The Endgame of Crypto Finance: Why Does It Still Lead Back to TradFi?

Introduction: Has the Crypto World Really “Decentralized TradFi”?

Cryptocurrencies and blockchain technology were once seen as tools to disrupt traditional finance (TradFi), but the reality is far more complex. From the issuance and redemption of stablecoins to the launch of crypto asset trading funds (ETFs), crypto finance is continually integrating itself into the operational mechanisms of the traditional financial system. Stablecoins like USDC and USDT are often considered “decentralized currencies,” but their value and operations are heavily reliant on traditional banking systems and financial market infrastructure. This shows that crypto finance has moved from opposing traditional finance to becoming nested within it. Using TradFi as the focal point, this article explores why crypto finance ultimately returns to traditional finance through examples such as USDC, USDT, and Bitcoin ETFs.

I. TradFi Is a “Credit Factory,” Not a Technological Laggard

1.1 What Is TradFi’s Real Moat?

The core competitiveness of traditional finance does not lie in algorithms or cryptographic technology, but in its role as a “credit factory”: the banking system creates money and manages credit through deposit-lending mechanisms, enjoying institutional advantages backed by government endorsement. BNP Paribas research points out a fundamental difference between stablecoins and fiat currency systems: “Stablecoins are only based on the circulation of existing financial assets and cannot create new financing, whereas the banking system can expand loans and money supply through deposits and reserve mechanisms.” In other words, when bank deposits increase, they not only provide resources for lending but also directly expand the money supply and economic credit. In contrast, fully reserved stablecoins can only use existing assets as intermediaries and cannot proactively scale up financing. Therefore, the role of traditional banks in capital flows and money creation is a moat that the crypto system cannot easily replace.

Additionally, regulatory trust and legal status are moats for traditional finance. Banks benefit from deposit insurance, central bank liquidity support, and strict regulation, which enhance public trust and system stability. While crypto institutions claim to be decentralized, in practice they often need regulated channels to obtain fiat: for example, Circle issues USDC with “most reserves held in SEC-registered 2a-7 Treasury funds (managed by BlackRock), with the rest in cash at a handful of top global banks with stringent capital and regulatory requirements.” Crypto asset custodians like Coinbase Custody operate as regulated trust companies in the US, relying on traditional financial arrangements behind their services. Clearly, traditional finance’s advantage in credit and trust mechanisms makes it not a technological laggard, but rather the foundational infrastructure on which the crypto world depends.

1.2 How Does the Traditional Banking System Support Global Credit Cycles?

The banking system’s ability to expand credit also plays out at the macro-policy level. In global economic operations, central bank policy, cross-border settlement systems (like SWIFT), and interbank lending networks form a web for transmitting money and credit. Although stablecoin issuance is pegged to the dollar, it cannot escape the influence of US monetary policy and the banking system: in the past year, USDC has bridged approximately $277 billion between fiat and blockchain, indicating that users are actively exchanging and redeeming stablecoins within the fiat banking system. Emerging stablecoins that fail to secure bank accounts or regulatory approval remain very limited in scale. If risks emerge in the banking system, stablecoins will be directly affected. Furthermore, traditional financial tools such as insurance mechanisms, clearing and settlement systems, and emergency liquidity support help maintain overall financial network stability during extreme events—tasks that pure blockchain mechanisms cannot independently fulfill. Thus, it is precisely traditional finance’s robust credit cycles and risk management that provide a deep credit foundation for global finance—a capability that crypto-native technology cannot quickly replace.

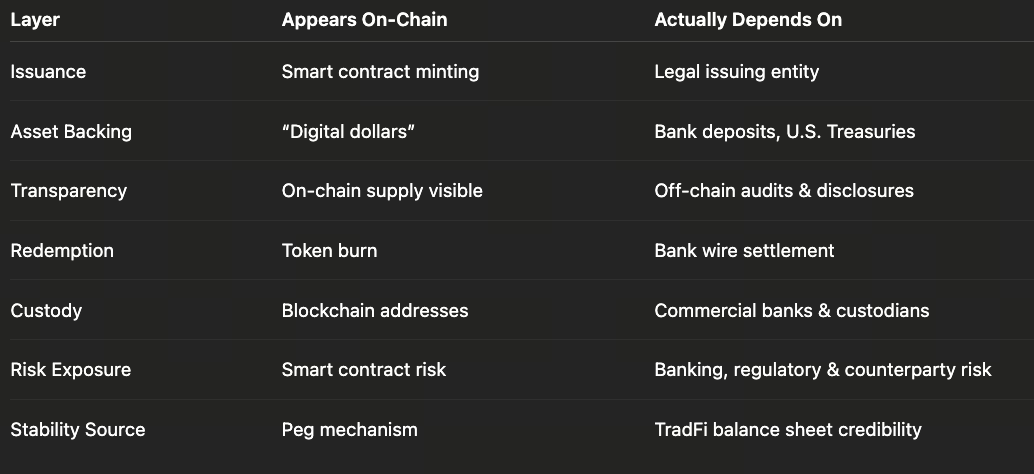

II. Stablecoins Are Not “Decentralized Currencies,” But On-Chain Reflections of TradFi

2.1 Are Stablecoins Decentralized Currencies?

On the surface, stablecoins like USDC and USDT circulate on blockchains and seem “decentralized,” but in reality they are centralized products issued by one or a few entities. The SEC recently stated that “covered stablecoins are crypto assets pegged to reference assets like the dollar and backed by low-risk, highly liquid reserves.” In other words, these stablecoins promise 1:1 redemption for dollars from their issuers or trusts; their value depends entirely on underlying fiat reserves. For example, Circle states that USDC is “100% backed by high-liquidity cash and cash equivalents and always redeemable 1:1 for dollars,” with monthly audits by major accounting firms to ensure reserve value exceeds circulating supply. But these reserves aren’t held on-chain—they’re in bank accounts and money market funds. Circle discloses that most USDC reserves are allocated to US Treasuries and government money market instruments managed by BlackRock’s 2a-7 fund; the rest sits at major banks like BNY Mellon, Citi, and Wells Fargo. This means USDC’s value is derived from banks and capital markets within traditional finance—not from network consensus.

2.2 How Do Stablecoin Trust Mechanisms and Reserve Structures Work?

Take USDC as an example: Circle’s audit reports disclose “minting and burning” data—such as $277 billion in USDC issued or redeemed over 12 months—essentially tracking capital flows between crypto and banking systems. Behind this lies fiat moving among banks: users deposit dollars (or other fiat) into banks; Circle mints equivalent USDC on-chain; conversely, USDC is burned when users redeem for dollars from banks. Functionally, stablecoins resemble “bank deposits mapped onto blockchains.” Regulators like the SEC and CFTC repeatedly emphasize that truly stable stablecoins must hold sufficient, high-quality reserve assets. The CFTC previously penalized Tether (USDT), noting that Tether claimed every USDT was dollar-backed “but for much of the time this was not true; some reserves were just unpaid loans or poor-quality assets.” Evidently, stablecoins lacking transparency or regulatory oversight risk losing user confidence if reserves fall short.

Moreover, the traditional financial framework provides compliance and legal protection for stablecoins. Issuers like Circle and Paxos must adhere to national financial licensing and audit requirements—for example, Paxos is supervised by New York’s Department of Financial Services (NYDFS). Recent regulatory statements (such as multiple SEC declarations in 2024–2025) indicate that with full asset backing and regulatory oversight, some stablecoin issuance/redemption may not be directly classified as securities transactions. This implies that stablecoins are fundamentally similar to electronic money: they represent claims on dollars (or fiat) carried by blockchain technology. Even when circulating on public chains, they rely on fiat settlement and trust guarantees from traditional finance. Therefore, seeing stablecoins as “decentralized digital currencies” is mistaken—they are more accurately digital representations of traditional financial systems.

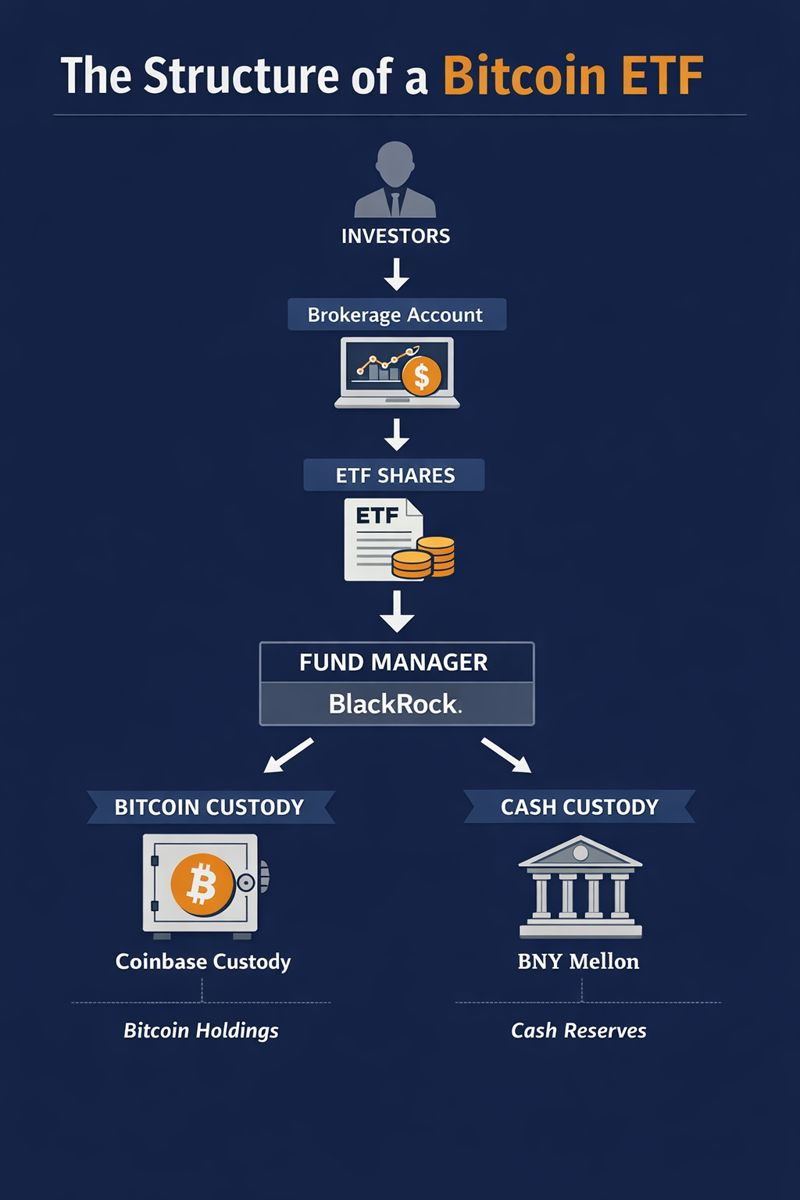

III. Crypto ETFs Are TradFi’s “Formatting” of Crypto Assets

3.1 How Do Crypto Asset ETFs Bridge Crypto and Traditional Finance?

Crypto asset ETFs (such as Bitcoin ETFs) essentially package crypto assets into investment products compliant with securities laws so they can be listed on traditional exchanges. For example, BlackRock’s iShares Bitcoin ETF prospectus states: “The trust’s main asset is bitcoin, custodied by Coinbase Custody; cash is held at BNY Mellon.” Similarly, ARK Invest’s Bitcoin ETF with 21Shares designates Coinbase Custody as its custodian. These cases show that crypto asset ETFs operate much like commodity or currency ETFs: they have dedicated asset managers (fund companies), custodian banks, secure clearing systems, regular disclosure requirements, and listing structures regulated by exchanges and authorities. Investors can buy or sell ETF shares through brokerage accounts without directly holding crypto private keys or using crypto exchanges.

3.2 What Are ETF Custody and Regulatory Mechanisms?

Once crypto assets are “packaged” into ETFs, they rely on traditional financial trust systems. First, custodians must ensure asset safety: Coinbase Custody operates as a regulated trust company under US law—its custody agreement specifies assets are owned by the trust under New York commercial law; if the custodian goes bankrupt, trust assets should not be part of bankruptcy estates (though courts’ final rulings remain uncertain). This is a challenge faced by both traditional custodians and crypto institutions. Moreover, ETF issuers sign service agreements with registered custodians specifying bank responsibilities for cash/digital asset safekeeping. For instance, BNY Mellon must ensure that cash is available whenever new ETF shares are issued; Coinbase Custody coordinates bitcoin transfers for ETF creations/redemptions. ETFs also disclose holdings regularly and undergo fund audits so investor rights are clearly defined by law. This “formatting” gives crypto asset trading the same standardized process as stocks or futures—while also making it deeply dependent on traditional financial institutions’ involvement. For example, listing Bitcoin ETFs on stock exchanges requires compliance with market surveillance rules and price monitoring agreements with crypto exchanges—all classic securities market regulations. Thus, crypto ETFs do not make crypto assets fully independent from TradFi; instead they repackage them via traditional channels to enter mainstream financial markets.

IV. What Happens to Stablecoins and ETFs Without TradFi?

4.1 How Would Stablecoins Operate Without Banks or Regulation?

Without support from traditional finance, stablecoins could hardly uphold their value promises. Stablecoins rely on fiat currency reserves: without bank accounts there’s no way to store or clear dollars. If all banks refuse deposits from stablecoin issuers or regulation bans issuance (as happened when EU MiCA took effect—many non-compliant stablecoins were delisted due to reserve/issuance standards), fiat reserves would be severed and the “1:1 redemption for dollars” foundation would collapse. Lacking liquidity or regulatory protection, any supposedly collateralized stablecoin could face redemption runs: if many users request payouts simultaneously but reserves are locked in banks or hard to liquidate quickly from money markets, prices could depeg. Historically, Tether in 2018 was penalized for failing to prove 100% dollar backing; more extreme algorithmic stablecoins (like TerraUSD) collapsed rapidly without real reserves. In short, without banks, clearing networks, or regulation, creating trustworthy “crypto dollars” is extremely difficult—any digital currency pegged to USD must bear high capital costs or lose redemption assurance, forfeiting its original stability function.

4.2 What Happens to Crypto ETFs Without Custody or Settlement?

Crypto ETFs also cannot exist independently of traditional financial infrastructure. ETFs require banks for fund settlement and regulated custodians for digital asset safekeeping—for instance, BlackRock’s Bitcoin ETF relies on global giants like BNY Mellon for cash custody and Coinbase Custody for bitcoin storage. Without these institutions’ participation, ETFs lack trust structures or compliance endorsements; investors couldn’t trade shares via brokerage accounts. Without banks, issuers can’t guarantee cash settlements for creations/redemptions; without custodians, bitcoin lacks third-party legal protection. In practice—even at peak crypto adoption—most institutional investors access crypto markets via off-exchange custody/settlement services; large OTC trades still go through banking channels. Thus without TradFi as an anchor point, crypto financial products would shrink in scale and credibility.

V. What Is Happening in Crypto Finance?—From “Opposition” to “Nesting”

5.1 How Is the Relationship Between Crypto Finance and TradFi Evolving?

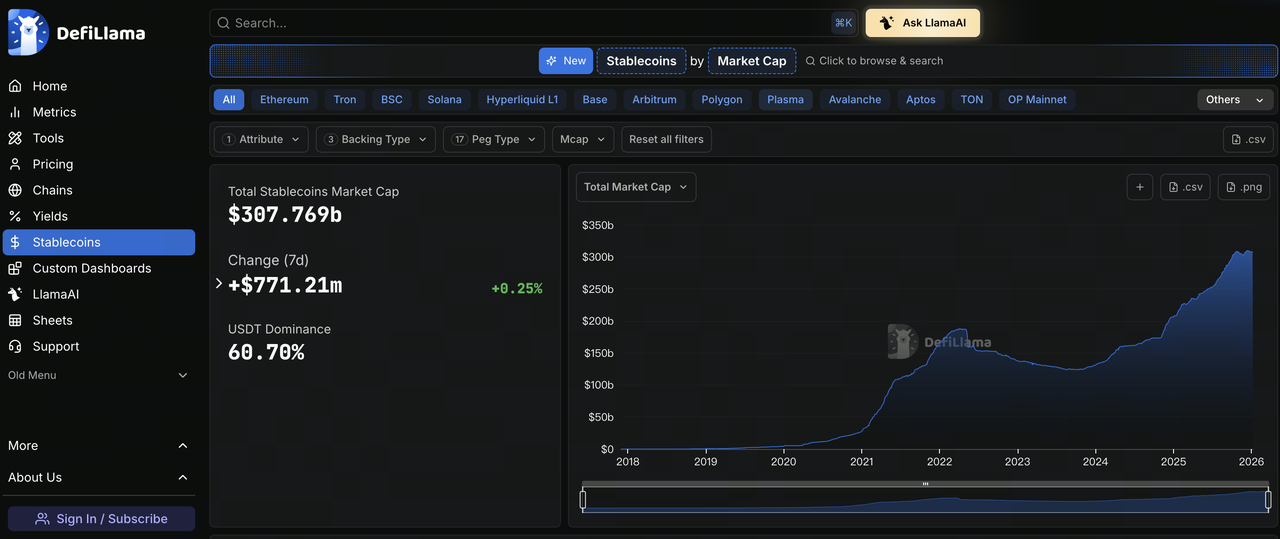

Chart: https://defillama.com/stablecoins

The crypto world once loudly advocated decentralization and de-banking, but now mutual nesting is increasingly evident. Regulatory data shows stablecoin market cap and crypto investment products keep growing: by September 2025 global stablecoin market cap exceeded $300 billion—growth occurring as cryptocurrencies engage with traditional financial ecosystems (e.g., major banks/asset managers actively building digital asset custody/trading services—BNY Mellon’s digital custody business; Fidelity’s Bitcoin Trust). The European Systemic Risk Board (ESRB) also notes: “The rapid growth of stablecoins/fiat currencies is increasingly intertwined with TradFi; asset backing/investment products deepen connections between crypto assets and mainstream financial markets.” Meanwhile, the crypto community seeks regulated development: new laws (such as proposed US stablecoin regulation) require sufficient reserves/audits; regulatory standards for ETFs/custody services are clarifying globally. All this shows that crypto finance is no longer an isolated “opponent,” but is transforming into a new field nested layer-by-layer within TradFi.

5.2 What Does Moving From Opposition to Nesting Mean?

This evolution means crypto finance must redefine its own role. The vision of escaping TradFi may be alluring—but most real-world financial activity still depends on banks, clearinghouses, regulators for support. So crypto’s path forward will likely be complementary/coexistence with TradFi rather than outright replacement—for example stablecoins improve payment efficiency but ultimately route funds through banks; crypto exchanges innovate trading models but their dollar gateways remain bank accounts. For healthy future development, crypto finance must balance decentralization ideals with TradFi rules: leveraging blockchain advantages (global instant settlement; transparent contracts), while adhering to regulation/risk management to win broad trust/participation. As Circle says: expansion of the USDC economy relies on “partnerships with major digital asset exchanges, banks, wallets—and a growing fiat access network.” In other words, crypto finance’s future will be dual-track: “blockchain + TradFi,” not abandoning banks entirely.

VI. Gate Expands TradFi Product Offerings

By introducing CFDs (Contracts for Difference) for gold, forex, indices, commodities, and stocks into a unified account system, Gate extends users’ price judgment capabilities from crypto assets into broader TradFi markets. This system uses USDx as an internal unit for margin/account display—100% backed by USDT—allowing users to manage TradFi asset price exposure without changing their stablecoin usage habits. In terms of trading rules, Gate TradFi clearly distinguishes itself from perpetual crypto contracts: adopting fixed trading sessions/timeslots; fixed leverage; cross-margining; overnight fees—classic TradFi market mechanisms—executed via MT5 for trade execution/risk control processes. This product design reduces operational costs for users participating in TradFi markets cross-platform; it also reflects how crypto platforms are borrowing/adopting mature TradFi trading systems/risk frameworks—evolving toward multi-asset/cross-market comprehensive trading infrastructure.

Conclusion: The Real Question Isn’t “Whether to Use TradFi,” But How Crypto Finance Defines Its Own Role

The focus shouldn’t be whether we need traditional finance—but how crypto finance defines its value within today’s financial ecosystem. From stablecoins to Bitcoin ETFs, crypto assets are leveraging TradFi frameworks to scale up legitimacy/market size. For industry participants—the key is how to use blockchain tech to boost efficiency/accessibility while embracing advantages from banking/regulation for sustainable growth. As BNP Paribas research notes: stablecoins “remain backed by fiat support,” but can offer convenience for cross-border payments/asset trades atop this base. Going forward, if crypto finance can clearly delineate its division of labor with TradFi—innovating via decentralized tech while relying on banks/trusted intermediaries for stability—it can truly reach further frontiers ahead.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?