Payments Chains: The AWS Moment for Money

Hey Fintech Nerds 👋

I’ll be in SF next two weeks. Running a workshop for founders on how to do social comms, meeting some folks about Fintech Nerdcon, and at the first ever SardineCon.

MESH raised another $130m, Nubank delivered 42% earnings growth and 40% revenue. Wow. Circle announced their stablecoin-blockchain, and rumors say Stripe/Paradigm* are working on one too. Your 📣 Rant this week, why payments are going onchain.

In markets, Stablecoins x AI are the meta narrative play. At the other side of this Adyen, who’s not talking about stablecoins, or AI. Or you could be like Nubank and crush with and without crypto. (see 👀 Things to Know for more)

80 Fintech CEO’s signed a letter to the President pushing back on “Chase” and others implementing fees. In the same week the Fed announced it’s ending it’s nicely activities regime (!!)

Want to support Fintech Brainfood? Get yourself to Fintech Nerdcon in Miami, or check out the work we do at Sardine*.

Here’s this week’s Brainfood in summary

📣 Rant: The AWS moment for payments

💸 4 Fintech Companies:

- Lava Payments - The monetization platform and wallet for AI Tools

- Tracelight - Excel AI Co-pilot for finance power users

- Casap - Card Dispute AI Co-pilot for Issuers.

- Fiscal AI - The AI Native Bloomberg

👀 Things to Know:

- Circle delivers its first ever earnings release, dips 6% after share secondary offering.

- Nubank just posted 42% earnings and 40% revenue growth, with 123m customers.

If your email client clips some of this newsletter click below to see the rest

Weekly Rant 📣

The AWS moment for payments: Why Payments Companies are building their own chain

Fortune reported Stripe and Paradigm may be working on a payments-first chain. No confirmation, but assume it’s real. Circle also announced their own during earnings. What does this mean?

Zoom out with me for a second. Payments infrastructure is still bespoke, fragile, and expensive to scale. If you believe AI multiplies transaction volume, and if you believe money is becoming software, you land at the same place:

Payment-native chains are inevitable. Current infrastructure isn’t good enough onchain or off. Stablecoins, tokenized deposits and onchain finance are coming.

The question is which network commoditizes the plumbing and lets operators win on software.

Editor’s note: I advise Paradigm. Views are mine. This piece analyzes the strategic logic of payment-native chains and what it means for operators.

The AWS moment for payments:

There’s no AWS for payments processing. Processors all rebuild the same stack. There is no common utility layer. A shared, neutral, high-throughput rail would shrink fixed ops cost and move competition up the stack, toward software and workflow. Imagine that infrastructure, but without Amazon. Credibly neutral.

Existing chains lack payment features native to the chain. Think of a payments processing utility with an “EC2 for settlement,” or, “S3 for receipts,” “IAM for compliance keys.” The prize is not cheaper basis points, it is developer velocity, and hiding the pains like offramping.

Existing high-throughput networks like Solana, Base do many things, including memecoins, which can make them crowded and hard to use if a President drops a new token, for example. A Swiss Army Knife rarely makes a good machete.

We’ve seen other stablecoin-focused chain projects from Tether (like Plasma), and new companies Codex and Conduit emerge to solve in this space. There’s lots of teams spotting the same problems.

A winning chain would have a minimum viable feature set for operators:

- High sustained TPS with predictable finality under peak,

- Backward compatibility with bank rails and message formats,

- Distribution to where merchants already are,

- Native compliance hooks and auditability,

- Fees in regular currencies (e.g. USD)

- Clear neutrality guarantees: shared governance, limited sponsor privileges, broad interoperability.

Having a handful of big partners to help jump-start that network would be a heck of a go-to-market, especially if it could be credibly neutral. And I see no reason why it can’t. (It’s now uncontraversial that Coinbase builds Base, which even JPM Morgan has partnered with.)

Where does that leave deposit tokens, banks and central banks?

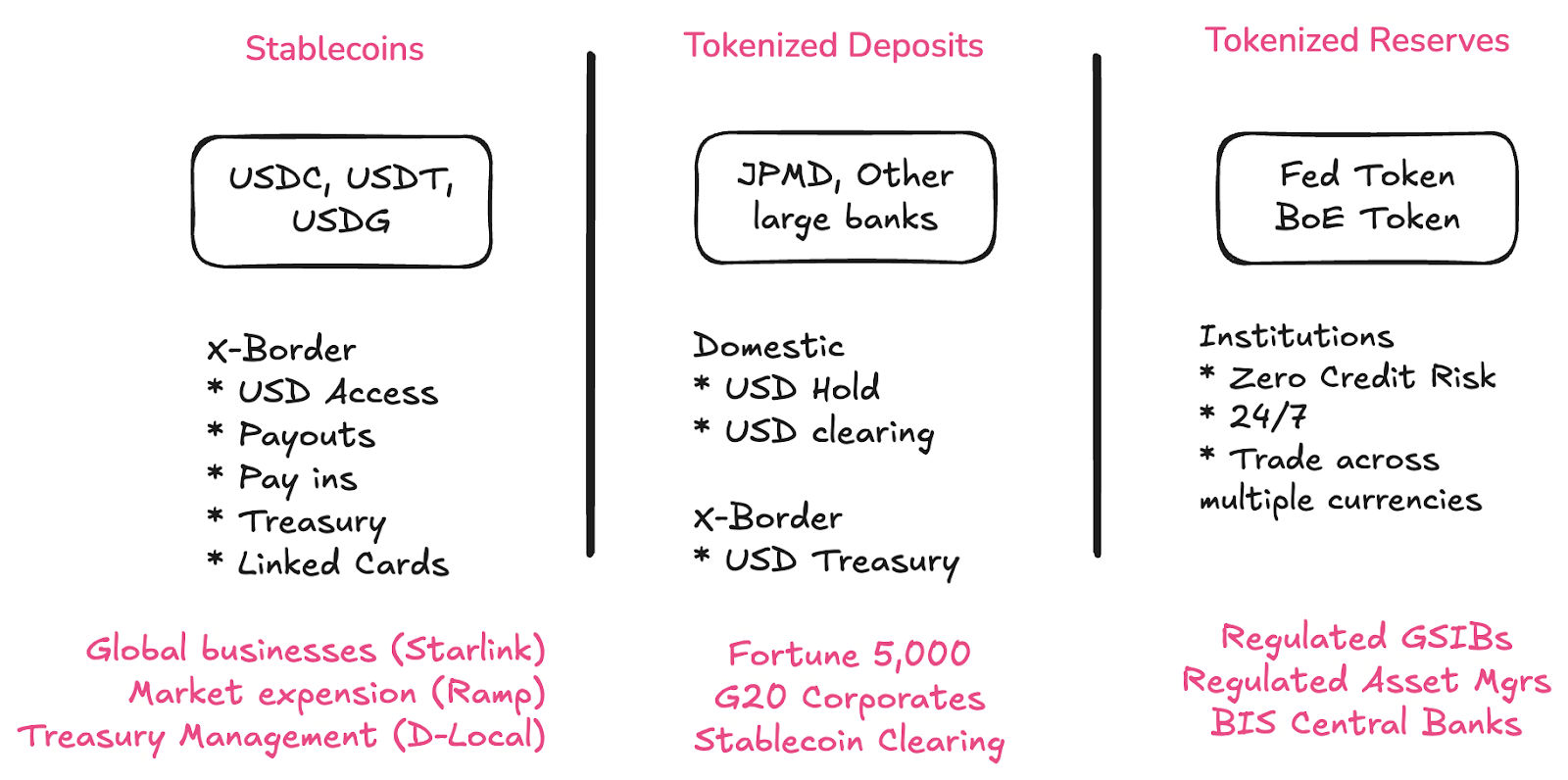

Stablecoins, deposit tokens and CBDCs will co-exist. They solve different problems for different people. All three of those will go onchain.

- Stablecoins create new opportunities for access to dollars for non banks and institutions in the global south.

- Tokenized deposits help much larger organizations come back into the commercial banking system.

- Tokenized reserves help giant banks settle with each other and the central bank nationally and maybe even internationally.

Stablecoin clearing will be a huge opportunity for banks: Just this week I saw one founder note that their partnerships with tier 1 banks like Deutsche Bank, Wells Fargo, US Bank, and JP Morgan has enabled much more structural security in their off-ramps.

Every bank should launch Tokenized deposits: This is a no-brainer. The future of payments infrastructure is onchain, so your balance sheet should be too. I’m spending a lot of time defining how lately. Look for that in a future Brainfood. Because the answer isn’t what you’ll get by doing an RFP.

Tokenized Deposits will make stablecoins backwardly compatible with TradFi. And this is a critical point. If all of those banks offer tokenized deposits (their deposits are onchain), the off ramp disappears. This is how we become backwardly compatible.

This is very different to the BaaS era. Where small banks engaged in “novel activities” only to be a massive risk to the fintech companies and stablecoin ecosystem. We have a dedicated law for stablecoins, and that’s invited the big banks in.

Yes, because it’s a commercial opportunity.

But crucially. The commercial opportunity has regulatory clarity.

Can openness survive branded rails?

One big fear is that “Stripe chain,” along with efforts by Robinhood and Coinbase would re-centralize the internet and defeat the purpose of onchain finance on the face of it. But this thoughtful piece by Cristian Catalini argues the opposite.

Catalini’s point: platforms like Coinbase or Robinhood pay for decentralization because it insures them against platform capture.

The new L1 payments chains need to be credibly neutral.

How do you know something is credibly neutral? There are three tests.

- Shared governance

- A limited role for the parent

- Broad and inclusive interoperability.

These will be interesting things to come back to as the Paradigm* project takes more shape.

Commoditizing payments processing - Competing on software

There’s an incentive to commoditize the infrastructure that I think most are missing. These “branded rails” are an intentional strategy to commoditize fixed infrastructure opex, just as Amazon did with AWS.

When Stripe acquired Bridge, I argued at the time that the rationale is that Stripe is becoming software. They’re not competing on low-cost processing; they’re competing on the value they can add fixing workflows like refunds, retries and recurring logic. They do this because payments infrastructure is broken, and those hidden problems are not obvious to outsiders to the industry.

Now imagine if the infrastructure wasn’t broken.

What if you had a commodity infrastructure that was instant, 24/7, and custom built for the needs of ultra high-volume and throughput payments companies and its customers? That’s something that is not true of existing chains.

The problem with incentives, is there’s always a call to the dark side. To create a closed loop so you can capture more of the economics, and the expense of becoming a true network. And I agree, that’s a massive risk.

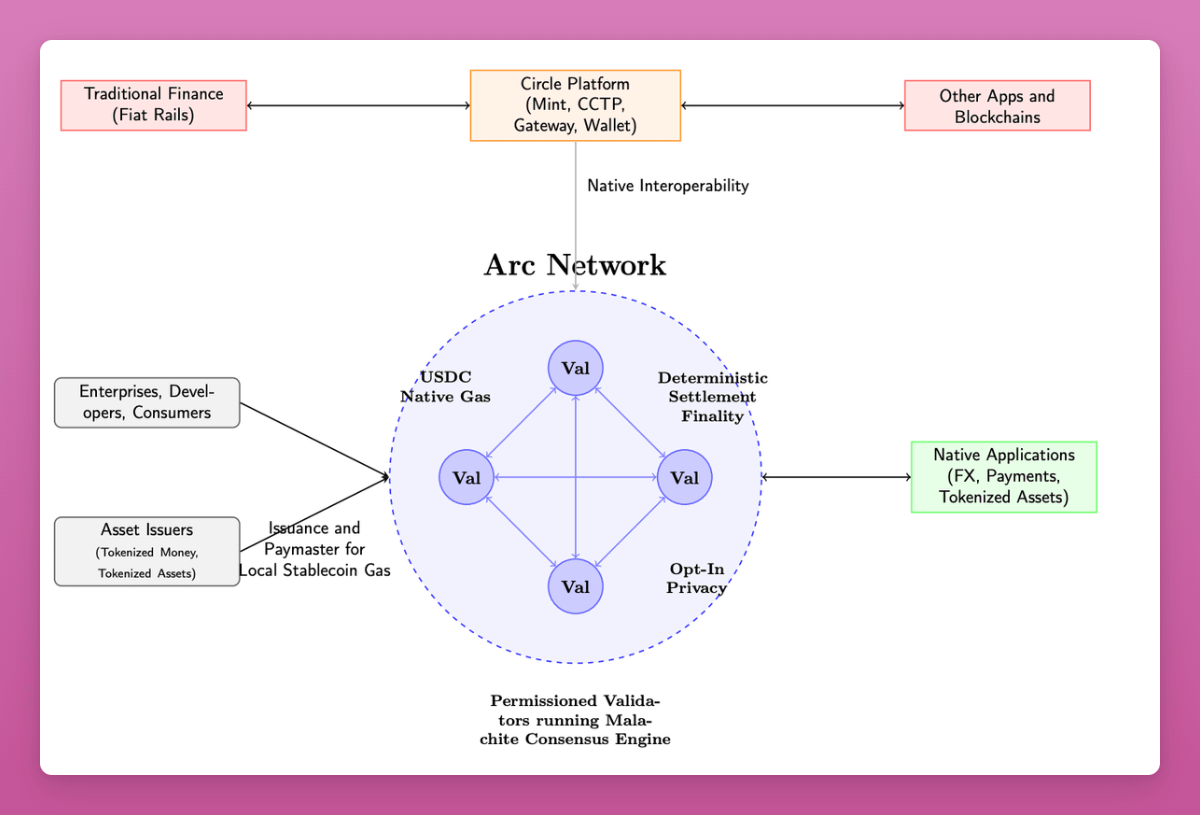

Circle launching Arc this same week isn’t a coincidence.

It’s confirmation that the stablecoin leaders see the same pattern Stripe does. Circle has likely been working on, and building Arc for years at this point.

After an incredible run in public markets, it’s now facing into falling rates, and a need to drive new sources of revenue (Circle makes the vast majority of its revenue from treasury yield, 80% of which it gives away to distribution partners).

What differentiates it from networks like base, ethereum or solana are several FI and payments industry friendly features.

Here’s the laundry list from the litepaper. Most of it won’t ship on day one, but it shows where Circle’s head is at.:

- Pay transaction fees (gas) in USDC.

- Regulated institutions run validators.

- Faster throughput (3k to 10k TPS).

- Opt in “privacy.” Payment amounts are hidden, addresses are visible (but not identified in the public).

- Opt in disclosure featur. Regulators get a “view” key

- Will launch with USYC (treasuries token). Collateral and margin on chain.

- Bridging uses Circle’s proprietary Gateway and CCTP. Circle supports a massive amount of chains for USDC already. They’re re-using that.

- Roadmap includes an institutional FX capability.

- Payments features like attaching invoices. They also include “onchain” refunds and dispute mechanisms.

This is a litepaper, and obviously a wish list of features more than something that is available but it is a statement of intent and of where the industry is going.

My observations:

- A lot of this is aimed at capital markets actors. Collateral, margin, regulators

- There’s a lot of language written for risk audiences. “Institutional grade,” and adding “consumer protection.”

- Circle sacrificed it’s issuing profit for distribution: They share the vast majority of their revenue with Coinbase / Binance. New products help.

- Can circle be all things to all people? They have a head start, they have mindshare, but do we want separation of concerns?

Rob Hadik from Dragonfly makes the bear case

So now to win, Circle has to go head to head with Stripe on the merchant or SMB side or Kinexys on the enterprise side and win the end customer relationship? Hard to see how they can win that battle.

Rob Hadik

(Hadick invests in rivals, but is generally spot on.)

My take: It’s all to play for in the future of onchain finance. Circle has every right to make a big play with their head start.

There will likely be a small handful of winners, and all companies are smart to try and expand into the market. It’s also a positive that we’re well past decentralization theatre at the expense of infrastructure that’s ready for the scale global markets need.

If you want decentralization, that’s what Bitcoin is for.

If everyone creates their own chain, don’t we end up where we started?

If every firm builds a chain, do we just recreate today’s nightmare of broken reconciliation with new tech?

No.

Tokenization’s utility doesn’t depend on one chain, it depends on scale and programmability.

Distribution matters.

Circle was willing to give up 80% of its revenue to get distribution. And if Binance and Coinbase continue to dominate and they can pivot to new revenue lines it will make sense. But other market actors have other forms of distribution.

Rarely are outcomes binary.

In 2017, and 2021 I often remember the sensation of “just another chain.” There are plenty of cases where that has been true (anyone remember EOS?)

But at one point, Solana was just another chain.

We’re not done innovating yet, and we’re facing into the most monumental shift in technology our species has lived through in AI.

Building the payments rail for an AI explosion

Subscriptions are already breaking as a default payment mechanism for AI tools.

- Power users break the model: We’ve seen Anthropic and others add usage limits, since a small percentage of users rack up high fees.

- Most tools that wrap models don’t know their COGS: Underneath the subscription is inference (GPU costs), cloud platform fees, token use from the AI models. Tracking all of that is hard (companies like Lava Payments and Polar are attacking that problem)

- This is creating a profitability gap for AI tools: The coding tools like Cursor and Windsurf have been reported to be massively loss making.

AI models are getting cheaper as they age, but frontier models are not. Subscription models don’t cover the costs of power users. And if we want an AI revolution, we need more AI usage not less.

That means yes we need to understand the underlying transaction costs. But most importantly, we need an ultra fast, ultra low-cost, programmable payments rail.

AI will multiply payment volumes by an order of magnitude.

The AI labs, VCs and payments companies are all building for a world where money moves between agents much faster than humans can comprehend. As AI Agents pay for compute, tokens, and services from each other they need need payments systems that are much more commodity in nature.

The battle to be the Rail for the AI-Native Era of Payments

Enter stablecoins.

Today’s stablecoins are often cheaper vs international remittances. But traditional payments are often better, faster, and/or cheaper for domestic payments. Most existing blockchains have been designed to be many things, to many people, and they do that job well.

The problem is, Ethereum at 15 to 30 transactions per second (TPS) or Solana at 3k TPS isn’t ready to handle peak load from today’s payments. Now multiply that total payment volume (TPV) by 10x or 100x if agent-to-agent payments take off.

Far from being “just another blockchain,” these dedicated payment chains could be a major part of the future market structure as payments go AI native.

The goal of AI-native financial infrastructure isn’t purely decentralization or speed. It’s to build something fast enough and decentralized enough for what’s coming. And to assume that job is done is missing the point.

The level of interest in stablecoins is reaching fever pitch. Surely, like AI, short term, we’re in a bubble. But if you’re thinking long term, think about where the infrastructure and partner landscape will be in 2 - 3 years time.

- Deposits will be tokenized - meaning the “off ramp” is no longer needed, because the off ramp is onchain natively.

- Stablecoins will get more competitive - meaning many of today’s drawbacks about slowness or expense will vanish

- Every Neobank, provider and bank will integrate - meaning we’ll demand much more performance from stablecoins

- AI will demand 10x to 100x more payments capacity - meaning the settlement rails of today won’t be able to keep up.

We need new infrastructure for this world.

This means if you’re not adopting stablecoins in your day-to-day workflow.

Or being clear-eyed about where it fits in your roadmap.

If you’re still treating stablecoins as speculative, you’re ignoring the operating system upgrade for money itself.

ST.

Disclosure: I currently operate in an advisory capacity to Paradigm, the VC firm listed in the Fortune article, but to be clear, these views are my own, and not the views of anyone I advise or work with.

4 Fintech Companies 💸

- Lava Payments - The monetization platform and wallet for AI Tools

Lava helps developers understand their underlying cost drivers and use those to add monetization to their AI wrapper platform regardless of their underlying model choice. It supports multiple model providers like OpenAI, Antrhopic, Eleven Labs and inference providers like Groq. It also supports a wallet system that allows builders to use multiple tools from one place, without signing up to 10, 20 or 30 subscriptions.

🧠This wallet and metering model could be disruptive in the long term. Yes billing is hard. But there’s also a giant churn and unit economics problem coming. Where AI wrappers massive top line revenue hides even more massive cost structures that aren’t improving. The long term solution of giving users one wallet to rule them all seems like the ideal solution. If I’m Ramp or Brex, I’d want to steer into this trend aggressively and own the expenses wallet for developers.

- Tracelight - Excel AI Co-pilot for finance power users

Tracelight helps build with language (e.g. do a cohort MRR analysis), discover formula errors, format with a single prompt, and save any command as a workflow for the future.

🧠 Tracelight is capitalizing on how poor Microsoft Co-pilot’s UX is in practice. Google isn’t much better. If your experience of AI is mostly Microsoft co-pilot you’re living in the dark. They’re infuriatingly bad, so the potential gets wasted. Tracelight is betting once you’ve used their product, you’ll find it so delightful it’s worth paying them to fix your experience. What I wonder is, if that’s a big enough business by itself, or just a sitting acquisition target for $MSFT or $GOOG?

- Casap - Card Dispute AI Co-pilot for Issuers.

Casap is a co-pilot and collaboration platform for card disputes. When a customer of a bank or Fintech company starts a dispute Casap asks detailed questions and for evidence to get to the bottom of what actually happened. It aims to figure out if a customer is being honest, trying their luck, and if the better outcome is direct communication with the merchant. If the dispute is submitted, it calculates a win probability for the bank / fintech.

🧠This is one of those ugly plumbing challenges nobody tried to innovate at, being fixed with AI. “Friendly fraud” where customers just hit the dispute button to get a refund even though they got the product is a huge issue. Investigating that is expensive for a bank, and since (in the US), the merchant is liable for fraud, they might not go deep. Meanwhile the merchant might not even fight a chargeback for less than $400 because their work is so manual. This is an area ripe for AI automation as an API. Next steps? Every major issuer processor should partner with these guys.

- Fiscal AI - The AI Native Bloomberg

Fiscal is a data terminal and API platform for market data. It pulls together public data feeds as well as long form content into rich user experiences. It helps add context to data, so for example if you’re looking at AWS revenue’s it can overlay other hyperscaler benchmarks quickly. Pricing starts at $24/mo, and scales up to $199/mo for enterprise.

🧠 As wide as this data set is, I suspect its an addition to Bloomberg not a genuine competitor for a while. What makes Bloomberg so powerful is the sheer breadth of global data it has, and it’s ability to break news through the terminal inside trading floors that often ban mobile phone use. What’s interesting about this, though, is that its pricing lets it be the sidecar option, which could slowly eat away at the terminal and even obviate the need for it for many sub-categories of investors or firms.

Things to know 👀

“The company is offering 2 million of Class A common stock for sale, while selling stockholders are unloading another 8 million” says Coindesk. Circle’s stock fell 6% to $154. 50% down from it’s peak, but still 5x higher than its IPO price.

🧠Investors and leadership likely did well here. Investors selling 8m shares are netting $1.24B. I’m told some leadership was also able to cash out, but employees and ex-employees are still locked up. Lets hope the rate cuts are kind to them 🤞

🧠Rate cuts are coming: Circle modelled a 50bps and 100bps rate cut on revenue. 100bps cut slashes run rate gross revenue by $618m (-23%), gross profit $303m (-30%), and margins 3.3%

🧠Supply growth could be a way out. They need to have USDC supply grow by $28b (~44% of today’s $64b) to stay neutral.

🧠Seen from this lens, the Circle strategy of product expansion makes sense. Circle has a lot of traction as the largest “onshore” regulated market actor. Its partnerships with institutions, multiple blockchains and yield product (USYC) could all drive growth.

🧠This company has re-invented itself several times before. We could see that happen again.

👀 2. Nubank just posted 42% earnings and 40% revenue growth, with 123m customers. Wow.

Here’s the breakdown…

- 122.7 million customers (+4.1M net additions)

- $3.7 billion revenue (+40% YoY)

- $637 million net income (+42% YoY)

- $12.2 monthly revenue per active customer (+18% YoY)

- $0.80 cost to serve per customer

- 83.2% monthly activity rate

That’s a benchmark every other organization in finance should print out on their wall. Only Webank in China (with 494m users) can beat.

The unit economics almost don’t make sense:

- $0.80 cost to serve each customer

- $12.20 revenue per customer/month

- That’s 15x return 🤯

🧠 Most banks struggle to hit 3x - That’s the benefit of self-owned technology and a branchless servicing model.

Geographic Split:

- Brazil: 107.3M customers (60% of adult population)

- Mexico: 12M customers (13% of adult population)

- Colombia: 3.4M customers (10% of adult population)

🧠 That says to me, the newer markets are taking longer to penetrate. Where’s the next growth engine coming from? Not many 200m + populations around 👀

Other Products:

- 36.2M investment customers (+70% YoY)

- 6.6M crypto customers (+41% YoY)

- 55M active credit customers

- 13.6M unsecured loan customers (+56% YoY)

- 6.8M secured loan customers (+158% YoY)

🧠 Impressive product expansion into the existing base. Investments, crypto and lending in the same app is the new default. It’s noteworthy both BBVA and Santander now offer crypto capability

Tweets of the week 🕊

That’s all, folks. 👋

Remember, if you’re enjoying this content, please do tell all your fintech friends to check it out and hit the subscribe button :)

Want more? I also run the Tokenized podcast and newsletter.

(1) All content and views expressed here are the authors’ personal opinions and do not reflect the views of any of their employers or employees.

(2) All companies or assets mentioned by the author in which the author has a personal and/or financial interest are denoted with a *. None of the above constitutes investment advice, and you should seek independent advice before making any investment decisions.

(3) Any companies mentioned are top of mind and used for illustrative purposes only.

(4) A team of researchers has not rigorously fact-checked this. Please don’t take it as gospel—strong opinions weakly held

(5) Citations may be missing, and I’ve done my best to cite, but I will always aim to update and correct the live version where possible. If I cited you and got the referencing wrong, please reach out

Disclaimer:

- This article is reprinted from [Simon Taylor]. All copyrights belong to the original author [Simon Taylor]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?