What Is Immunefi (IMU)? Building an Incentive-Driven Security Economy for Web3

What Does Immunefi Do?

(Source: immunefi)

Immunefi is a bug bounty platform focused on Web3 and smart contract security. Its primary mission is to help blockchain and DeFi projects identify and fix potential vulnerabilities. By bringing together white-hat hackers and security researchers from around the world, Immunefi uses a bounty system to encourage high-quality vulnerability disclosures, proactively reducing user asset risks.

In addition to vulnerability reporting, Immunefi provides a full suite of security services, including bug bounty program management, advisory consulting, and process oversight. The platform has delivered security support for major protocols such as Synthetix, Chainlink, and SushiSwap.

IMU: Building the Economic Layer for Web3 Security

The IMU token serves not just as a platform token, but as an economic engine for the on-chain security ecosystem. Immunefi leverages IMU to unify the interests of three essential groups within a single incentive framework:

- Protocols seeking comprehensive protection

- Researchers who develop and deliver security solutions

- Communities and users who support and use security products

This structure embodies the idea of creating value through positive action, ensuring that every participant in the security process receives real rewards as overall defense strengthens.

Security Flywheel Model

Immunefi positions IMU as the core asset linking all stakeholders. Through a self-reinforcing flywheel model, the platform establishes a positive cycle between security investment and returns.

Protocol Side: Credits System

Protocols joining the Immunefi ecosystem can participate in two ways:

- Accumulate IMU credits as security coverage and protection levels increase

- Stake IMU to unlock advanced protection packages and fee discounts

This approach encourages protocols to actively invest in their own security rather than simply buying services.

Researcher Side: Boost Incentives

Security researchers can stake IMU to increase the payout multiplier for bug bounties, boosting their earning potential. This mechanism attracts more high-quality researchers and aligns their interests with Immunefi’s long-term objectives.

Community Side: Patrons Program

General users and community members can bind IMU to support researchers or protocols they endorse:

- Supporting researchers: share in the rewards from their vulnerability contributions

- Supporting projects: help strengthen security and earn exclusive rewards

As researchers’ influence and staking volume grow, community rewards increase, creating strong incentives for active participation.

How Does the Flywheel Continue to Amplify Value?

In summary, this mechanism creates a clear pathway:

Protocols invest in security → Researchers enhance protection quality → Communities amplify incentive effects → Ecosystem value consistently accumulates

This structure improves the quality of vulnerability data and provides more reliable inputs for AI analysis and risk forecasting, further strengthening on-chain defenses.

IMU Tokenomics

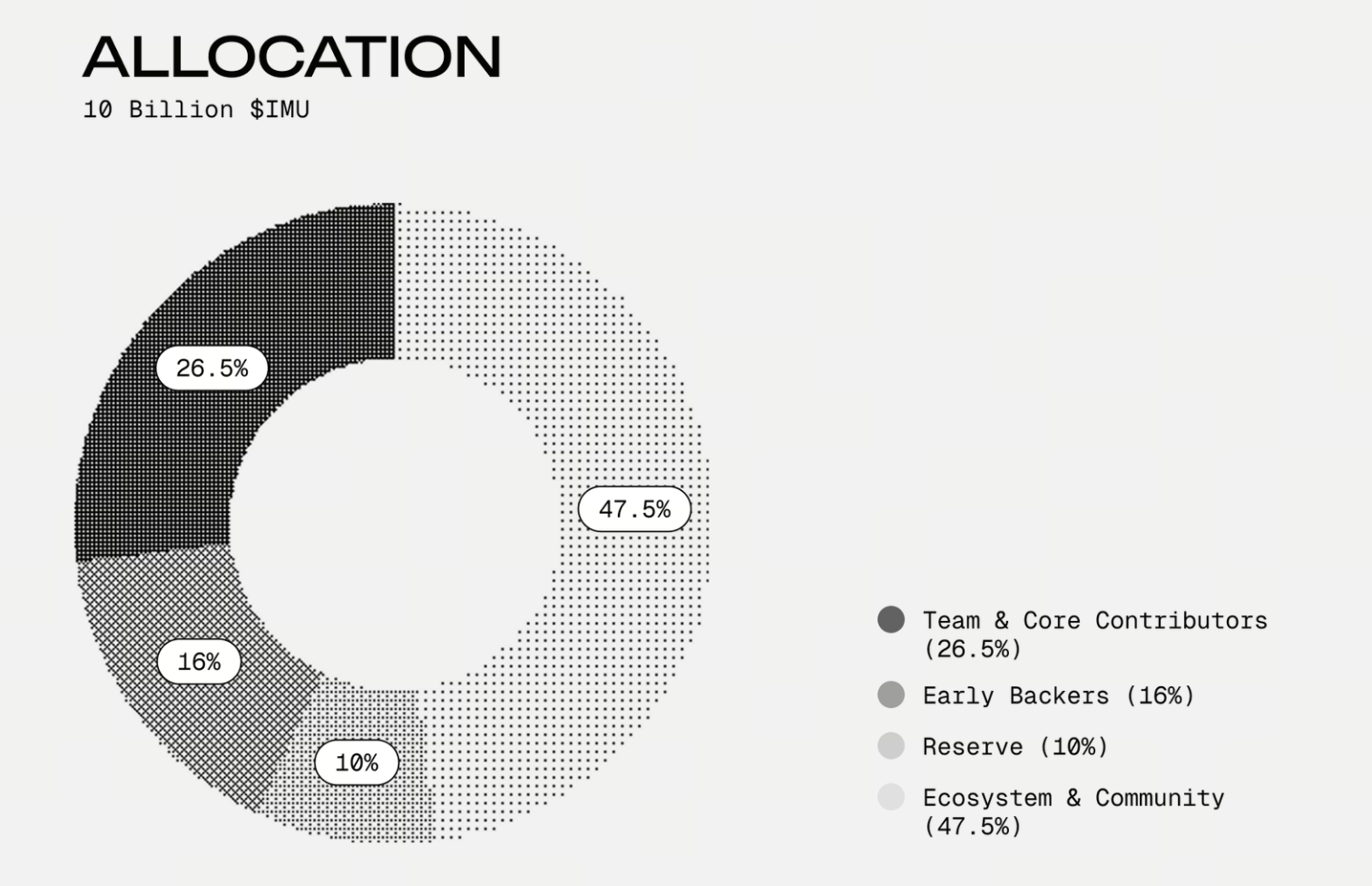

IMU features a fixed supply model, with an initial total of 10 billion tokens. Token release is contingent on ecosystem growth.

Token Distribution Structure

- Ecosystem and Community (47.5%): Used for platform incentives, bug bounty bonuses, staking rewards, partnerships, airdrops, and liquidity, ensuring tokens directly support usage and growth.

- Team and Core Contributors (26.5%): Unlocked linearly over 36 months to ensure long-term commitment and alignment.

- Early Supporters (16%): Unlocked over three years as a reward for early support.

- Reserve (10%): Flexible fund for future growth and unforeseen needs.

(Source: docs.immunefi)

Growth-Linked Release Logic

IMU distribution is not fixed or scheduled; it is tied to real contribution events, including:

- Enhanced protocol security coverage

- Effective vulnerability submissions by researchers

- Community support for security initiatives

This approach makes token value reflect actual usage rather than mere inflationary incentives.

Compliance and Governance Positioning

The IMU whitepaper is written in accordance with the EU MiCA (Markets in Crypto-Assets Regulation) framework, clearly outlining token roles, governance logic, risk management, and compliance strategy. This provides a solid regulatory foundation for Immunefi’s long-term growth in the European market.

Conclusion

Immunefi is working to shift security from a cost center to a core value that can be invested in and amplified. Through the incentive flywheel built by IMU, protocols, researchers, and communities become a unified interest group maintaining the on-chain economy. As Web3 matures, this security economic model may prove to be an essential foundation.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About