Gate GTETH: Redefining Ethereum Staking for a Fast-Moving Market

The Market Has Evolved, but Staking Remains Stuck in the Past

Since Ethereum’s transition to PoS, staking has theoretically become one of the most natural ways for ETH holders to participate. Yet in practice, the proportion of capital committed to long-term staking has never matched its technical maturity. The issue isn’t that users disregard potential returns, but rather that the market’s pace has fundamentally shifted. In today’s crypto environment—characterized by rapid rotations and frequent strategy changes—any mechanism requiring a waiting period is seen as a drag on capital efficiency. This has created a widening gap between traditional staking and the current market dynamics.

The Real Cost: Loss of Flexibility

For most traders, the primary pressure of staking isn’t the yield, but the loss of control over their funds. In practice, ETH staking typically faces these restrictions:

- Unlock periods lack flexibility, making it hard to react to market shifts

- Reward accumulation and distribution processes are not intuitive

- Assets are passively locked, preventing instant reallocation

These features make staking more of a long-term commitment than a flexible asset management tool—prompting many liquidity-focused users to remain on the sidelines.

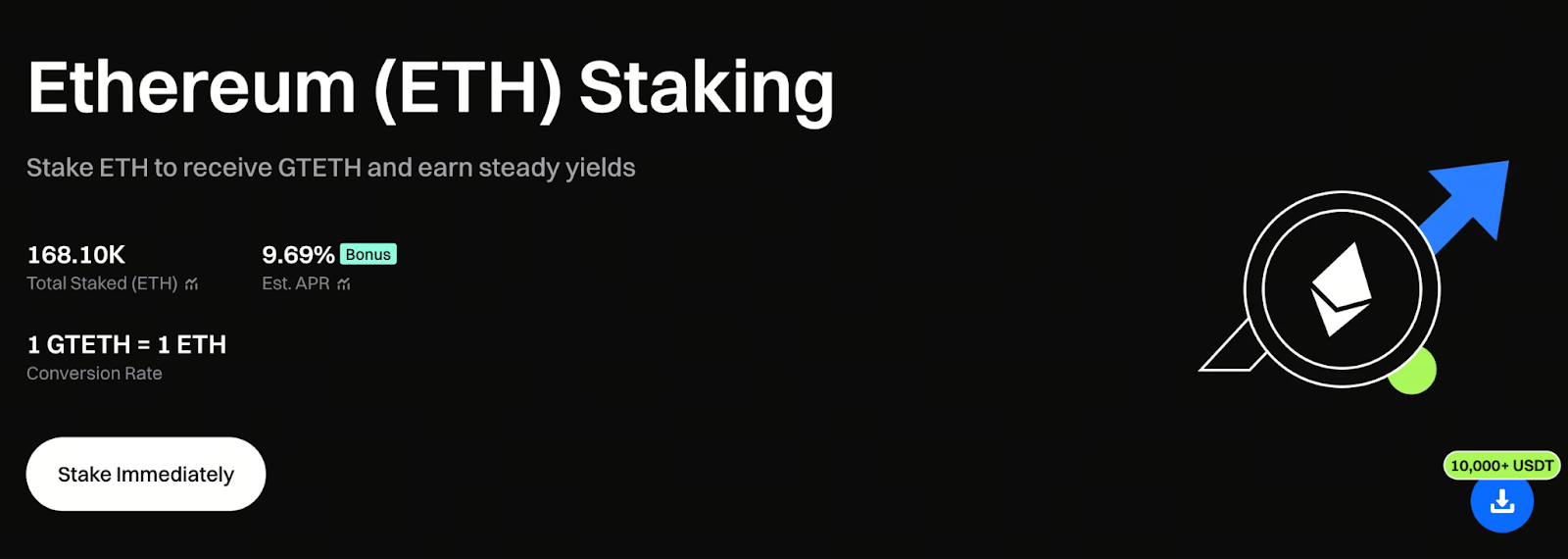

GTETH: Turning Staking into an Asset Class

GTETH doesn’t aim to educate users on PoS intricacies; instead, it reimagines how assets are used. For holders, the process is reduced to a single choice: whether to convert ETH into GTETH.

After conversion, node operations, reward calculation, and distribution are managed by the system. Staking shifts from a series of actions requiring oversight into an asset that can be held, traded, and allocated—seamlessly integrating with everyday capital management.

Rewards: From Manual Claims to Automatic Accumulation

Unlike models that require manual reward claims, GTETH uses a value-embedded rewards design. Base returns from Ethereum PoS, along with additional GT incentives provided by Gate, are reflected in GTETH’s value over time. Users need not take any action—simply hold GTETH and its corresponding ETH value grows as rewards accrue. All reward sources remain transparently verifiable on-chain, ensuring a clear structure and traceable outcomes.

Liquidity: The New Default

GTETH’s biggest departure from traditional staking is its elimination of the tradeoff between returns and liquidity. Holders can convert GTETH back to ETH at any time or freely trade it in the market—no fixed unlock periods required. In this model, rewards and liquidity coexist within a single asset, enabling ETH staking to finally match the speed of modern market operations.

From Passive Earnings to Strategic Allocation

With liquidity constraints removed, GTETH’s role evolves. It’s no longer just an alternative to staking—it’s an ETH allocation unit that fits into broader strategy management. Whether reducing exposure during market volatility or quickly reallocating funds for new opportunities, GTETH allows for dynamic adjustments while preserving staking returns, ensuring staking remains integrated within the investment portfolio.

Transparent Returns, Quantifiable Long-Term Efficiency

GTETH rewards come from two stable sources:

- Ethereum PoS staking returns: approximately 2.69% annualized

- Additional GT incentives from Gate: approximately 7% annualized

All accrued rewards are reflected in the final ETH redemption in a single transaction, making the process straightforward and the efficiency measurable.

Join Gate ETH staking now and start your on-chain mining journey: https://www.gate.com/staking/ETH?ch=ann46659

VIP Level Sets the Compound Return Potential

GTETH’s fee structure is tied to Gate VIP levels. The base fee rate is 6%, with tiered discounts:

- VIP 5–7: 20% fee discount

- VIP 8–11: 40% fee discount

- VIP 12–14: 60% fee discount

While differences per transaction may be modest, over time and with compounding, fees become a major factor influencing final returns.

How GTETH Differs from Mainstream LSTs

Most liquid staking tokens are still just certificates mapping locked positions, with limited use cases and flexibility. GTETH, however, functions as a daily asset management tool—its value changes naturally with returns and allows unrestricted market access. This design makes staking a dynamic ETH management strategy that can adjust in sync with trading strategies, rather than a static allocation.

Conclusion

GTETH’s core value isn’t in technical packaging, but in redefining staking’s role in your portfolio. It preserves the stable return potential of PoS while removing the capital constraints of lockups, enabling ETH staking to operate in step with market rhythms. Now that PoS is the norm for Ethereum, staking no longer needs to be a rigid long-term commitment—it can be a flexible, liquid, and yield-generating configuration that meets the demands of modern Web3 asset management.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About