When BTC Is No Longer Just “Hold and Wait”: An Alternative Holding Strategy Offered by GTBTC

1. Many BTC Remain Idle

For most long-term holders, managing BTC is simple: buy, store, and wait.

This strategy makes sense during bull markets. However, over longer time horizons, challenges emerge—when the market enters a period of consolidation or trades sideways, BTC may not decline, but it generates little to no additional value.

From an asset management perspective, this represents a classic inefficient state.

2. BTC Holders Face a Real Challenge

As BTC’s market cap grows, its price volatility continues to decline. This makes it increasingly difficult to rely solely on price appreciation for returns. For long-term holders, the core question shifts from “Will it go up?” to “Is there a better way to hold BTC while waiting for appreciation?”

This is the backdrop for the emergence of yield-generating BTC products.

3. GTBTC Is Not a High-Risk Substitute

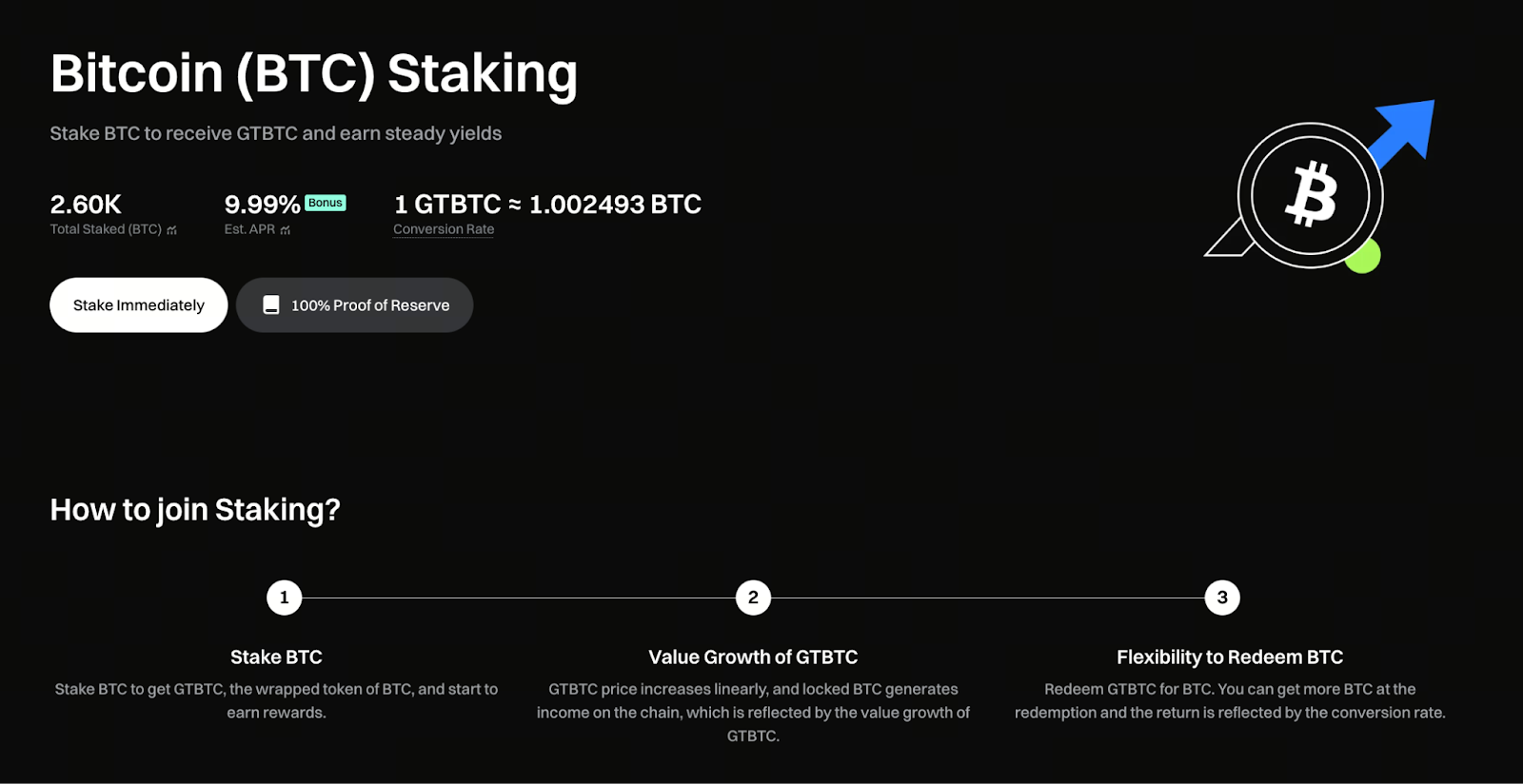

Image: https://www.gate.com/staking/BTC?pid=24

GTBTC is not designed to make users give up their BTC. Instead, it optimizes BTC utilization without changing its core attributes. Through Gate’s on-chain earning system, users convert BTC into GTBTC. The asset value remains anchored to BTC, but returns are no longer dependent solely on price movement.

This approach makes GTBTC more of an asset upgrade than a replacement.

4. Returns Don’t Come from Frequent Trading

Unlike strategies that rely on high-frequency trading, GTBTC’s returns come from structured management. Users don’t need to trade repeatedly or constantly monitor market trends.

Returns accumulate naturally through net asset value growth. This is especially valuable for users who prefer not to monitor the market intensively. It’s a “time-for-yield” model.

5. How GTBTC Reshapes Holder Expectations

Traditionally, holding BTC through a sideways market feels like nothing is happening. Under the GTBTC structure, even with limited price movement, the asset continues to grow through its yield mechanism.

This positive feedback helps reduce emotional swings, making holding behavior more stable and rational.

6. The True Value of 9.99% Annualized Yield

A 9.99% annualized yield isn’t aggressive, but for an asset like BTC, its significance is amplified. It means BTC can take on greater asset management functions, not just serve as a store of value, without meaningfully increasing risk exposure.

This marks a major upgrade for long-term allocation strategies.

7. GTBTC’s Role in Asset Allocation

GTBTC isn’t suited for chasing short-term gains, but it’s well positioned within a long-term asset portfolio. It enhances return efficiency per unit of time while maintaining BTC’s overall risk profile.

For users who already believe in BTC’s long-term value, GTBTC is a natural extension.

8. GTBTC and the Future of BTC Utilization

GTBTC isn’t an isolated product—it reflects the market’s evolving approach to BTC utilization. In the future, BTC will likely shift from “hold and wait for appreciation” to a foundational asset that’s manageable, optimizable, and composable. GTBTC is one example of this broader trend in action.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About