Gold Breaks Above $4,600 as Safe-Haven Demand Surges

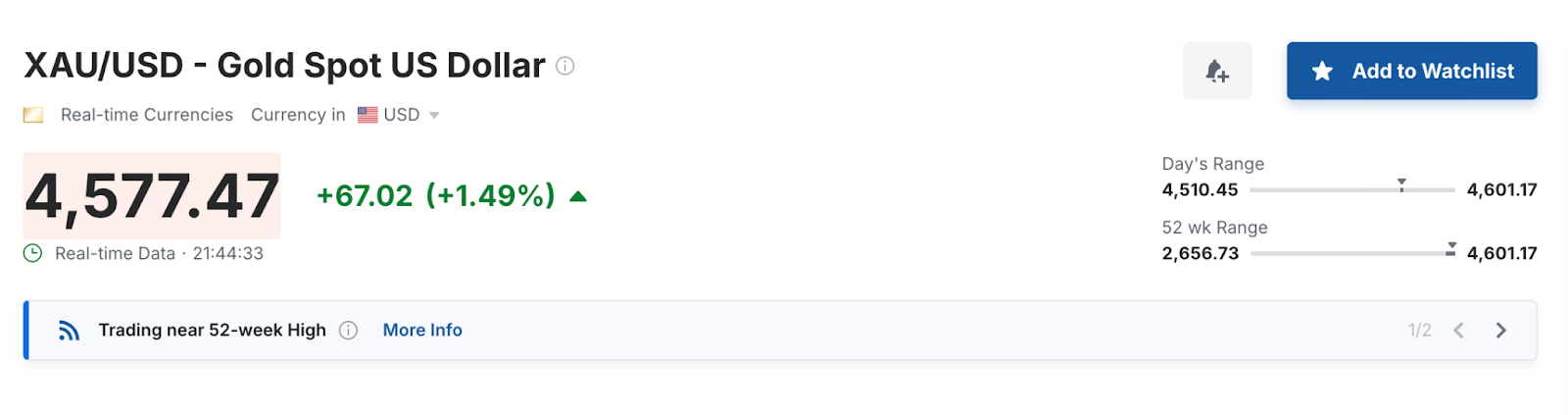

Gold Price Sets All-Time High

(Source: Investing)

Market data indicates that spot gold broke the $4,600 threshold for the first time on January 12, capturing significant market attention. Since the beginning of the year, gold prices have climbed by roughly $280, highlighting robust bullish momentum.

Safe-Haven Demand Emerges as Primary Driver

Multiple traders report that rising global uncertainty has heightened risk awareness, prompting capital flows toward assets with safe-haven properties. Gold, a classic safe-haven asset, has naturally become a leading choice for portfolio allocation.

U.S. Rate Cut Expectations Intensify

Beyond geopolitical factors, shifts in U.S. economic data are also shaping market direction. Last week’s disappointing employment report has fueled expectations that the Federal Reserve will pivot to a more accommodative policy. Most analysts now anticipate at least two rate cuts from the Fed this year, providing further support for gold prices.

Gold’s Advantage in a Low-Rate Environment

When interest rates decline and economic prospects remain uncertain, non-yielding assets like gold tend to become more appealing. Historically, gold has shown relative strength whenever markets face both low interest rates and elevated uncertainty.

To explore more about Web3, click to register: https://www.gate.com/

Conclusion

In summary, geopolitical tensions, weakening economic indicators, and heightened expectations for rate cuts have combined to drive gold prices sharply higher early in the year. As risk aversion continues to build, gold’s future performance will remain closely linked to shifts in the global macroeconomic landscape.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About