What Is SOFR? The Benchmark Rate Shaping Modern Financial Markets

What Is SOFR?

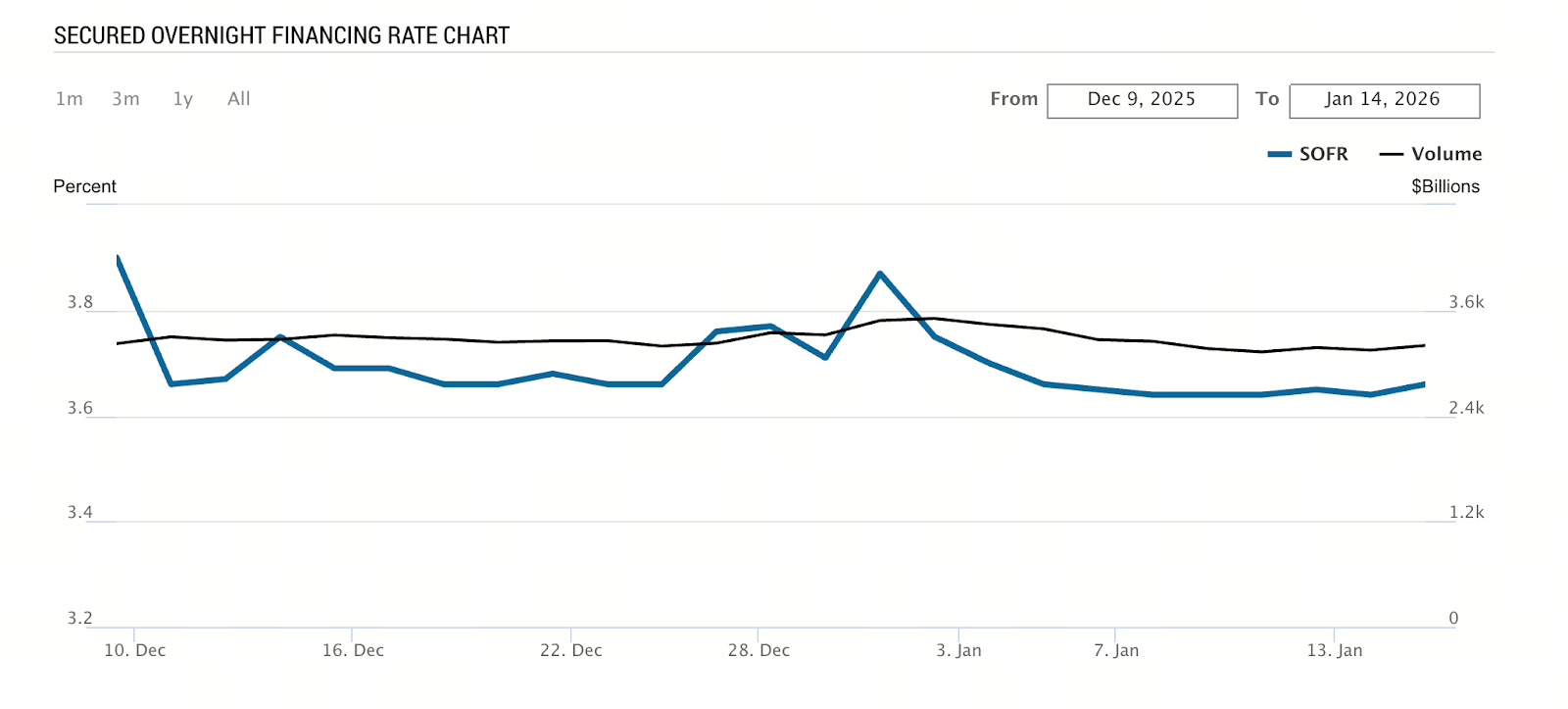

(Source: New York Fed)

If you’ve recently started following interest rates, dollar liquidity, or the relationship between TradFi and crypto markets, you’ve probably seen one term repeatedly—SOFR.

SOFR stands for Secured Overnight Financing Rate. It reflects:

The actual cost of overnight borrowing in the market when U.S. Treasury securities serve as collateral. Consider SOFR a daily snapshot of dollar funding costs. It’s not an estimate or a model; it’s the result of real market transactions.

Core Uses of SOFR

SOFR’s primary role is to measure the interest rate at which major financial institutions borrow overnight using U.S. government bonds as collateral. This borrowing mainly occurs in the repo market—a critical area that most people rarely encounter.

In the repo market:

- One party uses U.S. Treasury securities as collateral

- Borrows cash from another party

- Agrees to repurchase those bonds the next day or within a short period

SOFR is calculated by weighting the rates from these completed transactions.

Why Is SOFR So Important?

SOFR receives significant attention not because it sounds technical, but because it represents the most fundamental cost of dollar funding. Unlike previous rates that relied on banks’ “reported” or “estimated” values, SOFR is based entirely on actual transactions in a market with daily volumes exceeding $1 trillion.

This means:

- It’s difficult to manipulate

- It reflects real funding demand

- It instantly reveals market stress and liquidity conditions

For banks, funds, corporations, and even central banks, SOFR is an extremely valuable benchmark.

Who Manages and Calculates SOFR?

SOFR is jointly managed by the Federal Reserve Bank of New York and the Office of Financial Research (OFR) at the U.S. Treasury. SOFR is published each business day at 8:00 a.m. Eastern Time, reflecting market data from the previous business day.

The calculation relies entirely on actual transaction data from the repo market—not surveys, quotes, or forecasts. This makes SOFR a cleaner and more reliable benchmark rate.

SOFR in Financial Markets: Practical Applications

In practice, SOFR is widely used for:

- Interest rate derivatives

- Floating-rate loans

- Bond pricing

- Interest rate terms in financial contracts

Many financial products that previously referenced LIBOR are gradually shifting to SOFR as their benchmark. SOFR isn’t just a number—it’s at the heart of the financial system’s pricing logic.

SOFR: Bridging TradFi and Web3

As RWA (Real World Assets) move on-chain and stablecoins become increasingly integrated with traditional financial products, the importance of benchmark rates like SOFR will only grow. Looking ahead, on-chain dollar interest rate products, structured yield protocols, and institutional-grade DeFi applications will likely reference SOFR as a key indicator.

SOFR: Investment Indicator or Market Thermometer?

For most investors, SOFR isn’t data for direct trading, but it’s an excellent tool for monitoring market conditions. When SOFR remains stable, dollar liquidity is relatively smooth; when SOFR fluctuates sharply, it often signals market stress. In this sense, SOFR serves as a thermometer for the funding market.

If you want to explore more Web3 content, click to register: https://www.gate.com/

Summary

SOFR isn’t a buzzword or an academic concept—it’s a key interest rate derived from real transactions, reflecting the cost of dollar funding. As crypto and traditional finance continue to converge, SOFR is no longer just a number for banks; it’s a foundational indicator for anyone concerned with capital flows, interest rate environments, and market risk.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About