How TradFi Is Evolving: Tokenization, RWAs, and Crypto Integration

Traditional finance (TradFi) is undergoing a structural transformation.

Rather than being replaced, the global financial system is evolving as blockchain infrastructure, asset tokenization, and real-world assets (RWAs) introduce new ways to issue, settle, and manage traditional financial instruments.

This evolution is driven by long-standing inefficiencies in traditional financial infrastructure. Slow settlement cycles, high operational costs, limited trading hours, and heavy reliance on intermediaries have become increasingly misaligned with a digital, global, and always-on economy. Tokenization and on-chain settlement offer a practical path to address these constraints without dismantling existing regulatory frameworks.

At the center of this transition is the tokenization of real-world assets (RWAs). By representing equities, bonds, commodities, and other traditional assets on blockchain networks, TradFi is shifting toward a hybrid model that combines regulatory structure with programmable, on-chain infrastructure. This shift is redefining liquidity, access, and capital efficiency across financial markets.

This article explains how TradFi is evolving, why tokenization and RWAs matter, and how crypto-native infrastructure is being integrated into traditional financial systems. It examines the implications for investors as traditional finance and crypto continue to converge.

A Brief History of Traditional Finance

Traditional Finance (TradFi) refers to the global financial system built around banks, stock exchanges, asset management institutions, and regulatory frameworks. For centuries, it has served as the backbone of capital allocation, trade settlement, and risk management across global markets.

Despite its long operational history and asset scale reaching hundreds of trillions of dollars, the TradFi system has remained largely dependent on centralized intermediaries and legacy infrastructure. This historical structure has ensured stability and compliance, but it has also introduced inefficiencies that are increasingly visible in a digital-first economy.

Why TradFi Is Entering a New Era

TradFi is now entering a new phase of evolution driven by technological and structural pressure rather than ideological change.

As financial activity becomes more digital and global, long-standing issues such as low transaction efficiency, high operational costs, and restricted trading hours have become harder to ignore. These limitations are particularly evident in cross-border settlement, where transactions can take days to complete and incur significant fees. This mismatch between modern financial demand and legacy infrastructure is a key reason TradFi is undergoing structural reconstruction.

Tokenization and the Rise of RWAs

At the center of this transformation is RWA tokenization, which brings real-world assets such as equities, bonds, real estate, and commodities onto blockchain networks in a compliant, programmable format.

Tokenization allows traditional assets such as stocks, bonds, real estate, commodities, and artworks to be digitally represented on the blockchain. By converting ownership and economic rights into on-chain tokens, RWAs can be divided into smaller units, lowering investment thresholds and expanding access to assets that were previously limited to institutions or high-net-worth individuals. This process is redefining how traditional assets are issued, traded, and managed.

How Blockchain Is Reshaping TradFi Infrastructure

Asset tokenization refers to the creation of a digital representation of physical or financial assets on the blockchain, encoding ownership rights, income rights, and key attributes into tradable digital tokens. This mechanism forms the technical foundation for bringing TradFi assets on-chain and developing RWAs. By enabling on-chain settlement and programmable ownership, blockchain is increasingly viewed as next-generation financial market infrastructure rather than a parallel or experimental system.

At its core, tokenization maps legal ownership and economic value to blockchain-based tokens. The first step is defining the asset being tokenized, commonly including real estate, equities, bonds, commodities, artworks, and other high-value assets.

The second step is selecting the appropriate token standard. Fungible and divisible assets typically use standards such as ERC-20, while unique assets like artworks or collectibles are better suited to non-fungible token standards such as ERC-721 or ERC-1155. Depending on regulatory requirements and application scenarios, issuers then choose between public blockchains, consortium chains, or private chains as the issuance and circulation infrastructure.

This tokenization framework delivers multidimensional change. Partial ownership lowers investment thresholds, while on-chain issuance enables more frequent secondary market trading, improving liquidity. Traditionally illiquid assets such as private equity, venture capital, and real estate can also enter more open trading environments through tokenization.

From TradFi to On-Chain Finance

Real World Asset (RWA) tokenization is widely regarded as one of the most scalable growth areas in the convergence of blockchain and traditional finance. Multiple research institutions estimate that as equities, bonds, real estate, and commodities move on-chain, the long-term market size of RWA tokenization could reach the scale of hundreds of trillions of dollars.

From a current development perspective, the RWA market has entered a phase of tangible growth. As of December 2023, total value locked (TVL) related to RWAs within the DeFi ecosystem stood at approximately USD 5 billion and continues to expand. This indicates that RWA tokenization has moved beyond proof-of-concept and into real-world implementation.

RWA tokenization spans a wide range of asset types, including cash and stablecoins, precious metals and commodities, equities and bonds, credit assets, real estate, artworks, and even intellectual property. Tokenization enables these assets to be issued, traded, and settled on blockchain networks in digital token form.

This transition illustrates a broader pattern of TradFi crypto integration, where traditional assets retain regulatory structure while adopting blockchain-based issuance, settlement, and distribution models. Supported by blockchain infrastructure, assets that were once illiquid and difficult to access can achieve higher trading frequency and broader participation through secondary markets.

What TradFi Evolution Means for Investors

For investors, understanding how TradFi is evolving is no longer optional, as tokenized assets and blockchain-based settlement are beginning to influence liquidity, access, and portfolio construction across markets.

The most direct change is the significant reduction in investment barriers. Through tokenization and fractional ownership, retail investors can now access asset classes that were previously reserved for institutions or high-net-worth individuals, such as real estate, private assets, or high-value commodities.

Blockchain infrastructure also enables investors to construct diversified, global portfolios more efficiently, spanning tokenized equities, real estate, commodities, and other RWAs, without relying on complex intermediaries or geographic constraints.

However, regulatory uncertainty remains a critical consideration. In the United States, the Securities and Exchange Commission (SEC) has clarified that tokenized securities remain subject to existing federal securities laws and do not receive exemptions simply because they are issued on-chain.

Additionally, investors must account for technical risks, including smart contract vulnerabilities, cross-chain bridge security issues, and oracle reliability. Understanding these factors and implementing appropriate risk management strategies is essential for participating in this emerging financial system.

The Future of TradFi and Crypto Integration

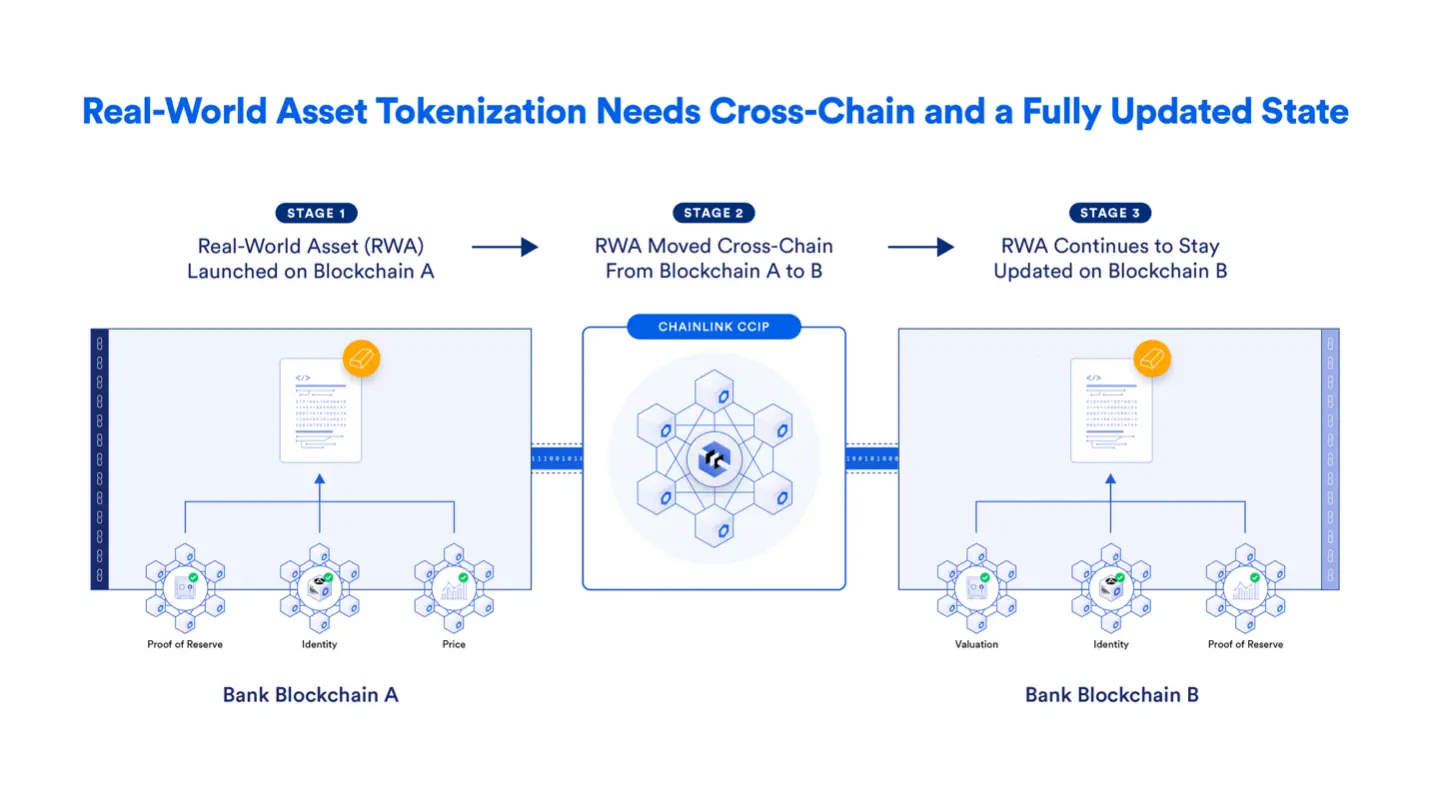

The integration of TradFi and crypto is progressing along a clear technological path. Early-stage solutions relied on cross-chain bridges to connect traditional assets with blockchain networks. While these bridges enabled initial experimentation, they also introduced security and scalability challenges.

As the industry matures, cross-chain interoperability protocols such as Chainlink’s Cross-Chain Interoperability Protocol (CCIP) are emerging as more secure and standardized solutions. These frameworks allow RWA tokens to be issued and transferred across multiple blockchain ecosystems while reducing systemic risk.

At a higher level, native integration represents a deeper convergence between TradFi and blockchain. In this model, financial institutions build core functions such as clearing, settlement, and asset management directly on decentralized or hybrid infrastructures, fundamentally reshaping financial systems from the ground up.

Major institutions including Swift, DTCC, and ANZ are already exploring this direction, working with blockchain middleware to connect existing capital market systems with multi-chain environments.

Conclusion

TradFi is not being replaced, but restructured. The evolution of TradFi is not about replacing traditional finance, but about integrating crypto-native infrastructure in ways that improve efficiency, access, and global interoperability.

Driven by blockchain technology and RWA tokenization, traditional finance is evolving toward a more efficient, accessible, and globally connected system. This transformation preserves the stability of existing financial institutions while unlocking new models for asset issuance, trading, and settlement. As TradFi and crypto continue to converge, platforms like Gate offer investors a practical pathway into this emerging financial architecture, one that reflects the demands of the digital era while remaining grounded in regulatory and market reality.

Further Reading

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Bitcoin's Future & TradFi (3,3)

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?