Memecoin's social media buzz continues to rise as traders return to risk assets.

Meme coins fell 65% in 2025 as traders became more risk-averse, but these tokens are now rebounding as sentiment improves across the crypto market.

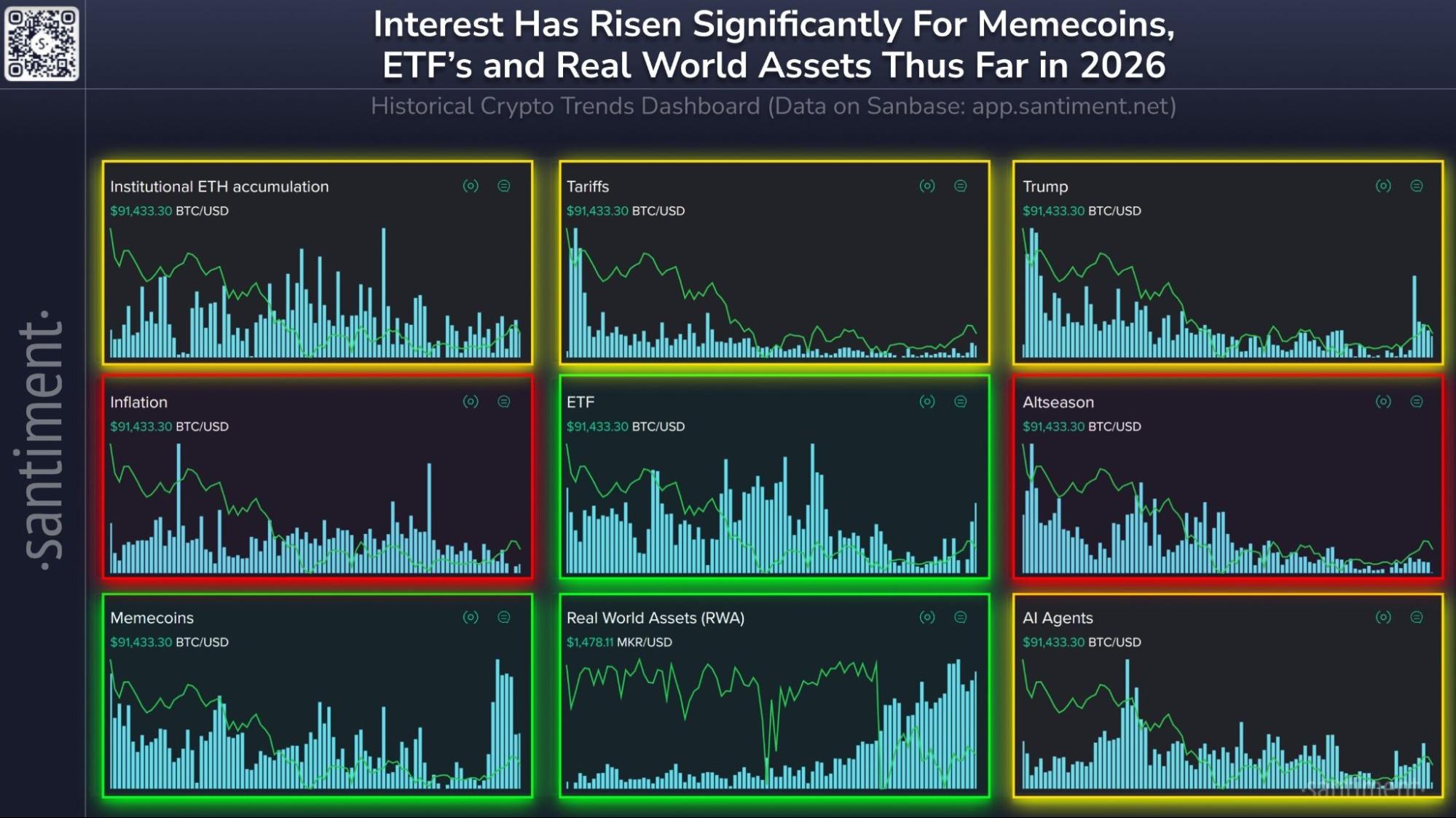

Since the start of the year, MEME coins have seen a sharp rise in social media buzz, which has coincided with a recovery in market capitalization. Analysts suggest this trend could signal a renewed appetite for risk in the crypto sector.

Many MEME coins have posted strong gains recently. A wave of speculative activity has pushed the total market cap for MEME coins higher, drawing increased attention from traders and boosting overall interest. Market intelligence platform Santiment reported these developments on Wednesday.

Vincent Liu, Chief Investment Officer at market maker Kronos Research, told Cointelegraph that traders are moving back into assets with deep liquidity and strong reflexivity.

He explained, “MEME coins offer tight narratives, strong social collaboration, and immediate asymmetric upside, which make them a natural choice for renewed risk-taking when market sentiment turns positive.”

Social conversations about meme coins among traders have surged recently. Source: Santiment

“MEME coins typically lead the rally when risk appetite returns. The Fear & Greed Index has bounced from extreme fear to neutral, further confirming the shift. If mainstream coin volumes also pick up, the rally could broaden; otherwise, MEME coin trading may remain a short-lived sentiment play.”

Meme Sector Market Cap Rebounds

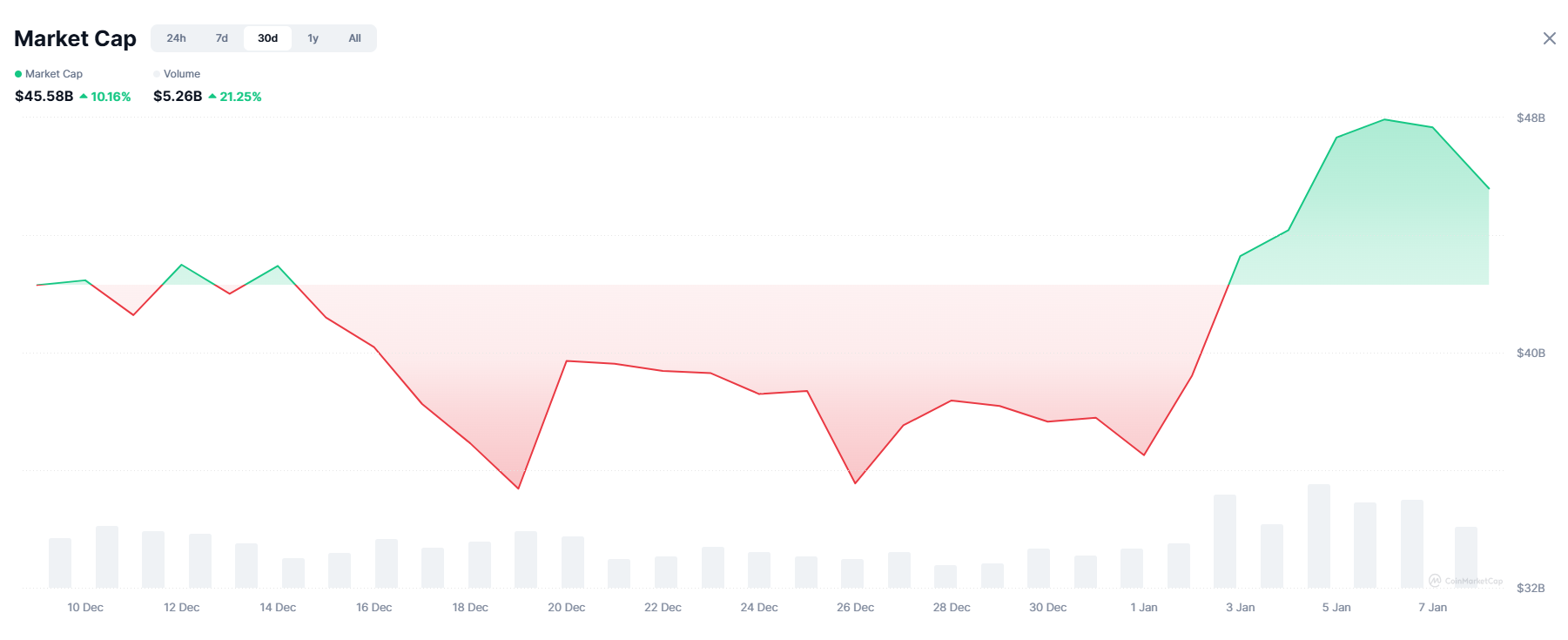

Meme coins dropped more than 65% overall in 2025, with market cap hitting a yearly low of $35 billion on December 19 as traders sought safer investments and reduced risk exposure.

Now, meme coin market cap has recovered, breaking above $47.7 billion on Monday—up from $38 billion on December 29, according to CoinMarketCap. As of Thursday, market cap hovered near $45 billion.

Trading volume for meme coins has also surged, climbing from $2.17 billion on December 29 to $8.7 billion on Monday—a 300% increase—before easing back to around $5.22 billion on Thursday.

Over the past 30 days, meme sector market cap and trading volume have both soared. Source: CoinMarketCap

Liu noted that the rebound is mainly driven by portfolio shifts and renewed retail participation, not fundamental repricing. If social media momentum and liquidity persist, this momentum could continue in the near term.

However, he cautioned, “Meme coin markets are highly reflexive, and a slowdown in capital flows could trigger sharp corrections at any time.”

Meme Coins Serve as a Risk Appetite Barometer

Pav Hundal, Chief Analyst at Australian crypto exchange Swyftx, told Cointelegraph that MEME coins are among the most direct barometers of risk appetite in the crypto market.

He said, “The next few days will show whether this rally is a short-term burst of sentiment or the beginning of renewed risk-taking in the market.”

“When altcoins rally while Bitcoin trades sideways, it signals that capital is moving further out on the risk curve. Historically, this divergence means speculation is outpacing mainstream benchmarks, often leading to significant corrections and serving as a warning for unchecked bullish trading.”

Crypto data aggregator CoinGecko shows that Bitcoin (BTC) traded between $90,697 and $92,847 in the past 24 hours.

Reversal Risks Still Loom Over Market Sentiment

Risk appetite among traders seems to be recovering, but both Liu and Hundal warn that this rally carries short-term risks.

Liu stated, “Macro conditions remain the biggest risk factor. Any escalation in geopolitical tensions or policy shocks—including U.S. action against Venezuela or broader emerging market turmoil—could quickly reverse risk sentiment, even if crypto assets show short-term momentum.”

Hundal observed that while macro conditions have improved since late last year, “in my view, this looks more like enthusiasm running ahead of fundamentals.”

Statement:

- This article is republished from [Cointelegraph] and copyright belongs to the original author [Stephen Katte]. If you have any concerns about this republication, please contact the Gate Learn team for prompt handling according to established procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team. Unless Gate is explicitly referenced, translated articles may not be copied, distributed, or plagiarized.

Related Articles

Top 10 Meme Coin Trading Platforms

Review of the Top Ten Meme Bots

What's Behind Solana's Biggest Meme Launch Platform Pump.fun?

Introduction to Raydium

What is Dogwifhat? All You Need to Know About WIF