TradFi ETFs Explained: How Exchange-Traded Funds Work in Traditional Finance

In TradFi (Traditional Finance), an ETF (Exchange-Traded Fund) is an open-ended investment fund that trades on stock exchanges and tracks the performance of an index, asset class, or basket of securities. Structurally, ETFs combine the diversification benefits of mutual funds with the real-time trading characteristics of stocks.

Unlike traditional mutual funds, ETFs rely on a creation and redemption mechanism operated by authorized participants (APs). This mechanism allows ETF shares to be issued or redeemed based on market demand, helping keep market prices closely aligned with net asset value (NAV). As a result, ETFs typically offer higher liquidity, greater pricing transparency, and lower operating costs.

Because of this structure, TradFi ETFs have become one of the most widely used investment vehicles in global financial markets. They provide efficient access to equities, bonds, commodities, and, more recently, crypto-related assets, making ETFs a core building block of modern portfolio construction.

This article explains how ETFs work in traditional finance, covering their operating mechanisms, major ETF types, benefits and risks, and how ETFs are increasingly used to bridge traditional and crypto markets.

What Is an ETF?

An ETF (Exchange-Traded Fund) is a financial instrument built around low-cost, “basket-based” asset allocation. It is widely used across equities, bonds, commodities, and, more recently, crypto-related markets. As ETF products continue to evolve, they have become an important bridge connecting traditional finance (TradFi) and crypto markets.

According to Nicholas Peach, Head of iShares Asia-Pacific at BlackRock, global ETF assets under management are expected to grow to USD 30 trillion by 2030, highlighting the strategic role ETFs play in modern investment systems. In practical terms, an ETF allows investors to access multiple securities through a single TradFi-regulated product that trades like a stock but behaves like a diversified fund.

How ETFs Work in Traditional Finance

ETFs are investment products listed and traded on stock exchanges. They are typically designed to track the performance of a specific index, sector, commodity, or asset basket and are widely used as passive investment tools in modern portfolios.

Like individual stocks, ETFs can be bought and sold in real time during market hours. At the same time, their underlying assets consist of a basket of securities closely aligned with the tracked index, allowing investors to achieve diversified exposure through a single product.

Compared with traditional mutual funds, ETFs operate through four core mechanisms:

- Exchange-listed trading

- Basket-based creation and redemption

- Market maker arbitrage mechanisms

- Generally lower overall fees

Together, these mechanisms improve ETF liquidity, price transparency, and tracking efficiency. By investing in ETFs, investors can gain index-level market exposure without selecting individual securities, reducing single-asset volatility while building a more stable, cost-controlled long-term investment strategy. This structure explains why ETF trading mechanisms in TradFi are often considered more transparent and efficient than many other pooled investment products.

Types of ETFs in TradFi Markets

Understanding the different types of TradFi ETFs helps investors align product selection with specific goals such as growth, income generation, inflation hedging, or market neutrality. The ETF market offers a wide range of product types designed to meet diverse investment strategies. Based on underlying assets, ETFs are commonly categorized into equity ETFs, bond ETFs, commodity ETFs, and money market ETFs.

Equity ETFs typically track stock indices or specific sectors, such as the S&P 500, NASDAQ, or technology-focused ETFs. Bond ETFs focus on fixed-income instruments, including government and corporate bonds, offering relatively stable income streams. Commodity ETFs track assets such as gold or crude oil, while money market ETFs focus on short-term monetary instruments.

In recent years, crypto-related ETFs have also entered the market. For example, spot Bitcoin ETFs approved by the SEC in 2024 allow investors to gain exposure to Bitcoin price movements through standard brokerage accounts, without managing private keys or digital wallets.

From a strategy perspective, ETFs can be divided into passive ETFs and active ETFs. Passive ETFs aim to closely replicate index performance without active stock selection, while active ETFs rely on fund managers’ discretionary decisions to adjust holdings in pursuit of returns above benchmark indices.

Through this variety of types and strategies, ETFs provide flexible, efficient, and customizable investment tools suitable for both long-term allocation and short-term trading needs.

ETF Creation and Redemption Mechanism

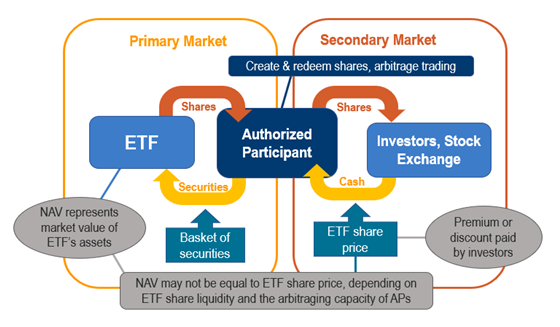

The creation and redemption mechanism is a defining feature of ETFs and the key driver ensuring that ETF market prices remain aligned with net asset value (NAV). This process is led by authorized participants (APs), typically large financial institutions.

Using an S&P 500 ETF as an example, authorized participants purchase the index’s constituent stocks according to index weights and deliver them to the ETF issuer. In return, the issuer provides ETF shares, usually issued in large blocks known as “creation units,” commonly consisting of around 50,000 ETF shares.

When an ETF trades at a premium to its NAV, authorized participants can create new ETF shares and sell them on the open market, using arbitrage to bring prices back in line. When ETFs trade at a discount, the redemption process works in reverse to restore balance.

This dynamic creation and redemption mechanism ensures ETF pricing fairness and transparency while providing investors with a highly liquid, cost-efficient investment vehicle. Simply put, this creation and redemption process is what allows ETFs in traditional finance to maintain tight price alignment with underlying assets, even during periods of market volatility.

ETFs vs Mutual Funds: Key Differences

Although both ETFs and mutual funds are pooled investment products, they differ significantly in management style, trading mechanics, and cost structures.

In terms of management, ETFs are primarily passively managed and designed to track index performance, while mutual funds are actively managed by professional portfolio managers seeking to outperform benchmarks.

From a trading perspective, ETFs trade intraday like stocks, with real-time price fluctuations. Mutual funds are priced once per day based on NAV. As a result, ETFs tend to be more suitable for flexible trading strategies, while mutual funds offer more stable pricing that may appeal to beginners.

In terms of costs, ETFs generally have lower management fees. Industry data shows that the asset-weighted average operating expense ratio for ETFs is around 0.15%, while actively managed mutual funds typically carry higher fees.

These differences allow investors to choose between ETFs and mutual funds based on investment goals, risk tolerance, and trading preferences. When comparing ETFs vs mutual funds in TradFi, intraday liquidity, cost efficiency, and transparency are often the deciding factors.

Benefits and Risks of Investing in TradFi ETFs

The core advantages of ETF investing include diversification, low costs, and trading flexibility. Through ETFs, investors can gain exposure to multiple asset classes, including domestic and international equities, bonds, and commodities, within a single product. Like all TradFi investment products, ETFs combine structural advantages with market-dependent risks, making product selection and asset allocation critical.

From a cost perspective, ETFs typically feature lower operating expense ratios. For example, Schwab ETFs report an asset-weighted average expense ratio of just 0.04%, significantly lower than many actively managed mutual funds.

Trading flexibility is another key advantage. ETFs can be traded throughout market hours like stocks, while mutual funds typically allow only one transaction per day.

However, ETFs also carry risks. While ETFs reduce single-stock risk through diversification, equity ETFs may still exhibit higher volatility than bond ETFs. Leveraged and inverse ETFs involve amplified risk and are generally more suitable for experienced investors.

Understanding both benefits and risks allows investors to select ETFs aligned with their investment objectives and risk profiles.

Crypto Market Exposure Through ETFs

As crypto markets increasingly intersect with traditional finance, Bitcoin ETFs have become a prominent example of this convergence. Spot Bitcoin ETFs approved by the SEC in 2024 allow investors to gain Bitcoin exposure through standard brokerage accounts, eliminating the need for private key management. Bitcoin ETFs represent a milestone in TradFi and crypto market convergence, allowing traditional capital to gain crypto exposure within familiar regulatory frameworks.

These products lower entry barriers for traditional investors and introduce institutional capital and liquidity into crypto markets.

On platforms like Gate, this financial linkage is even more pronounced. Gate offers not only spot trading for popular crypto assets, including trending Chinese meme coins, but also leveraged ETF products supporting 3L / 3S directional trading. These products allow users to participate in both rising and falling markets without engaging in complex derivatives trading.

Currently, Gate leveraged ETFs support 258 crypto assets, offering investors expanded options for crypto exposure and portfolio diversification.

Accessing ETF Markets via Crypto Platforms

As the boundaries between traditional ETFs and crypto assets continue to blur, investors increasingly seek cross-market liquidity, diversification, and real-time trading.

Global financial assets exceed USD 400 trillion, with equities, forex, and commodities dominating. While crypto market capitalization stands at approximately USD 3 trillion, its high growth potential and innovation continue to influence traditional finance.

Within this full-asset-allocation trend, Gate provides tools that allow investors to diversify across traditional and crypto assets within a single platform.

Gate offers broad crypto market access and innovative products such as leveraged ETFs, enabling investors to participate in both crypto and TradFi-linked opportunities. Investors can allocate assets across low-correlation categories, including crypto assets, equity ETF portfolios, and commodities, to optimize risk diversification and potential returns.

As ETFs continue to evolve, they remain one of the clearest examples of how traditional finance adapts to new asset classes while preserving regulatory structure and investor protection.

Summary

Since the launch of the first U.S. ETF in 1993, the SPDR S&P 500 ETF (SPY), ETFs have provided retail investors with efficient access to diversified asset exposure. From traditional indices like the S&P 500 to Bitcoin ETFs, ETFs have transformed high-barrier assets into accessible investment units.

By understanding ETF core mechanisms, creation and redemption processes, product types, and differences from mutual funds, investors can manage risk and returns more effectively. Combined with Gate’s platform, investors can allocate across traditional equities, bonds, commodities, and crypto assets, including leveraged ETFs and innovative crypto products, within a single account.

ETFs offer diversification, low costs, transparency, and trading flexibility, while also carrying specific risks. Whether beginners or experienced investors, those who understand ETF fundamentals, select suitable products, and leverage platform tools effectively can build efficient, resilient, and diversified portfolios across multiple markets for long-term value growth.

Further Reading

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Bitcoin's Future & TradFi (3,3)

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?