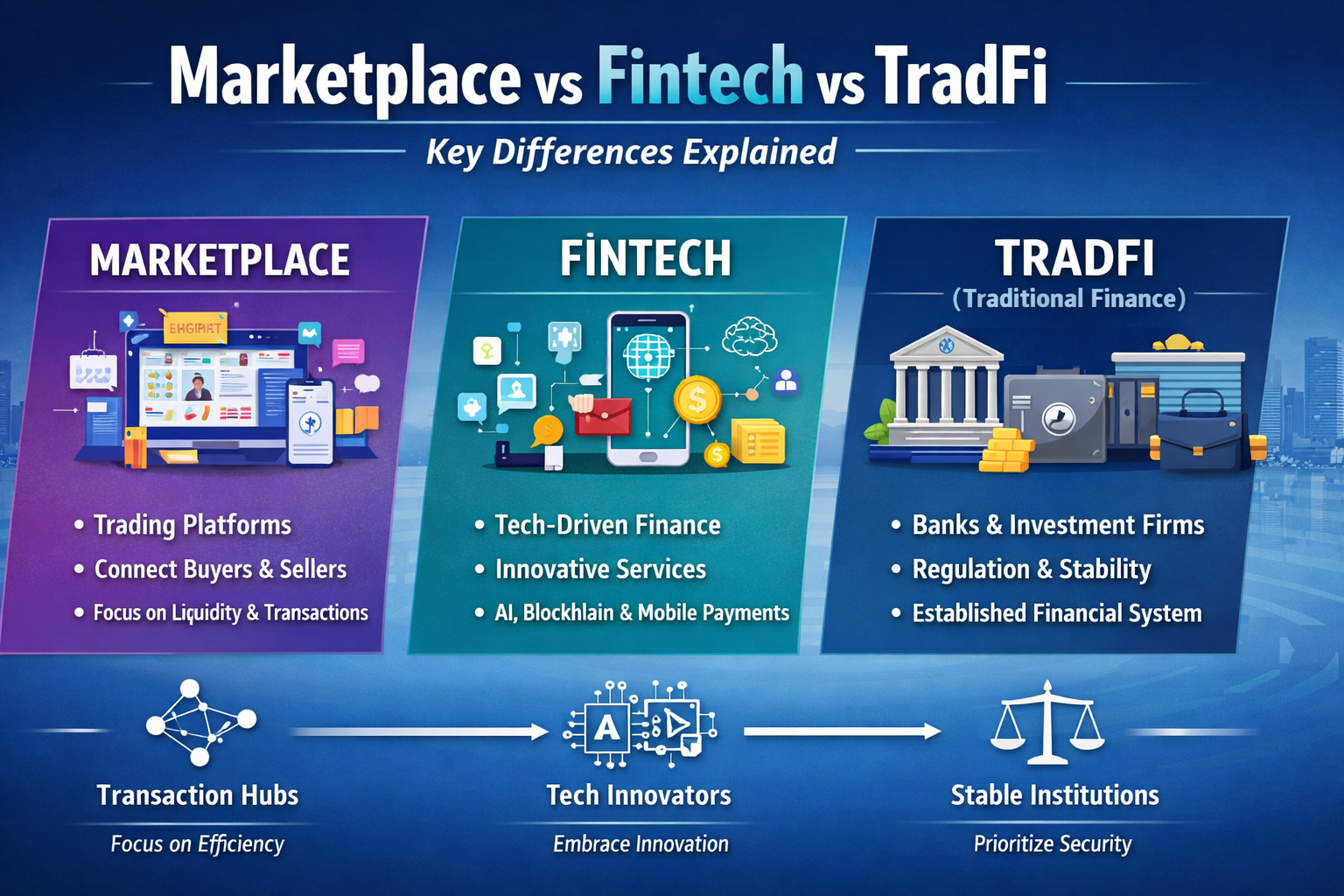

Marketplace vs Fintech vs TradFi | A Detailed Comparison of Three Financial Systems

1. Definition and Role of the Marketplace

In financial transactions and business services, a marketplace is a venue or platform that connects participants and facilitates transactions. Whether it’s a stock exchange, e-commerce platform, P2P lending platform, or digital asset market, these entities share a key trait: they do not create financial products themselves but instead provide the environment where trading occurs.

The marketplace delivers core value by:

- Reducing information asymmetry

- Boosting supply-demand matching efficiency

- Shortening transaction times

- Enabling price discovery

- Increasing market transparency

In essence, a marketplace functions like a highway, allowing both sides to transact faster and at lower cost.

2. How Fintech Reshapes Financial Services

Fintech, or financial technology, is not a single product—it’s an entire industry ecosystem driving financial innovation through technology. The focus is on leveraging:

- Artificial Intelligence

- Big Data

- Mobile Internet

- Blockchain

- Cloud Computing

to improve the efficiency of traditional finance.

Fintech aims to:

- Reduce payment and cross-border transfer costs

- Accelerate lending and enhance risk management accuracy

- Optimize user experience

- Enable younger users to manage funds more flexibly

- Deliver innovative services in insurance, wealth management, and credit

In this way, fintech is the technological transformer of financial services, fundamentally making finance cheaper, faster, and smarter.

3. Core Strengths and Limitations of TradFi

TradFi, or Traditional Finance, refers to the established financial system—banks, securities firms, insurance companies, and similar institutions.

Its core attributes include:

- Strict regulatory oversight

- Comprehensive legal liability

- Mature risk controls

- High security and low default rates

- Ability to allocate large-scale capital

However, TradFi also has clear drawbacks:

- Slow decision-making processes

- Lengthy technology upgrade cycles

- Limited motivation for innovation

- High costs for certain services

TradFi is a stability-oriented system, but it lacks flexibility.

4. Key Differences Among Marketplace, Fintech, and TradFi

While all three are part of the financial services and trading ecosystem, their roles are fundamentally distinct:

● Marketplace answers “Where do transactions occur?”

It provides venues and liquidity, but users—not the platform—are the principal parties to transactions.

● Fintech addresses “How can transaction and service efficiency be improved?”

It focuses on how technology transforms lending, payments, investment, and security.

● TradFi addresses “How is system security and legal operation ensured?”

It serves as the foundational infrastructure of the financial system, responsible for risk management and regulatory compliance.

Further distinctions include:

- Roles: Marketplace is the connector; Fintech is the innovator; TradFi is the regulator and capital provider.

- Objectives: Marketplace seeks liquidity; Fintech seeks efficiency; TradFi seeks stability.

- User experience: Fintech typically offers the best experience, while TradFi is the most regulated but also the most cumbersome.

- Technology reliance: Highest in Fintech, followed by Marketplace, and lowest in TradFi.

- Expansion speed: Fintech usually expands fastest, Marketplace follows, and TradFi is the slowest.

To put it another way: if the financial ecosystem were a city, Marketplace would be the commercial district, Fintech the technology companies, and TradFi the government and infrastructure.

5. Latest Industry Trends for 2026

By 2026, these sectors are converging at a rapid pace:

(1) AI-driven risk management becomes the market standard: Fintech companies deploy AI models for risk monitoring and credit assessment, far outpacing traditional banks, and marketplaces are adopting these tools as well.

(2) Open finance and cross-platform data integration: More countries are advancing open banking and open finance initiatives, enabling user-authorized data sharing among marketplaces, fintechs, and banks.

(3) Embedded finance takes off: Marketplaces are integrating financial functions directly, offering services like loans, installment plans, and insurance on their platforms.

(4) TradFi accelerates digital transformation: Major banks are launching mobile products similar to those of fintech firms and partnering with marketplaces to reach younger demographics.

Industry boundaries are blurring, but important differences remain.

6. Impact on Users and Businesses

For individual users, these changes bring:

- Faster payments and lower transaction fees

- More diverse borrowing options

- Broader investment choices

- More personalized financial services

For businesses:

- Marketplaces create more traffic and customer touchpoints

- Fintech provides tools to cut costs and boost efficiency

- TradFi delivers large-scale capital, risk management, and credit backing

Ultimately, what matters most for businesses is not choosing one model, but integrating the strengths of all three.

7. Conclusion: The Three Will Coexist, Not Replace Each Other

Marketplace, Fintech, and TradFi each have clear distinctions. However, the future is not about one replacing the others, but about complementarity and integration:

- Marketplaces expand use cases

- Fintech delivers technological empowerment

- TradFi provides stable support

Understanding the differences between marketplace, fintech, and tradfi is key to making informed decisions in the financial and business landscape of 2026.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About