The Second-Handed Look at Perp DEX: HYPE Crosses the Cutoff Line, EVM's Ceiling is Confirmed

A follow-up on Perp DEX is indeed warranted. Nearly 20 projects are set to begin their TGE journey in Q1 2026. From Aster’s trading activity to StandX’s order book points, the constant stream of updates has left the market unsettled.

This shouldn’t be seen as skepticism toward Hyperliquid. Although the synergy between HyperEVM and HYPE hasn’t materialized, Lighter projects haven’t managed to dethrone the new leaders. Our fixation on the Binance-FTX rivalry has reduced the Perp DEX War to a secondary narrative.

Entering a New HYPE Chapter

Lighter Isn’t Lighter—Hyper Is More Hyper

Lighter is a clear success story. After Hyperliquid validated the Perp sector, Lighter quickly established itself, reinforcing the narrative that Hyperliquid rivals Binance, while Lighter positions itself as Hyperliquid’s challenger.

The “stacking turtles” approach can’t continue forever. If you look at the competitive dynamics, OKX has struggled to grow OKB outside Binance’s shadow, and Coinbase’s market cap is more than five times that of Kraken.

Trading is inherently monopolistic. Even the number two player can’t self-sustain. The Perp DEX sector has entered a red ocean phase, with no room for meaningful market expansion. What’s left is a zero-sum game among existing players, all jockeying for TGE outcomes.

Let’s clarify BNB’s position: Binance’s main platform and BNB Chain need connectors—something HYPE has yet to deliver.

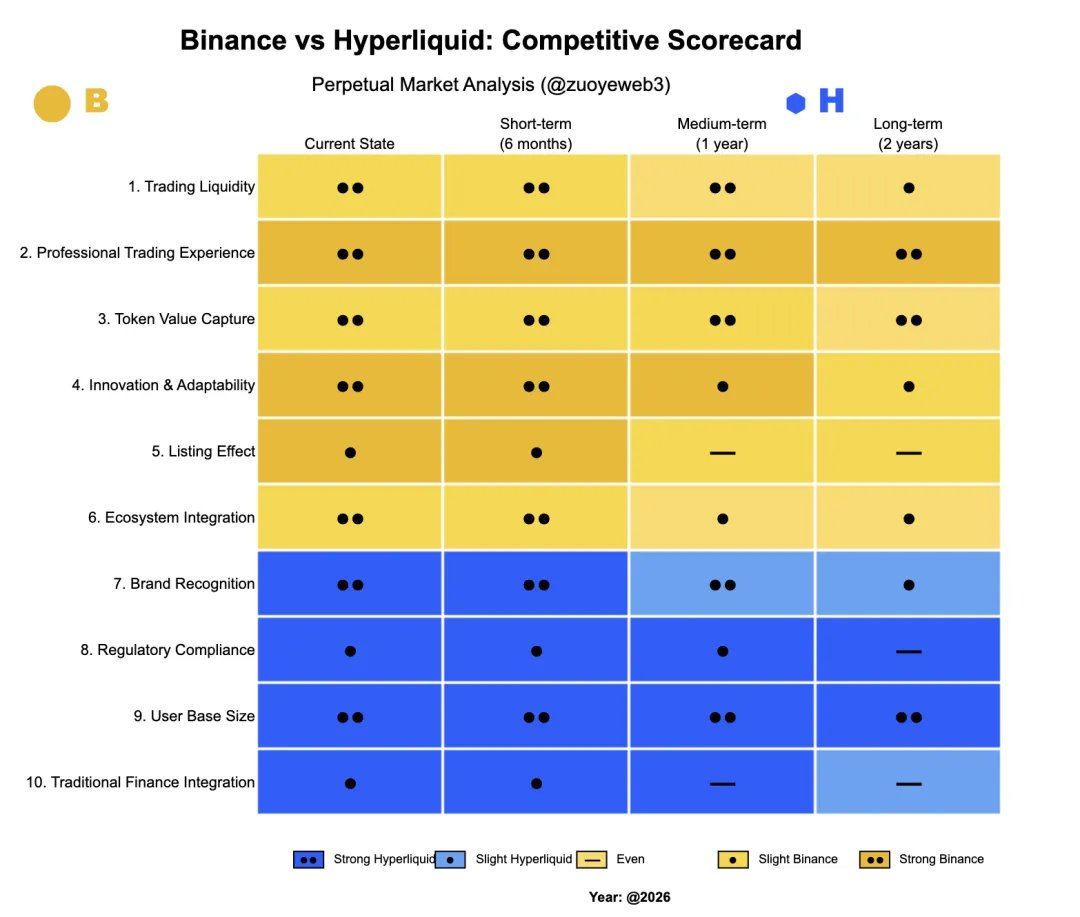

Image description: Binance vs. Hyperliquid comparison

Image source: @zuoyeweb3

Projects rely on the “listing effect” of Binance and are willing to pay top-tier fees. This applies across Binance’s spot and derivatives markets, pre-market trading, and even wallet Alpha and YZi Labs’ EASY Residency.

Binance, in turn, needs project teams to drive off-platform user engagement and slow the post-listing drop-off. That’s why BNB Chain-native projects like PancakeSwap and ListaDAO are tasked with onboarding project assets and sustaining the next listing cycle.

This is the real function of BNB and BNB Chain for Binance—but it only works as long as the “listing effect” remains. This, in turn, has driven Hyperliquid to break new ground.

If we re-examine this logic, Hyperliquid’s rise is proof. Perp has traditionally followed the “spot first, then derivatives” playbook, but Hyperliquid broke the mold by centering on Perp trading from the start. This pivot reflects the industry’s recognition that exchanges can no longer guarantee a listing effect, and mainstream trading has become the new normal.

- OKX and its peers can’t maintain project prices after listing. They lack both liquidity and a robust DeFi ecosystem, relegating them to secondary distributors. OKB doesn’t capture on-chain value and functions only as an internal coupon, losing its original purpose.

- Hyperliquid delivers a professional experience for traders. After FTX collapsed, HyperCore became synonymous with on-chain trading. The larger the trade, the more critical Hyperliquid’s liquidity becomes.

To add context, Aster and CZ once pushed for “privacy/dark pool trading,” but this hasn’t dented Hyperliquid’s market share. Privacy is not a top priority for traders outside of rare money laundering cases, and Binance’s KYC requirements are largely irrelevant.

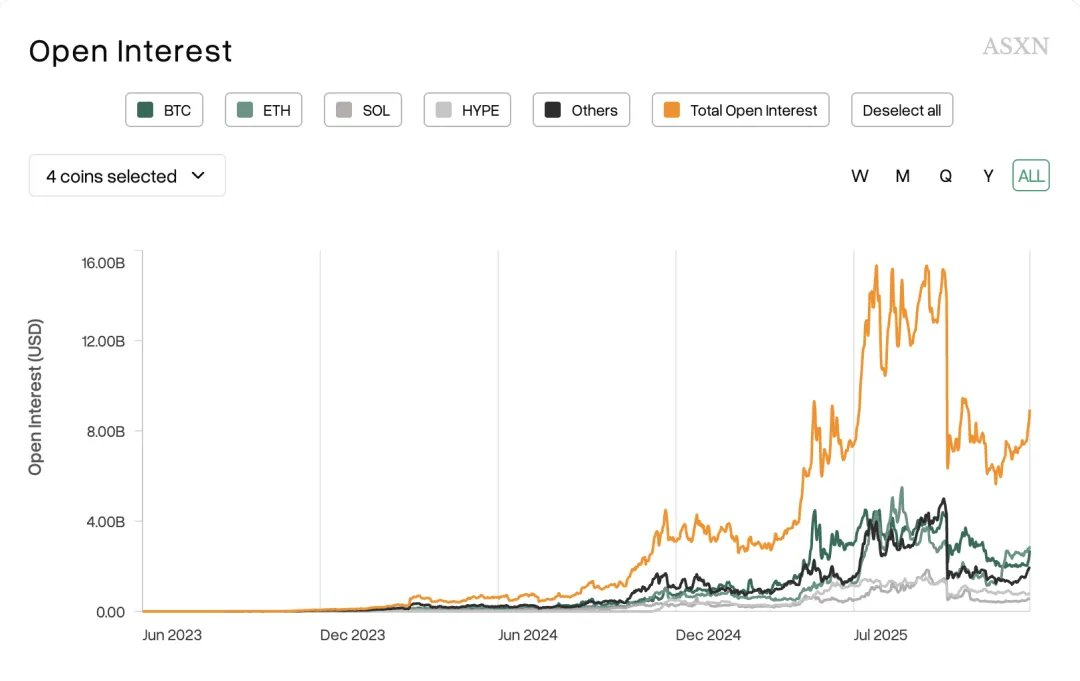

Image description: Trading focus on mainstream assets

Image source: @asxn_r

The fundamental, irreversible trend is that traders now focus almost exclusively on major assets like BTC and ETH. New tokens see a burst of activity at launch, but that’s it—whether it’s BeraChain, Monad, Sonic, or other new L1s.

The “listing effect” that leading exchanges once relied on—and the fees that sustained second- and third-tier exchanges—are relics of the past. This shift explains why exchanges are now launching their own Perp DEXs and broadening their scope to all asset classes, including stocks, forex, and precious metals.

But none of this threatens Hyperliquid’s liquidity. In my previous piece, “RFQ Architecture: Market-Making at Scale, an Alternative for Late-Stage Perp DEX,” I highlighted how Variational opens market-making to retail traders—a real market need. By contrast, most Perp DEX “point farming” competitions are just liabilities to be paid out at TGE.

If you think Bitget’s marketing can capture Binance’s derivatives market, then StandX’s order book points could just as easily challenge Hyperliquid’s market share.

The more liquid a market, the more it becomes a daily destination for traders. In the Perp DEX sector, where the listing effect is even weaker, the gap between airdrop hunters and real users grows wider. Most users still rely on CEXs for dual-asset products, much less trading Perps on-chain.

Ligher is adding forex, Edge is building its own chain, but without surpassing HyperCore’s liquidity, they’re forced to add complexity to support their narrative. This undermines their token value capture and risks turning them into OKB-style “internal coupons.”

As for regulatory “discounts” on Hyperliquid: Since BitMEX, neither CEXs nor DEXs have lost market favor due to U.S. regulatory action. Only hacks or severe crashes have caused major market share shifts.

- Hacks: KuCoin (2020), ByBit (over $1.4 billion stolen in 2025)

- Crashes: BitMEX’s March 12, 2020 outage

- Reputation: Huobi—Sun’s pGala incident

Only SBF’s FTX was killed by Coindesk’s FUD and a lack of industry savvy compared to CZ. The “1011” event is just business as usual for legacy exchanges like Binance.

We’re now in a rare window of relaxed SEC oversight. Binance has landed in Abu Dhabi, Hashkey completed its Hong Kong IPO, and Hyperliquid is not outside the reach of regulation. Even if Hyperliquid insists on a “decentralized” front, it can follow Binance’s model by bringing core clearing under regulatory frameworks.

Law is a barrier for the weak; compliance is the price of legitimacy for the strong.

Strong Operations Are Essential for Public Chains

The “listing effect” on CEXs and the volume-boosting effect on DEXs are both fading. Hyperliquid’s liquidity remains strong, and HYPE has crossed the critical threshold, avoiding FTT’s fate.

But that’s not the whole story. HYPE still isn’t aligned with the HyperEVM ecosystem and can’t manufacture the kind of “artificial prosperity” seen in the BNB ecosystem, nor replicate Ethereum’s DeFi system. This has already been detailed in “Ethereum Bleeding, Hyperliquid Losing Momentum.”

This piece focuses on why these trends exist and where the solutions might lie.

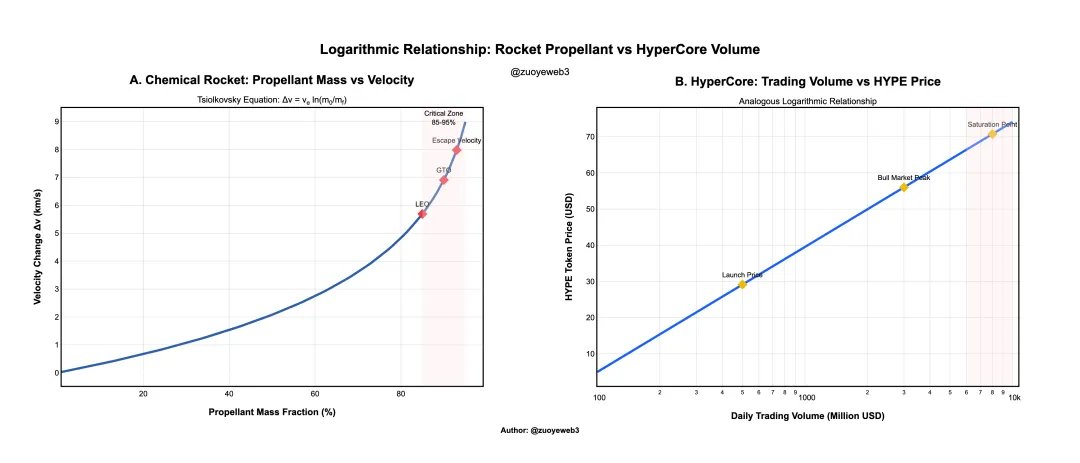

Rocket fuel and thrust are logarithmically related, just as HyperCore trading volume and HYPE price are.

In a chemical rocket, you need exponentially more fuel for linear speed increases. Today, HyperCore trading fees support HYPE’s price, but trading volume can’t grow forever—especially with Binance and Perp DEXs splitting the pie.

Image description: Token price vs. trading volume

Image source: @zuoyeweb3

To illustrate, HYPE’s initial price was in the single digits, but a stable price near $30 is the “fair value” in the public view. The trading volume in the chart is also adjusted to clarify the relationship between price and HyperCore volume.

This doesn’t contradict the fact that Perp DEX competition can’t dethrone Hyperliquid. In crypto, only BTC and ETH have lasting value, and the Perp market has already plateaued for now.

Let’s break down the Hyperliquid team’s “hands-off” approach. The logic is simple but harsh: The Hyper team still benchmarks public chains to BTC and looks to FTX as a derivatives reference—learning from successes, avoiding failures.

The USDH auction ticker is a telling example. Hyperliquid’s official nodes don’t vote, don’t designate teams, and don’t provide liquidity support. USDH lacks development potential and has no clear advantage over USDC or USDe.

The team’s “laissez-faire” stance is now HyperEVM’s biggest problem. This doesn’t mean they lack operational capacity—remember, Hyperliquid’s first breakout was meme-driven, and the launch of Unit included an “official” cross-chain bridge. USDC has long been routed to HyperCore via Arbitrum.

But all these efforts focus on HyperCore. To the team, HyperCore is the product and HyperEVM is the ecosystem: the product needs strong operations, the ecosystem should be open.

Unfortunately, the landscape has changed. Today’s public chains are like super apps—just like internet giants, there haven’t been new mass-market hits in years. TON, Monad, Berachain, Sonic all fit this pattern, and Plasma is more like a vault than a stablecoin chain.

On-chain infrastructure is now so mature that public chains and L2s lack direct network effects. They must either fight for existing users (like ETH L1/Solana), bring in RWAs as SaaS variants (like Canton), or artificially maintain engagement (like BNB Chain).

But Jeff wants to avoid the pitfalls of FTX’s aggressive operations, so HyperEVM takes a conservative approach. This forces projects to rely on community governance, making it impossible to foster interaction with HYPE. Once HYPE is distributed, projects quickly rise and fall.

Even HyperCore’s operations are minimal. If you follow Hyperliquid, Jeff, and Hyper Foundation, there’s almost no interaction with project teams.

This approach worked in 2017 or during DeFi Summer 2020, when launching a new on-chain product guaranteed traffic, profits, and high expectations for the token. Those days are gone.

Hyperliquid doesn’t need a dramatic shift—just learning from BNB could build a growth flywheel of its own.

HYPE’s path forward is to emulate BNB.

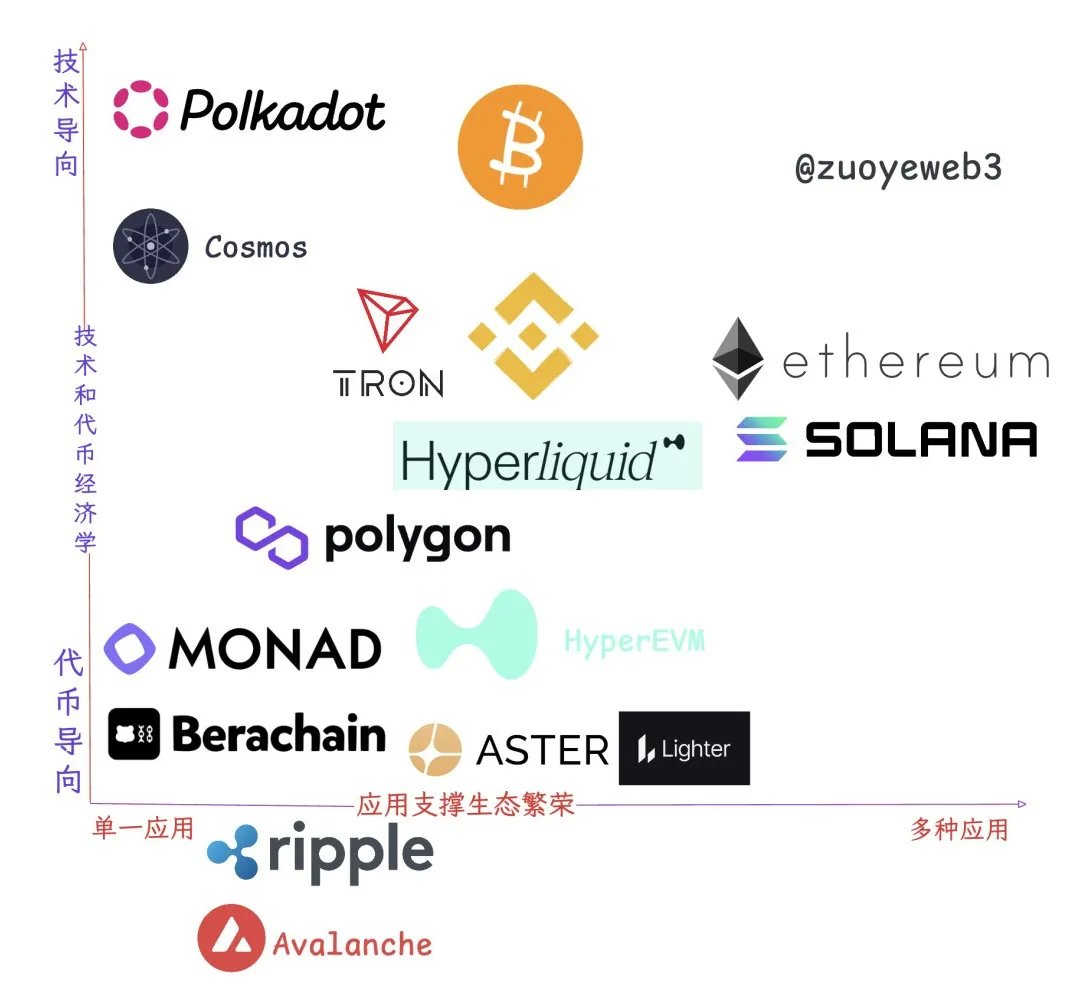

Image description: Ecosystem and application relationships

Image source: @zuoyeweb3

Looking at today’s surviving public chains and L2s, ecosystem prosperity and mainnet token value capture are far more complex than theory suggests. Only Ethereum fits the textbook model; the rest don’t fit neatly into categories.

In short, ideals remain ideals because they never fully manifest in reality.

- Single Application: TRON and Polygon survive on one killer app—USDT for TRON, Polymarket for Polygon.

- Tech-Driven (“Era Relics”): Polkadot and ATOM are technologically advanced but their tokens don’t capture economic value.

- Pure Token: Monad/Berachain—once the token launches, their mission is done.

- Ecosystem Prosperity: Solana and Ethereum.

- Existential: Ripple, Avalanche—existence is everything, and everything is existence.

There are further distinctions. Binance’s main platform and HyperCore belong to the “bucket group”—their tokens capture strong value and their products cover spot/Perp trading, wealth management, staking, and transfers. They aren’t public chains, but functionally they’re close.

BNB Chain’s value is as an extension of Binance’s main platform in public chain form. Even with leadership changes, Binance hasn’t abandoned BNB Chain. Public chains make many things easier than exchanges, and traffic is long-term value.

Hyperliquid’s HIP-3 is another outlet for HyperCore liquidity, creating competition with HyperEVM for user flow. This battle now takes place not just between HIP-3 projects, but also among Builder Code and HyperEVM projects.

Hyperliquid wants to be the AWS of liquidity, but its internal structure is still unclear.

BNB Chain isn’t Binance’s ideal, but it’s more than enough for Hyperliquid to learn from.

BNB Chain is Binance’s distribution channel—it can’t survive without strong operations, nor can it support Binance. But for HyperEVM’s current stage, that’s sufficient.

There’s room to take a step forward while balancing minimal operations and openness—such as designating leaders in lending, swap, and LST sectors. The failed HIP-5 proposal was too blunt, and using repurchased HYPE to buy project tokens is also unworkable.

Ecosystem collaboration doesn’t break any rules. The Hyperliquid team rarely interacts with project teams, possibly preferring off-chain partnerships, but on-chain exposure is still crucial.

If even minimal HyperEVM operations are neglected, HYPE could hit $50, but without network effects, it will lose exponential growth potential.

Without HyperEVM’s support, HyperCore would need OKX-level liquidity, but even that wouldn’t build a HYPE flywheel.

In short, for on-chain ecosystems, a “decentralized” HyperEVM has no retreat.

Conclusion

Hyperliquid is lighter and more capital-efficient than Binance. Lighter isn’t lighter than Hyperliquid, and Aster is racing to add complexity.

Perp DEXs like Aster and Edge, whether at or near TGE, will all pursue their own L2s or public chains as part of their valuation play—just as PumpChain’s token launch is part of its plan.

This is the pivotal moment for Hyperliquid to embrace complexity and leverage its scale for future advantage.

As mentioned, Hyperliquid isn’t known for product innovation (Jeff also tried prediction markets), but excels at engineering integration. If FTX isn’t the right model, BNB Chain is an excellent one to follow.

Disclaimer:

- This article is reprinted from [zuoyeweb3]. Copyright belongs to the original author [zuoyeweb3]. If you have concerns about this reprint, please contact the Gate Learn team, who will address the issue according to relevant procedures.

- Disclaimer: The views and opinions expressed in this article are those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Unless Gate is mentioned, reproduction, distribution, or plagiarism of the translated article is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?