What Is GTBTC? A Brief Overview of Gate’s BTC Yield-Bearing Asset

I. Why Holding Only BTC Is Increasingly Insufficient

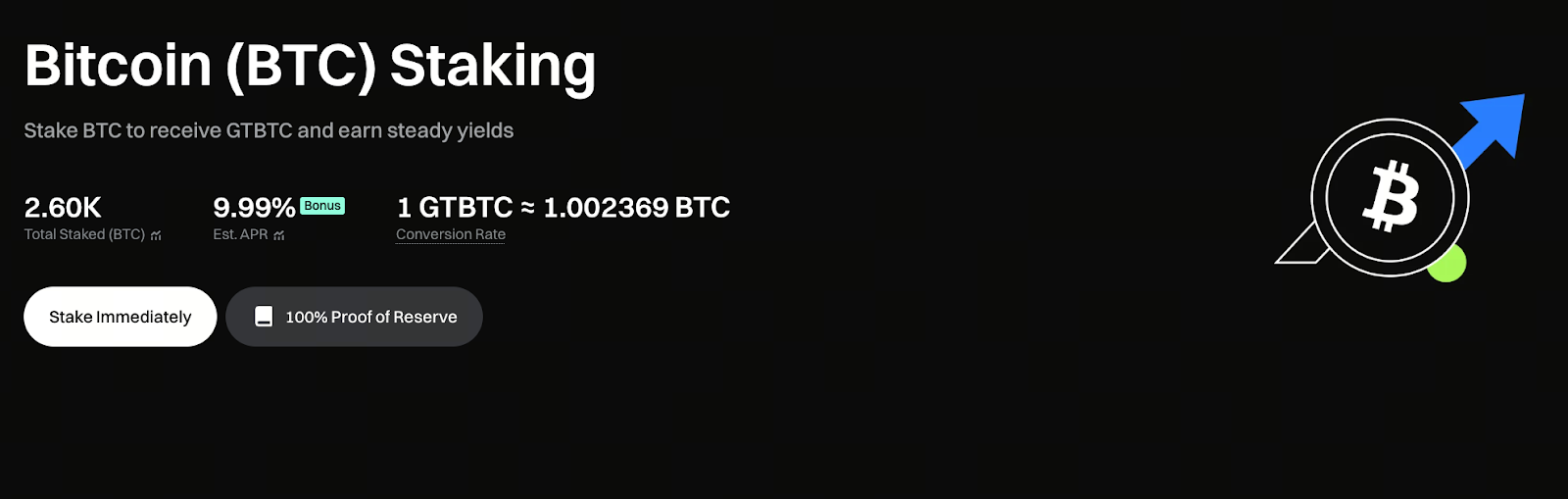

Image: https://www.gate.com/staking/BTC?pid=24

In the early stages of the crypto market, simply holding BTC long-term delivered high returns. As the market matured, BTC’s price movements became more rational, and merely “HODLing” no longer meets the return expectations of many investors.

As a result, more users are asking: Can I continue to earn returns without selling my BTC?

In response, Gate introduced GTBTC—a BTC-centered product focused on compounding yields and maximizing asset efficiency.

II. The Essence of GTBTC: Not a New Token, But a BTC Yield Certificate

First, it’s crucial to clarify: GTBTC is not a new cryptocurrency, nor does it replace BTC as an asset.

More accurately, GTBTC is a yield certificate anchored to BTC. When you convert BTC to GTBTC, your asset remains tied to BTC, but the yield mechanism changes.

The core objective is straightforward: transform BTC from a static asset into one that continuously generates returns.

III. Where Does GTBTC’s Yield Come From?

GTBTC currently offers a 9.99% annualized yield. This yield is not generated out of thin air, but is based on the following structure:

First, Gate stakes users’ BTC participating in GTBTC either on-chain or through strategic staking approaches. These staking operations produce baseline returns.

Second, through large-scale management and strategy optimization, the platform consolidates these returns and distributes them to users via GTBTC. You can participate in BTC yield mechanisms without managing complex on-chain processes yourself.

This design significantly lowers the operational barrier for everyday users and eliminates the time cost of frequent asset management.

IV. How Does GTBTC Differ from Traditional BTC Wealth Management?

Many users compare GTBTC directly with “BTC fixed-term wealth management,” but the underlying design principles differ.

Traditional BTC wealth management typically offers fixed terms and fixed yields, making it suitable for users with clear short-term objectives. GTBTC, on the other hand, emphasizes asset certification and long-term compounding. Put simply, GTBTC serves as a “long-term BTC yield position” rather than a one-off wealth management product. This structure makes GTBTC better suited for medium- to long-term asset allocation, rather than chasing short-term gains.

V. Who Is GTBTC Most Suitable For?

GTBTC is particularly well-suited for the following user profiles:

First, long-term BTC holders who do not trade frequently. GTBTC allows them to earn additional returns without altering their BTC holding strategy.

Second, new users seeking lower operational complexity. Compared to self-managed on-chain staking, GTBTC encapsulates all technical details, offering a user experience closer to traditional wealth management.

Third, risk-averse users focused on asset efficiency. During periods of market volatility, GTBTC offers a relatively stable yield curve.

VI. Does GTBTC Carry Risks? What Should You Be Aware Of?

No yield-generating product is completely risk-free, and GTBTC is no exception.

First, GTBTC’s value is anchored to BTC and is subject to BTC’s market price fluctuations. Yield cannot offset the price risk if BTC declines. Second, GTBTC’s yield depends on platform strategy and the broader market environment. While the current annualized rate is 9.99%, future yields may adjust as market conditions change. For this reason, GTBTC is best used as part of a diversified asset portfolio, not as your sole holding.

VII. The Role of GTBTC in BTC Asset Allocation

From a broader perspective, GTBTC is not designed to replace BTC, but to enhance its utilization and efficiency.

In traditional finance, assets are considered efficient when they are yield-generating. GTBTC’s design aims to bring BTC closer to this standard.

For users seeking to build a more robust yield structure while holding BTC long-term, GTBTC offers a solution worth considering.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About