Solana Stablecoin Market Cap Hits All-Time High, Surpassing the $15 Billion Milestone

Solana Stablecoin Milestone: On-Chain Liquidity Enters a New Phase

Image: https://x.com/coinbureau/status/2012045904304619838

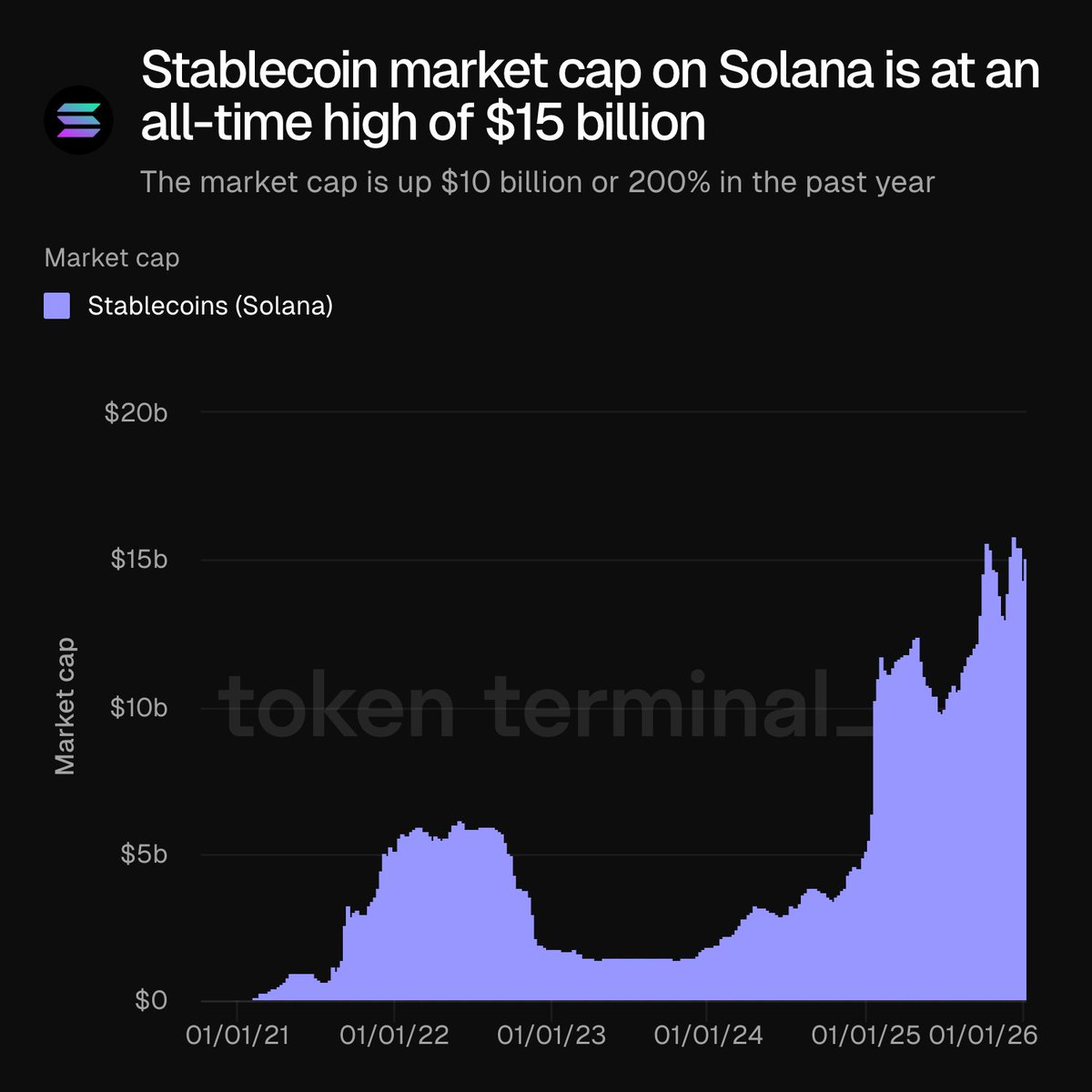

Recent on-chain data shows the total supply of stablecoins on the Solana network has surpassed $15 billion, reaching an all-time high. This figure is nearly three times higher than a year ago (a year-over-year increase of more than 200%), making Solana one of the fastest-growing major public blockchains for stablecoins in the crypto market today.

Stablecoins like USDC and USDT, which are on-chain assets pegged to fiat currencies, are widely recognized as key indicators of on-chain liquidity, capital efficiency, and the intensity of financial activity. The rapid growth of Solana’s stablecoin supply signals a significant capital shift toward high-performance, low-cost blockchain infrastructure.

Core Drivers Behind Stablecoin Growth

The continued expansion of Solana’s stablecoin supply is primarily fueled by several structural factors:

1. High-Performance Network and Ultra-Low Transaction Costs

Solana is renowned for its high throughput and low latency, with transaction fees typically just a few cents or even less. These features give Solana a clear advantage in high-frequency transfers, DEX trading, and payment settlement, making it an ideal network for the high-turnover use of stablecoins.

2. Rising Demand for DeFi and On-Chain Payments

As decentralized exchanges, lending protocols, and yield strategies in the Solana ecosystem become more active, demand for stablecoins as foundational liquidity assets and units of account continues to rise. Whether in liquidity pools, margin systems, or lending markets, stablecoins occupy a central role in capital structures.

3. USDC’s Dominance Strengthens Ecosystem Trust

Currently, USDC accounts for more than 60% of Solana’s stablecoin supply, reflecting leading issuers’ strong confidence in Solana’s network stability, security, and compliance potential. This structure also provides a lower-friction channel for institutional capital to enter the ecosystem.

Impact on Solana DeFi and Payment Ecosystem

The expansion of stablecoin supply is not just a data point—it has systemic effects throughout the ecosystem:

Enhancing Liquidity Depth and Capital Efficiency

Greater stablecoin reserves translate to deeper on-chain liquidity, providing DEXs with larger order books, reducing slippage, improving price discovery, and enhancing the overall trading experience.

Driving On-Chain Payments and Cross-Border Settlements

Compared to traditional payment systems, stablecoins offer inherent advantages for cross-border transfers—speed, low cost, and transparent settlement. Solana’s high TPS makes it highly competitive for micropayments, large-scale settlements, and real-time clearing.

Enabling DeFi Product Innovation and Structural Diversity

As the foundation of DeFi systems, ample stablecoin supply provides the necessary conditions for innovations like yield aggregation, structured products, and cross-chain liquidity solutions, driving Solana’s ecosystem toward more sophisticated financial models.

Institutional Participation and On-Chain Infrastructure Upgrades

On the institutional side, more traditional finance and payment companies are exploring Solana as a stablecoin settlement layer. Public disclosures show that payment giants like Visa are expanding stablecoin settlement pilots, and some banks and financial institutions are experimenting with issuing on-chain assets and transferring funds via Solana.

These developments indicate that blockchain is evolving from an experimental financial tool into a potential alternative for global payment and clearing infrastructure.

Future Outlook: The Evolution of Solana’s Stablecoin Ecosystem

Looking ahead, Solana’s stablecoin ecosystem is likely to expand in the following areas:

- Deeper Institutional Integration: As global stablecoin regulatory frameworks become clearer, more compliant institutions may choose Solana as a custody and settlement network.

- Greater Cross-Chain Interoperability: As bridge technology and multi-chain architectures mature, stablecoins will be able to move freely across blockchains, further amplifying their utility.

- Continued Application Adoption: From NFT markets and supply chain finance to real-world asset (RWA) tokenization, stablecoins are set to become a key bridge between the traditional economy and on-chain finance.

Conclusion

Solana’s stablecoin supply has reached a record high, reflecting the rapid growth of its ecosystem and signaling that on-chain finance is entering a more mature stage. With technical performance, market demand, and institutional participation all driving momentum, stablecoins are steadily becoming critical infrastructure for blockchain integration into the global economy.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About