Risk-averse sentiment is pushing silver prices upward, as spot silver sets a new record high.

Silver Price Hits All-Time Record High

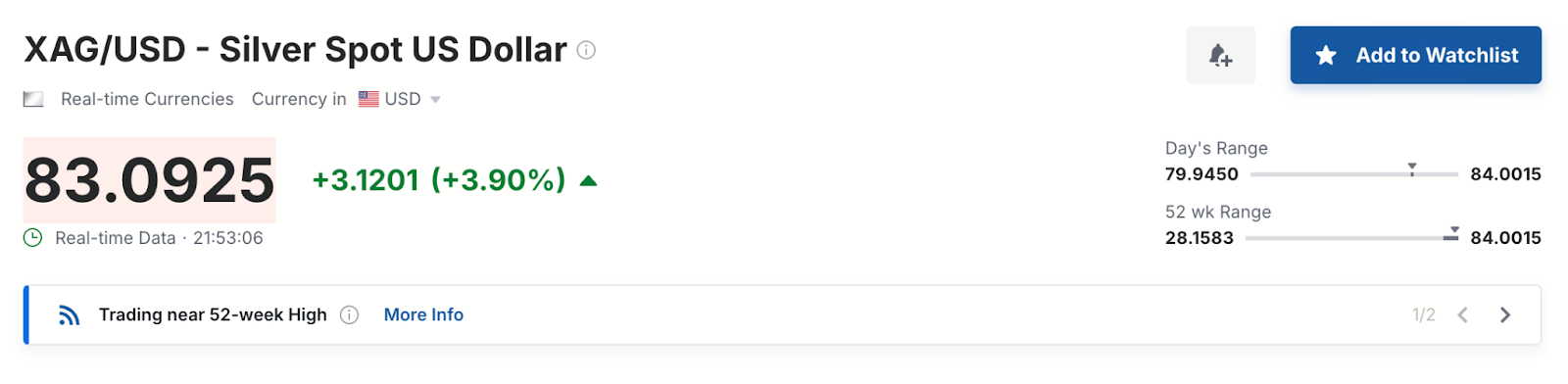

(Source: Investing)

Market data shows that spot silver has broken past its previous two-week high, with the latest price reaching $83.9 per ounce—a new all-time record. This rally has positioned silver as a central focus in the current precious metals market in 2026.

Safe-Haven Inflows Accelerate

Analysts widely attribute this surge to rising global uncertainty. With ongoing geopolitical tensions, investors have become more risk-averse, driving capital toward assets with safe-haven characteristics, benefitting silver in particular.

US Policy and Middle East Tensions Drive Market Volatility

Developments in the United States have further unsettled the market and driven demand for defensive assets. According to reports, U.S. officials disclosed that President Trump is weighing several possible actions against Iran. These considerations include deploying an aircraft carrier strike group to the Middle East and undertaking cyber and information operations.

Recently, the U.S. government also held initial meetings to discuss supporting protest activities in Iran, with some considerations involving military action against Iranian government targets. However, some officials believe that large-scale military intervention at this stage could disrupt the ongoing protests. This uncertainty is a primary driver for the current silver rally.

Rate Cut Expectations Fuel Further Gains

Beyond geopolitical factors, economic data is playing a crucial role. Weaker nonfarm payroll figures have strengthened expectations for a Federal Reserve rate cut. As the outlook for interest rates turns more dovish, investors are increasing allocations to non-yielding assets.

Looking to learn the latest about Web3? Sign up to get news right to your inbox: https://www.gate.com/

Silver Outlook: Safe-Haven Status Reinforced

In a climate marked by global uncertainty and unclear policy directions, silver and other precious metals have once again emerged as critical safe-haven assets. The combined influence of geopolitical risk and monetary policy expectations continues to provide robust support for silver prices. Market participants remain closely watching future developments in the Middle East and U.S. economic policy to gauge the longevity of this record-breaking run.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About