Gold Price Surges Over 2% to a New All-Time High: What It Means for Global Markets

Latest Gold Market Data Overview

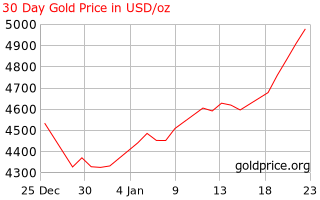

Chart: https://goldprice.org/

Gold prices have recently surged, outpacing other major assets. The latest market data shows that spot gold has soared, breaking above the $5,000 per ounce mark for the first time—a jump of more than 2% from previous levels—driving precious metals prices to record highs.

This rally highlights robust demand for safe-haven assets, particularly amid escalating geopolitical tensions and mounting macroeconomic uncertainty. Trading volumes for gold have risen sharply in major markets such as the US and Europe, with other precious metals like silver and platinum also climbing.

Key Drivers Behind Gold’s Rise

- Escalating Geopolitical Risks

Global conditions remain highly uncertain, with factors such as Middle East tensions and trade disputes between Europe and the US. These conflicts and uncertainties are prompting capital flows into gold, widely regarded as a safe haven. - Federal Reserve Policy Expectations

With inflation remaining persistent, expectations are growing that the Federal Reserve may ease monetary policy. This could weaken the dollar’s appeal and make non-yielding assets like gold more attractive. - Heightened Capital Market Volatility

Frequent fluctuations in global equity and bond markets have increased gold’s appeal as a hedge. When risk appetite wanes, investors tend to hold gold to hedge against market uncertainty.

Global Macroeconomic Impact on Gold

Gold prices are shaped not by a single market, but by the global macroeconomic environment as a whole:

- US Dollar Movements: A weakening US Dollar Index typically lifts gold prices, as dollar-denominated gold becomes cheaper and demand increases.

- Inflation and Monetary Policy: Expectations of rate cuts by major central banks drive down bond yields, making non-interest-bearing gold more appealing.

- Economic Growth Outlook: When economic data disappoints and growth slows, returns from traditional assets decline and capital shifts toward gold and other safe havens.

Together, these macroeconomic factors provide the foundation for gold’s long-term upward trend.

Risks and Opportunities Investors Should Monitor

Risks:

- Market Volatility: Despite the recent rally, gold prices could see sharp corrections following major economic data releases or a rebound in risk appetite.

- Monetary Policy Shifts: If major central banks tighten policy sooner than expected or the dollar strengthens, gold’s rally may lose momentum.

Opportunities:

- Long-Term Safe-Haven Allocation: Allocating a portion of assets to gold may help reduce overall portfolio risk, especially as global economic uncertainty rises.

- Short-Term Trading Strategies: After strong breakouts above key technical levels, traders can look for pullbacks and technical support areas to pursue short-term trades.

Future Gold Price Outlook and Strategies

Financial institutions generally remain optimistic about gold’s medium- and long-term outlook. Some analysts believe that, amid ongoing safe-haven demand and macro uncertainty, gold has room to rise further.

Investors can tailor their strategies to their risk tolerance, for example:

- Long-Term Holding: Suitable for reducing overall portfolio volatility

- Staggered Entry: Gradually building positions during pullbacks to lower average cost

- Monitoring Policy Signals: Keeping a close eye on central bank meetings and economic data releases

Conclusion

Gold prices have climbed more than 2% recently, repeatedly setting new highs amid a complex macroeconomic backdrop and intensifying global risks. As a key safe-haven asset, gold is once again attracting investors in a climate of heightened global economic uncertainty. Whether for long-term allocation or short-term trading, understanding the core drivers behind gold’s rally is crucial for investors.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Gate Alpha Launches Points System: Trade On-Chain, Earn Points, Unlock Airdrops

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?