Solana Price Prediction: Can SOL Return to 200 as PayFi Challenger RTX Gains Narrative Momentum

Preface

As the crypto market absorbs the rapid gains seen earlier this year, investors are reassessing which assets have the potential to maintain momentum. With Bitcoin’s price action stabilizing, market risk appetite is rebounding. Mainstream altcoins supported by active on-chain activity and real-world applications are once again attracting capital, and Solana (SOL) stands out as a leading example.

The market is also experiencing subtle shifts. In addition to traditional Layer 1 blockchains, PayFi projects—focused on integrating payments with real-world finance—are beginning to draw attention from long-term investors. Among these, Remittix (RTX) has recently emerged as a frequently discussed new player.

Solana’s Market Momentum

From a market structure perspective, Solana has consistently delivered high TPS performance this year and continues to attract new projects in DeFi, NFT, and Web3 infrastructure. This combination of active development and actual usage provides dual support, enabling SOL to maintain a relatively stable price range even amid volatility.

Technical Structure and Price Outlook

Technically, SOL has repeatedly held key support levels established earlier this year and has gradually set higher lows. This leaves room for a bullish price outlook. Some market models suggest that as long as the broader crypto market avoids systemic risks, Solana could retest the $200 threshold. Unlike previous cycles, capital is no longer concentrated on a single blockchain narrative. Investors are placing greater importance on projects that connect with real-world financial needs, which is also directing attention toward emerging payment-focused initiatives.

PayFi Narrative Gains Traction: Remittix (RTX) Accelerates Real-World Adoption

Amid this narrative shift, Remittix (RTX) is positioned as a PayFi-centric project, aiming to bridge the gap between crypto assets and traditional finance. While still in its early stages, its product development is steadily progressing.

According to official sources, the Remittix wallet has launched on the Apple App Store, with a Google Play version confirmed for future release. This will enable users to directly manage and transfer digital assets. More importantly, its PayFi mainnet platform for crypto-to-fiat conversion is scheduled to go live on February 9, 2026, targeting cross-border payments and real-world financial applications.

To date, Remittix has raised $28.8 million in private funding and sold over 701 million tokens, signaling sustained market interest in its payments narrative.

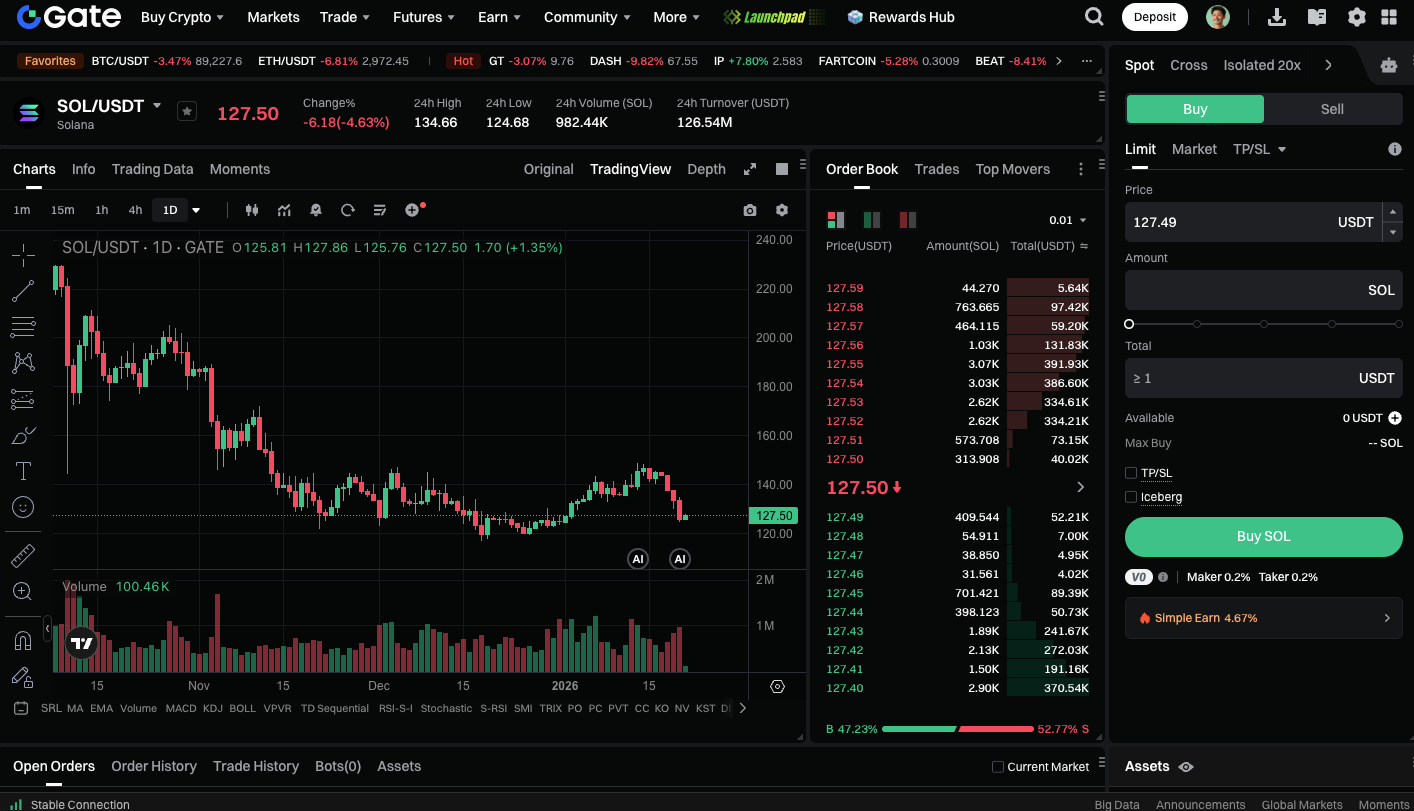

Start trading BTC spot now: https://www.gate.com/trade/SOL_USDT

Conclusion

Solana remains one of the few mainstream blockchains combining high on-chain activity with a mature ecosystem. As market sentiment continues to recover, SOL’s prospects for retesting $200 are increasingly supported. With capital turning its attention to “how crypto assets can achieve real-world financial utility,” PayFi projects are gaining visibility. Remittix (RTX) has captured market interest with its product rollout and clear timeline, reflecting the search for the next growth theme. In the coming period, SOL and RTX may not simply compete, but rather represent a dual-track evolution—from infrastructure to practical value—in the crypto market.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Gate Alpha Launches Points System: Trade On-Chain, Earn Points, Unlock Airdrops

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?