UAE-Backed Fund Quietly Takes Major Stake in World Liberty Financial

Mysterious Transaction Occurs at Critical Pre-Inauguration Juncture

Investigations reveal that a pivotal investment agreement was quietly finalized just four days before Trump’s official inauguration in January 2025. Eric Trump signed on behalf of the project, while the actual funding originated from Aryam Investment 1, a firm registered in Abu Dhabi and backed by UAE National Security Advisor and presidential brother, Sheikh Tahnoon bin Zayed.

This $500 million investment was not disclosed in advance, and the transaction only became public knowledge after recent media reports.

Capital Flows and Relationship Network

Contract details indicate that about half of the investment was paid immediately, with funds allocated as follows:

- Roughly $187 million was transferred to entities controlled by the Trump family

- At least $31 million went to companies associated with the Steve Witkoff family

Steve Witkoff is a co-founder of World Liberty Financial. His son, Zach Witkoff, currently serves as CEO and was later appointed as a U.S. Middle East envoy. Senior leadership from UAE AI conglomerate G42 also helped manage the investment vehicle and, following the deal, obtained a board seat at World Liberty, making Tahnoon’s investment platform the largest external shareholder in the project.

Equity Structure Shift Finally Clarified

As early as June 2025, observers noted that DT Marks DeFi LLC, a Trump-affiliated company, saw its stake drop from 75% to about 40%, but the destination of the shares was not disclosed at the time. Now, with Aryam’s investment exposed, the figures align: if the new investor acquired a 49% stake and existing shareholders were diluted proportionally, DT Marks’ actual ownership would fall within the 38%–40% range, closely matching figures released on the official site.

Overlap With AI Chip Policy Timeline

Within weeks of the investment’s completion, the U.S. government announced it would ease restrictions on advanced AI chip exports to the UAE. Soon after, another Tahnoon-led company, MGX, used the World Liberty-issued USD1 stablecoin to invest up to $2 billion in Binance.

(Source: The Block)

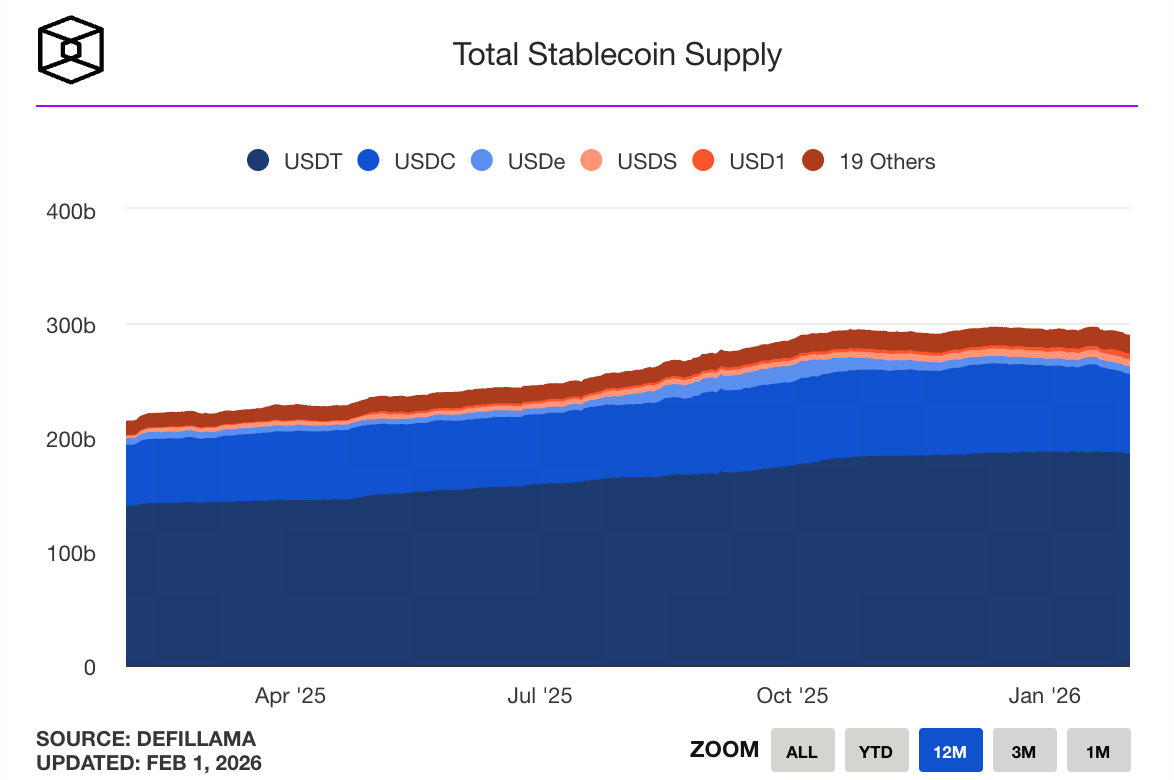

This transaction directly expanded USD1’s market circulation, pushing its market cap above $5 billion and making it one of the fastest-growing stablecoins.

Tahnoon and the UAE’s Technology Strategy

Tahnoon has long driven the UAE’s AI and technology sector strategy. His G42 group previously faced U.S. restrictions on chip supplies due to close ties with Chinese companies. However, under the Trump administration, these restrictions were lifted, and in 2025, G42 was approved to receive high-performance computing resources equivalent to 35,000 Nvidia GB300 chips.

World Liberty’s Development Blueprint

World Liberty Financial was established in October 2024. Its current operations include:

- Stablecoin issuance (USD1)

- DeFi lending services

- Application for a national trust bank charter

The official website still lists Trump and his three sons as co-founders, but day-to-day operations are managed by a crypto-native team.

To learn more about Web3, click to register: https://www.gate.com/

Summary

The discreet partnership between World Liberty Financial and UAE capital has not only reshaped the project’s equity structure but also created unprecedented intersections among crypto finance, geopolitics, and AI technology policy. As financial flows and policy timelines come to light, this deal stands as a hallmark case at the intersection of global crypto finance and international power dynamics.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About