What Is Gate TradFi? How to Trade Traditional Assets on Gate

It enables trading across markets such as U.S. stock CFDs, gold, forex, indices, and commodities without opening traditional brokerage accounts or converting funds into fiat currencies.

Unlike traditional brokers, Gate TradFi operates within a crypto-native trading framework. Users manage both crypto assets and traditional financial positions under a single Gate account, with trades settled through a USDT-backed internal accounting unit (USDx) and executed via the professional MT5 trading system.

This guide explains what Gate TradFi is, how it works, which asset classes it supports, how it differs from traditional brokers, and how users can trade traditional assets step by step through the Gate platform. It is designed to help beginners understand and confidently access traditional financial markets within a crypto trading environment.

What is Gate TradFi?

Gate TradFi is a crypto-based TradFi trading platform launched by Gate (a leading global crypto asset trading platform), designed to connect traditional financial markets with the crypto trading ecosystem.

With Gate TradFi, users can:

- Use USDT as margin directly within the Gate platform to trade traditional financial instruments, without installing additional software.

- Access multiple asset classes in one place, including gold, forex, global stock CFDs, major indices, and commodities.

- Manage both crypto assets and traditional financial positions under a single Gate account, simplifying portfolio allocation.

Compared with traditional brokers, Gate TradFi removes the friction of overseas account setup, fiat deposits and withdrawals, and high cross-border remittance costs, giving users a more flexible, cross-market trading perspective.

What Assets Are Available on Gate TradFi

To meet evolving market demand, Gate TradFi integrates major global assets directly into the Gate app. Users can access a wide range of traditional asset classes from a single interface. On Gate TradFi, users can trade a wide range of traditional financial assets via CFDs, covering major global markets.

Currently supported assets include:

- Gold (e.g. XAU/USDT)

- Major forex pairs (e.g. EUR/USD, USD/JPY)

- Stock CFDs (e.g. FAANG stocks and selected tech equities)

- Major global indices (e.g. S&P 500, NASDAQ 100, FTSE 100)

- Commodities (e.g. crude oil, copper, platinum)

How Gate TradFi Trading Works (CFDs Explained)

Contracts for Difference (CFDs) are widely used financial derivatives that allow traders to trade traditional assets via CFD trading, profiting from price movements without owning the underlying asset.

On Gate TradFi, users can trade CFDs on traditional assets using USDT, without physical delivery or custody requirements. This structure removes the complexity of physical delivery, custody, and additional securities accounts.

Gate TradFi uses USDx as the margin and account display unit. USDx is not a fiat or crypto currency, but an internal accounting unit used for TradFi balances. It is fully backed by USDT at a 1:1 ratio. After transferring USDT into a TradFi account, balances are displayed as USDx automatically, without manual conversion, additional fees, or custody costs.

In terms of trading rules, Gate TradFi contracts differ significantly from crypto perpetual contracts. TradFi contracts follow traditional market schedules, with fixed trading hours and market closures. Leverage is preset and cannot be manually adjusted. Margin uses a cross-margin model, allowing long and short positions on the same instrument to be hedged by lot size. Profits and losses are calculated using counterparty pricing, and overnight holding fees apply during market closures, in line with mainstream CFD markets.

Regarding leverage and fees:

- Forex and index CFDs support leverage of up to 500x

- Stock CFDs support leverage of up to 5x

- Trading fees can be as low as USD 0.018 per order, offering a transparent and controllable cost structure

Gate TradFi operates on the MT5 (MetaTrader 5) trading system. Account data and trade history remain synchronized between the Gate app and the MT5 client. Risk management follows a margin-ratio-based liquidation mechanism. When margin ratio falls to 50% or below, forced liquidation is triggered and positions are reduced progressively to control risk exposure.

For detailed rules, please refer to TradFi Contract Overview.

How to Trade on Gate TradFi

Below is a step-by-step trading guide explaining how to trade on Gate TradFi using USDT.

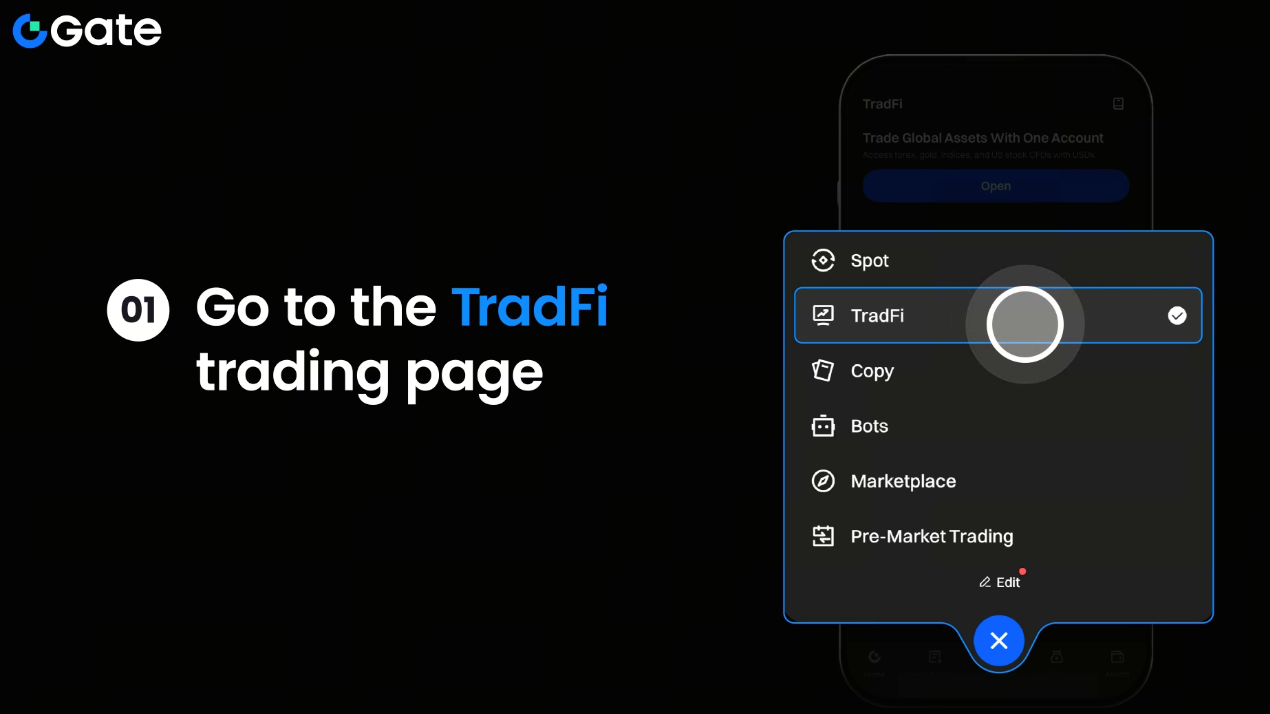

Step 1:

Log in to the Gate app and select the “TradFi” tab from the navigation bar. You’ll be guided to review and accept relevant agreements.

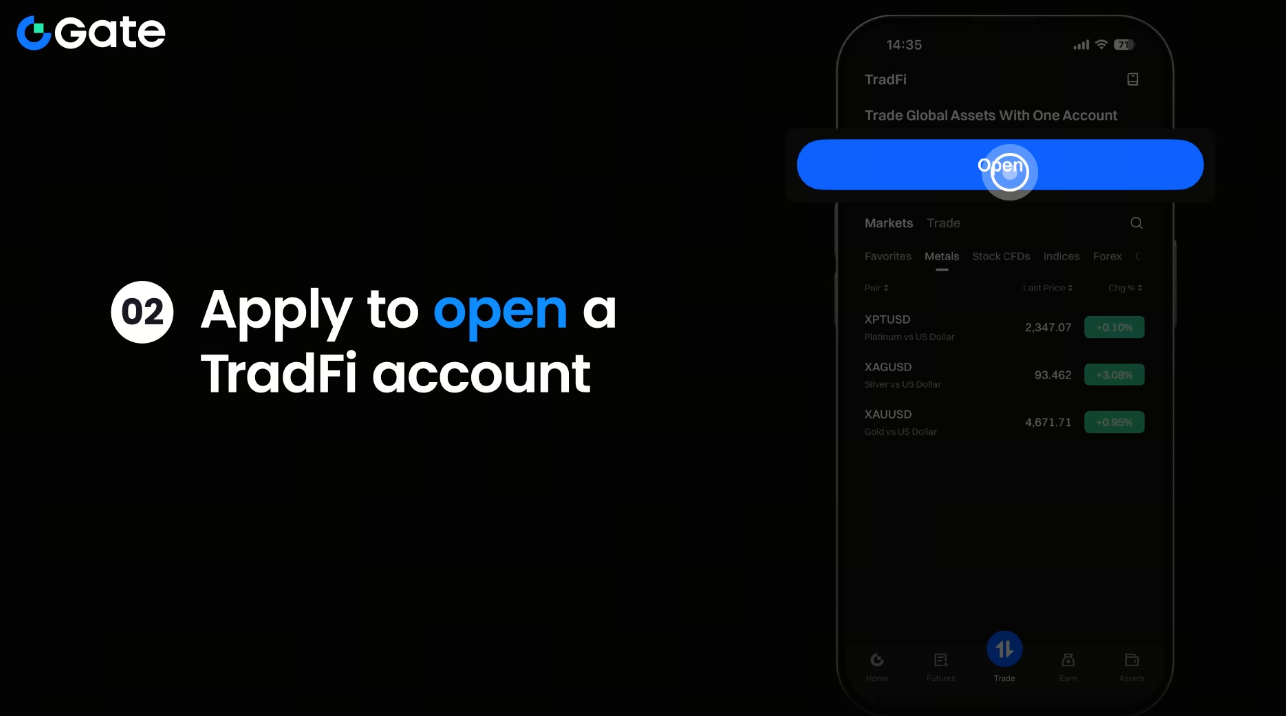

Step 2:

Follow the on-screen instructions to open a TradFi account.

Step 3:

Transfer USDT from your Gate spot account or other accounts into your TradFi account. The balance will be displayed automatically as USDx.

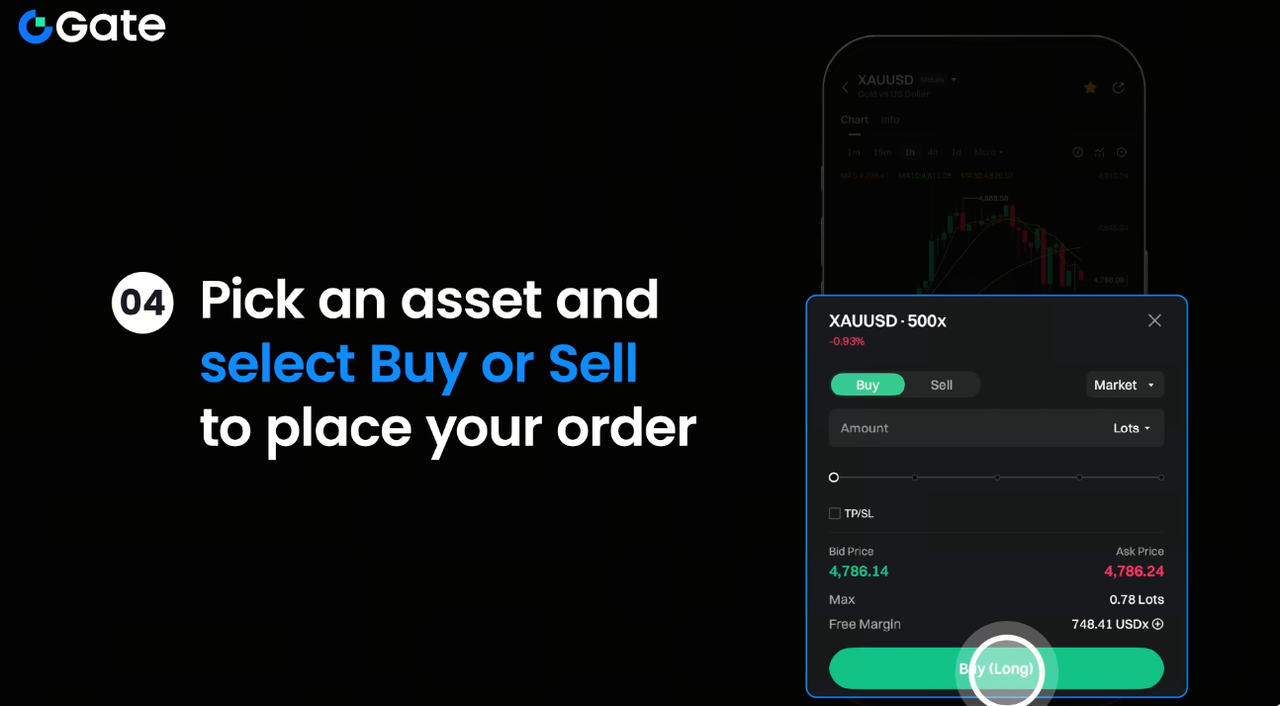

Step 4:

Select a trading instrument and place an order. The trading interface clearly shows contract specifications, leverage, required margin, and estimated liquidation price.

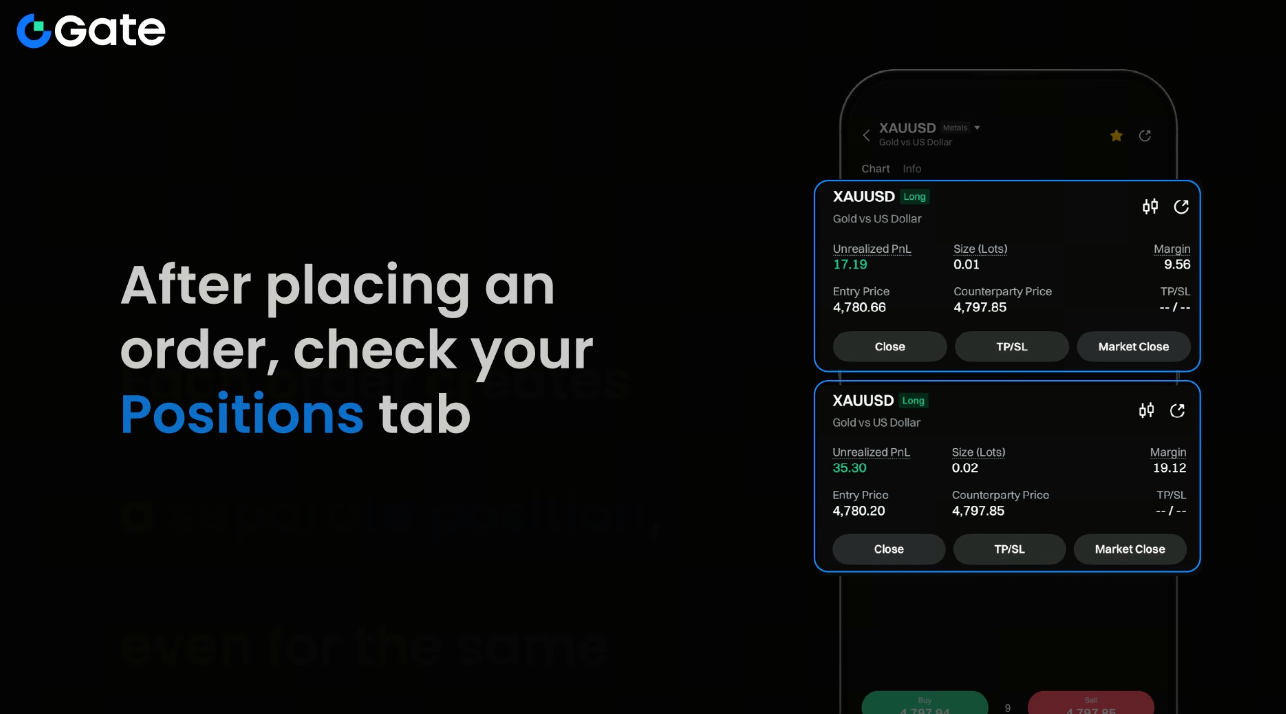

Step 5:

Manage your positions effectively. Gate TradFi uses MT5 as its trading engine. Users can monitor account data and trade history via the Gate app or MT5 client. To close a position, simply place an order in the opposite direction.

Gate TradFi vs Traditional Brokers

When comparing Gate TradFi vs traditional brokers, the key differences lie in account structure, capital flow, leverage flexibility, and overall accessibility.

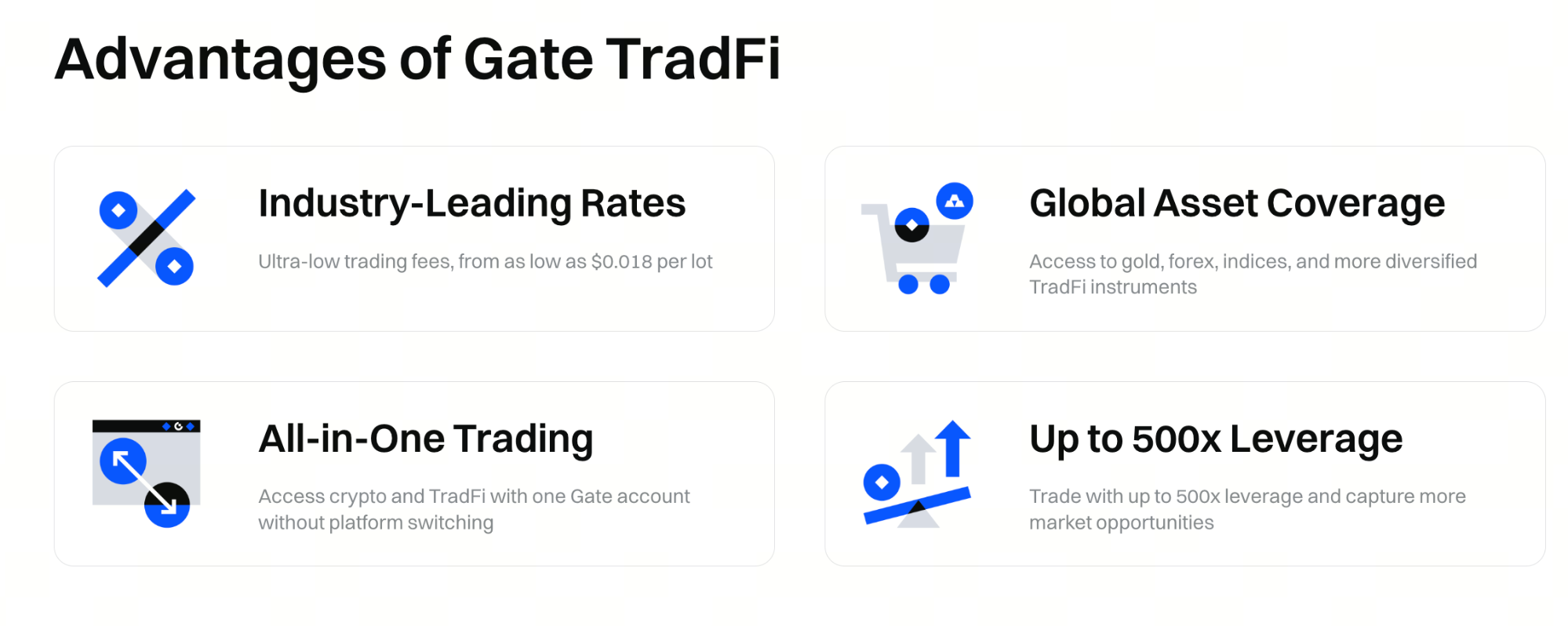

Key advantages include:

- Crypto and traditional asset coverage: In addition to crypto, users can trade gold, forex, indices, commodities, and popular stock CFDs.

- One-stop trading: A single Gate account enables trading across crypto and traditional markets without opening separate securities or forex accounts.

- Highly competitive fees: Contract fees can be as low as USD 0.018 per order, depending on contract type and position size.

- Flexible leverage: Different CFDs offer different leverage levels, with forex contracts supporting up to 500x leverage.

Who is Gate TradFi Suitable For?

Gate TradFi is a powerful bridge between traditional capital markets and digital assets. It is especially suitable for crypto traders and cross-market traders seeking exposure to traditional financial markets without leaving the crypto ecosystem.

For high-frequency traders and arbitrage traders seeking maximum capital efficiency, Gate TradFi’s high leverage and millisecond-level execution make it well-suited for capturing cross-market opportunities and responding quickly to macroeconomic events such as interest rate decisions or employment reports.

Gate TradFi is also ideal for investors focused on diversification. During periods of high volatility or downturns in crypto markets, users can shift exposure toward traditional defensive assets like gold or major currencies.

Risks and Considerations When Trading TradFi Assets

Trading gold, forex, and index CFDs on Gate or other crypto platforms involves significant risk. Users should fully understand the product structure and market dynamics before participating.

First, TradFi assets often offer high leverage, with some instruments reaching up to 500x. While leverage increases capital efficiency, it also magnifies losses. Users must monitor margin ratios closely to avoid forced liquidation.

Second, traditional markets are heavily influenced by macroeconomic events such as Federal Reserve decisions, employment data, and geopolitical developments. Unlike crypto markets, TradFi markets close on weekends and holidays, which can result in overnight price gaps when markets reopen.

Finally, in extreme market conditions or “black swan” events, liquidity may dry up, leading to wider spreads, slippage, or even negative balance risk. Choosing a platform with strong risk controls and compliance standards is critical for capital protection. Ultimately, trading CFDs involves significant risk and is not suitable for all investors.

Summary

The expansion of Gate TradFi extends Gate’s trading ecosystem into traditional asset price trading, giving users more flexibility to analyze prices, hedge risk, and execute trades across multiple asset classes within a single platform.

As the boundary between crypto and traditional finance continues to blur, demand for multi-asset, cross-market trading is expected to grow. Ongoing development of Gate TradFi represents an important step toward building a comprehensive trading infrastructure and offers a practical reference for how digital platforms can integrate traditional assets within a compliant framework.

FAQs

What is Gate TradFi, and how is it different from crypto perpetual contracts?

Gate TradFi enables crypto users to trade traditional assets such as gold, forex, and U.S. stocks via CFDs. Unlike crypto perpetual contracts, TradFi follows traditional market rules:

- Fixed trading hours with market closures

- Settlement in USDx (pegged 1:1 to USDT)

Overnight holding fees during market closures

- For more details, see TradFi Contracts FAQ.

What is USDx and how do I get it?

USDx is the internal accounting unit used in Gate TradFi accounts. It is fully backed by USDT at a 1:1 ratio. Users do not need to purchase it separately. Simply transfer USDT into a TradFi account and the balance will be displayed as USDx automatically.

What advantages does Gate TradFi offer over traditional brokers?

Gate TradFi lowers entry barriers and improves fund efficiency by:

- Eliminating the need for separate securities or forex accounts

- Removing complex KYC and cross-border transfer fees

- Offering flexible leverage up to 500x for forex and indices

What trading system does Gate TradFi use? Does it support automated trading?

Gate TradFi integrates MetaTrader 5 (MT5), a globally recognized professional trading engine. Users can trade via the Gate app or MT5 client, access advanced charting tools, and review detailed position records. This setup ensures millisecond-level execution and alignment with global trading environments.

For more account details, see TradFi Accounts Explained: How Traditional Finance Accounts Work.

What are the main risks when trading TradFi assets?

Key risks include:

- High leverage risk: Up to 500x leverage can amplify losses; forced liquidation occurs when margin ratio falls to 50% or below.

- Overnight gap risk: Weekend market closures may lead to large price gaps.

- Liquidity risk: During extreme volatility, spreads may widen and slippage may occur. Tight stop-loss strategies are strongly recommended.

Further Reading

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Bitcoin's Future & TradFi (3,3)

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?