TradFi vs DeFi: Key Differences, Risks, and the Future of Finance

TradFi is built on centralized institutions, regulated intermediaries, and account-based infrastructure, while DeFi relies on blockchain networks, smart contracts, and user-controlled wallets to deliver financial services without intermediaries.

This structural distinction shapes everything from custody models and settlement speed to risk exposure, accessibility, and capital efficiency. TradFi prioritizes stability, regulatory compliance, and scale, whereas DeFi emphasizes transparency, programmability, and permissionless access.

This article provides a systematic comparison of TradFi and DeFi, explaining how each system works, how their risk and return profiles differ, and why they are increasingly converging rather than competing. It also explores what this convergence means for investors as traditional finance and crypto infrastructure continue to evolve.

What Is TradFi and What Is DeFi?

TradFi vs DeFi compares institution-led finance with blockchain-based, smart contract-driven finance.

TradFi (traditional finance) refers to the system centered on regulated institutions such as banks, brokerages, exchanges, and clearing houses. Its primary objectives are financial stability, scalable capital allocation, and risk control through regulation and legal enforcement.

DeFi (decentralized finance) is a blockchain-based financial system built on smart contracts. It enables asset trading, lending, borrowing, and yield generation without centralized intermediaries. DeFi is defined by permissionless access, global reach, and high composability between protocols.

At a fundamental level, TradFi prioritizes stability and order, while DeFi prioritizes efficiency and innovation.

From a scale perspective, TradFi remains the dominant force in global finance. According to multiple international financial institutions, total TradFi assets exceed USD 400 trillion across equities, bonds, foreign exchange, commodities, and derivatives. DeFi, even at peak market cycles, has maintained total value locked (TVL) in the hundreds of billions at most, several orders of magnitude smaller.

This difference in scale positions TradFi as the system that carries global capital, while DeFi serves as a primary engine for financial experimentation.

Core Differences Between TradFi and DeFi

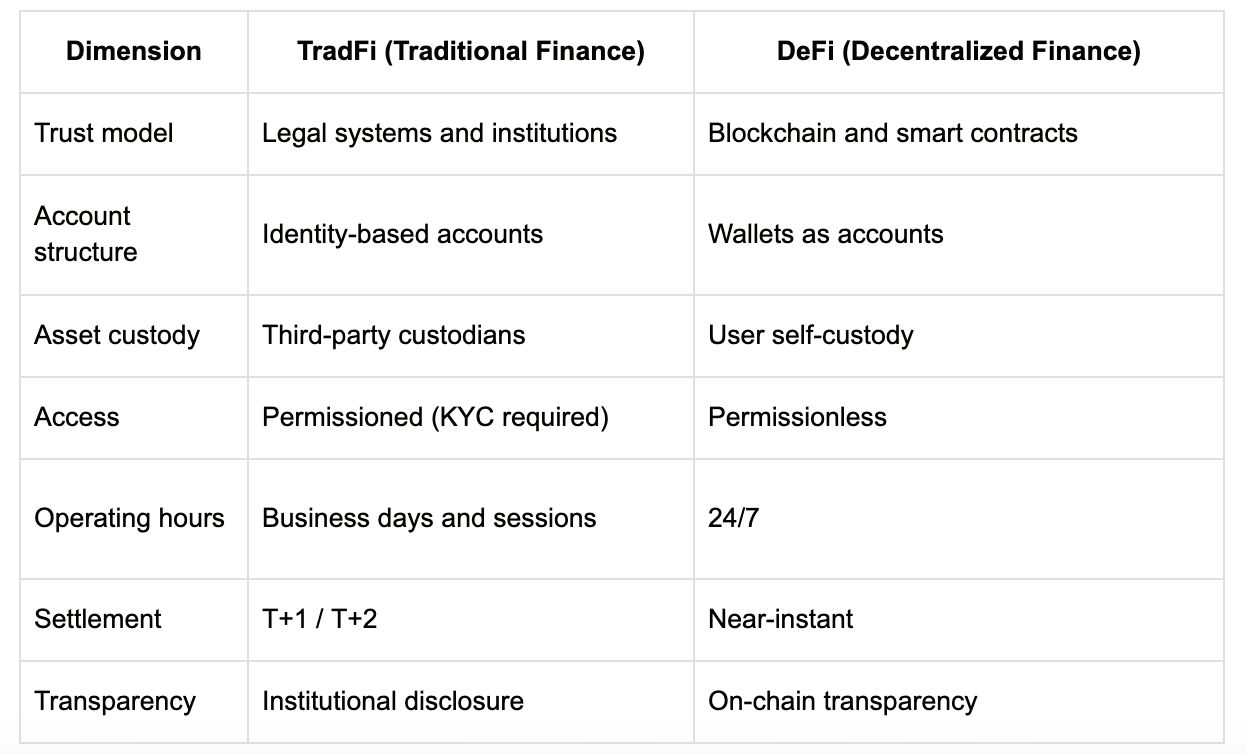

The core structural differences between TradFi and DeFi lie in how trust is established, how assets are controlled, and how systems operate.

TradFi is based on institutional trust. Accounts are identity-linked, assets are typically custodied by third parties, and transactions follow defined processes and settlement cycles.

DeFi relies on code-based trust. Wallets function as accounts, users retain direct control of assets, and smart contracts execute rules automatically on-chain, operating continuously without downtime.

These differences directly shape user experience, efficiency, and risk distribution across both systems.

Risk Profiles of TradFi vs DeFi

TradFi risks are primarily macroeconomic and institutional in nature. These include monetary policy shifts, inflation, interest rate changes, systemic financial risk, and account access restrictions. Such risks tend to develop gradually and follow relatively predictable patterns.

DeFi risks are more technical and market-structure driven. Smart contract vulnerabilities, hacking incidents, liquidity shortages, and flawed protocol design can trigger sudden losses. Historically, individual DeFi exploits have resulted in losses of hundreds of millions of dollars within short timeframes, though the impact is often confined to specific protocols or sectors.

In short, TradFi risks behave like slow-moving variables, while DeFi risks are fast-moving and abrupt.

Return Opportunities in TradFi and DeFi

TradFi returns are largely driven by economic growth, corporate earnings, interest rate spreads, and business cycles. Return profiles tend to be more stable, predictable, and oriented toward long-term compounding.

DeFi returns are driven by protocol incentives, risk premiums, and capital efficiency. While short-term upside potential is higher, returns depend heavily on market sentiment, liquidity conditions, and technical security.

Capital allocation between TradFi and DeFi often shifts significantly across different market cycles.

Are TradFi and DeFi Competitors or Complements?

TradFi and DeFi are increasingly complementary rather than mutually exclusive.

In recent years, integration has accelerated. Bitcoin and Ethereum ETFs now hold hundreds of billions of dollars in assets, becoming primary channels for TradFi capital to enter crypto markets. At the same time, real-world asset (RWA) tokenization is expanding DeFi’s scope, with tokenized treasuries, credit instruments, and commodities reaching tens of billions in on-chain value.

These trends suggest that blockchain is becoming new infrastructure for TradFi rather than a replacement.

How Investors Choose Between TradFi and DeFi

For most investors, the decision is not ideological but practical. The choice depends on market cycles, capital size, and risk tolerance.

Market Cycles

- Risk-on environments: DeFi tends to outperform due to higher elasticity and speculative demand.

- Risk-off environments: TradFi assets such as cash equivalents, commodities, and bonds are more attractive for capital preservation.

Capital Size

- Smaller portfolios: DeFi’s low barriers and capital efficiency offer greater opportunity, with higher technical risk.

- Mid-sized portfolios: Blended allocation helps balance drawdowns and returns.

- Large portfolios: Liquidity, compliance, and security favor TradFi dominance, with DeFi as a tactical supplement.

Risk Tolerance

- Low risk: TradFi-focused, with limited DeFi exposure.

- Medium risk: Dynamic allocation across both systems.

- High risk: Greater DeFi participation, requiring active risk management.

The key decision is not choosing sides, but constructing portfolios that adapt across conditions.

The Future Relationship Between TradFi and DeFi

As crypto adoption grows, TradFi and DeFi are moving toward structural convergence. Investors increasingly expect unified platforms that support multi-asset exposure without switching between banks, brokers, and crypto exchanges.

Blockchain offers TradFi practical upgrades in settlement speed, transparency, and programmability. As on-chain identity, custody solutions, and compliance frameworks mature, tokenized (on-chain) TradFi assets are shifting from experimentation to real-world deployment. Platforms such as Gate TradFi unify traditional and crypto market access into a single, accessible solution.

Meanwhile, DeFi is evolving toward sustainability, prioritizing risk management over incentive-driven growth. This makes DeFi more compatible with institutional capital and regulated environments.

Conclusion

The TradFi vs DeFi debate is no longer about replacement. They are converging.

TradFi provides stability, scale, and regulatory clarity. DeFi provides efficiency, transparency, and innovation. For investors, the long-term opportunity lies in understanding how these systems interact and adjusting allocations dynamically as financial infrastructure evolves.

FAQs

What is the fundamental difference between TradFi and DeFi?

TradFi relies on centralized institutions and regulation, while DeFi relies on blockchain and smart contracts. They differ in trust models, asset custody, access, and risk structure.

Is TradFi safer than DeFi in today’s market?

TradFi offers clearer institutional safeguards but lower return elasticity. DeFi offers higher efficiency and transparency but carries technical and market risks. Safety depends on investor risk tolerance.

Why are more TradFi assets entering crypto markets?

Blockchain improves settlement efficiency and asset mobility, enabling TradFi to reach new users while reducing friction across systems.

Should retail investors allocate to both TradFi and DeFi?

Allocation depends on market conditions, portfolio size, and risk tolerance. Balanced exposure often reduces systemic risk.

What is the biggest change for investors as TradFi and DeFi merge?

Greater choice and efficiency. Investors will increasingly manage traditional and crypto assets within unified, multi-asset platforms.

Further Reading

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Bitcoin's Future & TradFi (3,3)

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?