How the EMA Indicator Influences Crypto Market Trends: Latest Technical Analysis and BTC/ETH Price Interpretation

What Is the EMA Indicator?

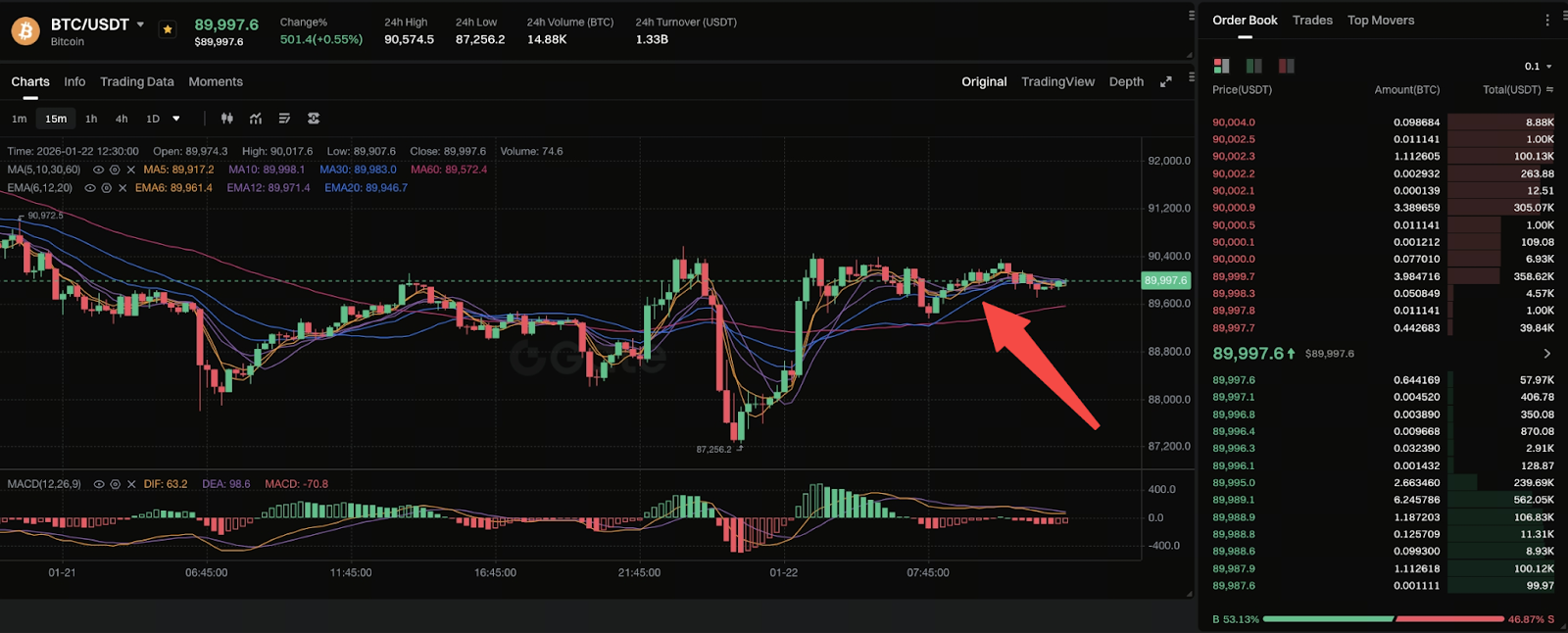

Source: https://www.gate.com/trade/BTC_USDT

The Exponential Moving Average (EMA) is a widely used trend-following indicator in crypto technical analysis. By assigning greater weight to recent price data, the EMA responds more quickly to new market developments than the Simple Moving Average (SMA), making it a more sensitive tool for detecting trend changes. Traders use EMA to identify trend direction, determine support and resistance levels, and confirm trading signals. Its calculation emphasizes recent price movements, which makes EMA particularly well-suited for the volatile nature of crypto markets.

In practice, traders often track multiple EMA timeframes—such as EMA 21, 50, 99, and 200—to assess the relationship between short-term and long-term trends. When a short-term EMA crosses above a long-term EMA, it’s typically seen as a bullish signal. Conversely, a short-term EMA crossing below a long-term EMA may indicate a bearish trend.

The Role of EMA in Crypto Technical Analysis

In the crypto market, EMA is more than a line on a chart—it’s a crucial tool that reflects the collective actions of market participants. Recent analysis highlights EMA as a dynamic support and resistance level watched by thousands of traders. During bull markets, EMA can serve as a support for upward movement, while in bear markets it often acts as resistance.

The main advantage of EMA is its ability to react quickly to recent price changes, which is especially important in crypto markets. During periods of rapid price movement, EMA can signal potential trend reversals earlier, offering practical value for short-term traders seeking optimal entry and exit points.

Moreover, combining EMA with other indicators like MACD and RSI helps filter out noise from single indicator signals and improves the reliability of trading signals. EMA is also a direct component of momentum indicators such as MACD, making it a vital part of any technical analysis framework.

BTC and ETH: Latest Price Trends and EMA Relationships

Recent data indicates that Bitcoin has shown several important EMA-related signals from a technical standpoint. For instance, BTC’s price recently broke above the 200-day EMA, which the market interprets as a sign that it may be emerging from previous bear market pressure—often considered an initial confirmation of a long-term trend reversal.

Other market reports reveal that BTC has tested multiple EMA support and resistance levels during recent price swings. The roles of the 100-day EMA and 50-day EMA as support and resistance for BTC have been especially prominent, making these EMA levels key technical reference points for traders.

For Ethereum (ETH), technical analysis shows its price has repeatedly stayed above major EMAs, forming structural support and suggesting a healthy pullback range. This indicates that ETH may continue an upward trend with EMA support.

Overall, the relationship between BTC, ETH, and major EMA lines not only reflects changes in market momentum but also frequently serves as a critical basis for traders to adjust their positions.

How Can EMA Improve Your Trading Strategy?

If you’re looking to use EMA in your trading, consider these approaches:

- Multi-timeframe EMA analysis: Track crossover relationships between short-term (e.g., EMA 21/50) and long-term (EMA 99/200) EMAs to identify signals of trend reversal or continuation.

- Combine with trend confirmation indicators: Use RSI and MACD to filter out potential noise and strengthen the reliability of trend signals.

- Support and resistance confirmation: When price repeatedly tests near an EMA, treat the EMA as a dynamic support or resistance level for risk management.

- Quantitative risk management: Integrate EMA signals into your stop-loss or target settings to enhance trading discipline and risk control.

Using these methods, EMA becomes not just a trend indicator but a core component of trading strategies, enabling more structured and systematic market analysis.

Risk Warnings and Practical Advice

While EMA is highly valuable in technical analysis, keep these considerations in mind during real-world trading:

- EMA is not a catch-all indicator: Markets often experience consolidation periods, where EMA signals may generate significant noise.

- Incorporate fundamental dynamics: Changes in regulatory policy and macroeconomic data can also have a major impact on crypto prices.

- Prioritize risk management: Never rely solely on EMA for trading decisions. Always combine it with position management and stop-loss strategies.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About