Russell 2000 Reaches Record Peak, Sparks Altcoin Speculation

Russell 2000: Context Behind Its Record Highs

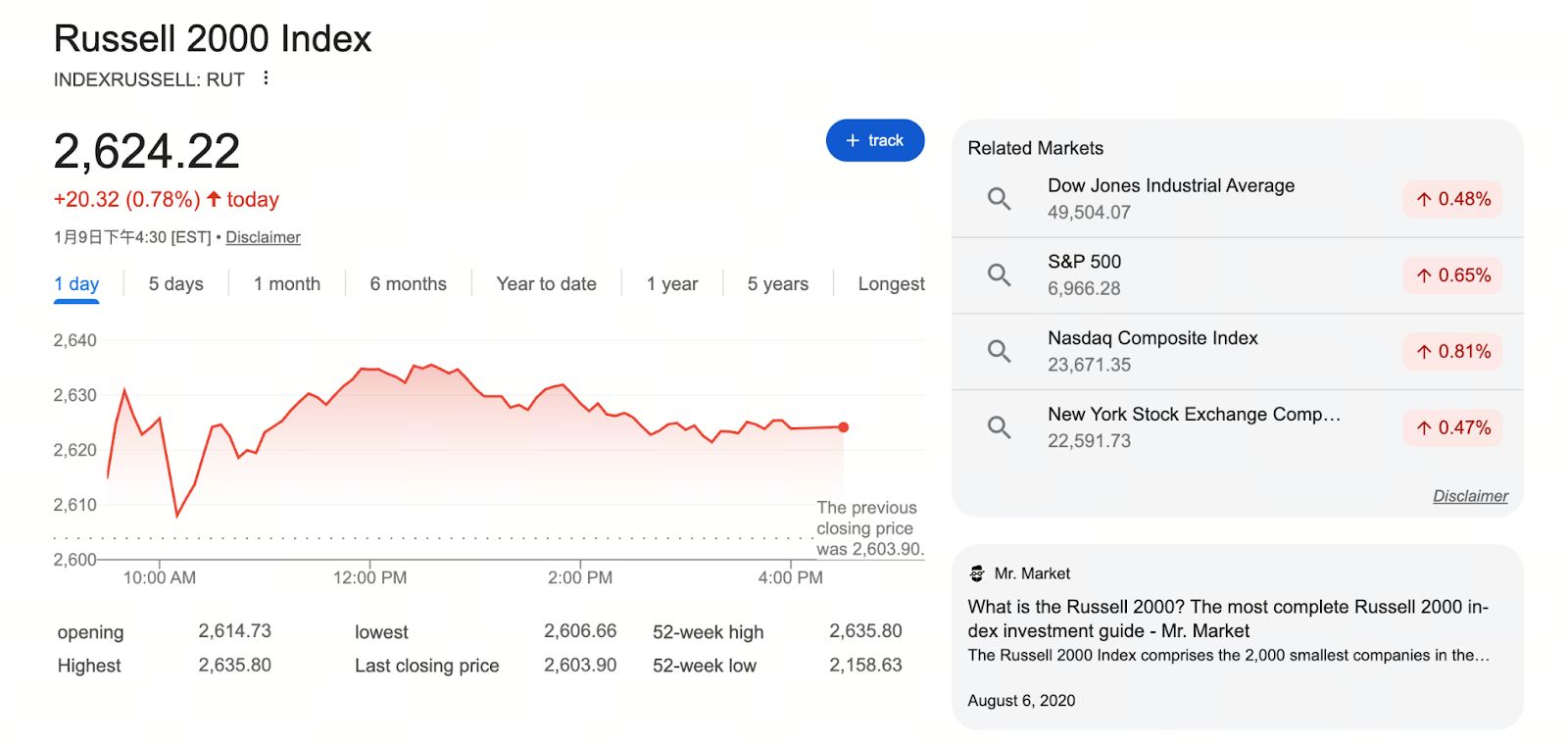

(Source: Google)

The Russell 2000 Index tracks roughly 2,000 U.S. small-cap stocks and typically represents a higher-risk segment of the equity market. Recently, the index hit an all-time high, driven by several key factors:

- Policy stimulus: Since December 2025, the Federal Reserve has been purchasing $40 billion in U.S. Treasury notes every month.

- Government intervention: On January 8, the U.S. President authorized the purchase of $200 billion in mortgage-backed securities.

- Capital flows: Outflows from Treasury funds and concepts like tariff dividends have increased market liquidity, further boosting small-cap stocks.

These factors have collectively fueled a clear risk-on environment, with small-cap stocks leading the charge.

Potential Link to Altcoins

Some crypto investors have noticed that the Russell 2000’s strong performance may trigger short-term rallies in altcoins. In previous cycles—such as in 2017 and 2021—hot small-cap markets coincided with upward moves in certain altcoins.

However, experts caution that correlation does not equal causation. While similar patterns have appeared in the past, sustained market momentum is required to establish a clear trend. Investors should watch for short-term capital inflows and rising risk appetite that could impact prices, but long-term growth still depends on overall market sentiment and ongoing capital flows.

To learn more about Web3, click to register: https://www.gate.com/

Summary

The Russell 2000’s recent surge to record highs reflects market optimism driven by policy stimulus and ample liquidity. For the altcoin market, this opens short-term speculative opportunities. However, investors should remain cautious and monitor whether market momentum will persist. The strong performance of small-cap stocks and potential links to the crypto market underscore the importance of risk management and trend analysis, rather than relying solely on historical patterns.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About