GTBTC: An Alternative Way to Earn Up to 10% Annual Yield on BTC Within the Gate Ecosystem

The Evolving Logic of BTC as an Asset

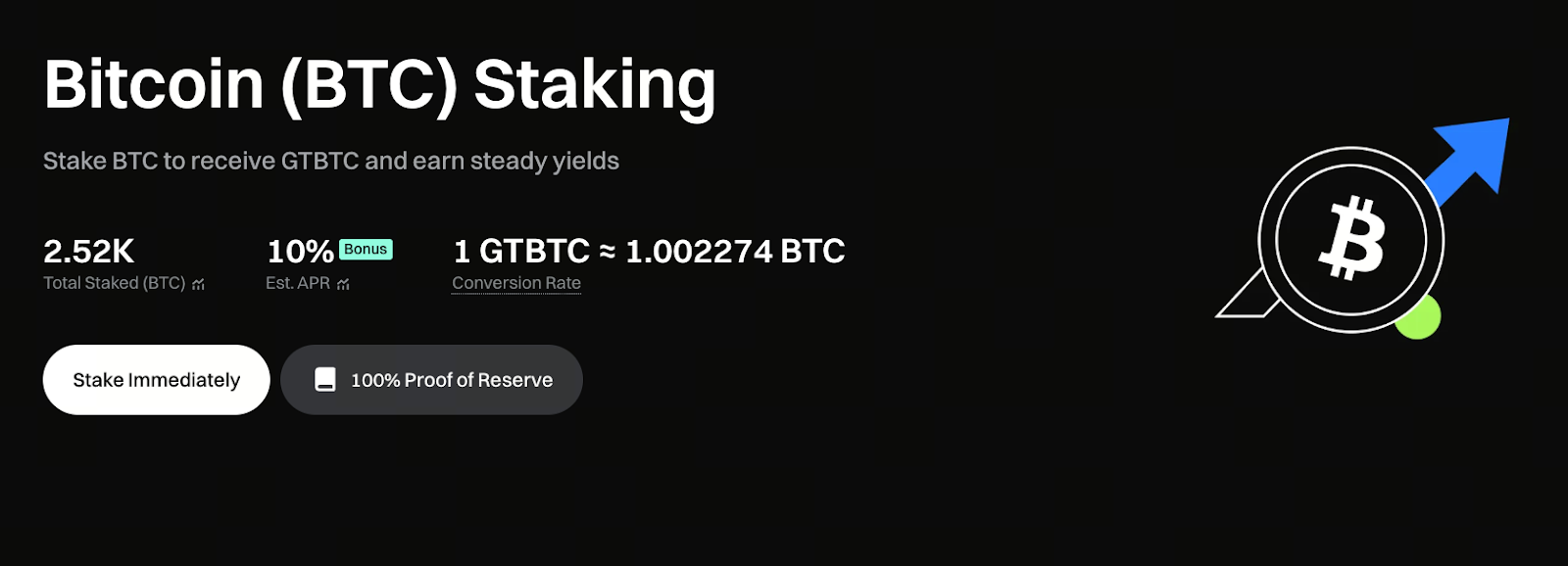

Image source: https://www.gate.com/staking/BTC

Initially, BTC was widely regarded as a single asset with relentless upward momentum, with its value driven mainly by price volatility. As the market has expanded and the profile of participants has shifted, the strategy of holding BTC purely for price appreciation no longer satisfies the full spectrum of user needs.

In an environment marked by frequent market swings and corrections, maximizing BTC’s operational efficiency has become a central concern for asset managers.

GTBTC: Purpose and Genesis

GTBTC is Gate’s response to this changing landscape—a BTC yield solution designed for today’s market. Rather than serving as a BTC replacement, GTBTC is a standardized token that encapsulates the results of BTC staking and yield strategies within the Gate ecosystem.

By staking BTC through Gate’s on-chain Earn program, users receive GTBTC, which represents both their BTC principal and the yield they accrue.

How GTBTC Reflects a 10% Annualized Yield

Currently, BTC staking offers a reference annualized yield of about 10%. This yield is not paid out as daily interest. Instead, GTBTC employs a net asset value accumulation model, where returns are continuously integrated into the asset’s value.

This structure enables users to hold their assets without frequent transactions and removes the need for repeated reinvestment, aligning with the habits of long-term BTC holders.

How GTBTC Changes BTC Holding Strategies

Prior to GTBTC, BTC was typically held passively—stored and left to appreciate. With GTBTC, BTC evolves from a simple store of value to a yield-generating allocation asset.

This shift does not alter the underlying risk profile. Instead, it allows previously idle assets to generate additional value while maintaining the same risk parameters.

A Pragmatic View of GTBTC’s Yield Potential

It’s important to recognize that GTBTC’s reference annualized yield is not guaranteed; actual returns fluctuate based on market conditions and participation levels. GTBTC is best suited for long-term portfolio allocation, rather than for short-term yield generation.

For users aiming to boost BTC holding efficiency without engaging in high-frequency trading or leverage, GTBTC delivers a balanced and practical solution.

Conclusion

As the crypto market matures, asset value is increasingly defined by more than just price. GTBTC embodies a BTC usage model focused on asset management.

When BTC is actively utilized to accumulate value throughout the holding period, its role in portfolios fundamentally evolves.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About