TradFi Bonds Explained: How Bonds Function in Traditional Finance Markets

In TradFi (Traditional Finance), bonds are debt securities that represent a contractual loan from investors to an issuer, such as a government or corporation. When an investor buys a bond, they become a creditor and are entitled to receive periodic interest payments (coupons) and the repayment of principal at a specified maturity date.

Bonds form the foundation of traditional fixed-income markets and play a central role in government financing, corporate funding, and institutional portfolio construction. Unlike stocks, which represent ownership, bonds establish a defined legal obligation between issuer and investor, with clearly specified cash flows and repayment terms.

Because of this structure, TradFi bonds are widely used to generate predictable income and manage risk within diversified portfolios. The global bond market exceeds USD 100 trillion in outstanding value, making it one of the largest and most important segments of the traditional financial system.

This article explains how bonds function in traditional finance markets, including bond types, issuance and trading mechanisms, key metrics such as yield and duration, major risks, and how fixed-income markets are evolving through tokenization, RWAs, and crypto platforms.

What Are Bonds and Why Do They Exist?

At their core, bonds are debt securities that represent a legal agreement in which an issuer borrows money from investors. When an investor purchases a bond, they are effectively lending funds to the issuer (such as a government or corporation) in exchange for periodic interest payments and the return of principal at maturity.

Bonds exist because the real economy requires financing. Issuers raise capital through bond issuance to fund infrastructure development, business expansion, or government spending, while investors receive relatively stable fixed income that helps balance portfolio risk.

In traditional finance, the global bond market is enormous, with outstanding bonds exceeding USD 100 trillion in total value, making it a foundational pillar of global capital markets. Compared with stocks, bonds are generally considered lower-risk investments because returns are contractually defined and bondholders are paid before equity holders in the event of liquidation. For example, a company may issue a bond with a 5 percent annual interest rate, allowing investors to receive 5 percent interest each year until maturity.

This predictability makes bonds a core asset for conservative investors and institutional portfolios. By understanding the fundamentals of bonds, investors can better grasp their role in the market and build a foundation for exploring innovative fixed-income products available on Gate. In this sense, bonds serve as a contractual bridge between capital providers and capital users, forming a foundational layer of fixed-income markets in TradFi.

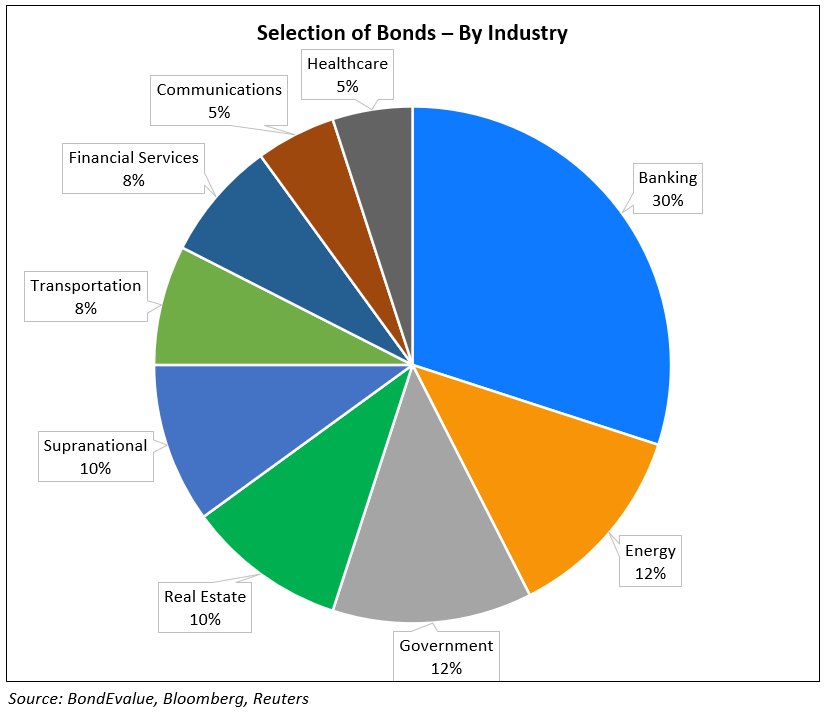

The Bond Market Ecosystem: Governments, Corporations, and Institutions

The bond market ecosystem is diverse, with governments, corporations, and local authorities acting as primary issuers. Each type of bond has distinct characteristics and risk profiles. These issuer categories define the structure of traditional bond markets, shaping yield levels, default risk, and investor demand across economic cycles.

- Government bonds, such as U.S. Treasury bonds or German Bunds, are issued by national governments and are typically considered the safest category of bonds due to sovereign credit backing and very low default risk. These bonds are commonly used to fund public projects or implement monetary policy and serve as global benchmark interest rates. They are a core component of fixed-income portfolios.

- Corporate bonds are issued by companies to raise funds for operations or expansion. They generally offer higher potential returns than government bonds but carry higher risk. Highly rated companies such as Apple or Microsoft may issue lower-risk bonds, while startups or highly leveraged firms may issue high-yield bonds (often referred to as junk bonds) to attract investors with higher interest rates. Investors should evaluate corporate bonds based on credit rating, maturity, and risk tolerance. For example, a corporate bond may offer a 6 percent annual yield compared with a 2 percent yield on government bonds, reflecting higher default risk.

- Municipal bonds are issued by cities or regional governments to finance local projects such as schools and transportation infrastructure. In many countries, interest income from municipal bonds may receive tax advantages, increasing their appeal. The broader bond ecosystem also includes agency bonds (such as those issued by Fannie Mae) and international bonds issued by foreign entities, each with different liquidity, risk, and return characteristics.

Key Bond Metrics Every Investor Should Understand

To invest in bonds effectively, investors must understand several key metrics. Yield to maturity (YTM) is one of the most important, as it represents the total return an investor can expect if the bond is held until maturity, including interest payments and capital gains or losses. For example, a bond with a face value of USD 1,000 and a coupon rate of 5 percent purchased at USD 950 will have a YTM higher than 5 percent, reflecting the discount purchase price. These metrics form the analytical framework investors use to evaluate bond pricing, risk, and expected returns in TradFi markets.

The coupon rate is the fixed annual interest rate set at issuance, such as 4 percent, and determines the periodic interest payments. Credit ratings, provided by agencies such as S\&P or Moody’s, range from AAA (highest quality) to C (high risk). Lower-rated bonds carry higher default risk but may offer higher yields.

Duration measures a bond’s sensitivity to interest rate changes. The longer the duration, the more sensitive the bond price is to rate movements. For example, if market interest rates rise by 1 percent, a bond with a duration of five years may decline in price by approximately 5 percent. Liquidity risk refers to how easily a bond can be bought or sold without significantly affecting its price. Government bonds typically have high liquidity, while niche corporate bonds may be less liquid. Investors should also consider inflation risk, as rising inflation can erode the real returns of fixed-rate bonds.

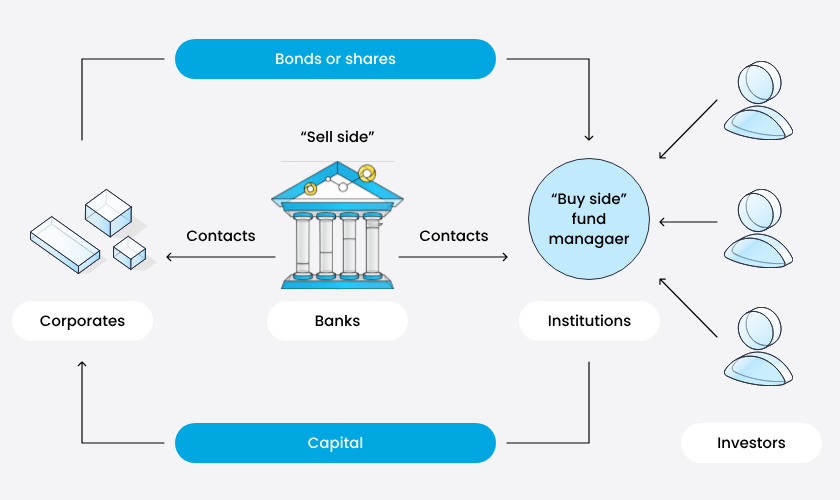

How Bonds Are Issued and Traded: Primary vs Secondary Markets

Bond transactions take place in the primary market and the secondary market, which together form a liquid bond trading ecosystem.

Together, the primary and secondary markets ensure that TradFi bonds can be issued efficiently and traded continuously, supporting both capital formation and investor liquidity. The primary market is where new bonds are issued. Issuers such as governments or corporations sell bonds directly to investors to raise capital. Underwriters assist with pricing and distribution, and investors may participate through auctions or subscriptions. For example, U.S. Treasury bonds are regularly issued via auctions open to both individual and institutional investors. Primary market transactions establish the initial terms of the bond, including face value and coupon rate.

The secondary market is where existing bonds are traded after issuance. This market provides liquidity, allowing investors to adjust holdings or exit positions before maturity. Secondary market prices are driven by supply and demand and influenced by interest rates, credit events, and market sentiment. A corporate bond with a face value of USD 1,000 may trade at a premium of USD 1,050 or a discount of USD 950 depending on market conditions. Trading channels include exchanges, over-the-counter markets, and electronic trading platforms, with most retail investors participating through brokers or financial platforms.

The Role of Bonds in Portfolio Allocation

In balanced portfolios, bonds act as stabilizers and risk diversifiers. Traditional asset allocation theory recommends allocating capital across stocks, bonds, and cash to optimize risk-adjusted returns. Bonds provide fixed income and tend to complement the higher volatility of equities. When stock markets decline, bond prices may rise or remain stable, helping offset portfolio losses. A classic example is the 60/40 portfolio, consisting of 60 percent stocks and 40 percent bonds, which historically exhibits lower volatility. In traditional asset allocation models, bonds are primarily used to reduce portfolio volatility while generating steady income.

Bond income also supports long-term financial goals such as retirement planning or education funding. Investors can select bonds based on maturity and credit quality, using short-term government bonds for liquidity or long-term corporate bonds for higher returns. Even in low interest rate environments, bonds may offer capital gains opportunities when interest rates are expected to decline.

As markets digitize, tokenized RWA bonds are expanding access to fixed-income assets. Through Gate, investors can access a wide range of fixed-income products and integrate traditional bonds into crypto portfolios, achieving greater diversification and improved risk management across traditional and digital assets.

Risks Associated With Bond Investing

Although bonds are often considered relatively safe, they carry several important risks that investors must manage. Understanding these risks is critical when evaluating bond investments in traditional finance, particularly during periods of rising rates or elevated inflation.

- Credit risk arises when issuers fail to pay interest or principal. Lower-rated corporate bonds face higher default probabilities, with some high-yield bonds historically experiencing default rates exceeding 5 percent.

- Interest rate risk occurs when market interest rates rise, causing existing bond prices to fall because newly issued bonds offer higher yields. This risk is especially pronounced for long-term bonds. Conversely, falling rates may generate capital gains.

- Inflation risk reduces the real value of fixed income. If inflation exceeds the bond’s interest rate, purchasing power declines. For example, a bond yielding 3 percent during a 4 percent inflation period produces negative real returns.

- Liquidity risk refers to difficulty selling bonds quickly without price concessions, particularly for niche or low-rated bonds. Additional risks include currency risk for foreign-denominated bonds and reinvestment risk, where interest income must be reinvested at lower yields.

Bonds, Blockchain, and the Rise of Tokenized RWAs

Blockchain technology is transforming the bond market by driving the growth of DeFi and tokenized real-world assets (RWAs). Tokenized RWAs convert traditional bonds into digital tokens on the blockchain, enabling more efficient, transparent trading and settlement.

For example, a company may issue tokenized bonds where each token represents USD 1,000 in face value. Investors can purchase these tokens using crypto wallets, benefit from instant cross-border transfers, and access markets 24/7 while reducing intermediaries and lowering entry barriers. Tokenized bonds represent a practical entry point for RWA adoption in fixed-income markets, combining TradFi cash-flow structures with blockchain-based settlement.

DeFi platforms also offer bond-like products such as lending protocols or yield-generating mechanisms that provide fixed or variable returns through smart contracts. These automated systems improve efficiency and trust but introduce new risks, including smart contract vulnerabilities and regulatory uncertainty.

Industry data shows that the tokenized RWA market has grown to several billion dollars in scale, becoming a key bridge between traditional finance and the crypto ecosystem.

How Investors Access Bond Opportunities via Crypto Platforms

As a leading global crypto exchange, Gate is committed to providing diverse fixed-income investment opportunities that bridge traditional bond markets and crypto innovation. Through Gate, investors can access tokenized bonds and RWA products that represent government or corporate debt in digital token form, simplifying participation and trading.

For example, investors may participate in tokenized corporate bonds offering approximately 6 percent annualized returns, denominated in USD stablecoins for seamless crypto-based investment. This model allows investors to gain bond-like exposure through crypto-native infrastructure, without relying on traditional broker accounts or custody arrangements.

Gate’s strengths include security, a user-friendly interface, and broad market coverage. The platform provides detailed product information such as yield, credit rating, and maturity, helping users make informed investment decisions. Gate also integrates DeFi protocols, allowing users to earn yields through staking and liquidity mechanisms similar to traditional bond interest income.

To support new investors, Gate offers educational resources and low entry thresholds, with minimum investments as low as USD 100. Whether seeking stable returns or portfolio diversification through crypto assets, Gate provides reliable access to the fixed-income investment landscape while leveraging the efficiency of blockchain technology.

Final Thoughts

Bond investing remains a cornerstone of balanced portfolios, offering stable income and risk diversification. Whether through traditional government, corporate, and municipal bonds or through tokenized RWAs and DeFi products available on Gate, bonds help investors diversify assets and optimize risk-adjusted returns.

As fixed-income markets evolve, TradFi bonds and tokenized bond RWAs are increasingly viewed as complementary tools within diversified, multi-asset portfolios. Understanding key bond metrics such as yield to maturity, coupon rate, credit rating, duration, and liquidity, as well as associated risks including credit, interest rate, inflation, and liquidity risks, is essential for investment success. The rise of blockchain technology and tokenized RWAs has made bond investing more efficient, transparent, and accessible, particularly for retail investors.

Through Gate, investors can access both traditional bond exposure and innovative crypto-based fixed-income products within a single ecosystem, enabling the integration of traditional finance and digital assets. Whether pursuing stable income or diversified portfolio growth, the convergence of bonds and tokenized assets provides a resilient investment pathway across market cycles.

Further Reading

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Bitcoin's Future & TradFi (3,3)

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?