Italy Inflation Rate Inches Higher: Latest Data Analysis and Economic Impact

Overview of Italy’s Latest Inflation Rate Data

Source: https://www.tradingview.com/news/te_news:515140:0-italian-inflation-rate-inches-higher/

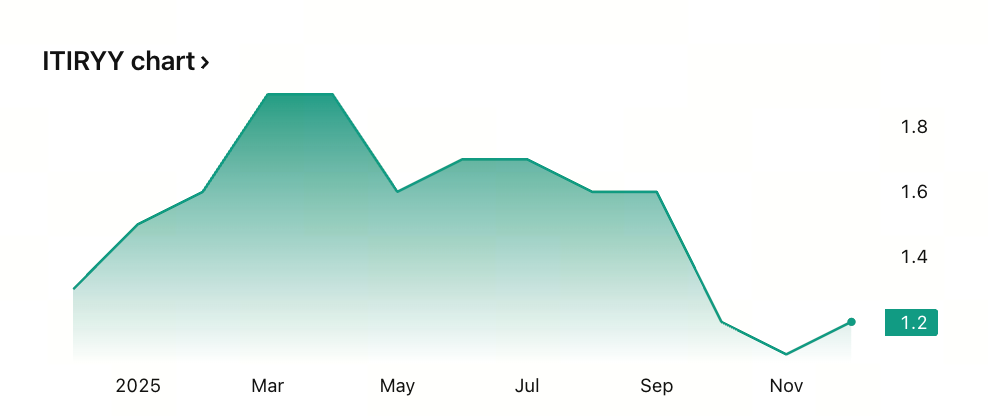

The latest figures from Italy’s National Institute of Statistics (Istat) show that as of year-end 2025, Italy’s Consumer Price Index (CPI) has increased by approximately 1.2% year-over-year. This is a slight uptick from November’s 1.1% and is marginally above previous market expectations. Media commonly describe this trend as “Italy Inflation Rate Inches Higher.”

While this rise is modest, it warrants attention in the context of a persistently sluggish economy. The data indicates a gradual recovery in price levels, which could increase pressure on both household spending and business operations.

Key Drivers of Price Increases

Breaking down the data, several categories have seen price increases:

- Transportation service prices climbed about 2.6%, a noticeable rise from the previous month, reflecting a rebound in fuel costs and transportation demand.

- Food prices—including both fresh and processed items—also rose, up approximately 2.3% to 2.6%.

- However, regulated energy product prices fell further, dropping around –5.3%, which helped offset some upward pressure on the overall CPI.

This data suggests that higher prices for consumer goods and services are the main contributors to the inflation uptick, while continued weakness in energy prices has limited the overall increase.

Energy vs. Core Inflation Trends

Beyond headline CPI, core inflation—which excludes energy and food—also edged higher, rising from 1.7% to 1.8%. This points to intensifying underlying price pressures.

Core inflation typically offers a clearer view of domestic demand and price trends. Its increase signals that prices for less volatile goods and services are broadly rising, consistent with a tightening price environment overall.

Impact of Inflation on Consumers and Retail

Despite price increases, the latest data shows Italy’s retail sales rose 0.5% month-over-month and 1.3% year-over-year in November, indicating consumer spending is still expanding to some degree.

However, it’s important to note the retail growth figures have not been adjusted for inflation. As a result, the rise in nominal sales may primarily reflect higher prices, while actual consumption volumes likely saw only minimal growth or even stagnation.

For Italian consumers, this means:

- Household purchasing power remains limited

- The trend toward reduced real spending may become more pronounced in the future

- Businesses may adjust inventory or promotional strategies as consumer demand slows

Outlook and Policy Direction

Current data and market forecasts indicate Italy’s inflation rate remains low, with a slight gap compared to the broader Eurozone. According to the latest projections, Italy’s CPI is expected to stay within a moderate range in 2026. However, future trends remain uncertain due to global energy price volatility, supply chain disruptions, and evolving domestic consumption habits.

From a policy perspective, the Bank of Italy and the European Central Bank (ECB) are closely monitoring whether price pressures will spill over into wages and core service prices to guide interest rate and fiscal policy decisions. The central bank is likely to maintain an accommodative or neutral stance to support economic growth rather than move aggressively to curb inflation.

In summary, the slight rise in Italy’s inflation rate reflects a gradual return of underlying demand pressures. Overall inflation remains under control. For both consumers and businesses, understanding the structural drivers of price changes will support more informed budgeting and operational planning.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Gate Alpha Launches Points System: Trade On-Chain, Earn Points, Unlock Airdrops

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?