MiniMax's Funding Story: 7 Rounds in 4 Years – Who is Driving China's First Capital Feast for AI?

Over two consecutive days, leading AI startups Zhipu and MiniMax both debuted their IPOs on the Hong Kong Stock Exchange. Unlike the listing frenzies that marked the mobile internet era, IPOs in the large model sector aren’t a post-battle celebration; they signal the start of the next competitive round, not a prize for the winners.

With Zhipu and MiniMax entering the secondary market in quick succession, both are set to launch larger-scale private placements. This is a sector where commercialization remains uncertain, yet sustained R&D investment is a given. For these companies, the true value of an IPO lies in accessing greater resources with higher efficiency.

On the eve of MiniMax’s listing, we interviewed the MiniMax team and several investors to reconstruct the market’s diverse perspectives on large model startup opportunities over the past three years, and to highlight the company’s defining traits.

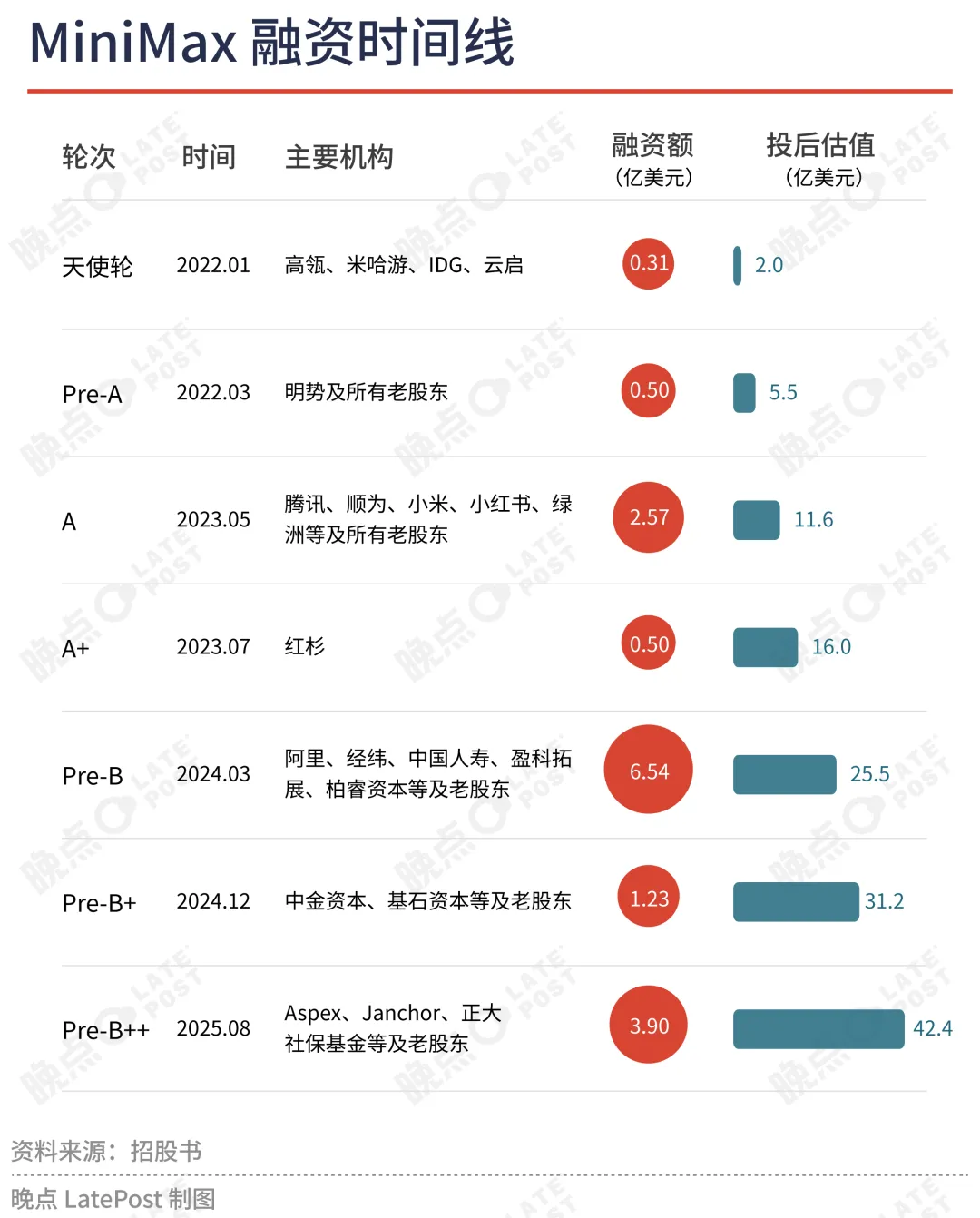

Across seven pre-IPO financing rounds, 30 institutions invested a combined $1.5 billion in MiniMax. Alibaba contributed the largest share; Hillhouse led the first round and, by equity, is second only to Alibaba as the largest external shareholder; MingShi participated in the most rounds.

On the morning of January 9, before heading to the Hong Kong Stock Exchange for the bell-ringing ceremony, MiniMax founder Yan Junjie shared his thoughts with LatePost:

We hope to have the opportunity to make a greater contribution to the advancement of intelligence across the industry. We’ve explored a grassroots path to AI entrepreneurship. While challenges remain ahead, if our journey can inspire the broader AI innovation ecosystem, we’ll be deeply honored.

By midday close, MiniMax’s stock price had surged over 78%, rising from its offering price of HKD 165 to HKD 294, and bringing its market capitalization to HKD 89.8 billion.

Launching Ahead of the Boom

Hillhouse: First Investor, Largest External Financial Shareholder

MiniMax was founded in early 2022, just before the ChatGPT wave, with Hillhouse as its inaugural investor.

During the startup’s planning phase at MiniMax’s Beijing office, Hillhouse partner Li Liang spent three hours discussing with Yan Junjie and Yun Yeyi before presenting a term sheet with a blank valuation—inviting them to name their preferred valuation and investment amount. Yan Junjie proposed: $30 million in funding at a $200 million valuation.

Prior to founding MiniMax, Yan Junjie and Yun Yeyi were colleagues at SenseTime. Yan, born in 1989 and raised in Henan, earned his PhD from the Institute of Automation at the Chinese Academy of Sciences. Over seven years at SenseTime, he advanced from researcher to the company’s youngest vice president, serving as executive dean and overseeing smart city and gaming divisions. Yun graduated from Johns Hopkins University and led strategy in the CEO’s office at SenseTime.

The first Hillhouse investor to engage with MiniMax, Xue Zizhao, told LatePost that just days before meeting Li Liang, Yan Junjie delivered a nine-hour “tech lecture” to the Hillhouse team—covering Transformer scaling laws, GPT-3 progress, DeepMind’s reinforcement learning, diffusion models for image generation, and how CLIP bridges images and language. “Few people could connect all these technologies at the time. I personally doubted it could be done, but in hindsight, IO (Yan Junjie) was right on every count.”

In MiniMax’s early days, the team dissected technological shifts and market opportunities on a whiteboard.

MiniMax’s strategy was to develop text, voice, and image models simultaneously, leveraging large model and multimodal technologies to create AI applications for everyday users. This vision—Intelligence with everyone—was set at the company’s founding.

Hillhouse saw this as a systems engineering challenge; the team needed expertise in algorithms, hardware, data, engineering, and applications. Yan had led teams of over 1,000 at SenseTime, with deep experience in algorithms, engineering, organization, and AI commercialization.

In less than two weeks, Hillhouse completed the term sheet and investment approval, leading MiniMax’s angel round. Sequoia approached MiniMax a week later but missed this round. A year and a half later, in July 2023, Sequoia became a MiniMax shareholder in the $1.55 billion pre-investment fourth round.

In November 2022, Zhang Lei organized a small Middle East trip with a select group of entrepreneurs, including BYD founder Wang Chuanfu, Horizon Robotics founder Yu Kai, and the relatively unknown Yan Junjie, who had just started his venture.

In the VIP lounge at the Qatar World Cup, Yan explained AGI (Artificial General Intelligence) to Middle Eastern partners in his still-developing English. Just two weeks later, the term—then niche—spread globally with ChatGPT’s release.

Hillhouse investor Xue Zizhao, who was first to engage MiniMax, formally joined the company in 2023: “I invested myself in it.”

Hillhouse continued investing after the angel round. Before the IPO, it held 7.14% of MiniMax, second only to Alibaba, making it the largest external financial investor.

miHoYo’s Liu Wei: “Super smart is overrated; resilience is underrated”

In early 2021, miHoYo founder Cai Haoyu declared: “By 2030, we aim to build a virtual world inhabited by a billion people.” MiniMax’s original application vision aligned: using multimodal technology to create AI characters that interact with ordinary users (here, “AI character” refers to AI roles, not the current AI Agent concept). miHoYo’s founders, including Liu Wei (“Dawei Ge”) and Luo Yuhao (“Luo Ye”), had long known the MiniMax team and learned of Yan Junjie’s entrepreneurial plans at the same time as Hillhouse, making their investment a natural fit.

miHoYo epitomizes the ideal investor for founders. Yun Yeyi told LatePost that they rarely interfere in company operations; meetings focus more on “life philosophy,” rooted in trust in the team.

Yan Junjie has lived through the previous AI boom’s highs and lows. “I endured a year and a half of losses, and then a run of wins after getting things right.” In a recent interview with Luo Yonghao, Yan recalled the challenges of facial recognition at SenseTime, and how overcoming immense pressure strengthened his technical confidence.

He also witnessed the industry’s struggles in the computer vision era. A founder from the AI “Four Dragons” once remarked: Yan endured the hardships of AI 1.0.

Last year, discussing large models, Liu Wei told us: Among large model founders, “super smart” is always overrated, while resilience is consistently underrated. Yet entrepreneurship is a marathon—resilience is invaluable.

Yunqi, IDG Join to Close the Angel Round

During his time at SenseTime, Yun Yeyi became acquainted with several investors, including Johns Hopkins alumnus and Yunqi managing partner Chen Yu, and IDG partner Niu Kuiguang, who had invested in SenseTime over multiple rounds.

Both quickly joined MiniMax’s angel round. Chen Yu had previously discussed technology trends with Yan and Yun. After Yan decided to launch MiniMax, a dinner in Shanghai led Chen Yu to commit on the spot: “I want to bet on a path that could disrupt existing technology. Previously, everything was small models; Yan saw the value of foundational large models early.”

Niu Kuiguang contacted Yun shortly after miHoYo and Hillhouse issued their term sheets; he called in the morning, flew to Shanghai that evening, and quickly finalized the investment after meeting Yan and the core team.

MiniMax’s angel round raised $31 million at a $200 million valuation, closely matching the team’s original plan—$30 million in funding and a $200 million post-investment valuation. MiniMax declined offers for more money and higher valuations.

MingShi: Sole New Shareholder in MiniMax’s Second Round, Most Frequent Investor

Before ChatGPT’s release, MiniMax completed two financing rounds. MingShi Capital was the only new shareholder in the second round. MingShi founding partner Huang Mingming and partner Xia Ling first met Yan in a Beijing hotel lobby, where Yan was reading papers on his iPad. He still tries to spend an hour a day reviewing new research.

Their first meeting lasted over two hours, with Yan focusing on technological changes. Xia Ling first heard of AGI from Yan and searched it live. Today, many people in similar situations would ask ChatGPT or Doubao rather than Baidu.

“Honestly, I wasn’t very sensitive to AGI at the time, but he quickly explained that GPT is an end-to-end, data-driven model.” MingShi had invested in Li Auto seven times, and since 2021, end-to-end models have driven major advances in intelligent driving.

Yan also discussed how technological shifts change business logic: previous AI companies struggled because models weren’t general enough, requiring retraining for each scenario. Large models offer “One Model for all”—serving multiple scenarios and tasks—allowing AI commercialization to break free from custom to-B and to-G development.

In early 2022, Xia Ling met Yan twice more. Not long before, at MingShi’s year-end review, Xia presented a five-year AI tech trend outlook, telling Yan that multimodal technology could remake Adobe and discussing Agency and smarter robots. Yan set down his chopsticks and shared MiniMax’s specific application directions.

Their next meeting happened on February 14. Xia wanted to confirm: Does MiniMax prefer to-C or to-B? “To-C,” Yan replied, vowing not to follow the old custom to-B route. This matched Xia’s thinking. The discussion was so engaging they barely ate, and Xia packed up squid flowers for his family instead of holiday flowers.

Like Hillhouse, MingShi valued Yan’s comprehensive experience in algorithms, engineering, and business. This was validated that year: in late 2022, MiniMax, having trained several text models, began searching nationwide for GPUs. As autonomous driving companies exited, many GPUs became available, and MiniMax was able to rent computing power at half price thanks to the large model boom.

MingShi founder Huang Mingming described Yan’s determination: “At the time, ChatGPT hadn’t launched, OpenAI was lukewarm, and Yan, who’d reached senior management at SenseTime, jumped out to start a company.” MingShi is one of MiniMax’s most frequent investors, joining six of eight rounds including the IPO cornerstone and seven pre-IPO rounds.

ChatGPT Changes Everything

Investment Boom Amid Rapid Consensus

In October 2022, MiniMax launched its first product, Glow, which quickly attracted over a million anime users in two months with minimal promotion. For a startup operating less than a year and exploring AI to-C, this was a strong start. But ChatGPT’s November release created a tidal wave, and Glow became a small ripple.

Under rapid consensus, MiniMax benefited directly, launching its third round in early 2023, raising $260 million—over three times the previous two rounds combined—and reaching a post-investment valuation of $1.157 billion. Strategic investors like Tencent, Xiaomi, and Xiaohongshu joined, along with new shareholders Shunwei and Oasis, while all previous investors continued to participate.

At the same time, MiniMax was no longer one of the few options in the market. The “hundred-model battle” began, with startups each offering unique strengths: Wang Huiwen launched Guangnian Beyond with $50 million of his own money; Wang Xiaochuan, creator of Sogou Input, founded Baichuan Intelligence; Li Kaifu started Zero One Universe. Among the new tech forces was Zhipu, founded earlier in 2019; Moonshadow, founded by Yang Zhilin, developer of XLNet and Transformer-XL, whose academic background is directly related to large language models. These companies quickly secured funding, with some investors backing multiple firms, including Alibaba, Tencent, and Shunwei.

MiniMax’s strategy was to retain more control and avoid rapid dilution. Tencent wanted to invest more in MiniMax’s third round, but ultimately MiniMax took $50 million from Tencent.

ByteDance Withdraws, Sequoia Joins

In May 2023, Wang Huiwen exited Guangnian Beyond for health reasons. Another key player in China’s large model landscape, ByteDance, made its decision.

ByteDance had already formed a large model team and considered external investment, similar to Google’s investment in Anthropic, and Tencent/Alibaba’s dual strategy of in-house R&D and investment. By June 2023, ByteDance had sent investment intentions to two large model companies: MiniMax and the newly formed StepStar.

However, after a mid-year senior management meeting, ByteDance decided not to invest externally in large model companies. Zhang Yiming’s stance: Why not build our own large model? We should do it ourselves, and we can do it well.

Meanwhile, Sequoia China led MiniMax’s A+ round, as Hillhouse’s three rounds of Super Pro-rata rights had expired.

In this round, MiniMax raised $50 million, with a post-investment valuation of $1.6 billion. Sequoia continued to invest in subsequent rounds, making this its largest investment in the large model sector to date. Before the IPO, Sequoia China held 3.81% of MiniMax, making it the third largest financial investor. Sequoia also invested in Guangnian Beyond, Moonshadow, and StepStar.

According to LatePost, Sequoia and Hillhouse negotiated their respective shares in this round down to the third decimal place.

Alibaba’s Major Investment: The Spring Festival That Changed Many Futures

During the previous AI boom, Alibaba was both a critical supporter and a subtle competitor to startups, reflecting today’s dynamic between tech giants and AI ventures.

Alibaba was on the boards of both SenseTime and Megvii. In 2017, both companies sought to acquire Uniview, a legacy hardware player in China’s security sector, by acquiring parent company Qianfang Technology. Ultimately, Alibaba acquired Qianfang for RMB 3.7 billion, bringing Uniview under its umbrella to support Alibaba Cloud’s government and enterprise expansion.

Over time, Alibaba Cloud shifted away from government and enterprise business focused on private deployments. After the large model boom, Alibaba’s sixth employee, Wu Yongming, returned in 2023 as group CEO and cloud CEO, launching a new Alibaba Cloud strategy: AI-driven, public cloud first.

Alibaba began investing widely in large model companies, which are major customers for cloud-based AI computing. In the second half of 2023, Alibaba invested in Zhipu, Baichuan Intelligence, and Zero One Universe.

By late 2023, Alibaba began engaging both MiniMax and Moonshadow.

This was a pivotal round for Moonshadow. Initially, Moonshadow sought investment from Xiaohongshu and others at a $900 million pre-investment valuation, but before Spring Festival, Alibaba stepped in, raising the valuation to $1.5 billion and investing nearly $800 million.

Early-stage companies are generally cautious about accepting such large investments due to high equity dilution. But Alibaba’s influence was immediate: the $800 million investment quickly became an AI industry headline. Combined with Kimi’s product launches and growth in early 2024, Moonshadow’s profile peaked.

Alibaba initially aimed for a 30%–40% stake in MiniMax, but ultimately invested $400 million. This was MiniMax’s fifth financing round, closed in March 2024, with a total of $654 million raised and a post-investment valuation of $2.55 billion. New investors included Matrix Partners China and China Life.

Before the IPO, Alibaba held over 13% of MiniMax, making it the largest external shareholder.

Insurance and Manufacturing Family Offices: More Institutions Back Large Models

After Alibaba’s major investment in early 2024, foundational model fundraising slowed sharply through 2024 and 2025. Tech giants like ByteDance and Alibaba ramped up comprehensive investment in AI models and products, with resources and traffic far exceeding those of startups. DeepSeek, which focuses solely on model R&D and ignores commercialization for now, is extreme, simple, and pure—pushing typical fundraising startups out of the spotlight. Only a few companies can still raise funding, and only select investors can deploy large amounts of capital.

Beyond venture capital, more types of investors became MiniMax shareholders, including China’s earliest insurance equity investor—China Life Investment; Richard Li’s PCCW; and Borui Capital, founded by CATL co-founder and vice chairman Li Ping. These investors bring fresh perspectives to the large model sector.

China Life: A Team That Inspires Confidence

“Young, determined, always smiling, and speaks calmly.” That’s the first impression Gu Yechi had of Yan Junjie. Gu leads equity investment at China Life Investment Insurance Asset Management, with a decade in regulatory work and a decade in equity investing.

As an insurer, China Life can’t afford mistakes—avoiding errors is more important than outsized returns. After meeting nearly all leading large model founders, Gu and the China Life investment team chose MiniMax, investing in two rounds in early and late 2024.

Gu meets Yan every two months. He sees Yan as “genuine, forward-thinking, deeply committed to technology, and consistent.” “In 2023, Junjie started discussing MoE (Mixture of Experts), then trained MoE models, which is now the industry’s mainstream architecture. Over a year ago, he told me large model companies should rely mainly on technology, not traffic buying, and that’s what they did. Now, this is the industry’s mainstream narrative.”

“That gives us confidence,” Gu said.

Borui Capital: Seeking Scientists Who Can Become Entrepreneurs

“If not for MiniMax, we might not have invested in large models,” Borui Capital managing partner Wang Limin told LatePost.

Borui Capital is a venture firm backed solely by CATL vice chairman Li Ping, who co-founded CATL in 2010 and now serves as vice chairman.

After ChatGPT, Borui, previously focused on advanced manufacturing and hard tech, began studying the generative AI revolution driven by large language models, but did not rush to invest.

In November 2023, Li Ping and the Borui team met Yan in Shanghai for three hours, leading to initial investment intent. Borui later joined MiniMax’s fourth round in early 2024—its first investment in software and IT.

Yan’s focus on cost control, MiniMax’s early planning for compute resources, and its batch exploration of applications and early R&D monetization felt familiar to Borui. CATL’s early days in automotive batteries followed a similar process: using bus and commercial vehicle business to form the first commercial loop, then investing those revenues into R&D to improve battery performance and drive steep cost reductions.

“Yan is clear-eyed about today’s large model startups, especially in China. There isn’t endless money to burn, nor the most advanced compute clusters. Chinese large model companies must find their own path, developing foundational models under cost and compute constraints.”

“What we learned from Robin (Zeng Yuqun) is that a top scientist also needs top business acumen to build a great company,” Wang said.

“Stay in the Wave”

Over the past three years, consensus formed rapidly and was overturned even faster: 2023 was a year of chasing the leaders, with everyone focused on GPT-4; 2024 began with Alibaba’s massive bet and ended with Doubao’s late surge; in 2025, DeepSeek open-sourced a world-class inference model at ultra-low cost, and the valuations of top global startups reached hundreds of billions of dollars—rendering the question of who will be China’s OpenAI irrelevant.

MiniMax’s survival strategy isn’t to maximize a single advantage, but to continually adjust and move toward making AI serve everyday people.

It develops large language models and pursues multimodal generation, because Yan believes that AI for ordinary users must be smart and support multimodal interaction—visual and voice. It builds both models and applications; Yan once said, “Without product adoption, even technical advances aren’t truly yours.” MiniMax serves both domestic and international markets.

Companion AI applications like Xingye/Talkie, video and voice content generation with Hailuo AI and MiniMax Voice, and open platform API business each contribute roughly 30% of MiniMax’s revenue—a balanced 1:1:1 ratio.

In technical areas directly overseen by Yan, he’s willing to take risks. In the second half of 2023, MiniMax devoted nearly all R&D resources to building MoE models, failing twice; in 2024, it put 80% of resources into a new model using linear attention architecture, which became the M1 released in early 2025. He consistently bets on the most promising technical directions at the time.

Exploring commercialization and focusing technical development are two sides of the same coin for MiniMax. As the name suggests, amid great uncertainty, it seeks the smallest probability of success with limited resources.

In early 2025, Yan said he hopes to always stay in the wave: “First, to help keep the wave going; second, to ensure the company keeps moving forward.”

So, stay in the wave.

Statement:

- This article is reproduced from [LatePost], copyright belongs to the original author [Cheng Manqi]. If you have any concerns about this reprint, please contact the Gate Learn team, and we will promptly address it according to our procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Unless Gate is credited, copying, distributing, or plagiarizing the translated article is strictly prohibited.

Related Articles

Arweave: Capturing Market Opportunity with AO Computer

The Upcoming AO Token: Potentially the Ultimate Solution for On-Chain AI Agents

What is AIXBT by Virtuals? All You Need to Know About AIXBT

AI Agents in DeFi: Redefining Crypto as We Know It

Understanding Sentient AGI: The Community-built Open AGI