Nansen Launches AI-Powered Trading Tools for Solana and Base Users: A New On-Chain Trading Experience

AI Accelerates Crypto Trading Penetration: Nansen Unveils Integrated AI Trading Tool

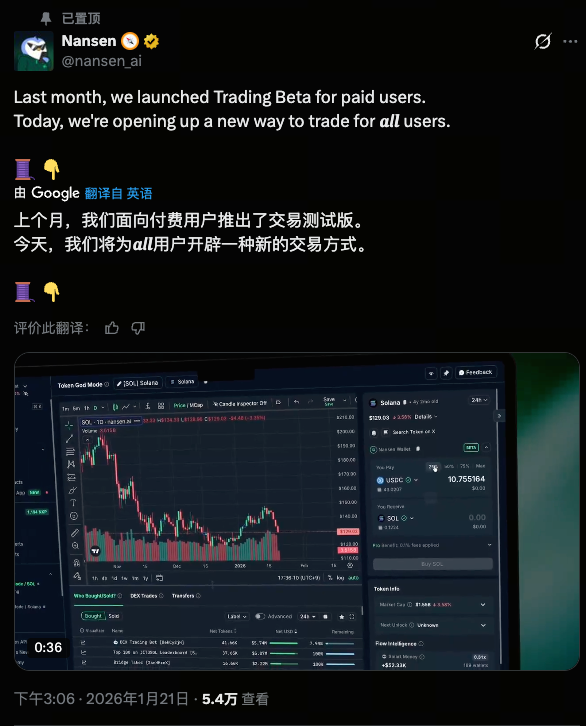

Image: https://x.com/nansen_ai/status/2013870819248873833

As artificial intelligence technology continues to advance in the crypto market, on-chain analytics platform Nansen has officially launched its AI-powered trading execution tool. This enables users to execute on-chain trades directly within the platform. The update marks a pivotal shift for Nansen, evolving from a pure data analytics provider to a comprehensive trading ecosystem.

This development not only changes how users interact with Nansen but also signals the rapid evolution of on-chain analytics tools into the execution layer.

I. Product Background: From On-Chain Analytics Platform to Trading Terminal

Nansen has long been recognized for its advanced on-chain analytics, with core strengths including:

- Extensive, labeled address database

- Intelligent wallet tagging system

- In-depth insights into fund flows and market behavior

As of January 21, 2026, Nansen has officially rolled out its integrated AI trading tool. Users can now generate and execute trades directly within Nansen, without having to switch to external DEXs or trading platforms.

This upgrade transforms Nansen from an on-chain data observer to an active trade execution participant, integrating analytics, decision-making, and execution in a single closed-loop product.

II. Core Features of the Nansen AI Trading Tool

The new AI trading tool introduces several key modules:

1. AI-Driven Trade Execution

Users can enter trade intentions in natural language, which the AI parses to automatically generate corresponding trading strategies and execution drafts.

2. Real-Time On-Chain Signal Recognition

Powered by data from over 500 million labeled addresses, the AI analyzes fund flows, behavioral patterns, and trend shifts in real time to extract key trading signals.

3. Unified Interface for Trade Execution

The entire workflow—from research and signal recognition to order execution—occurs within the Nansen platform, eliminating the friction of switching between multiple platforms.

This integrated process significantly lowers the barrier for intermediate and even beginner users to participate in on-chain trading.

III. Initial Supported Networks: Strategic Importance of Solana and Base

The Nansen AI trading tool currently focuses on the following two public blockchains:

Solana (Layer-1)

Solana is renowned for its high throughput and low transaction costs, making it essential infrastructure for high-frequency on-chain trading. According to the latest data, SOL is trading around $130, with robust ecosystem activity.

Its rapid confirmation and low fees create an ideal environment for AI-driven automated trading strategies, especially those requiring frequent on-chain interaction.

Base (Ethereum Layer-2)

Launched by Coinbase, Base is designed as a major scaling solution for the Ethereum ecosystem, balancing security and usability. By supporting Base, Nansen enables users to execute Ethereum ecosystem trades with lower gas costs.

Multi-chain support removes the limitations of single-network execution, increasing strategy flexibility and market adaptability.

IV. Market Context: Solana Price Trends and Tool Rollout Timing

Coinciding with Nansen’s launch, Solana has recently shown signs of a modest rebound, currently consolidating around $130.

While the broader market remains in a phase of structural adjustment, the relatively stable price environment offers ideal conditions for real-world testing and strategy validation of AI trading tools.

For traders focused on short-term opportunities or on-chain fund flows, the combination of data-driven insights and automated execution significantly boosts response speed and execution efficiency.

V. User Experience and Fee Structure

According to official sources, Nansen’s trading feature uses a tiered fee model:

- Free users: approximately 0.25% trading fee

- Professional (Pro) users: approximately 0.10% discounted fee

Trades can be signed and confirmed directly via integrated wallets, with no need for additional plugins or complex setup, delivering a seamless user experience.

This fee structure is especially friendly to small and mid-sized traders, supporting higher platform activity and user retention.

VI. Potential Impact on the Market and Ecosystem

The launch of the Nansen AI trading tool could drive a chain reaction across several dimensions:

- Lower trading barriers: Non-professional users can execute complex trades using natural language

- Greater strategy deployment efficiency: On-chain analytics and execution are merged, reducing time from decision to transaction

- Increased public chain ecosystem activity: Deep integration with Solana and Base supports higher on-chain trading volume and user engagement

From an industry perspective, this is more than a product upgrade—it signals the evolution of on-chain tools into intelligent trading infrastructure.

VII. Conclusion: On-Chain Trading Enters the AI Execution Era

In summary, Nansen’s launch of its AI trading tool marks a strategic shift from insight-driven to execution-driven product development. By integrating on-chain data, AI analytics, and trade execution on a unified platform, Nansen is redefining how users engage with on-chain trading.

As network support expands and AI capabilities advance, tools like these are set to become key catalysts for the intelligent and large-scale growth of on-chain trading.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About