The New Narrative of the $5,000 Gold Era: How to Understand the Logic of Tokenized Gold

A year ago, if someone had predicted gold would quickly surge to $5,000 per ounce, most people would have dismissed it as pure fantasy.

Yet that’s exactly what unfolded. In just two weeks, the gold market broke through historic milestones—$4,700, $4,800, $4,900 per ounce—one after another, racing toward the much-anticipated $5,000 mark with virtually no pullbacks.

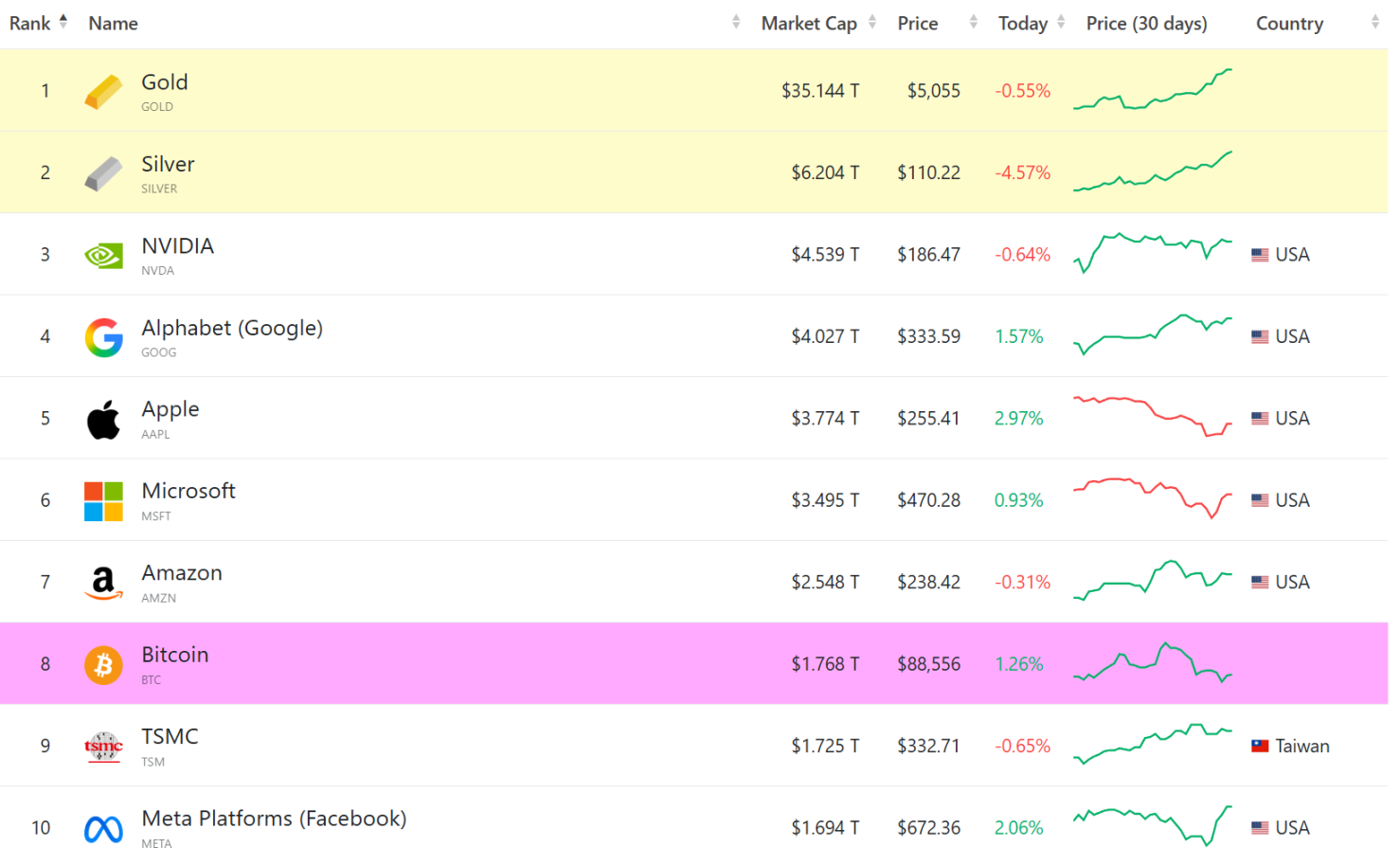

Source: companiesmarketcap.com

As global macro uncertainty continues to be validated, gold has reclaimed its classic role: a consensus asset independent of any single sovereign promise.

However, a pressing question is emerging: As gold regains its consensus status, can traditional holding methods still meet the demands of the digital age?

I. Macro Cycle Inevitability: The “Old King” Returns

Viewed over longer macro cycles, this gold rally reflects not short-term speculation, but a structural shift driven by persistent uncertainty and dollar weakness:

Geopolitical risks have expanded from Russia-Ukraine to the Middle East, Latin America, and other strategic resource and shipping regions. Global trade faces repeated disruptions from tariffs, sanctions, and policy clashes. The US fiscal deficit keeps widening, and the dollar’s long-term credit stability is increasingly debated. In this climate, markets are accelerating their search for a value anchor that doesn’t rely on any single nation’s credit or external endorsement.

Gold doesn’t need to prove it can generate returns; it simply needs to repeatedly demonstrate its resilience in eras of credit uncertainty.

This partly explains why BTC, once dubbed “digital gold,” hasn’t fully assumed the same consensus role in the current cycle—at least for macro hedging, capital flows have made the choice clear. (For more, see From Trustless BTC to Tokenized Gold: Who Is the Real ‘Digital Gold’?.)

Still, gold’s renewed consensus doesn’t mean every issue is resolved. For years, investors have been forced to choose between two imperfect options.

The first is physical gold: secure, sovereign, but almost entirely illiquid. Gold bars locked in safes incur high storage, insurance, and transfer costs, making real-time trading and daily use nearly impossible.

The recent shortage of bank safe deposit boxes highlights this tension—more people want to hold gold themselves, but practical constraints often get in the way.

The second option is paper gold or gold ETFs, which lower the barrier to entry. Products issued by banks or brokers are essentially claims on financial institutions, backed by settlement promises within account systems.

But this liquidity is far from absolute—paper gold and ETFs only provide liquidity within a single financial system. You can buy and sell within a specific bank, exchange, or clearing framework, but you can’t move assets freely beyond those boundaries.

They can’t be split or recombined, nor can they interact across asset systems or be used directly in diverse scenarios. This is “in-account liquidity,” not genuine asset liquidity.

My first gold investment, “Tencent Micro Gold,” worked this way. Paper gold doesn’t truly solve gold’s liquidity problem—it simply substitutes counterparty credit for the inconvenience of physical gold.

Ultimately, security, liquidity, and sovereignty have long been mutually exclusive. In a highly digital, cross-border era, such compromises are increasingly unsatisfactory.

This is the context in which tokenized gold is gaining traction.

II. Tokenized Gold: Restoring True Liquidity to the Asset

Tokenized gold, led by Tether’s XAUt (Tether Gold), aims to solve more than just the surface-level problem of making gold easier to hold or trade—a challenge paper gold also addresses. It tackles a deeper question:

How can gold maintain its “physical backing” while gaining the full, cross-system liquidity and composability of crypto assets?

XAUt’s design is conservative and traditional: each XAUt token represents one ounce of physical gold stored in a London vault. The gold is held in professional facilities, is fully auditable and verifiable, and token holders have direct claims on the underlying metal.

This approach avoids complex financial engineering and resists amplifying gold’s attributes through algorithms or credit expansion. Instead, it respects traditional gold logic—establish physical backing first, then explore digital transformation.

Fundamentally, tokenized gold like XAUt and PAXG isn’t creating a new narrative. It’s repackaging the world’s oldest asset using blockchain, making XAUt a form of “digital physical gold,” not a speculative crypto derivative.

The real breakthrough is the shift in liquidity. In traditional systems—whether paper gold or ETFs—liquidity is limited to “in-account” transactions within banks, brokers, or clearing houses.

XAUt’s liquidity is intrinsic to the asset itself. Once gold is tokenized on-chain, it inherits crypto’s core properties: free transferability, divisibility, composability, and seamless movement across protocols and applications—without centralized permissions.

Gold’s liquidity is no longer proven by accounts but by the asset itself, circulating globally 24/7. (For more, see “Gold Godfather” Debates CZ: Who Is the ‘Digital Gold’? A Trust Battle Across TradFi and Crypto.) On-chain, XAUt becomes a foundational asset unit, recognized and integrated by other protocols:

- It can be freely exchanged with stablecoins and other assets;

- It can be included in advanced asset allocation and portfolio strategies;

- It can even serve as a value carrier for payments and consumer use cases;

This is the liquidity paper gold could never deliver.

III. From “On-Chain” to “Usable”: The True Inflection Point for Digital Gold

Tokenized gold isn’t finished just because it’s on-chain.

The real inflection point is whether “digital physical gold” can be easily held, managed, traded, and even used as currency for payments. If tokenized gold remains just code locked in centralized platforms or single gateways, it’s no different from paper gold.

That’s where lightweight self-custody solutions like imToken Web make a difference. imToken Web lets users manage tokenized gold and other crypto assets instantly from any device, right in the browser—just like opening a website.

In self-custody, users control their private keys. Gold isn’t stored on any provider’s server; it’s anchored directly to your blockchain address.

Thanks to Web3’s interoperability, XAUt is no longer dormant in a safe. It can be purchased flexibly in small amounts, and payment tools like imToken Card can unlock its purchasing power in real time for global spending.

Source: imToken Web

In the Web3 environment, XAUt can be traded, combined with other assets, exchanged, and integrated into payment and consumption scenarios.

When gold combines high store-of-value certainty with modern usability, it completes the leap from “old-school safe haven” to “future currency.”

Gold’s millennia-spanning consensus isn’t outdated—the only thing outdated is how it’s held.

As gold enters the blockchain as XAUt and returns to individual control through self-custody solutions like imToken Web, it carries forward a logic that transcends eras—not a new story, but a timeless principle:

In an uncertain world, real value means relying as little as possible on others’ promises.

Disclaimer:

- This article is republished from [TechFlow]. Copyright remains with the original author [imToken]. For any concerns regarding republication, please contact the Gate Learn team for prompt handling according to established procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team. Unless Gate is explicitly mentioned, do not copy, distribute, or plagiarize translated articles.

Related Articles

Reflections on Ethereum Governance Following the 3074 Saga

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

Altseason 2025: Narrative Rotation and Capital Restructuring in an Atypical Bull Market

NFTs and Memecoins in Last vs Current Bull Markets