How Gate’s Precious Metals Perpetual Futures Enhance the Platform’s Trading Ecosystem Amid Strong Gold and Silver Performance

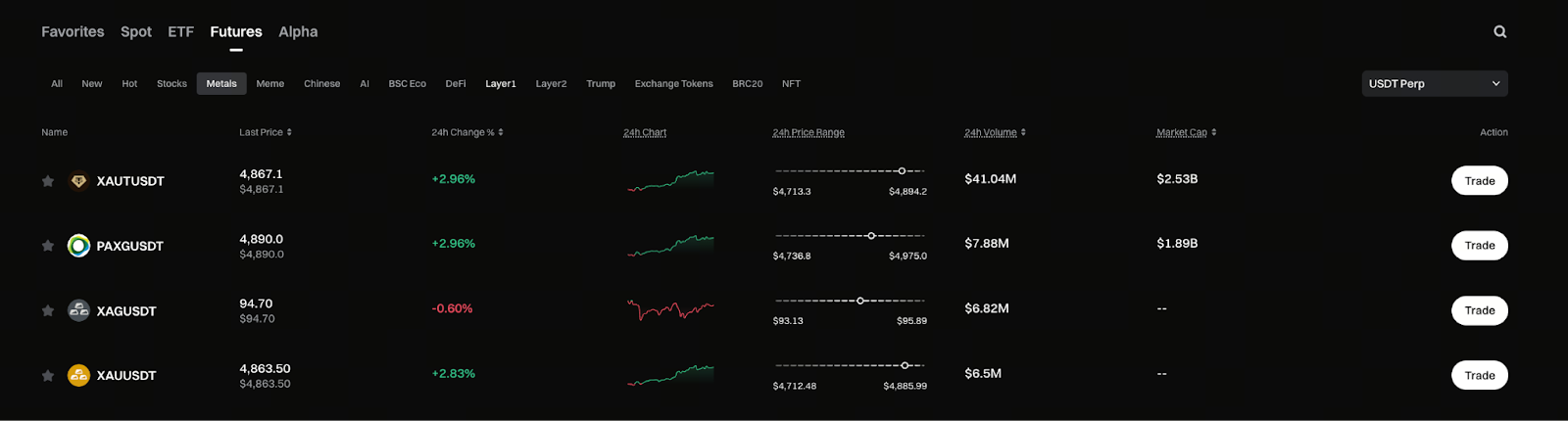

Image: https://www.gate.com/price/futures/category-metals/usdt

I. Why Gate Is Incorporating Precious Metals into Its Derivatives Ecosystem

As a derivatives-focused trading platform, Gate’s core strength lies in its broad multi-asset coverage and comprehensive trading toolchain. As the crypto market matures, single digital assets can no longer satisfy users’ needs for risk diversification and diverse strategies.

Gold and silver, as traditional safe-haven assets, naturally command high attention, strong macro attributes, and stable trading demand. Bringing them into the derivatives ecosystem marks a significant step for Gate in expanding trading boundaries and enhancing the platform’s asset diversity.

II. Precious Metals Hit New Highs as User Demand Shifts Toward Trading

When gold and silver trade in prolonged consolidation ranges, market demand is primarily allocation-driven. But as prices reach new highs, user focus shifts from “should I hold” to “how do I trade.” At this stage, users require:

- Trading mechanisms for instant market entry and exit

- Tools supporting both long and short positions

- A liquid environment for rapid position adjustments

Gate’s perpetual contracts for precious metals are designed to meet these needs.

III. Gate’s Positioning of Precious Metals Perpetual Contracts on the Platform

From a structural perspective, the precious metals section is not a standalone product but an integral part of Gate’s derivatives product line.

Its positioning is threefold:

- A bridge asset connecting TradFi and crypto

- A hedging tool to reduce portfolio volatility

- Additional low-correlation assets for derivatives users

With a unified contract interface and trading logic, Gate enables users to trade precious metals without extra learning costs.

IV. How Gate’s Approach Differs from Traditional Precious Metals Trading

Traditional gold and silver trading typically faces restricted trading hours and fragmented workflows. Gate has reimagined the precious metals trading experience with perpetual contracts:

- 24/7 trading: Not affected by holidays or market closures

- USDT settlement: Eliminates the complexities of foreign currency settlement and physical delivery

- Unified risk management: Leverages Gate’s extensive experience in the derivatives market

This shift transforms precious metals from “static assets” into “dynamically managed trading instruments.”

V. What the Precious Metals Section Means for Gate Users

For existing Gate users, precious metals perpetual contracts serve as a supplement—not a replacement.

- For derivatives traders: A new class of non-crypto native volatile assets

- For long-term holders: A tool to hedge systemic market risk

- For strategy-driven users: An asset for cross-asset portfolio allocation

During periods when gold and silver hit new highs, this supplementary value becomes especially significant.

VI. Gate’s TradFi Strategy Begins with Precious Metals

The launch of the precious metals section reflects Gate’s clear TradFi strategy: first introduce traditional assets with broad consensus and strong demand, then gradually expand tradable categories. This approach is not a short-term experiment but part of Gate’s long-term plan to build a comprehensive trading platform. For users, the cost of multi-asset trading and risk management on Gate will continue to decline.

Conclusion

Whether gold and silver continue to rise depends on the macro environment;

What’s certain is that Gate now provides a clear, accessible entry point for precious metals trading.

As the market experiences both strength and volatility, the launch of Gate’s precious metals perpetual contracts makes the platform’s trading ecosystem more complete and gives users more opportunities for active asset management.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About