The Right Way to Use Gate ETF Leveraged Tokens: Not a Chasing Tool, but a Trend Amplifier

Common Mistakes When Using ETF Leveraged Tokens

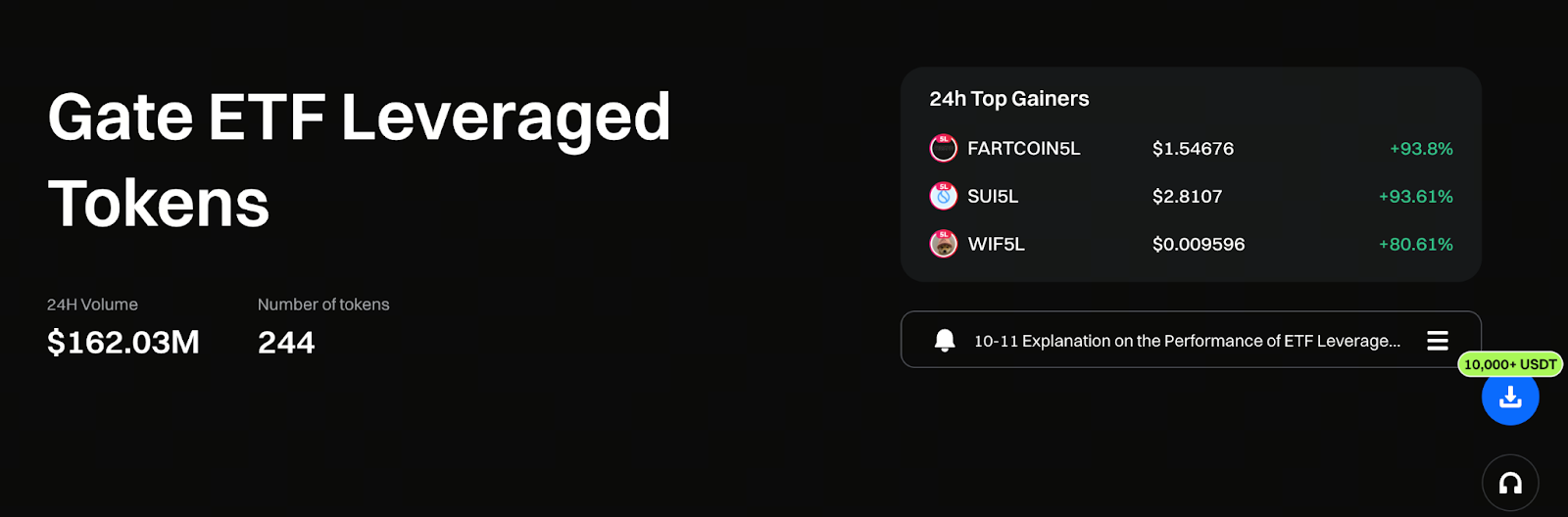

Image source: https://www.gate.com/leveraged-etf

Many traders first encounter Gate ETF leveraged tokens during periods of intense market enthusiasm. When prices surge, leveraged tokens climb even higher, seeming to offer huge opportunities. The reality is, ETF leveraged tokens are not designed for the peak of market sentiment. They work best during the middle or early stages of a trend.

If you use them as short-term momentum chasing tools, you’re likely to face pullbacks at elevated levels. This amplifies not only your returns, but also the cost of misjudgment.

Gate ETF Leveraged Tokens: Path Matters More Than Outcome

Unlike spot trading, ETF leveraged tokens are extremely sensitive to the price path. Even if the final price returns to the same level, differences in volatility along the way can result in completely different net asset values. This is a direct effect of their automatic rebalancing mechanism.

In strong, one-sided trends, the path is relatively smooth and rebalancing usually works in your favor. In choppy, back-and-forth markets, the path gets complicated and net asset value is more likely to erode.

So, before using ETF leveraged tokens, it’s more important to determine if the market has a clear trend than to simply predict whether prices will rise.

The Real Edge of Gate ETF Leveraged Tokens Isn’t Just the Leverage

Many focus on the 2x or 3x leverage, but Gate ETF leveraged tokens’ true advantage lies in their simplified risk structure.

- No margin required

- No liquidation price

- No need for constant position monitoring

This allows you to concentrate on direction and timing, not technical details. If you prefer to avoid complex parameters interfering with your decisions, this is a clear benefit.

Why ETF Leveraged Tokens Are Ideal for Trend-Following Traders

Trend-following traders don’t try to pick tops or bottoms. They wait for clear trend confirmation before acting.

Gate ETF leveraged tokens fit this approach perfectly. Once a trend is confirmed, leveraged tokens can help boost your capital efficiency and returns in a relatively short window.

If you’re used to frequent trading in sideways markets, ETF leveraged tokens may actually work against you.

Holding Period Matters More Than Entry or Exit

With ETF leveraged tokens, many risks come from the holding period—not the entry point.

- Hold too briefly and you may not capture the trend amplification.

- Hold too long and you risk losses from post-trend volatility.

The best strategy is to hold during the acceleration phase of a trend, rather than trying to capture the entire move from start to finish.

Gate ETF Leveraged Tokens Shouldn’t Be Your Core Portfolio

A frequent mistake is treating ETF leveraged tokens as your main portfolio allocation.

In reality, these tokens are best used as supplementary tools for:

- Boosting returns during strong trends

- Improving short-term capital efficiency

- Strategic allocation based on clear market views

Putting all your holdings into leveraged tokens tends to magnify emotional swings and decision errors.

How to Build a Rational Perspective on Gate ETF Leveraged Tokens

A rational approach includes several points:

- They aren’t long-term investment assets

- They don’t suit choppy, range-bound markets

- They can’t replace trend analysis

- They’re execution tools, not decision-making tools

Once traders recognize these boundaries, ETF leveraged tokens become much more effective.

Conclusion

Gate ETF leveraged tokens are best for traders who patiently wait for trends and act at the right time—not those chasing short-term excitement. Instead of asking, “Can I earn more?” first ask, “Is this the right time to use this tool?” When used appropriately, leverage becomes a tool for efficiency, not just a source of risk.

Related Articles

What is MetFi? All You Need to Know About METFI (2025 Update)

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Every U.S. Crypto ETF You Need to Know About in 2025

What are Leveraged ETF Tokens?

Gate Research: BTC Hits New Highs, Bitwise Files Solana ETF, Stablecoin Exceeds $190B