Stablecoin C2C: The Last Mile of Cross-Border Remittances

Stablecoins are fundamentally transforming global capital flows. Their potential is fully proven in enterprise (B2B) applications, while the potential for individuals (C2C) remains largely untapped. Whether sending money to family abroad, paying tuition, or providing emergency assistance, these transactions form some of the world’s most active and resilient capital streams.

In 2024, remittances to low- and middle-income countries reached approximately $685 billion, with South Asia, Latin America, East Asia, and the Pacific as leading destinations. Despite the scale, traditional remittance channels remain slow and expensive: average fees range from 4% to 6%, with hidden exchange rate markups further increasing user costs.

In analyzing cross-border remittances, we found that crypto technology in emerging markets goes beyond speculation and offers genuine utility. Payment companies are driving financial inclusion by providing capital access to the billions underserved by traditional finance. Remittances are more than just money transfers—they are acts of support and care. In many cultures, sending money is an expression of love, symbolizing concern beyond the monetary value.

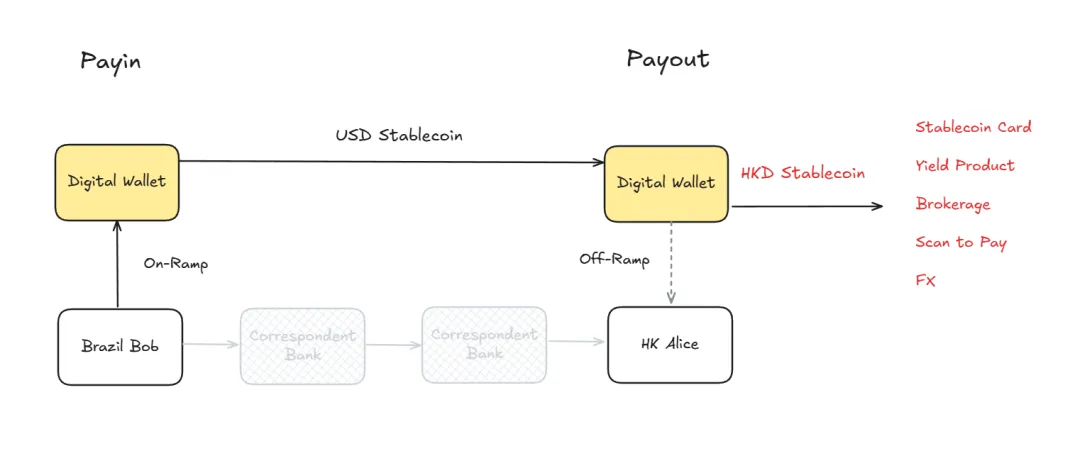

Stablecoins open a new path, connecting loved ones and enabling direct, peer-to-peer cross-border remittances.

Their unique value lies in being built on global blockchain ledgers, operating at the intersection of payments, lending, and capital markets.

This leads to further questions: Beyond efficient remittances, what more can we offer users? What additional services do they need?

If the “SWIFT + correspondent bank” model powers the global B2B network, and Visa/Mastercard connect B2C payments worldwide, then MoneyGram and Western Union have built the broadest C2C remittance networks. This article begins with an overview of the stablecoin C2C cross-border remittance market, then examines three stablecoin case studies to explore their value in C2C networks and uncover new user needs.

Clearly, this is not the final mile of C2C cross-border payments—it is the starting point for on-chain financial services.

Key Takeaways

- In emerging markets, crypto technology is practical—not just speculative: dollar access as a store of value and inflation hedge; real-time cross-border settlement.

- Stablecoins can significantly reduce costs in many cross-border remittance channels, including established ones, especially in reaching the last mile.

- Local stablecoins in Southeast Asia are growing rapidly, serving not only as alternatives to costly channels, but also as practical tools for local spending, bridging the gap between dollar receipts and everyday local currency use.

- Local currency pricing for local markets is not just a medium in the “stablecoin sandwich model” (USD stablecoin/regional stablecoin), but can be the starting point—letting users stay on-chain and spend in stablecoin-powered scenarios without cashing out to banks.

- Traditional remittance providers are integrating stablecoins into their payment systems, driving both internal efficiency and global cash-out points—the most practical “last mile” solution for stablecoins.

- This is crucial because about a quarter of the world’s population still relies mainly on cash, and these users are often excluded from the “pure digital economy.”

- Owning the “right to distribute” at the last mile is a rare structural advantage in the stablecoin era—tech companies can innovate quickly, but cannot build a trusted network of 500,000 outlets overnight.

- For example, an Argentine user can hold XYZ USD stablecoin and spend local pesos via a Stablecoin Card—issuers distribute XYZ stablecoin, users maintain dollar positions and avoid inflation, and new stablecoin use cases emerge.

- Some companies are adopting hybrid DeFi models, operating as companies but running DeFi infrastructure in the backend.

- This can deliver financial services, solutions, or products to anyone globally—for example, on-chain loans that outcompete local banks, all enabled by technology.

- This is not the last mile of C2C cross-border payments—it is the beginning of on-chain financial services.

I. Stablecoin C2C Cross-Border Remittance Market Overview

“We do not target the US market—it’s crowded, expensive, and fiercely competitive. Instead, we focus on emerging markets such as Latin America, Southeast Asia, and parts of Africa, where crypto technology moves beyond speculation and delivers real utility. That’s where stablecoins can make the biggest impact.”

—Stefan George, Co-Founder of Gnosis Pay

Remittance inflows in these regions total hundreds of billions of dollars annually, yet stablecoin activity is still early-stage but growing fast.

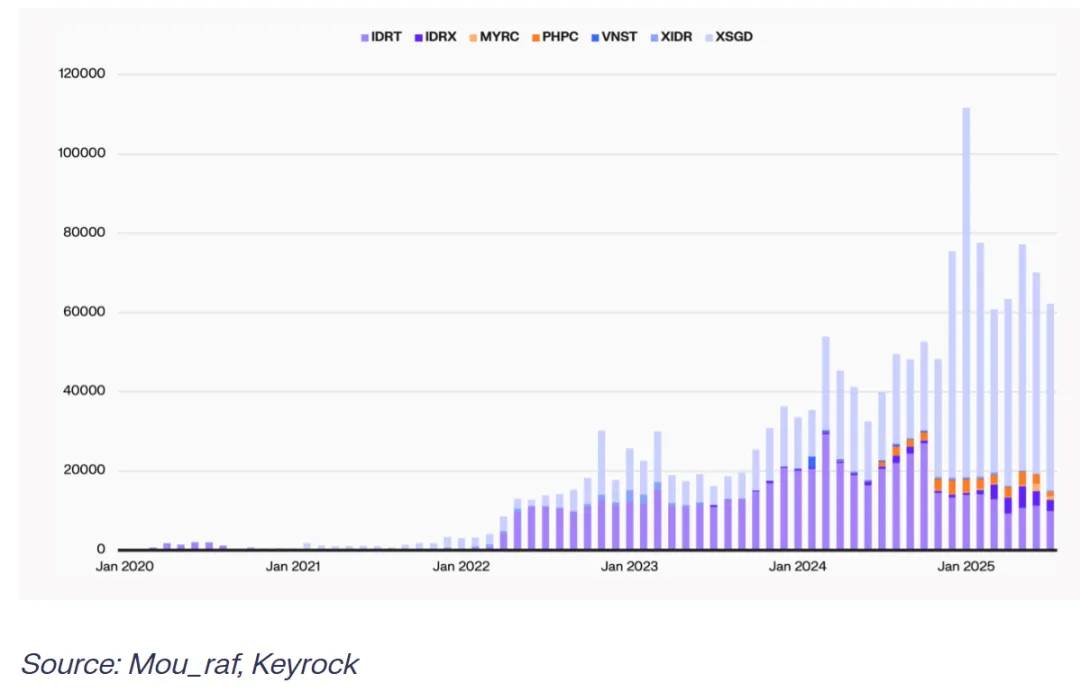

A. Southeast Asia’s Local Stablecoin Volume Is Surging

With remittance costs still high, Southeast Asian local stablecoins are poised for continued growth—not just as alternatives to expensive channels, but as practical tools for local currency spending. While many users prefer to receive dollars, daily spending is still in pesos, rupees, and other local currencies. Stablecoins denominated in local currencies bridge this gap. As infrastructure improves, with increased liquidity, better integration, and expanded exchange channels, local stablecoin adoption will accelerate.

(What are Remittances with Stablecoins? A guide)

B. The High Cost of Traditional Remittance Channels

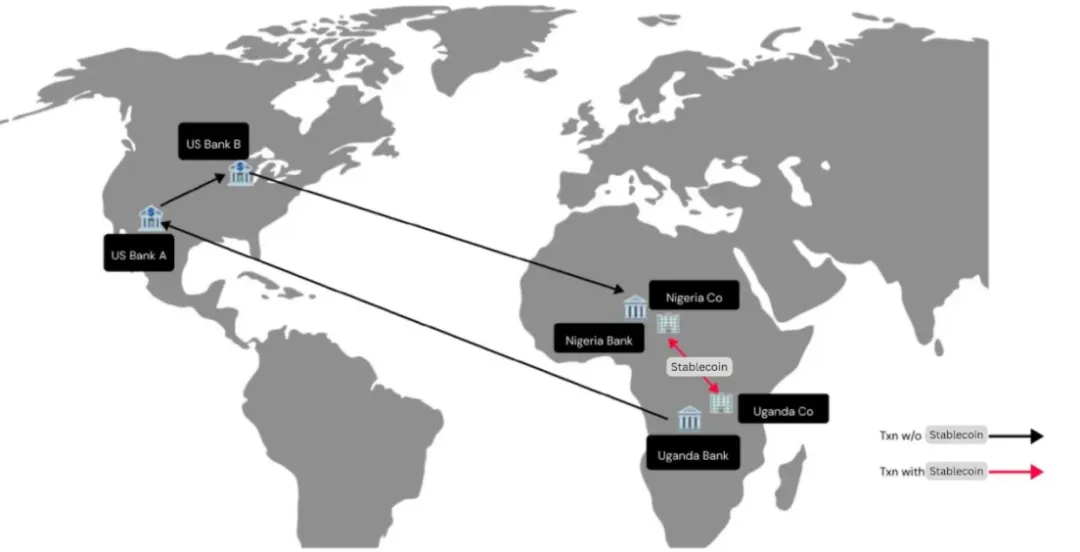

On average, sending $200 costs 6.3%, and $500 costs 4.3%. These fees include service charges (from banks, Western Union, etc.) and exchange rate markups. Providers often offer rates worse than market and profit from the spread. In many channels, FX markups account for 35% of total cost, and in some emerging markets, up to 80%.

(Stablecoin Payments and Global Capital Flow Models)

C. Stablecoin’s Cost Advantage

Fee breakdowns by provider highlight the inefficiency of traditional channels: for $200, banks charge 12.66%, MTOs 5.35%, mobile operators 3.87%. Stablecoins can cut remittance costs by roughly 92%.

(Blue Chip, The Ramping Bottleneck)

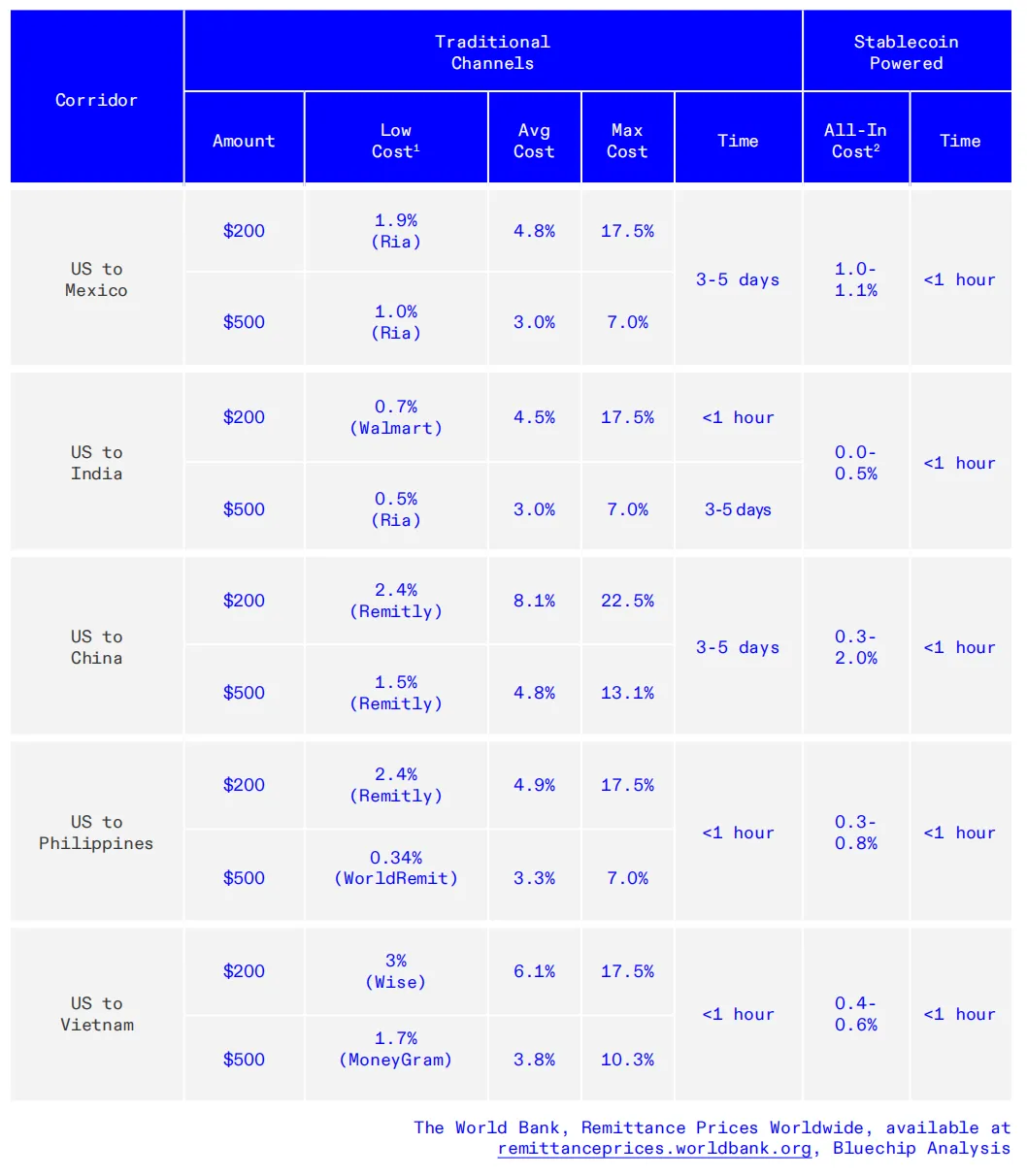

Stablecoins reduce costs across many channels, including mature ones. The gap between average and lowest costs shows pricing disparities. In many channels, average costs are two to five times higher than the cheapest provider—an advantage for remittance operators over banks. Stablecoin transfers often undercut both.

BCRemit (serving Filipino overseas workers) cut total transfer costs (fees + FX) to just over 1%, while avoiding the liquidity shortfalls and expensive short-term loans needed by traditional providers.

Similarly, Sling Money lets users top up “virtual accounts” and send funds at real-time mid-market rates, with no hidden markup and only up to 0.1% deposit fee, versus 13% for bank remittances. Funds are converted to USDP stablecoin and can be sent globally, instantly, and free.

D. Speed of Remittance Transfers

Stablecoin channels deliver order-of-magnitude improvements: costs are 4–13x lower than traditional methods, with near-instant settlement, versus one or more days for legacy methods. This efficiency is prompting incumbents to adapt, such as M-Pesa adding regulated stablecoins (USDC) to its product lineup.

While deposit/withdrawal UX remains a pain point, stablecoin transfers settle in under an hour. Traditional methods take from same-day to T+5, depending on funding tools, payment type, and channel.

(Stablecoin Payment Adoption Bottleneck: Costs and Quality Constraints)

E. Summary

As payments evolve, centralized exchanges and crypto payment providers are expanding into payments with new apps (Kraken’s Krak) and regional stablecoins (Bitso’s MXNB, BRL1). These regional stablecoins are essential—not just as a medium in the “stablecoin sandwich model” (USD stablecoin/regional stablecoin), but as a starting point, enabling users to stay on-chain and spend in stablecoin-powered scenarios without cashing out.

Traditional remittance providers are also integrating stablecoins, driving both internal efficiency and new global cash-out points—the most direct “last mile” solution—while exploring open stablecoin ecosystems and their network effects.

II. MoneyGram’s Stablecoin Reinvention

2.1 MoneyGram’s Global Reach and Transformation Vision

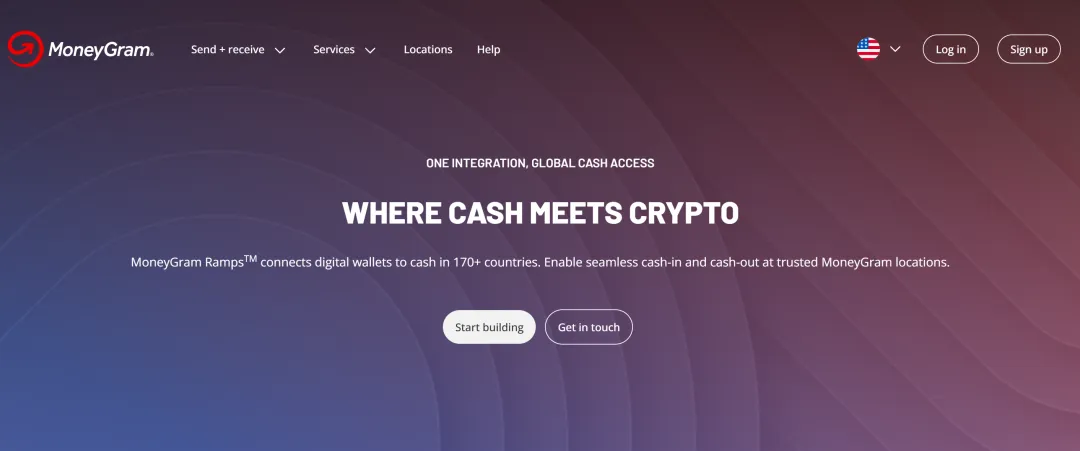

MoneyGram operates in over 200 countries and regions, with more than 20,000 remittance channels, roughly 500,000 offline outlets, and over 5 billion digital touchpoints. As a global payment network, it’s one of the few companies rivaling world-class scale.

CEO Anthony Soohoo sees stablecoins as a global network with enormous potential, envisioning a “refounding” of MoneyGram: preserving 85 years of success, while reimagining the company’s future form and mission—making cross-border capital flows seamless, low-cost, secure, and reliable, empowering individuals and communities.

(www.moneygram.com/us/en/ramps)

2.2 Stablecoin Value for MoneyGram

MoneyGram’s real business model is “B2B2C”—stablecoins can improve efficiency and reduce friction across the entire chain, from enterprise to consumer. Many focus only on MoneyGram’s “consumer side,” but agents and financial partners are also core users.

A. Reaching the Recipient—C Side Value

Stablecoins enable MoneyGram to reach the recipient side and develop new features and services for recipients.

From the customer’s perspective, stablecoins deliver:

- Inflation protection—helping recipients hedge currency devaluation in high-inflation environments;

- Financial access—connecting them to previously unavailable funding channels;

- Real-time and transparency—shorter wait times and better experience.

These benefits help recipients hedge inflation, access new funding channels, and improve their experience.

One standout project is the receiver-side wallet launched in Colombia, now available in seven countries. It lets recipients freely hold, withdraw, or use funds, giving them more control over their finances. Traditionally, remittance businesses charged senders, while recipients were often overlooked.

Launching any tech product requires deep understanding of real customer needs—not just following trends.

The crypto industry—especially stablecoins—is full of hype and press releases. Many companies innovate by PR, not by user needs.

—Anthony Soohoo, MoneyGram

B. B2B Process Optimization

Stablecoins also unlock huge value for B2B operations.

- Real-time settlement and impact on corporate finance—eliminates prefunding; real-time settlement and ledger sync are major advances for treasury management.

- Instant capital flows—digital ledgers enable real-time on-chain settlement, eliminating cash movement costs. Cash is only withdrawn when needed, which is especially valuable in volatile currency markets. Stablecoins let users lock in value and exchange only when spending, avoiding losses.

- Risk and liquidity management—digital operations lower cash requirements, boost liquidity, and improve efficiency. But consumers don’t need to know the tech—they just want fast, safe, low-cost transfers.

The company’s job is to hide complex settlement and make the user experience as simple as sending a text. That’s the “magic moment.”

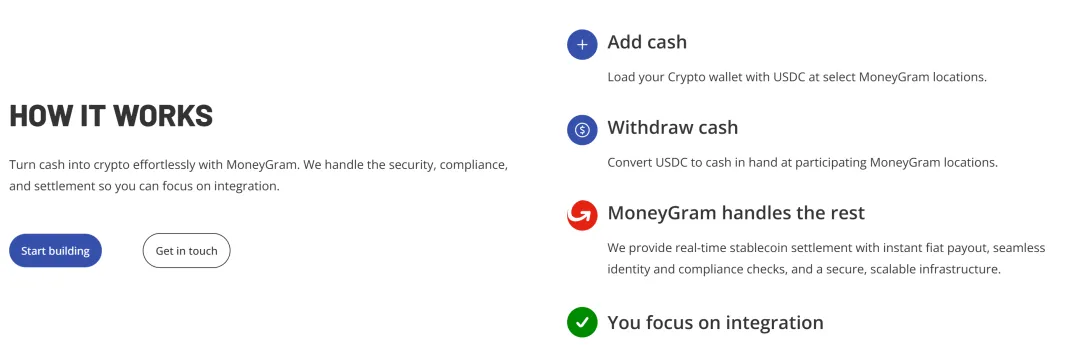

2.3 MoneyGram Ramps: Bridging Digital and Real Worlds

MoneyGram’s “MoneyGram Ramps” project marks its strategic entry into stablecoins. Previously, stablecoins served B2B and recipient use cases, but “Ramps” aims much bigger. With Stripe acquiring Bridge for $1.1 billion to secure prime deposit/withdrawal access, MoneyGram’s 500,000 outlets and global reach provide a natural edge.

(www.moneygram.com/us/en/ramps)

A. Background and Strategic Importance

MoneyGram is confident in stablecoin development, and “Ramps” is the core of its strategy. The company is building an open network, not a closed system—hence its partnership with Fireblocks, enabling stablecoin use both internally and across the global ecosystem.

MoneyGram Ramps allows any app or wallet to use its API for “cash-in” and “cash-out”—users can exchange cash for stablecoins and vice versa, anywhere MoneyGram is supported.

This matters because about a quarter of the world’s population is still cash-dependent and excluded from the “pure digital economy.”

Anthony Soohoo uses an analogy:

The crypto world was like “Hotel California”—easy to check in, impossible to leave. Users could deposit, but stablecoin use cases were limited.

MoneyGram’s goal is to be the bridge—connecting digital and real worlds, enabling true asset movement in and out.

MoneyGram is partnering with multiple apps and wallets (some not yet public), transforming from a payment company into a global financial network platform.

Soohoo’s vision draws on his Apple experience: when you launch the iPhone, you can’t predict the killer apps, but an open ecosystem creates miracles. For MoneyGram, “Ramps” is the start of its ecosystem platform.

B. Solving the “Last Mile”

Despite stablecoins’ promise, the “last mile” challenge remains—how to bridge on-chain flows with cash and the local economy.

MoneyGram controls last-mile distribution—an uncommon structural advantage in the stablecoin era. Tech companies can innovate, but can’t build a trusted network of 500,000 outlets overnight. For the first time, legacy players with distribution have the edge.

In September, MoneyGram launched a new app in Colombia, supporting USDC receipts and exchanges. Colombia was chosen for three reasons:

- High remittance inflows—Colombia receives 22x more inbound than outbound remittances, with many families relying on overseas funds.

- High digital adoption—young population, high smartphone penetration, and openness to digital wallets.

- Currency volatility—the peso has been unstable, and users want more stable value storage.

Given these factors, Colombia was the ideal launch market. MoneyGram has since expanded to Mexico, Honduras, and six more countries.

With “MoneyGram Ramps,” the company is advancing stablecoin adoption and laying the groundwork for global financial connectivity—delivering better financial services to users and new growth opportunities for MoneyGram.

III. Western Union’s Stablecoin and Digital Network

On October 28, 2025, Western Union announced the launch of the USDPT stablecoin on Solana and its digital asset network, aiming to redefine global capital flows. The initiative is driven by a shared vision—modernizing financial infrastructure worldwide and expanding digital asset adoption, all in compliance with regulations.

(Western Union plots its stablecoin move)

3.1 Western Union’s Global Impact

Western Union (NYSE: WU), founded in 1875, is a global leader in cross-border remittances with 150 years of history. It operates the world’s largest and most advanced electronic remittance network, with agent locations in nearly 200 countries and regions. As a subsidiary of First Data Corporation (FDC), a Fortune 500 company, it offers dollar and euro remittance and receipt services, with cross-border payments completed in as little as 15 minutes via bank, online, or mobile channels, and 24/7 digital support.

3.2 USDPT & Digital Asset Network

Western Union is launching USD Payment Token (USDPT), a new stablecoin, and an innovative digital asset network connecting the digital and fiat worlds. USDPT is built on Solana and issued by Anchorage Digital Bank. Western Union aims to expand remittance channels and enhance capital management for customers, agents, and partners with USDPT.

The company will provide users access to digital assets, leveraging its global compliance and risk management expertise for seamless USDPT usage. USDPT is expected to launch in the first half of 2026, with users accessing it via partner exchanges for broad and easy use.

“We are committed to empowering our customers and communities with new technology. As we enter digital assets, Western Union’s USDPT will let us capture stablecoin-related economic benefits.

We’re excited to launch the Digital Asset Network, which, through wallet partnerships, provides seamless cash-out channels for digital assets—solving the ‘last mile’ in crypto transactions. Our network and USDPT will help us deliver financial services globally.”

—Devin McGranahan, Western Union CEO

3.3 Stablecoin’s Core Drivers

(Western Union partners Anchorage Digital for stablecoin launch)

Western Union’s core drivers are much like MoneyGram’s:

- For large-scale capital movers, stablecoins solve real-time enterprise settlement, instant capital flows, and comprehensive risk/liquidity management.

- The global offline network’s “last mile” capability completes the stablecoin sandwich loop.

Western Union differs by launching its own USDPT stablecoin and building the ecosystem for stablecoin distribution.

That’s why it partnered with Rain, using crypto payment cards to distribute USDPT. The benefits: an Argentine user can hold USDPT and spend locally via Rain Card, maintain dollar positions to avoid inflation, and even access “send now pay later” lending scenarios—meeting borrowing needs while hedging FX risk.

Rain is a global stablecoin infrastructure platform for enterprises, neobanks, platforms, and developers. Its technology enables instant, compliant stablecoin transfer, storage, and use via global payment cards, deposit/withdrawal channels, wallets, and cross-border routes. As a principal Visa member, Rain cards work anywhere Visa is accepted, supporting millions of transactions in 150+ countries. Rain is purpose-built for stablecoins, trusted by 150+ institutions, and delivers secure, scalable infrastructure for free, instant global capital flows.

Rain will join Western Union’s Digital Asset Network, providing users daily cash access—allowing stablecoins in Rain wallets to be exchanged for local cash at Western Union outlets, unlocking real-world spending.

“Rain’s global stablecoin wallet makes them an ideal Digital Asset Network partner. Through Western Union, they’ll provide cash access in multiple markets. Our partnership delivers a comprehensive bridge between traditional finance and digital assets.”

—Macolm Clarke, VP Western Union

IV. Bitso: From Remittance Demand to Local Stablecoins

Bitso, Latin America’s first crypto unicorn, now handles 10% of total US-Mexico remittances—proof that stablecoins have become essential infrastructure.

As Bitso explores Mexican peso and Brazilian real stablecoins, it’s betting on cross-border utility. Local stablecoin exploration is key, offering a new perspective:

- USD stablecoins don’t solve every issue; local currency pricing is essential for local markets.

- USD stablecoin/local stablecoin “last mile” solutions may differ from MoneyGram or Western Union’s approaches.

- Local stablecoins offer untapped opportunities for financial innovation.

We’ve also analyzed Bitso’s business drivers in depth—valuable lessons for other projects.

(Tribal Credit, Bitso, Stellar Collab for Latam X-Border B2B Payments)

4.1 Origin: Cross-Border Remittance Challenges

Bitso was founded out of its co-founders’ firsthand experience with cross-border remittance barriers. Daniel Vogel, a Mexican living in San Francisco circa 2010, was introduced to Bitcoin and blockchain, prompting him to rethink money and issuance mechanisms.

He learned from Mexican colleagues about high costs and complexity in cross-border remittances. One colleague, Julio, borrowed $300 to send home for his daughter’s school needs, but hesitated due to fees. This highlighted the need for change.

It’s remarkable—you can video chat for free, but cross-border transfers are expensive.

Other co-founders, Ben and Pablo, also lived abroad and saw Bitcoin as a solution for cross-border transfers. Bitso’s founding goal was to solve remittance challenges, replace SWIFT and correspondent banks, and build efficient, low-cost cross-border payments.

A. Last-Mile Currency Exchange

Before Bitso’s launch, Daniel Vogel tried sending Bitcoin from the US to Mexico, but couldn’t exchange it for pesos locally. Bitso’s first product was a crypto exchange for Bitcoin-peso conversion, making it one of the earliest US-Mexico transfer companies.

B. Meeting Crypto Trading Demand

As Bitso grew, it found many clients wanted to invest in crypto but were deterred by order book complexity. Bitso launched a simple brokerage platform for easy mobile trading, which became a major revenue source.

C. Stablecoin Payment Channels

Bitso began building cross-border payment infrastructure only when stablecoins reached critical mass, replacing slow, inefficient correspondent banks and rails. Stablecoin cross-border transfers have scaled rapidly.

Today, Bitso processes nearly $80 billion in annual cross-border payments, making it Latin America’s largest digital asset infrastructure provider. About $60 billion flows from the US to Mexico annually, with Bitso handling 10% of US-Mexico remittances.

Bitso serves individuals and businesses, supporting corporate finance and brokerage. Its goal is to connect Latin America’s banking system to global crypto, facilitating cross-border transactions. Bitso believes currency should be digital and programmable, on the blockchain. Through APIs and client support, Bitso is building an open financial ecosystem for companies to build and scale.

4.2 Breaking Down the $80 Billion Business

Daniel Vogel explains:

- About 75% of volume comes from Mexico, with 10% from cross-border remittances; the rest from payment providers and intercompany transfers.

- For B2B, Mexico is the largest, followed by Brazil, Colombia, and Argentina.

- Retail is similar, but Argentina ranks second after Mexico.

A. Improving the PSP Model

Payment service providers (PSPs) drive most business volume. These companies help merchants and clients move funds cross-border, but traditional finance solutions are inefficient.

Previously, merchants waited days for funds as PSPs collected payments, held them, and then exchanged and cleared via banks. Now, each payment is instantly converted to USDC, USDT, or another stablecoin and sent directly to merchants, with PSP commissions deducted. This innovation is transforming PSP operations and fueling growth.

B. Cross-Border Remittances

Remittance is fiercely competitive, and FX profits are vital. Traditional providers face high capital and working capital costs, needing pre-funded accounts. If transfers take a business day, remittance firms must fund Thursday for Friday–Sunday operations, requiring three days’ working capital, with holidays adding more.

Bitso’s solution is 24/7 service, letting PSPs operate nights and weekends, reducing funds held and enabling instant replenishment. The process: dollars are converted to stablecoins, sent via Bitso, exchanged for pesos, and sent to clients or partners.

C. Tax Uncertainty as a Barrier

By 2025, stablecoin use and related business have surged, attracting enterprises of all sizes. Major payment networks like Visa and MasterCard are exploring stablecoin integration, creating new opportunities.

However, tax uncertainty remains a major issue—for example, Mexican tax law on stablecoins is still unclear. Once resolved, solutions will improve and the sector will accelerate. In the next decade, stablecoins will become mainstream, and traditional banking rails may fade into history.

4.3 Local Stablecoin Opportunities

Bitso has launched its own stablecoins, such as MXNB (Mexican peso) and BRL1 (Brazilian real, backed by local consortium). Daniel Vogel explains the logic—valuable reference for local stablecoin use cases and market interest.

USD stablecoins meet key needs: (1) dollar bank account access; (2) DeFi core utility; (3) cross-border settlement.

But global demand for USD stablecoins doesn’t fully translate to local stablecoins like MXNB or BRL1.

A. Local Currency Pricing for Local Markets

Despite the promise of on-chain economies, people prefer local currency pricing—matching consumer expectations. In Mexico, credit is issued in pesos, and income/repayment is in pesos. Local stablecoins like MXNB meet this need.

B. Unified FX Market Liquidity

On-chain pricing, FX, and settlement offer major advantages. As more liquidity moves on-chain, unified market liquidity will grow. MXNB and BRL1 are already active on chains like Avalanche.

C. Local Financial Innovation

In Mexico, SPAY connects banks and financial institutions for payments via phone number. But becoming a SPAY participant takes seven years, and innovation is rare due to strict regulation and high costs.

Local stablecoins like MXNB can spur innovation, offering simple tech solutions for fintechs to innovate without complex processes. As more companies use stablecoins to replace outdated systems, new use cases will emerge.

In summary, payments need to be tokenized like any other asset. Local currency stablecoins will play a vital role in DeFi. As more companies adopt stablecoins, new use cases will proliferate.

4.4 Bitso in Five Years

Daniel Vogel shares deep insights on crypto, quoting his father’s “wheel of fortune” metaphor—neither highs nor lows last, which is especially true in crypto. He sees many traditional financial rails ripe for disruption: correspondent banking, card processing, local/global payments, securities settlement. Crypto is growing fast but remains a small part of finance.

Vogel hopes for deeper on-chain integration in five years, especially with stablecoins as the foundation. While the on-chain world is expanding, it still serves a minority. He’s excited by hybrid DeFi models—companies running DeFi infrastructure behind the scenes—which can bring competitive on-chain loans and other products to everyone.

He wants this model to scale, making global financial products locally accessible—especially in regions with weak financial competition, high barriers, and bank monopolies. If Bitso can help clients access these products—FX, lending, and more—and drive real change, it will help individuals enter a new financial world.

V. Conclusion

In tech history, every industry’s breakout comes from a “killer app”—spreadsheets for PCs, browsers for the internet, instant service apps like Uber for mobile.

From single-point to local, from global information flow to global value flow—stablecoins are the crypto industry’s “killer app,” impacting every layer of the economy. From global USD stablecoins to regional stablecoins, they drive financial innovation. We are living in an exciting era.

Today, stablecoin markets are almost entirely dollar-denominated, but this will change. As tokenized payment use cases expand, demand for local stablecoins will grow.

Looking forward, expect more exchanges and remittance platforms to issue regional stablecoins and use internal liquidity for conversion. These players are shifting focus to utility and better payment experiences, expanding into wealth management, lending, brokerage, credit/debit cards, and more—all to keep users on-chain and serve them through regional stablecoin scenarios.

Stablecoin C2C is not the last mile of cross-border payment—it’s the starting point for on-chain financial services.

Statement:

- This article is republished from [Will 阿望], copyright belongs to the original author [Will 阿望]. If you have any objections to republication, please contact the Gate Learn team; we will handle it promptly as appropriate.

- Disclaimer: The views and opinions expressed are those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team. Unless Gate is mentioned, translated articles may not be copied, distributed, or plagiarized.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

What is Stablecoin?

Top 15 Stablecoins

A Complete Overview of Stablecoin Yield Strategies

Stripe’s $1.1 Billion Acquisition of Bridge.xyz: The Strategic Reasoning Behind the Industry’s Biggest Deal.