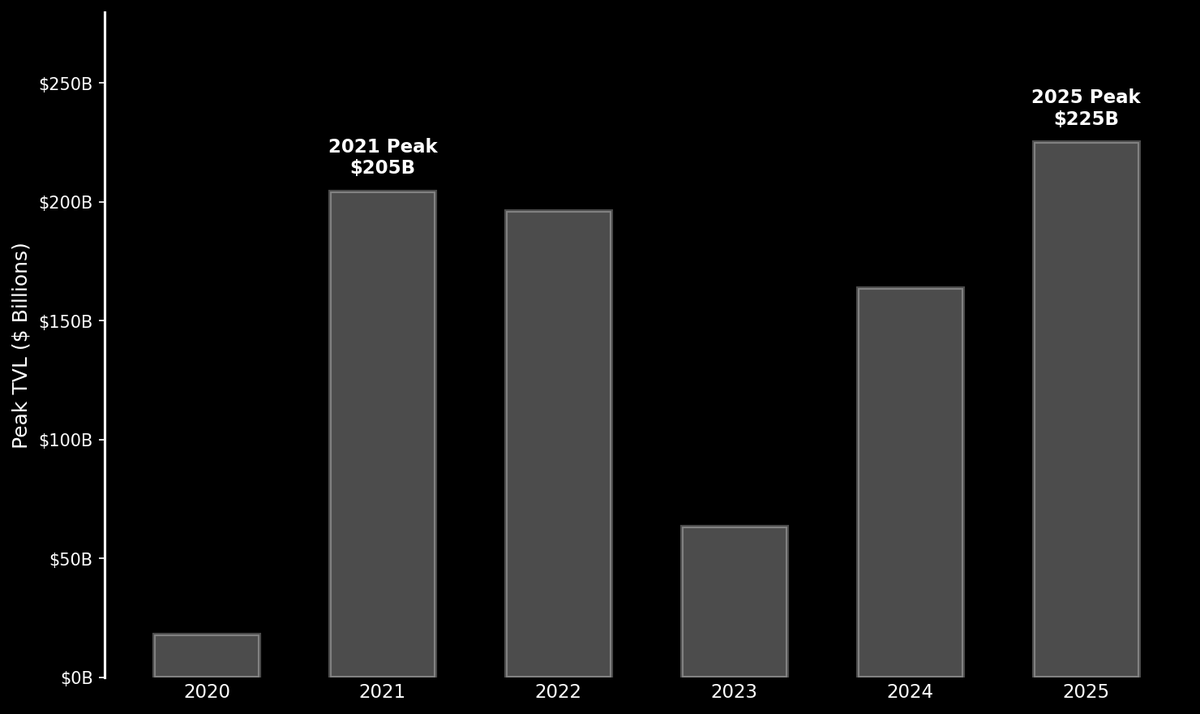

In 2025, DeFi TVL hit a new all-time high, but it wasn’t much higher than its 2021 peak. Now that things have cooled off, it’s worth asking where the next wave of capital and users are going to come from.

Current Situation

Riding the wave of DeFi summer, TVL climbed to $204 billion in late 2021, then slowly bled out after the collapse of FTX and others as we headed towards a bear market. Then DeFi clawed its way back, hitting $225 billion in October 2025. However, a 10% jump in four years isn’t exactly explosive. The first wave of participants, mostly crypto natives and traders, might be tapped out.

The fact that both peaks are so similar is cause for concern but it’s not existential. Our current crowd, as dedicated as they are, just isn’t big enough to take things to the next level.

To break through, DeFi needs a much bigger audience. The silver lining is that the audience is out there… waiting to be onboarded with the right tools.

Silver Lining

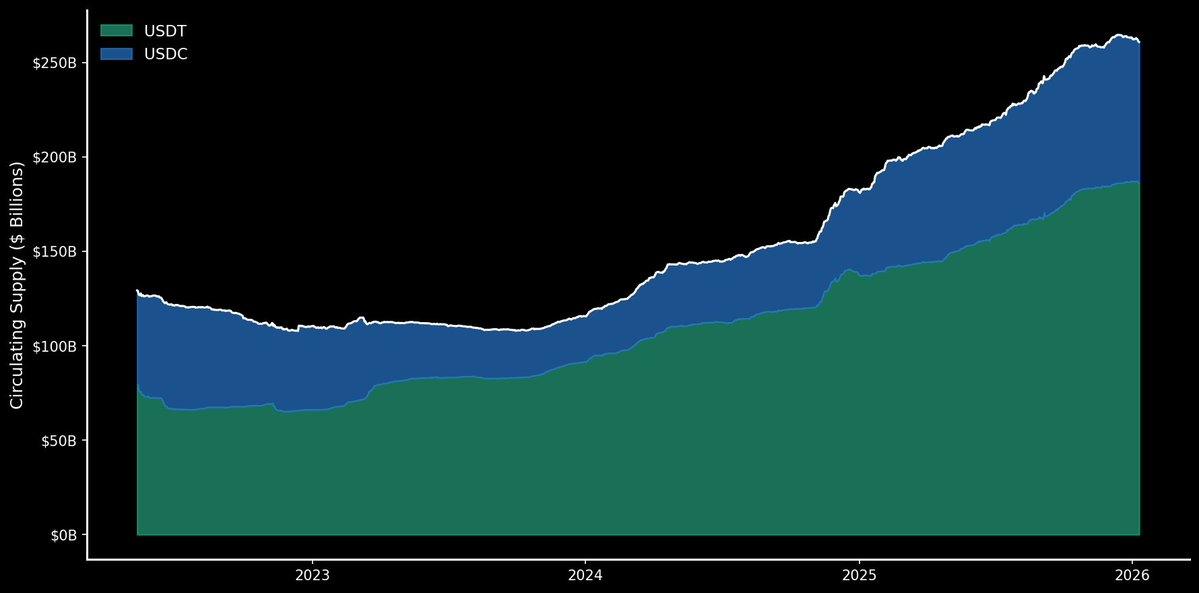

Last year the stablecoin market benefitted most and more dollars are onchain than ever before. USDT and USDC have been growing steadily, and together they represent over $260 billion (i.e. they’re bigger than DeFi).

People keep minting stablecoins even when DeFi isn’t parabolic, which shows that there’s still plenty of demand to move money onchain. We’re also seeing more and more users tapping into yield that DeFi offers, and the growth here signals where the next push can come from.

The rise of yield-bearing stablecoins and RWAs highlights this further. According to @ stablewatchHQ, yield-bearing stablecoins now represent over $20 billion in value, with products like sUSDS, sUSDe, and others finding a ton of traction over the past year or so. Alongside yield-bearing stablecoins, RWAs are also finding success onchain. These products offer real yield backed by treasuries and other traditional assets, and they’re growing fast.

Only issue is that right now, they’re mostly serving crypto-natives and onchain whales. Their potential is underrated for as long as that’s the case. There’s a mass market opportunity here for yield-bearing stablecoins and RWAs, if they’re packaged correctly for everyday users.

Retail Isn’t Here

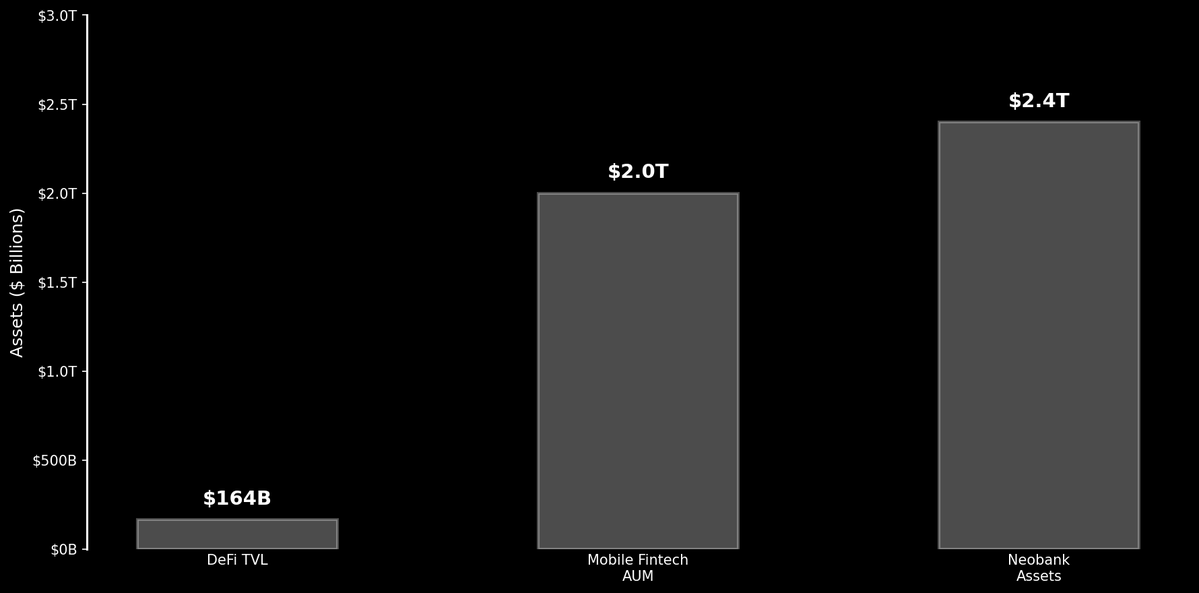

To see how big the opportunity is, we can look at DeFi next to fintech. The entire DeFi market sits at around $164 billion in TVL (current). Mobile fintech apps manage over $2 trillion in customer assets globally. The top 100 neobanks alone hold $2.4 trillion in total assets. DeFi is a rounding error by comparison.

“Build it and they will come” can only get us so far. If DeFi is going to grow, it needs to pursue the everyday users who make fintech massive.

The success of protocols like @ aave, @ ethena_labs, and @ pendle_fi in 2025 proves that participants are hungry for yield. These have been the bright spots, pulling in a lot of capital and attention. If we can deliver these products to the masses, in a way that’s well communicated and easy to use, there’s (literally) trillions of dollars and tens of millions of users up for grabs.

Path Forward

Over the next year, the real test for DeFi is whether it can make yield opportunities easy and safe for regular people. Growth won’t come from more complicated financial products, the hundredth yield farm, the hundredth perps DEX, or the millionth airdrop. It’ll come from simple, reliable products, built on decentralized protocols that solve real problems for the average person. And yield should be front and center (cough, Aave App, cough).

Hundreds of millions of people use banking and fintech apps. They’re already comfortable managing their money from their phones. If DeFi can win a small piece of that, it would kick off a new wave of growth, and we won’t top out at $200B TVL… again.

Embedded DeFi will play a big role here, with fintechs and neobanks plugging into onchain yield. But teams should also push beyond that. Protocols that lead the way for consumers will capture the most upside. The ones that keep optimizing for crypto-natives will be fighting over a pie that may not keep growing in its current state.

DeFi will win.

Disclaimer:

- This article is reprinted from [0xkolten]. All copyrights belong to the original author [0xkolten]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

Sui: How are users leveraging its speed, security, & scalability?

Dive into Hyperliquid

What Is a Yield Aggregator?

What is Stablecoin?