Pi Network Price Prediction: Testing 0.20 USD Support and the 1 Dollar Scenario

Preface

(Source: pibartermall)

After Binance founder Changpeng Zhao (CZ) publicly embraced meme culture, the crypto community reignited debate over exchange listing criteria. The Pi Network community’s voice has been especially prominent. As meme coins frequently secure listings on major exchanges, Pi Coin—despite its vast user base—remains absent from Binance’s trading roster. This disparity has prompted the market to reexamine Pi Network’s position and the disconnect between its price and underlying fundamentals.

Large User Base, Yet No Advantage on Major Exchanges

Pi Network has consistently attracted millions of everyday users through low-barrier mining, amassing tens of millions of accounts. For some investors, this scale should command attention from mainstream exchanges. However, the market increasingly recognizes that user numbers alone do not guarantee a listing. Amid the meme coin boom, short-term hype and trading activity have become decisive factors for rapid token listings. This trend has fueled the Pi community’s skepticism toward Binance’s listing decisions.

Mainnet Launched, But Still Limited to Select Exchanges

Pi Network launched its open mainnet in early 2025, ending years of testing. Since then, Pi Coin has been tradable on OKX, Bitget, and MEXC, signaling gradually increasing liquidity. To date, Binance has not released any listing announcement for Pi Coin. Even with strong community votes supporting Pi’s listing, these have yet to translate into action, further intensifying market uncertainty.

Key Factors Delaying Binance Listing, According to Market Speculation

From an industry standpoint, Pi Network still faces several structural hurdles:

- Insufficient transparency: The blockchain code is not fully open-source, and there are no publicly available, credible third-party security audit reports.

- Unclear process: It remains uncertain whether Pi Network has completed Binance’s formal listing application.

- Regulatory and compliance concerns: Major exchanges typically prioritize legal risk, governance structure, and long-term compliance.

Furthermore, although Pi’s official roadmap extends to 2026, its details remain vague, contributing to investor hesitation.

Token Unlock Pressure Amplifies Market Risk Sentiment

In the near term, another market focus is the imminent large-scale token unlock. Even as some data indicate declining spot liquidity on exchanges, investors worry that the unlock could trigger fresh selling pressure.

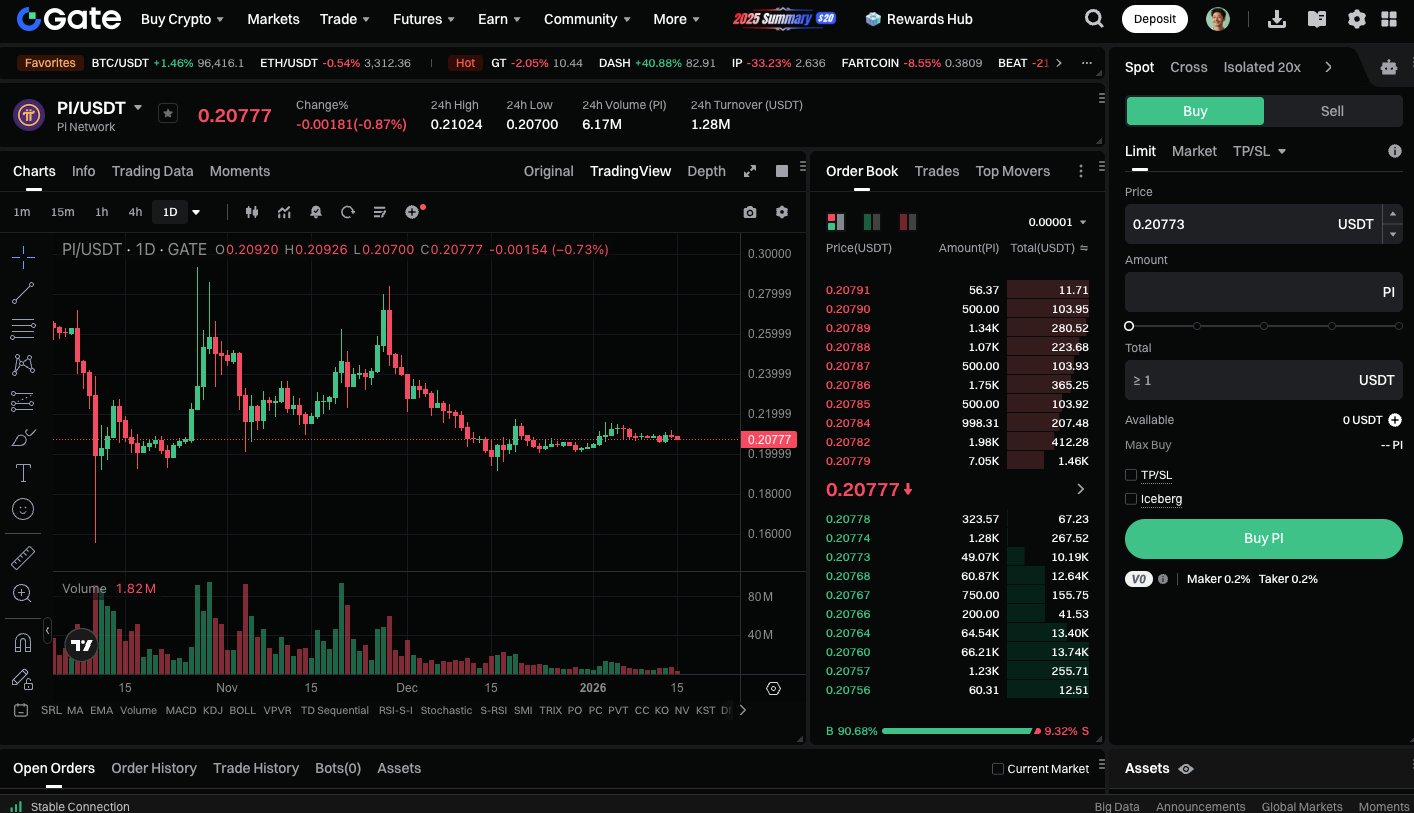

Currently, the $0.20 price level is considered the most critical support zone. If breached, market sentiment may quickly turn defensive, amplifying downside risk.

Is There Room for a Return to $1 in the Long Term?

On a longer time horizon, Pi Coin’s trajectory remains closely linked to the broader crypto market. If 2026 ushers in renewed market growth, alongside ecosystem adoption, improved transparency, and potential listings on leading exchanges, a return to $1 is conceivable. However, the market will need to see more concrete progress—beyond just community scale—before that happens.

Trade PI spot now: https://www.gate.com/trade/PI_USDT

Conclusion

Pi Network is at a pivotal, if awkward, crossroads. It boasts an unusually large and highly engaged user base, but faces persistent challenges around transparency, listing progress, and short-term token supply pressure that undermine market confidence. The $0.20 support level will be a key near-term indicator. Whether Pi Network can reach $1 again with a market recovery in 2026 will depend on its ability to convert user scale into verifiable value and trust.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Gate Alpha Launches Points System: Trade On-Chain, Earn Points, Unlock Airdrops

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?