What Is TradFi (Traditional Finance)? A Complete Guide

TradFi manages assets worth hundreds of trillions of dollars worldwide, covering equity markets, bond markets, foreign exchange, commodities, and derivatives. Through regulated intermediaries and legal frameworks, TradFi enables saving, lending, investing, payments, and risk management across the global economy.

As blockchain technology and decentralized finance (DeFi) mature, TradFi remains the dominant financial system while gradually integrating tokenization, on-chain settlement, and hybrid financial models. This guide explains what TradFi is, how it works, its core components, and how it differs from DeFi.

What is TradFi?

TradFi is short for Traditional Finance and refers to the mature global financial system most people rely on daily. It is built on centralized infrastructure and operates through legal systems and financial intermediaries, supporting global capital flows and financial markets.

Originating from medieval banking and early exchanges, TradFi has developed over centuries and now manages the vast majority of global financial assets, including equity markets with a total value exceeding $100 trillion. The system relies on intermediaries such as banks and brokers to facilitate transactions, manage assets, and deliver financial services. These institutions offer savings accounts, loans, mortgages, foreign exchange trading, and stock and bond investments, all under the supervision of central banks and regulators like the Federal Reserve and the SEC.

TradFi remains a pillar of the modern economy. In recent years, it has increasingly intersected with decentralized finance, as crypto exchanges begin offering TradFi-related products. Platforms such as Gate TradFi now provide access to stocks, gold, forex, and index CFDs, bridging traditional and crypto finance.

Main Components of TradFi

TradFi is built on several key pillars, including banks, capital markets, insurance companies, and regulatory authorities. Together, these centralized institutions deliver essential services such as financial intermediation, risk management, and payment settlement.

Key Participants

Banks, including retail and investment banks, sit at the center of TradFi. They provide deposit services, lending, and payment settlement, acting as the main conduit for capital flows. Capital markets and stock exchanges enable the trading of equities and bonds, helping companies raise funds while allowing investors to diversify risk. Insurance companies manage uncertainty by transferring risk through policies that protect individuals and businesses.

Financial Market Infrastructure

Financial markets form another core component of TradFi, encompassing money markets for short-term liquidity, capital markets for long-term financing, foreign exchange markets, and derivatives markets. These systems allocate resources across time and geography, supporting trade and hedging activities. Payment processors and clearing systems, such as the SWIFT network, ensure efficient global transaction settlement.

Regulation and System Stability

Regulatory bodies, including central banks and securities regulators, establish rules to ensure fairness, stability, and consumer protection. Core banking systems and IT infrastructure support account management, transaction processing, and financial reporting across the entire ecosystem.

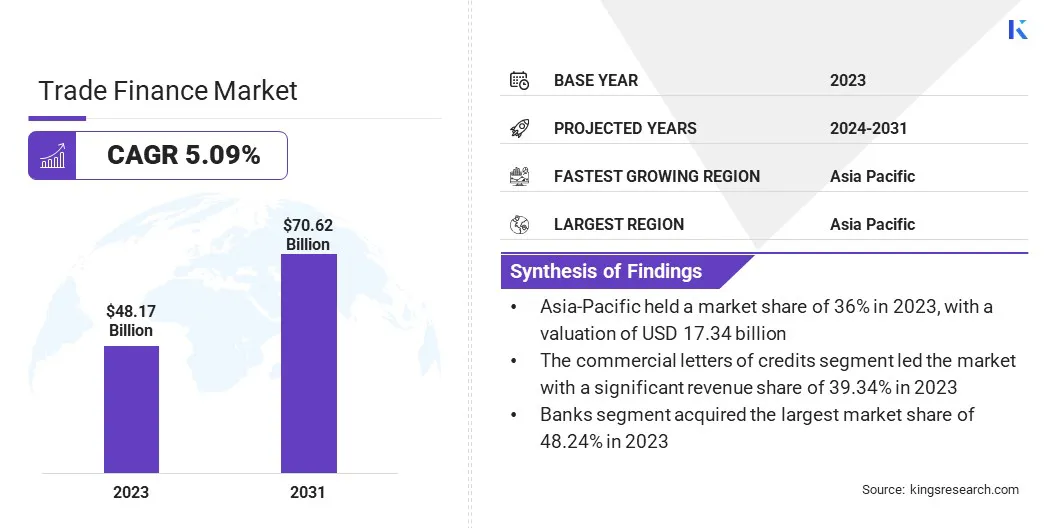

According to Kings Research, the global trade finance market was valued at USD 48.17 billion in 2023 and is projected to reach USD 70.62 billion by 2031. This highlights how coordinated collaboration across TradFi institutions continues to drive steady growth.

How TradFi Works

TradFi operates through centralized financial intermediaries that manage capital allocation, clearing and settlement, and risk distribution across the financial system.

The process typically begins with users depositing funds into banks, providing liquidity. Banks act as intermediaries by lending these funds to borrowers, earning interest spreads while managing credit risk. Transactions are verified and settled through clearing systems such as SWIFT. For example, stock trades are matched on exchanges, executed by brokers, and settled by clearing houses within T+1 or T+2 timeframes.

Central banks regulate liquidity through interest rate policies and open market operations to maintain system stability. Risk management relies on insurance companies and derivatives markets to hedge against currency, interest rate, or market volatility. Regulators oversee compliance to reduce systemic risk across the financial system.

Key Characteristics of TradFi

TradFi is defined by high centralization, strict regulation, and reliance on intermediaries. While this structure prioritizes stability and consumer protection, it often comes at the cost of efficiency.

Centralization and Intermediaries

TradFi transactions are validated, approved, and recorded by intermediaries such as banks, brokers, and clearing houses. While this helps ensure compliance and fraud prevention, it also introduces higher fees, administrative friction, and slower settlement times. For instance, equity trades typically settle in T+1 or T+2.

Regulation and Consumer Protection

Strict oversight is a defining feature of TradFi. Central banks and regulators establish frameworks for risk control, market stability, and consumer protection. Deposit insurance and fraud recovery mechanisms help maintain public trust, though heavy regulation can limit innovation and raise entry barriers.

Advantages and Limitations of TradFi

TradFi’s primary strength lies in its robust regulatory framework and consumer protection mechanisms, such as deposit insurance and fraud safeguards. It also benefits from deep liquidity, global scale, and mature infrastructure that has been tested over time.

However, TradFi also faces several limitations. High transaction costs, slow settlement times, and reliance on multiple intermediaries remain persistent issues. In addition, regulatory and geographic constraints mean financial services are not equally accessible worldwide, leaving some regions underserved.

Why TradFi Matters (Economic & Market Role)

TradFi forms the liquidity backbone of the global economy. Through deposit-lending mechanisms, it supports corporate financing and personal consumption, driving GDP growth. Capital markets connect savers with investors, enabling infrastructure development, trade, and employment.

Without TradFi, essential services such as cross-border payments, mortgages, and insurance would break down, directly affecting billions of people’s daily lives.

TradFi vs DeFi

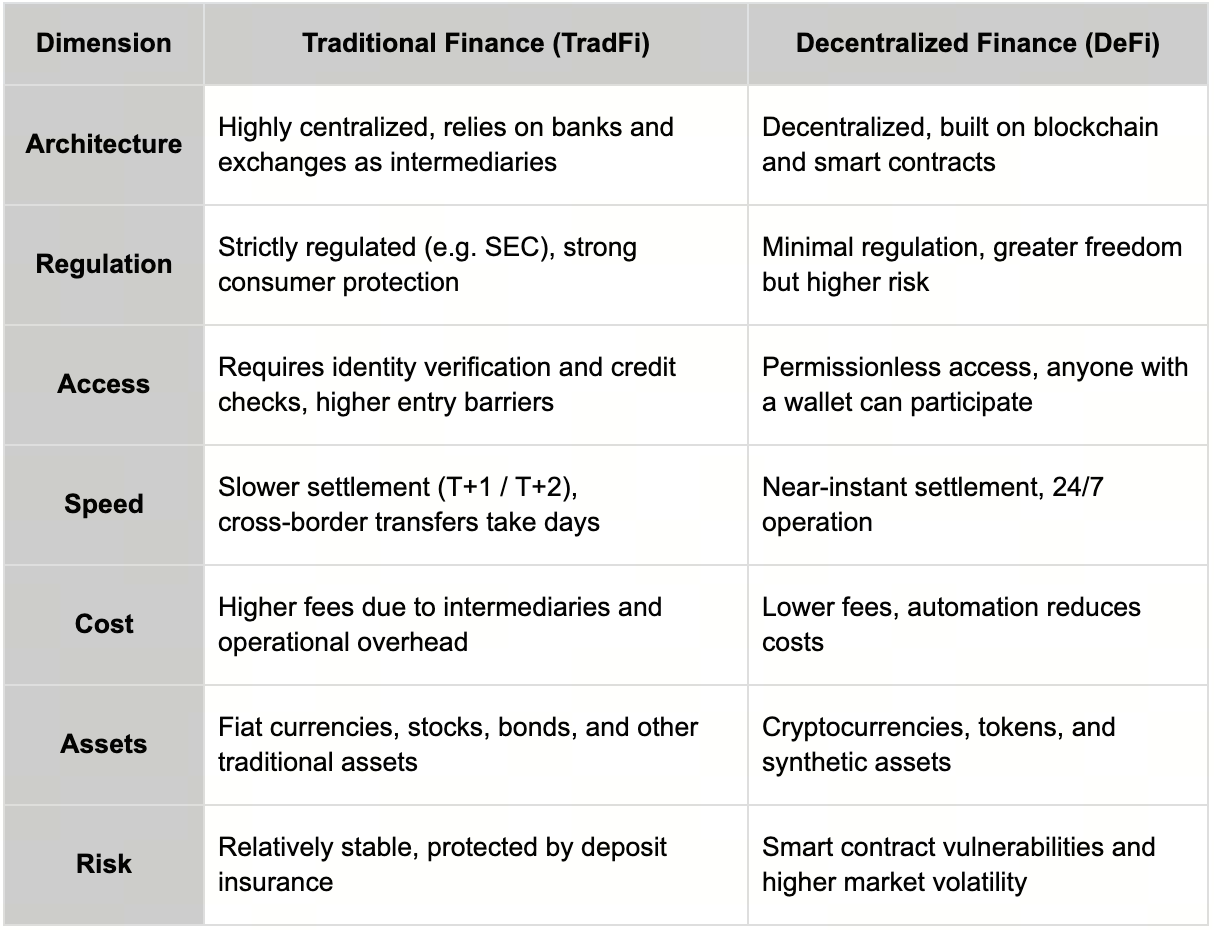

With the rise of blockchain and cryptocurrencies, a new financial paradigm has emerged: decentralized finance (DeFi). Built on smart contracts, DeFi enables lending, trading, insurance, and asset management without traditional intermediaries, giving users direct control over their assets. When comparing traditional finance vs decentralized finance, the difference between TradFi and DeFi becomes clear across architecture, regulation, accessibility, and settlement speed.

The fundamental differences between TradFi and Defi are clear, spanning architecture, regulation, access, and speed. TradFi relies on centralized intermediaries and regulated processes, while DeFi operates permissionlessly with 24/7 availability and near-instant settlement.

Despite these differences, TradFi’s centuries-long presence ensures it will remain dominant in scale and influence. At the same time, DeFi’s innovation helps address certain inefficiencies in TradFi. Together, they are shaping the future of global finance.

How to Access TradFi via Crypto Platforms

Crypto platforms such as Gate TradFi allow users to access traditional financial assets—including U.S. stock CFDs, forex, and gold—using crypto-based accounts, bridging traditional finance with digital asset liquidity. As the crypto industry matures, more platforms are integrating traditional financial assets (such as forex, gold, and U.S. stock CFDs) directly into crypto ecosystems. Users no longer need fiat on-ramps, physical asset ownership, or multiple platforms. With a single exchange account, they can access global TradFi markets.

Gate, for example, has integrated forex, indices, precious metals, commodities, and popular U.S. stock CFDs, enabling one-stop diversification and hedging for crypto users. Beyond trading, Gate also offers TradFi onboarding events and promotions to help users transition smoothly. For details, see our lt;Gate TradFi User Guide.

How TradFi is Evolving

From medieval intermediaries to digital finance, TradFi is undergoing a structural transformation toward on-chain finance. As blockchain adoption and asset tokenization expand, the boundary between TradFi and DeFi continues to blur.

Global asset managers such as BlackRock have shifted from observers to drivers by launching Bitcoin spot ETFs and promoting tokenization of real-world assets (RWAs) like government bonds and real estate. Meanwhile, TradFi derivatives, such as futures and options, are increasingly migrating on-chain as synthetic or mirrored assets, improving efficiency while preserving hedging and leverage functions.

Traditional banks are also exploring permissioned blockchains and deeper integration with DeFi protocols, giving rise to compliant hybrid finance architectures that combine regulatory oversight with on-chain liquidity. These trends are shaping the future of traditional finance, marking the ongoing evolution of TradFi toward hybrid and on-chain financial models.

Final Thoughts

TradFi is the global financial foundation built on centralized intermediaries and strict regulation. It has supported modern economic activity for centuries through efficient resource allocation and strong consumer protection, despite limitations such as high costs and slow settlement.

For TradFi vs DeFi in 2026, two parallel trends are emerging: TradFi is becoming more DeFi-like through smart contract adoption, while DeFi is moving toward regulatory compliance. This convergence is paving the way for a more open, transparent, and programmable global financial system.

FAQs

1.What is TradFi (Traditional Finance) and how does it affect daily life?

TradFi refers to traditional finance systems built on banks, exchanges, and legal frameworks. It underpins savings, loans, mortgages, insurance, and securities trading. Without it, modern economic activity would not function.

2.What are TradFi’s main strengths and weaknesses?

Strengths include strong regulation, consumer protection, stability, and deep liquidity. Weaknesses include reliance on intermediaries, high fees, slow settlement, and limited access in some regions.

3.What are the core differences between TradFi and DeFi?

The core differences between TradFi and DeFi lie in custody models, regulatory oversight, settlement speed, accessibility, and risk exposure. TradFi relies on centralized intermediaries and compliance frameworks, while DeFi operates through smart contracts with user-controlled custody and near-instant settlement.

For a deeper comparison, see TradFi vs DeFi: Core Differences, Risk Comparison, and the Future of Finance.

4.How can users invest in TradFi assets today?

Users can trade U.S. stocks, forex, and gold CFDs via Gate TradFi. A full walkthrough is available in Gate TradFi Complete Guide: How to Trade U.S. Stocks, Forex, and Gold CFDs with USDT.

5.What is TradFi’s future outlook in 2026?

Key trends include RWA tokenization, hybrid finance models, and deeper TradFi–DeFi integration. For more insights, see The Evolution of TradFi: How RWA and Crypto Integration Are Reshaping the Future of Finance.

Further Reading

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Bitcoin's Future & TradFi (3,3)

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?