Spot Gold Breaks the $5,000 Milestone as Silver Also Hits a New All-Time High — In-Depth Market Analysis

A Historic Milestone: Gold and Silver Break Key Price Barriers Together

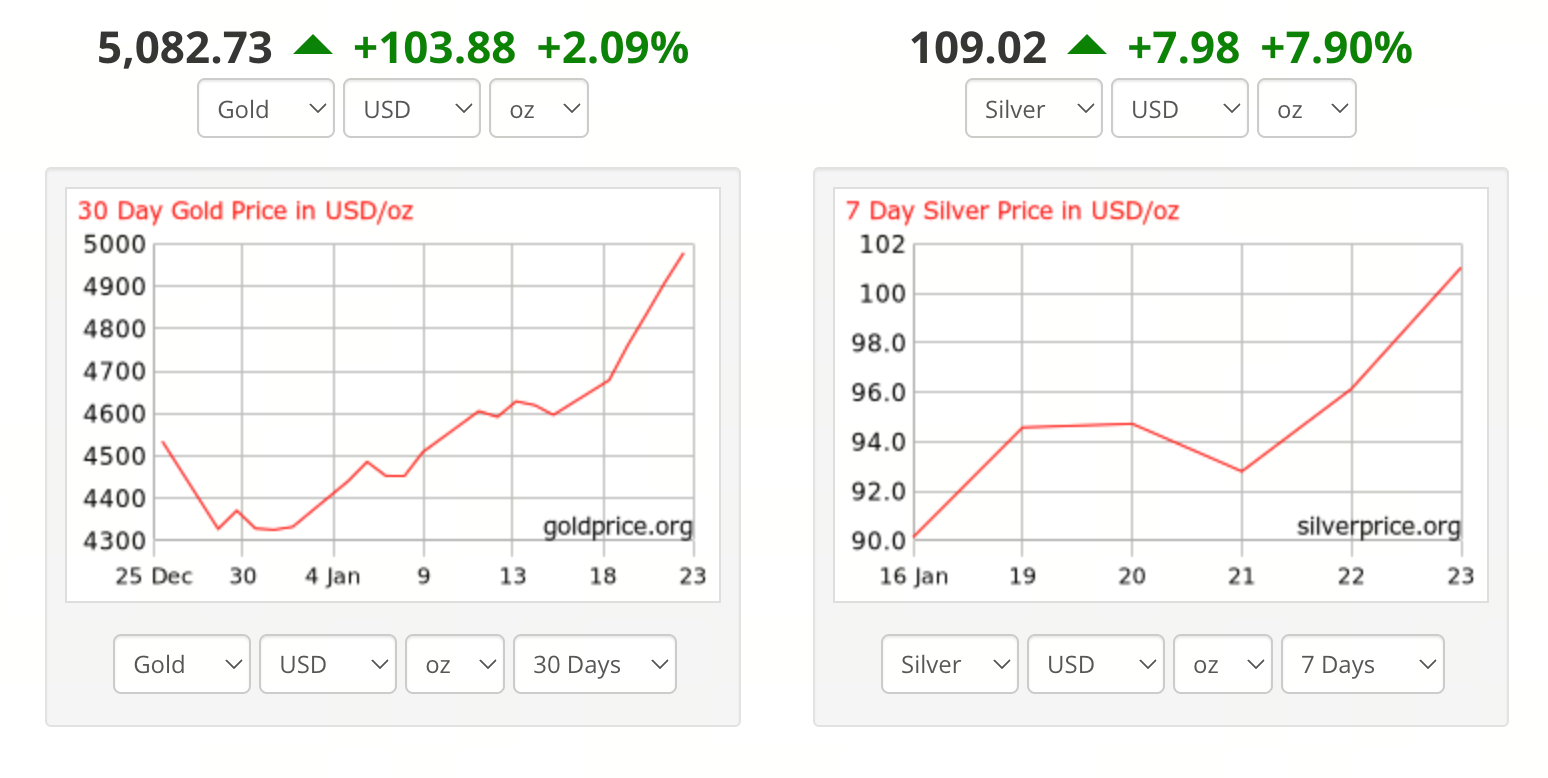

Chart source: https://goldprice.org/

The international precious metals market has recently experienced an extraordinary breakthrough. Spot gold prices climbed above the $5,000 per ounce psychological threshold for the first time, sustaining high-level volatility. At the same time, spot silver briefly surpassed $107 per ounce, also setting a new all-time high.

This synchronized rally in gold and silver is rare in the history of the precious metals market. It signals a significant strengthening of safe-haven asset pricing mechanisms and demonstrates that global capital is reassessing both risk assets and the broader monetary system.

Gold Price: Recent Performance and Phase Review

According to the latest market data, on January 26, 2026, during Asian trading hours, spot gold prices reached the $5,000 per ounce mark for the first time, with intraday highs approaching $5,052 per ounce.

Since 2025, gold has maintained a clear upward trajectory. Compared to its first breakthrough above $4,000, it took only about 100 days to reach the next major milestone, highlighting persistent inflows from trend-following capital.

The recent weakening of the US Dollar Index and heightened global risk aversion have created a favorable macro backdrop for gold. Most market participants believe gold retains medium-term momentum for further upside under current conditions.

Silver’s Record High: Structural Drivers and Industry Context

Mirroring gold’s advance, the silver market has also achieved a historic breakout. Spot silver briefly surged past $107 per ounce at the session’s open, setting a new record.

Unlike gold, silver’s rally is driven not only by its safe-haven appeal but also by its industrial utility. Since the start of 2026, silver’s gains have outpaced gold, mainly due to:

- Continued growth in demand from industries such as renewable energy, photovoltaics, and electronics;

- Tight global supply-demand dynamics and limited inventory flexibility;

- Rotation of speculative and allocation capital within the precious metals sector.

These structural factors often give silver greater price elasticity during bull markets.

Multiple Macro Drivers Fueling Precious Metals

This rally in precious metals is not a coincidence but the result of several overlapping macro and market factors:

- Persistent geopolitical risks: Ongoing regional conflicts and global uncertainty continue to drive long-term safe-haven demand.

- Weaker US Dollar Index: A softer dollar enhances the relative appeal of dollar-denominated precious metals.

- Central banks increasing gold reserves: Many central banks have ramped up gold allocations, providing stable physical demand support.

- Rising expectations for looser monetary policy: Anticipated rate cuts increase the relative attractiveness of non-yielding assets.

Collectively, these factors are reshaping the market’s view of gold and silver as core safe-haven assets.

Market Perspectives: Safe-Haven Dynamics Remain Strong

Institutional analysis suggests that the current rally in precious metals is grounded in clear macro fundamentals rather than market sentiment.

Several major international investment banks have raised their medium- and long-term gold price targets, focusing on:

- Systematic demand for safe-haven allocations;

- Adjustments in global central bank asset structures;

- Persistent concerns about inflation and debt over the long term.

Sentiment around silver is even more bullish. Analysts broadly agree that ongoing industrial demand growth will likely sustain silver’s supply-demand gap, giving it greater price elasticity than gold in the medium term.

Risk Advisory: High Volatility and Changing Market Pace

Despite the upward trend, investors should remain vigilant about potential risks:

- Volatility near historical highs in precious metals could increase sharply;

- Shifts in macro data or policy expectations may trigger short-term corrections;

- Rapid valuation increases bring heightened risk of periodic pullbacks.

As a result, both trend assessment and position management are crucial.

Conclusion: Precious Metals Bull Market Enters a New Phase

Gold’s breakthrough above $5,000 and silver’s surge past $107 represent more than price records—they reflect transformative shifts in the global financial landscape. The interplay of safe-haven demand, industrial demand, and monetary system adjustments is shaping a new cycle for precious metals.

For investors, understanding the driving forces matters more than predicting prices. Amid persistent macro uncertainty, precious metals are likely to remain vital tools for risk hedging and portfolio allocation.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About