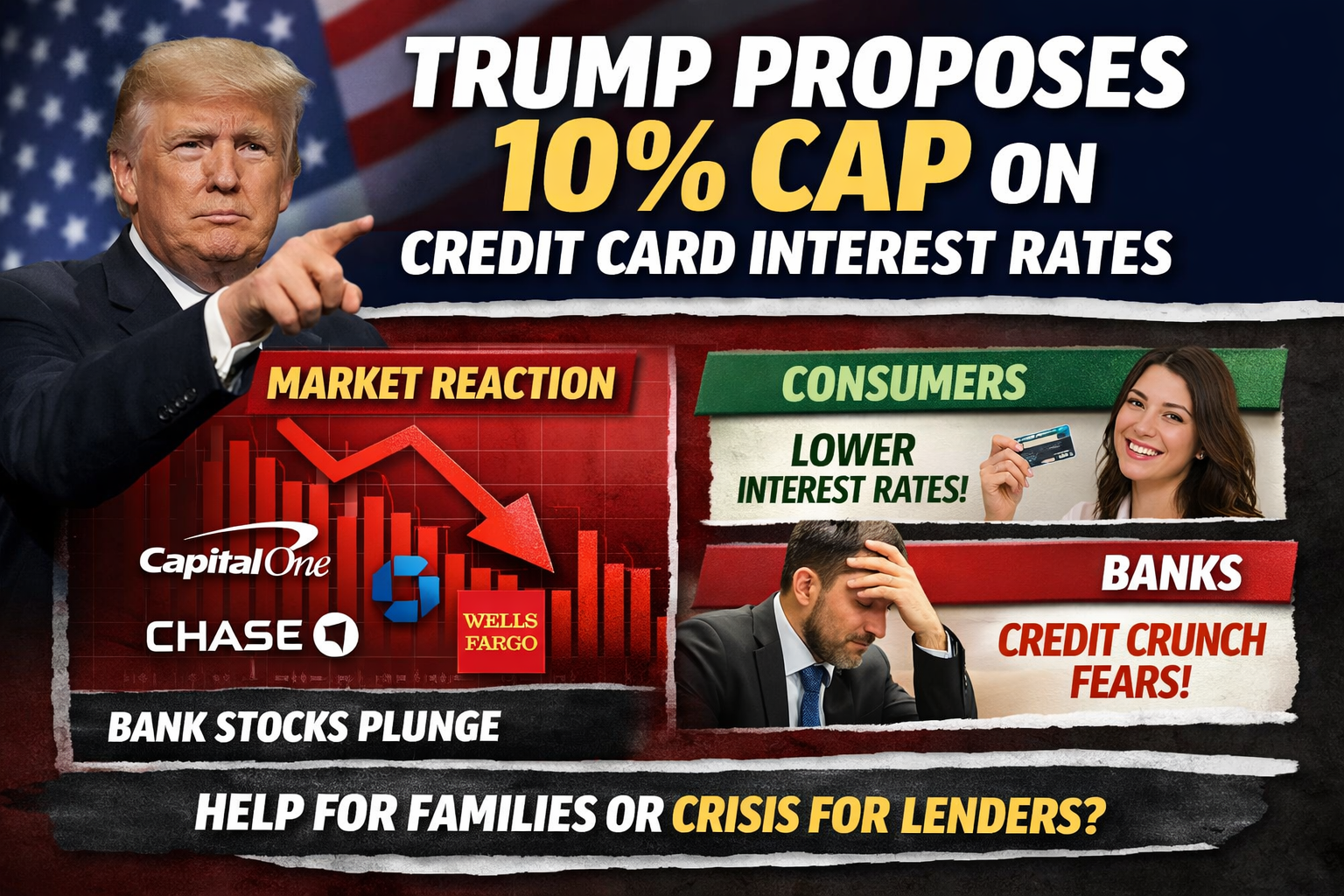

Trump Warns Credit Card Companies: Plans to Impose a 10% Interest Rate Cap After Taking Office, Triggering Market Turmoil

Trump’s Policy Update: The 10% Credit Card Interest Rate Cap

U.S. President Donald Trump recently reiterated on social media and in public remarks that, if inaugurated on January 20, 2026, he will push for a one-year temporary policy capping annual credit card interest rates at 10% nationwide. Trump highlighted that current market rates have hovered between 20% and 30% for an extended period, creating an unfair burden for everyday consumers. He explicitly stated that credit card companies refusing to comply would be deemed to be acting illegally.

This proposal comes amid lingering inflationary pressures and rising household debt costs. It aims to relieve the cash flow strain caused by high-interest debt for consumers, while also echoing Trump’s 2024 campaign promise to lower the cost of living for the average American family.

Market Reaction: Bank Stocks Crash on Revenue Fears

The announcement sparked swift movement in financial markets. Stocks of financial institutions with substantial credit card portfolios, including Capital One and Synchrony Financial, faced notable declines. Major banks like JPMorgan Chase and Citigroup also saw significant pullbacks as investors priced in the risk.

Key investor concerns include:

- Mandatory narrowing of credit spreads, threatening the high-margin credit card business model;

- Potential disruption to overall bank profitability structures, particularly for those reliant on consumer finance;

- Downward pressure on financial sector valuations and increased short-term volatility.

Because high credit card interest rates have historically been a major profit driver for banks, a sharp reduction would force a rebalancing of profitability and capital allocation strategies.

The Debate: Consumer Relief vs. Credit Crunch

From the consumer side, the policy has found support among certain groups. For families carrying high-interest credit card debt, a rate cap is seen as a direct and tangible form of relief that could save households billions in interest payments.

Financial institutions and industry groups, however, have voiced strong opposition, citing several key concerns:

- Possible tightening of credit supply: Lower rate caps reduce risk premiums, potentially excluding borrowers with weaker credit histories;

- Cost shifting: Banks may compensate by raising annual fees, cutting cashback and rewards, or tightening card approval standards;

- Shadow lending risks: Some consumers may turn to higher-cost, less regulated alternative credit channels.

Groups like the Consumer Bankers Association note that, while the intent is to improve affordability, an excessively low mandated rate cap could yield outcomes contrary to its original purpose.

Legal Reality Check: Executive Order vs. Congress

Legal experts argue that a president cannot unilaterally impose a nationwide interest rate cap by executive order. Such measures require legislation by the U.S. Congress to carry legal authority.

While Congress has previously considered proposals to restrict credit card interest rates,

- The legislative process is slow and politically contentious;

- The financial industry has substantial lobbying influence;

- There is ongoing debate over potential side effects for the economy and credit markets.

As a result, markets generally view the likelihood of near-term implementation as limited.

Market Outlook: What Investors Should Watch

In summary, the 10% credit card interest rate cap is primarily a policy signal with strong political overtones. Its short-term impact is likely to manifest in market sentiment and stock price volatility rather than immediate regulatory change.

- Investors should closely monitor legislative developments, bank earnings, and changes in credit data;

- Consumers can benefit from understanding the potential impacts to make informed decisions about interest rates, annual fees, and credit access.

If this policy moves forward, the U.S. credit card and consumer finance sectors could see a major structural shift, with effects reaching far beyond interest rates alone.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About