Telegram’s “Crypto Accounting”: Surging Revenue, Net Losses, and the $450M Token Sale Controversy

Telegram is back in the spotlight after financial data sent to investors revealed a sharp rise in revenue but a downturn in net profit. This shift is not due to slowing user growth—rather, TON’s falling price has directly impacted Telegram’s bottom line by introducing asset volatility into its profit statement.

The sale of more than $450 million worth of TON tokens has also prompted renewed scrutiny of Telegram’s interests and boundaries within the TON ecosystem.

TON Price Weakness: Telegram’s Revenue Soars While Net Losses Persist

The Financial Times reports that Telegram posted a major revenue jump in the first half of 2025. Unaudited financials show the company generated $870 million in revenue—up 65% year-over-year, far exceeding the $525 million reported for the first half of 2024—and nearly $400 million in operating profit.

Breaking down the revenue, Telegram’s ad income grew 5% to $125 million, while premium subscription revenue surged 88% to $223 million—almost double the prior year’s figure. The primary driver, however, was Telegram’s exclusive partnership with the TON blockchain, which now serves as the sole blockchain infrastructure for Telegram’s mini-app ecosystem. This partnership contributed nearly $300 million in related revenue.

Overall, Telegram sustained the strong growth momentum sparked by the mini-game craze in the first half of last year. In 2024, Telegram achieved its first annual profit, earning $540 million, with total revenue reaching $1.4 billion—well above the $343 million reported for 2023.

In 2024, roughly half of Telegram’s $1.4 billion revenue came from “partnerships and ecosystem,” with about $250 million from advertising and $292 million from premium subscriptions. Clearly, Telegram’s growth has been fueled by a surge in paid users and, even more so, by revenue generated from crypto-related partnerships.

Yet the high volatility of crypto assets has introduced new risks. Despite posting nearly $400 million in operating profit in the first half of 2025, Telegram still reported a net loss of $222 million. Insiders attribute this to the company’s need to revalue its TON token holdings. With altcoins remaining weak throughout 2025, TON’s price dropped steadily, at one point falling more than 73% from its peak.

Selling $450 Million: Cashing Out or Advancing Decentralization?

Retail investors, used to prolonged altcoin slumps and the paper losses of many DAT-listed companies, weren’t surprised by Telegram’s losses from virtual asset depreciation. What sparked greater community concern was the FT report that Telegram’s TON token sales have exceeded $450 million—more than 10% of the token’s current circulating market cap.

With TON’s price continuing to slide and Telegram selling a large portion of its holdings, some TON community members and investors have raised doubts about Telegram “cashing out” and undermining TON holders.

According to Manuel Stotz, Chairman of TONStrategy (Nasdaq: TONX), all TON tokens sold by Telegram are subject to a four-year vesting schedule. This means the tokens cannot be traded on the secondary market in the short term, so there is no immediate selling pressure.

Stotz added that the main buyers Telegram worked with—including TONX—are long-term investment entities. Their purchases are intended for long-term holding and staking, not short-term speculation. As a US-listed company specializing in TON ecosystem investment, TONX acquired Telegram’s tokens for strategic, long-term purposes.

Stotz emphasized that Telegram’s net TON holdings did not materially decrease after the transaction and may have even increased. Telegram exchanged part of its existing tokens for vested tokens and continues to earn new TON through advertising revenue sharing and other activities, keeping its total holdings high.

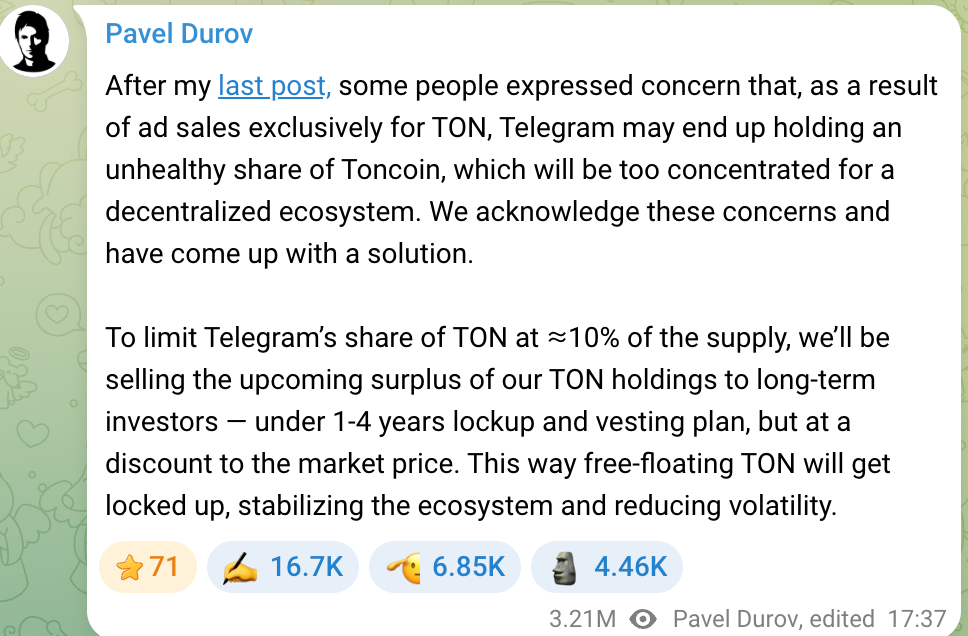

Telegram’s long-term accumulation of TON tokens has previously raised concerns in the community, with some worried that the company’s large holdings could hinder TON’s decentralization. Telegram founder Pavel Durov addressed this concern in 2024, stating the team would keep Telegram’s TON holdings below 10%. Any excess would be sold to long-term investors, promoting wider distribution and raising funds for Telegram’s development.

Durov noted that token sales would be made at a slight discount to market price and include lock-up and vesting periods to prevent short-term selling pressure and protect TON’s ecosystem stability. This approach is designed to avoid concerns over price manipulation and support TON’s decentralized vision. Telegram’s token sales are best viewed as asset restructuring and liquidity management—not opportunistic selling for profit.

While TON’s price decline in 2025 has pressured Telegram’s financials, its deep integration with TON means the two are closely linked—sharing both upside and downside.

Telegram’s active participation in the TON ecosystem has created new sources of revenue and product highlights, but also exposes it to the financial impact of crypto market swings. This “double-edged sword” is a key consideration for investors as Telegram weighs an IPO.

Telegram’s IPO Outlook

With stronger financials and expanded business lines, Telegram’s IPO prospects have become a focal point for the market. Since 2021, Telegram has raised over $1 billion through multiple bond issuances; in 2025, it issued $1.7 billion in convertible bonds, attracting major institutions like BlackRock and Abu Dhabi’s Mubadala.

These capital raises have provided Telegram with fresh funding and are widely seen as IPO preparation. However, the path to listing is not straightforward—debt structure, regulatory challenges, and founder-related issues all play a role.

Telegram currently has two main outstanding bonds: a 7% coupon bond maturing in March 2026 and a 9% coupon convertible bond maturing in 2030. Of the $1.7 billion in new convertible bonds, about $955 million replaced older bonds, while $745 million provided new capital.

The convertible bonds include a special IPO conversion clause: if Telegram goes public before 2030, investors can redeem or convert shares at about 80% of the IPO price—a 20% discount. These investors are betting Telegram will successfully IPO and deliver a valuation premium.

Telegram has already redeemed or repaid most of the 2026 bonds through its 2025 debt restructuring. Durov stated publicly that the 2021 debt has been mostly resolved and no longer poses a risk. Regarding $500 million in frozen Russian bonds, Durov said Telegram does not rely on Russian capital, and the recent $1.7 billion bond issue included no Russian investors.

Telegram’s main outstanding debt is now the 2030 convertible bond, leaving ample time for a potential IPO. Many investors expect Telegram to seek a listing around 2026–2027, enabling debt-to-equity conversion and new fundraising. Missing this window could mean greater long-term interest costs and the loss of a prime opportunity to shift to equity financing.

Investors evaluating Telegram’s IPO also focus on its profitability prospects and commission model. Telegram currently boasts about 1 billion monthly active users and an estimated 450 million daily active users, providing substantial commercial potential. Despite rapid business growth in recent years, Telegram still needs to prove its business model can generate sustainable profits.

On the positive side, Telegram maintains absolute control over its ecosystem—Durov recently emphasized that he remains the sole shareholder, and creditors have no say in company governance.

This gives Telegram the flexibility to prioritize long-term user engagement and ecosystem growth over short-term profits, free from shareholder short-termism. This “delayed gratification” strategy aligns with Durov’s product philosophy and will be central to Telegram’s growth story for investors during the IPO process.

It’s important to note that an IPO depends on more than just financials and debt structure. The Financial Times notes that Telegram’s listing plans are currently affected by ongoing legal proceedings in France involving Durov, creating uncertainty around the IPO timeline. Telegram has acknowledged to investors that this investigation could present an obstacle.

Disclaimer:

- This article is republished from [PANews]. Copyright belongs to the original author [Zen]. If you have any concerns about this republication, please contact the Gate Learn team, and we will address your request promptly according to our procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Unless expressly referenced to Gate, reproduction, distribution, or plagiarism of the translated article is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?