He Built 15 Products to Test Human Nature — Now He’s Elon Musk’s Head of Product

On June 30, 2025, X appointed a young new head of product: Nikita Bier, age 36. Before joining Musk’s team, Bier had already developed several viral social apps and sold them to tech giants for tens of millions of dollars.

Since acquiring Twitter, Musk has been relentless in his pursuit to transform it into a super app—one that integrates social networking, payments, investing, and banking. Yet this road is littered with failures; countless tech giants have had similar dreams, and none have succeeded.

Given this context, Nikita Bier’s arrival is especially significant.

In his first six months, Bier collaborated with the algorithm team to revamp the recommendation page, increasing the proportion of content from friends, mutual followers, and fans. He shifted X’s content distribution model, putting users’ social connections back at the center of content delivery.

Recently, Bier announced the upcoming launch of the Smart Cashtags feature, which will allow users to mention stock or cryptocurrency symbols in posts. X will automatically display real-time prices, percentage changes, and related discussions. This upgrade transforms X from a simple social platform into a real-time financial information hub. Users no longer need to leave X to check stock prices or switch between multiple apps—everything is available in one interface.

On January 16, he also revised X’s developer API policy, banning InfoFi-type apps that reward users for posting and revoking their API access. At the same time, he pushed for upgrades to X’s creator incentive program.

These reforms may seem scattered, but they all serve a core objective: to transform X from a social platform into a vast ecosystem that fuses social interaction, influence, and finance.

The Birth of the Dopamine Dealer

In 2012, Nikita Bier was still a student at UC Berkeley. That year, he developed an app called Politify, aiming to use data and logic to influence US politics.

Politify’s main feature was a tax calculator: users entered their income and family status, and the app calculated how each candidate’s tax policy would affect them. Bier believed that if voters could clearly see their economic interests, they would make more rational choices.

This idea saw huge success during the 2012 election. Despite having zero marketing budget, Politify attracted 4 million users and topped the App Store download charts. At the time, Bier believed that information asymmetry in voter decisions was the root of social problems—and that his product could solve it.

But reality hit hard. Bier discovered that even after downloading Politify and seeing their own economic interests, users didn’t change their voting choices. A blue-collar worker earning $30,000 a year might still vote for a candidate with less favorable tax policies, simply because of cultural identity.

This made Bier realize that data and logic can’t beat emotional resonance. From 2012 to 2017, Bier entered a period of intense trial and error. According to Startup Archive, after Politify, he and his team developed over a dozen apps, each exploring human nature from a different angle, but none succeeded—either they couldn’t attract users or couldn’t retain them.

Yet every failure deepened Bier’s understanding of human nature. He began to realize that humanity’s most basic desire isn’t rationality, knowledge, or efficiency—it’s to be seen, recognized, and praised.

By 2017, they had completed their fifteenth product: tbh (To Be Honest).

This was an anonymous social app where users could vote anonymously for friends on questions like “most likely to become president,” “most likely to become a millionaire,” or “most likely to save the world.” All questions were positive, and all feedback was praise.

Within two months, tbh attracted 5 million users, with daily active users peaking at 2.5 million. It started at a high school in Georgia and quickly went viral among US high school students. In October 2017, Facebook acquired tbh for just under $30 million.

tbh’s success marked Bier’s shift from trying to persuade users with data to motivating them with emotion. He stopped trying to solve social problems and instead leveraged human weaknesses to create addictive products. The serious entrepreneur disappeared, replaced by a masterful dopamine dealer.

Musk’s Choice

In October 2017, Nikita Bier and his team joined Facebook as product managers.

Inside Facebook, Bier shared tbh’s growth strategy with colleagues. According to internal Facebook documents obtained by BuzzFeed News in August 2018, Bier’s team described in detail how they leveraged Instagram’s mechanics for rapid growth.

The core strategy tapped into teenagers’ curiosity and herd mentality. Bier’s team created private Instagram accounts, followed every student at a target high school, and wrote a teaser in the account bio such as, “You’ve been invited to a mysterious app—stay tuned!”

Students, curious, would request to follow the account. Bier’s team would wait 24 hours to collect all requests, then set the account public at 4 p.m. after school, adding the App Store link to the bio.

Instagram would notify all students that their follow requests were accepted. Seeing the notification, students would visit the account, find the download link, and download the app.

This unorthodox tactic showed Bier’s keen grasp of human nature. If you want users to act, you don’t need to persuade them—you just need to create an emotional trigger they can’t resist.

Less than a year after the acquisition, Facebook shut down tbh due to “low usage.” But Bier chose to stay at Facebook as a product manager.

During this time, Bier gained deep insight into the workings and internal politics of large social platforms. He saw how Facebook used algorithmic recommendations to spark controversy, data analysis to predict user behavior, and product design to extend user engagement.

The most important lesson he learned at Facebook was that social platforms aren’t designed to connect people—they’re designed to generate emotional swings. The bigger the emotional swings, the longer users stay, and the higher the ad revenue.

In 2021, Bier left Facebook to join Lightspeed Venture Partners as a product growth partner. In 2022, he and his original team launched Gas, an upgraded version of tbh. Gas added voting, gamification, and paid features, allowing users to pay to see who praised them.

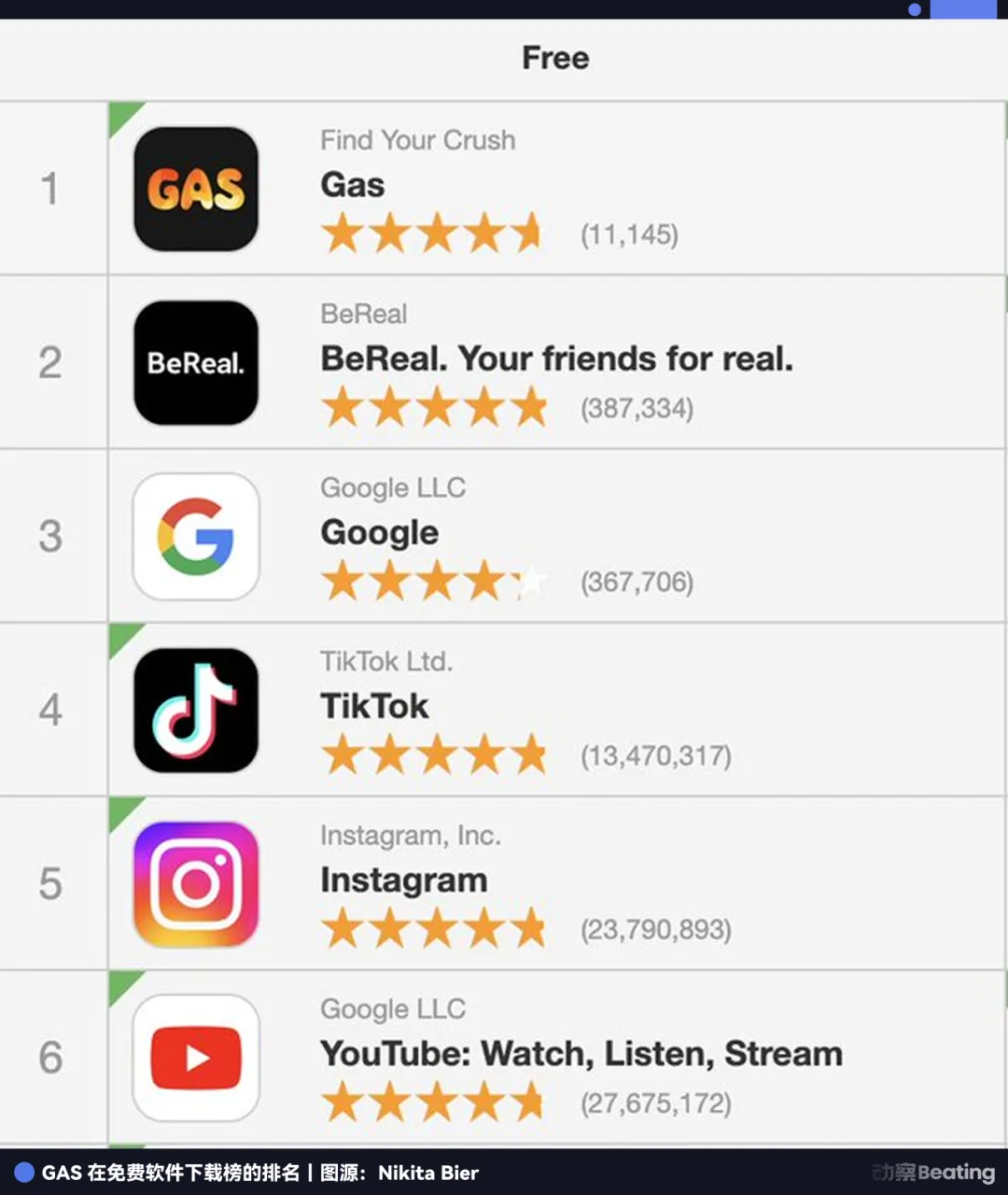

In three months, Gas attracted 10 million users and generated $11 million in revenue, at one point surpassing TikTok and Meta to become the most popular app in the US. In January 2023, Discord acquired Gas for $50 million.

Gas’s success confirmed another of Bier’s key insights: the human desire for praise can be monetized. If you create an environment where users crave visibility and recognition, and then set a paywall at the key moment, users will pay without hesitation.

This is exactly the insight Musk needed.

In October 2022, Musk spent $44 billion to acquire Twitter and rebranded it as X. In his vision, X would become the ultimate closed loop of social and finance. But to realize this dream, Musk had to solve a critical challenge: how to dissolve users’ psychological boundaries so they would naturally conduct financial transactions while engaging in social activity.

At its core, this is a question of human nature. What kind of motivation will get users to overcome the psychological barrier to trading, investing, or saving on a social platform?

Bier’s connection with Musk began with a bold self-recommendation. When Musk announced the Twitter acquisition, Bier tweeted: “@elonmusk Hire me to run Twitter as VP of Product.” The tweet received no response at first, but Bier didn’t give up.

Over the next three years, he continued posting on X, sharing deep insights on product growth, user psychology, and social networks. His tweets gradually gained significant influence, drawing Musk’s attention to his deep understanding of products and human nature.

So, by June 2025, when X needed a product leader to integrate social and finance, Musk thought of Bier. When Bier announced his new role, he wrote: “I’ve officially posted my way to the top,” and replied to his 2022 tweet: “Never give up.”

This story is the best illustration of Bier’s “influence as currency” philosophy.

Before joining X, Bier also served as an advisor to the Solana Foundation, leading its mobile strategy. During this time, he saw firsthand how cryptocurrency can achieve viral growth through social channels and realized that influence itself had become a tradable, priceable financial asset.

Musk chose Bier because, in Musk’s first-principles thinking, the essence of finance isn’t technology—it’s trust and emotion. You need to know how to leverage emotion.

And Bier is an expert in this area.

Everything he’s done at X is, at its core, the ultimate manipulation of emotional leverage. Take his reforms to X’s creator incentive program. Bier knows that to keep generating high-quality content, a platform must address creators’ core anxieties.

So, publicly, he upgraded X’s creator incentives, ensuring creators receive more money each cycle. Behind the scenes, he actively manipulates algorithms to create star influencers.

In January 2026, renowned US creator Dan Koe published a long-form post on X titled “How to Fix Your Entire Life in a Day.” Within a week, it reached 150 million views and 260,000 likes, becoming the most-read long-form post in X’s history.

This is Bier’s playbook. By pushing a single in-depth post to massive exposure, Bier sent a clear signal to all creators—especially those hesitant to publish in-depth content on X: if your content is good enough, X’s algorithm will help you spread it.

This is a more sophisticated strategy than direct cash incentives. It addresses creators’ fear that their content will vanish into the void. Dan Koe’s case helps them believe that on X, deep thinking and high-quality content can be discovered and amplified by the platform.

This strategy is consistent with the psychological techniques Bier used in tbh and Gas. He understands that creators crave visibility and recognition. By setting a benchmark for exposure, Bier precisely ignited the enthusiasm of the creator community, attracting more quality content and creating a virtuous ecosystem.

Gen Z’s Wealth Anxiety

Bier’s ability to tap into human nature allows him to consistently hit the pain points of his target audience. In finance, Bier faces a generation repeatedly battered by financial anxiety.

In October 2024, BuzzFeed published an article titled “This Woman Reveals How She Copes with Financial Anxiety in Her 20s.” The subject was 27-year-old Hayley, who lives in northern Colorado and works as a receptionist at an animal clinic for $17 an hour.

She can only get 33 hours of work per week. Her fixed monthly expenses include: $600 for rent, $400 for a car loan, $150 for car insurance, $50 for electricity, $70 for her phone, $100 for student loans, and a $50 minimum credit card payment, totaling $1,420. Although she sets aside $50 from each paycheck for spending money, it’s usually gone quickly.

Hayley says, “Every expense comes with guilt. I always feel like I should be saving that money. Until I fill this financial black hole, I can’t get the fundamental sense of security I need to feel at ease. Maslow’s hierarchy of needs is so true. I hate this society—it forces you to survive but takes away your ability to actually live.”

Hayley’s story is a snapshot of an entire generation.

According to a Bank of America survey in July 2025, 72% of young people have changed their lifestyles due to rising living costs, 33% of Gen Z feel significant financial pressure, and more than half blame economic instability.

EY research also highlights that financial issues are the main source of anxiety for Gen Z. An Arta Finance report from 2024 shows that financial stress has even caused 38% of Gen Z and 36% of millennials to experience a midlife crisis early.

This anxiety has become the fuel for X’s financial expansion.

After joining X, Nikita Bier quickly launched the series of product adjustments mentioned at the start of this article. But Bier’s real ambition isn’t just to make X a financial information platform—he wants to make X a financial transaction platform.

According to a Financial Times report in November 2025, X is developing in-app trading and investment features, allowing users to buy stocks and cryptocurrencies directly on X. CEO Linda Yaccarino revealed that Visa will be the first partner for XMoney accounts. By December 2025, X Payments had obtained money transmitter licenses in 38 US states, covering about 75% of the US population.

On X, every like, comment, and repost is an expression of user emotion. Bier’s job is to turn this emotional data into financial signals. If a user frequently likes posts about a particular stock, X can infer their interest and push a buy link at the right moment.

If a user often comments on cryptocurrency posts, X can infer they’re a potential crypto investor and push related investment products.

This is emotion-driven financial service. It doesn’t require users to search, fill out complicated forms, or go through tedious verification. It simply captures emotional swings and presents a simple trading entry point at the peak of emotion.

In an interview, Bier said, “Consumers don’t choose a product because of a functional gap, but because of the emotional resonance they feel when using it.”

Likewise, X’s financialization isn’t about providing better financial services, but about capturing users’ emotions and converting them into transactions at emotional highs.

This model is especially effective with Gen Z. According to a CFA Institute research report, 31% of Gen Z started investing before age 18, 54% get investment information from social media, and 44% hold cryptocurrency, with crypto making up an average of 20% of their portfolios.

For this generation, social media isn’t just an information channel—it’s where they make investment decisions. They don’t trust traditional financial institutions or Wall Street analysts; they trust social media KOLs, their own emotions, and intuition. X amplifies these emotions and instincts.

The Curse of the Super App

But before Musk and Bier, countless giants tried to build super apps—and failed.

As a former mobile phone giant, BlackBerry and its BlackBerry Messenger (BBM) came close to becoming a super app. Executives once ambitiously planned to layer payments and services atop social, aiming to build a digital empire for that era.

But reality was harsh. A series of missteps caused BlackBerry to lose ground in the competition. By 2013, its once 20% market share had shrunk to less than 1%. The grand imperial dream ended in failure.

BlackBerry’s failure wasn’t unique. Amazon’s attempt also failed. In 2014, the Fire Phone was launched with Bezos’s vision to unite e-commerce and social, but it quickly collapsed. The attempt cost Amazon a $170 million write-down and became one of Bezos’s biggest business blunders.

Looking back, we can identify three reasons why super apps don’t work in the West.

First is highly specialized user habits. Western users prefer dedicated, standalone apps. A small business owner may use Shopify for transactions, QuickBooks for accounting, and Slack for collaboration. To them, an all-in-one solution usually means mediocrity—super apps can’t match the depth of these niche leaders.

Second is strict regulatory barriers and privacy red lines. Super apps are about data dominance, but privacy protection is a regulatory minefield in the West. Consolidating massive data on a single platform creates social risks and drives compliance costs and leakage risks exponentially higher.

Finally, the market is already dominated by entrenched giants. There are no vacuums in mature markets—Google, Amazon, and Apple already control users’ digital lives. New super apps not only face functional competition but must also overcome entrenched brand loyalty.

So, can X succeed where others failed?

X has clear advantages: 550 million active users, and Musk has enough money and political capital to address regulatory challenges. Most importantly, X doesn’t have to start from scratch—it can gradually add financial features on top of its existing foundation.

This incremental approach saves users the hassle. There’s no need to download a new app or learn a new interface—just tap one more button in a familiar environment, and social and finance are connected.

But X faces serious resistance. US users are already used to Venmo for transfers and Robinhood for trading stocks and crypto. These specialized apps work well—why switch to X?

This is the challenge Nikita Bier must tackle. His strategy is to weave financial transactions into users’ daily social activity. He’s not asking people to “do business” on X; he’s making it easy to buy a stock or crypto while scrolling your feed. This seamless experience is the key to whether X can succeed.

But this seamless experience brings new issues. When social and financial functions merge, users’ emotional swings are directly converted into financial transactions. Will this model fuel irrational market booms? Will it cause users to make poor investment decisions at emotional highs? Will it invite regulatory scrutiny?

There is no answer to these questions yet.

Emotional Alchemy

Over the past decade, we’ve witnessed social media shift from “connecting people” to “generating emotion.” The attention economy has moved from “content is king” to “emotion is king.” Wealth distribution has shifted from “capital is king” to “influence is king.”

Nikita Bier’s career is a microcosm of this transformation. He went from an entrepreneur trying to change the world with rationality to a dopamine dealer exploiting emotion to capture users.

This transformation is the inevitable result of our era. In an age of information overload and scarce attention, reason gives way to emotion, logic to intuition, and the long-term to the short-term. Whoever can generate emotion wins attention; whoever wins attention gains influence; whoever gains influence acquires wealth.

This is a new era—an era driven by emotion, where influence equals wealth.

In this era, we are all products of Nikita Bier. Our likes, comments, and reposts are captured by algorithms, analyzed by data, and amplified by emotion. Our attention, emotions, and influence are all being converted into liquidity, wealth, and power.

In this era, emotion is both the most powerful weapon and the most dangerous poison.

Statement:

- This article is republished from [动察Beating]. Copyright belongs to the original author [Sleepy.txt]. If you have concerns about this republication, please contact the Gate Learn team, who will handle it promptly according to the relevant procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Unless Gate is mentioned, do not copy, distribute, or plagiarize the translated article.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?