Gate Ventures Weekly Crypto Recap (February 2, 2026)

TL;DR

- Kevin Warsh was nominated as the Federal Reserve Chair candidate, shocking the market due to his previous hawkish stance and unique policy approach.

- This week’s incoming data includes US job and employment data, ISM Manufacturing and Services PMI and UoM sentiment.

- BTC fell 8.7%, ETH dropped 19.4%. BTC ETFs saw -$1.49B net outflows (2nd largest on record), while ETH ETFs recorded -$326.9M.

- MicroStrategy’s BTC cost ($76,037) is underwater. On ETH, Bitmine ($3,849) and Trend Research ($3,180) face pressure, with Trend’s Aave liquidation near $1,880.

- HYPE standout with 45.8% WoW, driven by HIP-3 activity and commodity trading hype. trade.xyz hit $4.3B single-day volume. Additional boost from Ark Invest’s Cathie Wood mentioning Hyperliquid.

- Bybit formed partnership with Pave Bank to launch a retail neobank-style product “MyBank”.

- Nubank has received conditional approval from the U.S. to form a national bank.

- Mesh raises $75M Series C to build a universal crypto payments network.

Macro Overview

Kevin Warsh was nominated as the Federal Reserve Chair candidate, shocking the market due to his previous hawkish stance and unique policy approach.

On January 30, Donald Trump officially confirmed on social media his nomination of Kevin Warsh as the Federal Reserve Chair candidate. During his previous tenure at the Federal Reserve, Warsh publicly voiced concerns about prolonged quantitative easing (QE) and criticized the Fed for its role in enabling large-scale federal government spending, stating that the Fed’s bloated balance sheet subsidized the government’s borrowing costs. When the nomination news was initially released, possibly due to concerns that the successor might be less dovish than expected, the US dollar and Treasury yields rebounded. Meanwhile, gold, which had just recovered from overnight market volatility, retreated again under liquidity pressure.

Why did Warsh emerge as the front-runner? While Warsh continues to support central bank independence, his approach to balancing the Fed’s dual mandate aligns more closely with Trump’s ideology. Warsh’s assessments of employment and inflation differ from the Fed’s current stance. He advocates for shrinking the Fed’s balance sheet as a means to create space for rate cuts, which could stabilize credit markets. Warsh believes that the Fed’s disorderly balance sheet expansion following the subprime crisis has been a driver of inflation. By gradually reducing the balance sheet, the Fed could control inflation while creating more room for lowering interest rates. Warsh’s proposals could temporarily stabilize credit while potentially allowing for rate cuts within the year.

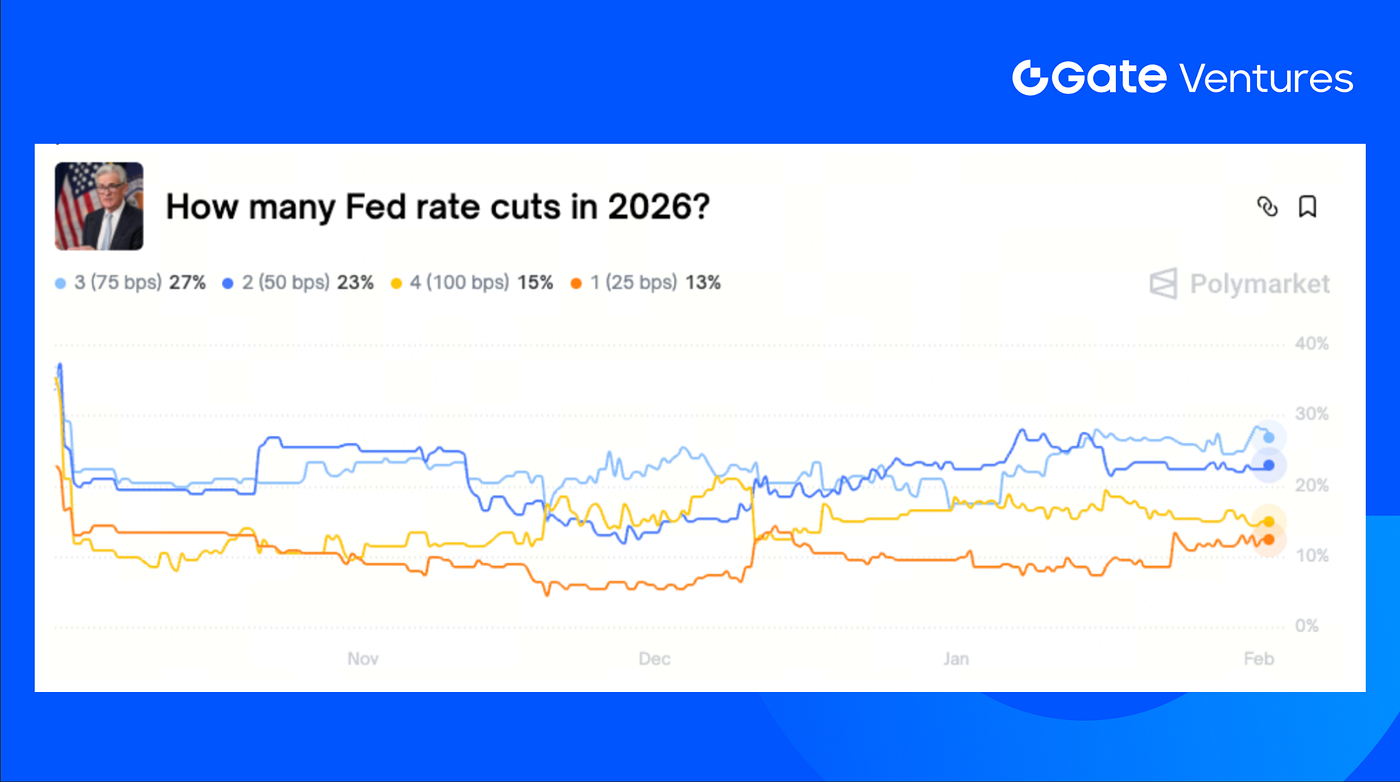

This week’s incoming data includes US job and employment data, ISM Manufacturing and Services PMI and UoM sentiment. PMI surveys of both manufacturing and service sector

business conditions will provide insights into growth, trade, inflation and job market trends around the world at the start of 2026. Friday’s non-farm payroll report, which will provide guidance on a key area of concern to US policymakers. There is a growing belief that a more serious downturn in the labor market might be necessary to prompt any further loosening from the Fed, meaning Friday’s report could prove material in guiding rate expectations. (1, 2)

How many Fed rate cuts in 2026, Polymarket

DXY

The US dollar index fell significantly last Tuesday as Trump hinted that he could manipulate the strength of the dollar, but the price recovered on Friday following the nomination of new Fed Chair. (3)

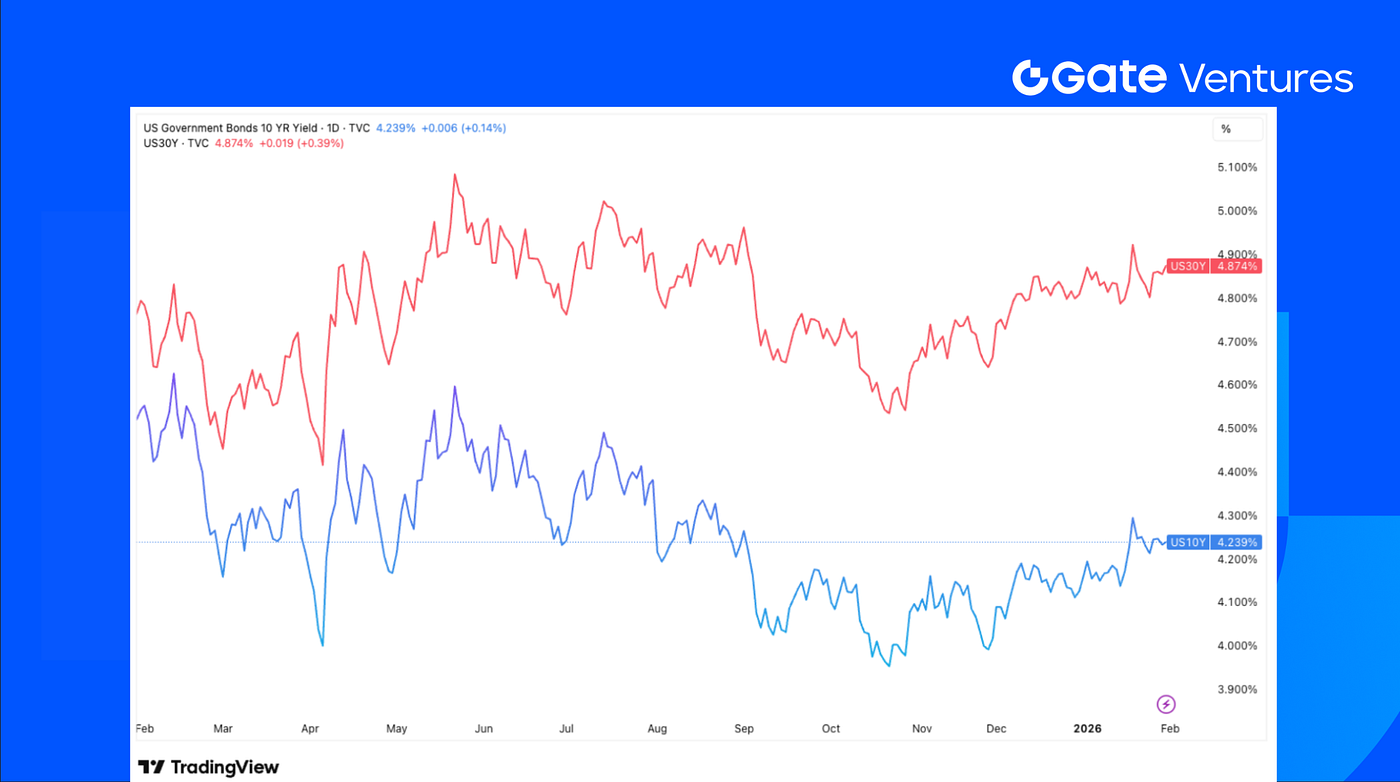

US 10-Year and 30-Year Bond Yields

After the official announcement of nominating Kevin Warsh as the next Fed Chair, the expectations of changing monetary policies caused a sharp rise in the bond yields, triggering massive profit-booking and the liquidation of overbought positions. (4)

Gold

Last week after approaching the historical high of nearly $5,600/oz, the gold price sharply declined on Friday, driven by the appointment of Kevin Warsh as the next US Federal Reserve Chair, whose policies lean hawkish. (5)

Crypto Markets Overview

1. Main Assets

BTC Price

ETH Price

ETH/BTC Ratio

Last week, BTC fell 8.7% and ETH dropped sharply by 19.4%. BTC ETFs recorded a net outflow of $1.49B, the second-largest weekly outflow in ETF history, while ETH ETFs saw $326.9M in net outflows. (6)

The ETH/BTC ratio declined 9.9%, breaking below the key 0.03 level to around 0.029, signaling continued relative weakness in ETH. Market sentiment has deteriorated further, with the Fear & Greed Index plunging to 14 (extreme fear). (7)

Positioning stress is becoming visible. MicroStrategy’s average BTC cost is $76,037, putting the position underwater at current prices. On the ETH side, Bitmine’s average cost stands at $3,849, while Trend Research’s average cost is $3,180. Notably, Trend Research’s ETH DeFi position on Aave faces a liquidation level around $1,880, highlighting rising downside risk if selling pressure persists. (8)

2. Total Market Cap

Crypto Total Marketcap

Crypto Total Marketcap Excluding BTC and ETH

Crypto Total Marketcap Excluding Top 10 Dominance

Total crypto market cap fell 11.3%. Excluding BTC and ETH, the market declined 8.1%, and altcoins outside the top 10 dropped 8.7%. This indicates that BTC and ETH are weakening more than the rest of the market.

In contrast, AI agents–related tokens on Base are seeing renewed hype, mainly driven by the launch of Moltbook and Moltbot, an AI-agent social network attracting short-term speculative interest.

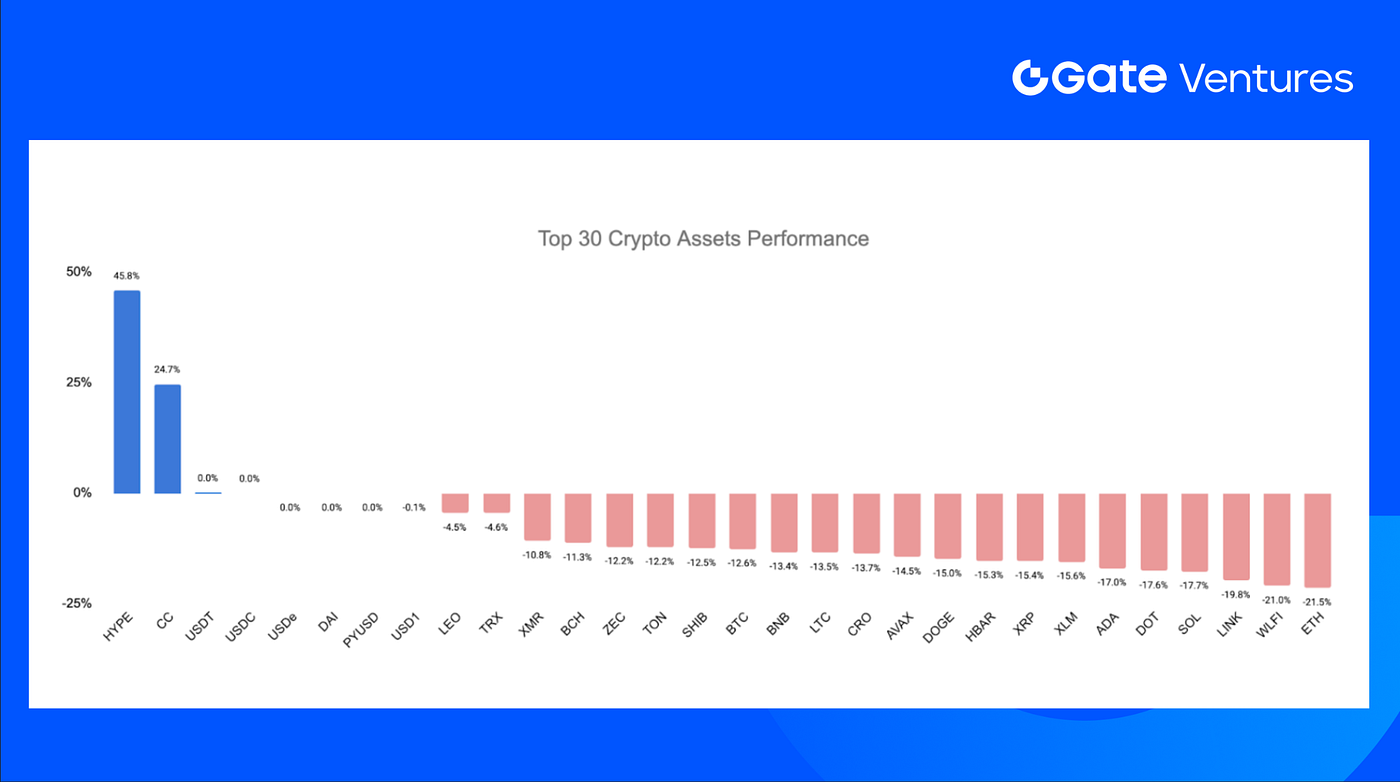

3. Top 30 Crypto Assets Performance

Source: Coinmarketcap and Gate Ventures, as of Feb, 02nd 2026

Across the top 30 cryptocurrencies by market cap, prices fell 8.5% on average, with only Hyperliquid and Canton Network posting gains.

HYPE surged 45.8% last week, mainly driven by strong activity in HIP-3, supported by rising interest in commodity-related trading. HIP-3 protocols such as trade.xyz recorded $4.3B in trading volume on Jan 30, marking a new single-day all-time high. (9)

Additional upside momentum came from Ark Invest’s Cathie Wood, who publicly mentioned Hyperliquid as an attractive investment, further boosting investor confidence. (10)

4. Token Launch

$BIRB (Moonbirds) is the official utility token of the Moonbirds ecosystem, signaling its move beyond NFTs toward a tokenized, on-chain economy. It is designed to support participation, rewards, and ecosystem growth across games, social, and creator-focused applications.

$BIRB began trading at $0.17 and is currently around $0.22, implying an estimated FDV of ~$222M. The token is listed on major exchanges including Coinbase, Gate, and Binance.

The Key Crypto Highlights

1. Hong Kong to advance comprehensive crypto regulatory framework in 2026

Hong Kong regulators plan to submit a draft digital-asset regulatory framework in 2026. Christopher Hui, Secretary for Financial Services and the Treasury, said the government is preparing a draft ordinance covering crypto advisory services, following a public consultation released in December. In parallel, the Hong Kong Monetary Authority has begun processing license applications for stablecoin issuers under the Stablecoin Ordinance. As of now, 11 crypto platforms are licensed to operate in Hong Kong, including Hashkey, OSL, EX.IO, etc. (11)

2. Nubank wins conditional U.S. approval to form national bank

Nubank has received conditional approval from the U.S. Office of the Comptroller of the Currency to form a national bank, moving the Latin American fintech into the bank organization phase as it expands regulated banking and crypto services in the United States. The approval would allow Nubank to offer deposits, lending, credit cards, and digital-asset custody, subject to meeting capitalization and supervisory requirements and securing further approvals from the FDIC and Federal Reserve. The move builds on Nubank’s growing crypto strategy, including in-app trading, expanded token offerings in Brazil, and pilots integrating stablecoin payments with traditional card products. (12)

3. Bybit’s neobank plans test crypto exchanges’ push into banking

Bybit is pushing deeper into traditional finance with plans to launch a retail neobank-style product, MyBank, as early as February. CEO Ben Zhou confirmed the initiative, which will be supported by a partnership with Pave Bank, a licensed lender backed by Tether, rather than a full banking license held by Bybit itself. Industry experts caution that while bank-like features such as payments, cards, and on/off-ramps are common, operating as a true bank brings significant capital, compliance, and liability burdens, potentially forcing heavier KYC and eroding the low-friction onboarding that attracts many retail users to crypto platforms. (13)

Key Ventures Deals

1. Galaxy Digital backs Tenbin to scale yield-bearing tokenized gold and FX markets

Galaxy Ventures has led a $7M seed round in New York–based Tenbin Labs, alongside Wintermute Ventures, GSR, FalconX and others, to build institutional-grade tokenized commodities and currencies. Rather than custody wrappers, Tenbin anchors pricing via CME Group futures, enabling fast settlement, low fees and the pass-through of futures basis yield. The firm plans to launch a tokenized gold product first, followed by high-yield FX tokens tied to emerging-market currencies, targeting DeFi users seeking alternatives to U.S. dollar stablecoins. (14)

2. Mesh raises $75M Series C to build a universal crypto payments network

San Francisco–based Mesh closed a $75M Series C led by Dragonfly Capital, with participation from Paradigm, Coinbase Ventures, SBI Investment and others, valuing the company at $1B and bringing total funding to over $200M. Positioned as asset-agnostic payments infrastructure rather than a token issuer, Mesh is building an “any-to-any” crypto payments network that allows consumers to spend any digital asset while merchants settle instantly in their preferred stablecoin or fiat. The funding will accelerate global expansion across Latin America, Asia and Europe, deepen partnerships with stablecoin and payments providers. (15)

3. Flying Tulip raises $75.5M more at $1B token valuation to build adaptive DeFi exchange

Andre Cronje’s Flying Tulip raised an additional $75.5M through a mix of private and public token sales, maintaining a $1B fully diluted token valuation. The latest $25.5M private Series A drew backing from Amber Group, Fasanara Digital and Paper Ventures, alongside $50M raised via Impossible Finance’s Curated platform, with further public sales planned on CoinList. Structured at a fixed $0.10 FT token price, all rounds include onchain “perpetual put” redemption rights, offering principal downside protection. Flying Tulip is building an integrated onchain exchange combining spot trading, perpetuals, lending and a native stablecoin (ftUSD), with capital intended to be deployed into onchain yield strategies to fund growth, incentives and buybacks ahead of its post-TGE rollout. (16)

Ventures Market Metrics

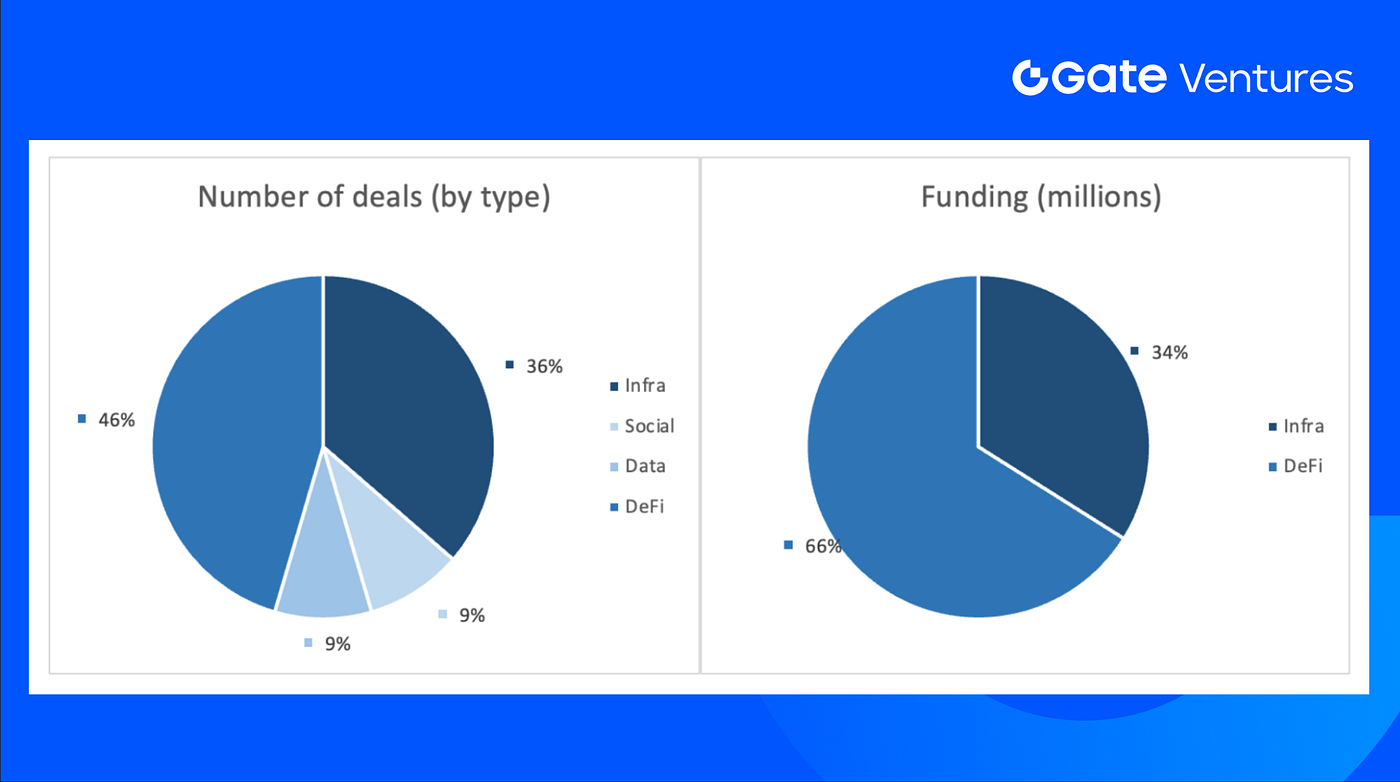

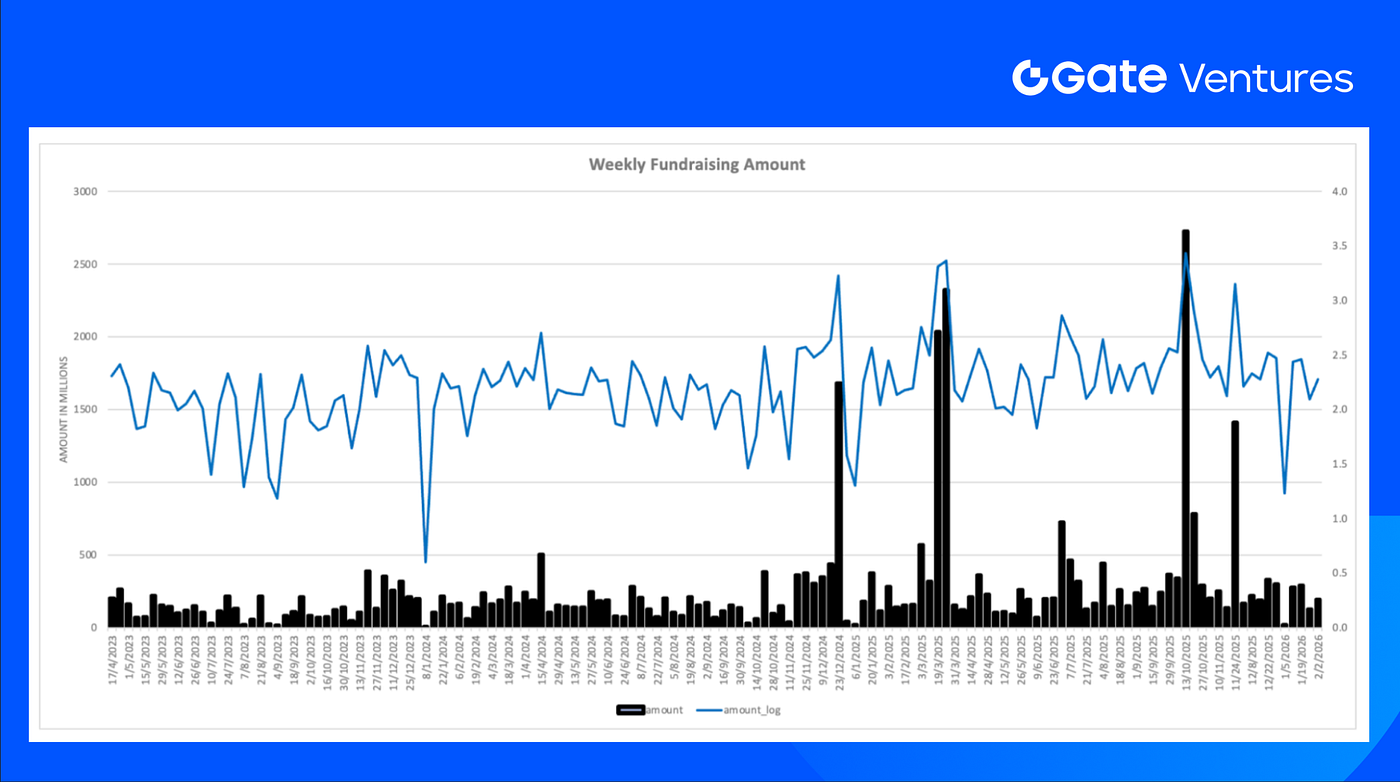

The number of deals closed in the previous week was 11, with DeFi having 5 deals, representing 46% of the total number of deals. Meanwhile, Infra had 4 deals (36%), Social had 1 deal (9%) and Data had 1 deal (9%).

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 2nd Feb 2026

The total amount of disclosed funding raised in the previous week was $188.5M, 3 deals in the previous week didn’t announce the raised amount. The top funding came from the DeFi sector with $124.5M. Most funded deals: Flying Tulip ($75.5M).

Weekly Venture Deal Summary, Source: Cryptorank and Gate Ventures, as of 2nd Feb 2026

Total weekly fundraising surged to $188.5M for the 1st week of Feb-2026, an increase of 52% compared to the week prior.

About Gate Ventures

Gate Ventures, the venture capital arm of Gate.com, is focused on investments in decentralized infrastructure, middleware, and applications that will reshape the world in the Web 3.0 age. Working with industry leaders across the globe, Gate Ventures helps promising teams and startups that possess the ideas and capabilities needed to redefine social and financial interactions.

Website | Twitter | Medium | LinkedIn

The content herein does not constitute any offer, solicitation, or recommendation. You should always seek independent professional advice before making any investment decisions. Please note that Gate Ventures may restrict or prohibit the use of all or a portion of the services from restricted locations. For more information, please read its applicable user agreement.

Reference:

- S&P Week Ahead Economic Preview, https://www.spglobal.com/marketintelligence/en/mi/research-analysis/week-ahead-economic-preview-week-of-2-february-2026.html

- How many Fed rate cuts in 2026, Polymarket, https://polymarket.com/event/how-many-fed-rate-cuts-in-2026

- DXY Index, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3ADXY

- US 10 Year Bond Yield, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3AUS10Y

- Gold Price, TradingView, https://www.tradingview.com/chart/z1UD772v/?symbol=TVC%3AGOLD

- BTC & ETH ETF Inflow, https://sosovalue.com/tc/assets/etf/us-btc-spot

- BTC Greed and Fear Index, https://alternative.me/crypto/fear-and-greed-index/

- Micro Strategy, Bitmine, Trend Research’s average cost, https://x.com/EmberCN/status/2017765861613072875

- HIP-3 Trading data, https://hyperscreener.asxn.xyz/hip3

- Ark Invest mention of Hyperliquid, https://www.bitget.com/news/detail/12560605178274

- Hong Kong to advance comprehensive crypto regulatory framework in 2026 https://cointelegraph.com/news/hong-kong-financial-regulators-crypto-framework

- Nubank wins conditional U.S. approval to form national bank https://cointelegraph.com/news/nubank-conditional-us-approval-national-bank

- Bybit’s neobank plans test crypto exchanges’ push into banking https://cointelegraph.com/news/bybit-neobank-move-cex-into-tradfi-test

- Galaxy Digital backs Tenbin to scale yield-bearing tokenized gold and FX markets https://www.coindesk.com/business/2026/01/27/galaxy-digital-leads-usd7m-investment-in-tenbin-to-build-improved-tokenized-gold-and-fx-markets

- Mesh raises $75M Series C to build a universal crypto payments network https://www.prnewswire.com/news-releases/mesh-secures-75m-series-c-reaches-1b-valuation-to-build-the-universal-crypto-payments-network-302670833.html

- Flying Tulip raises $75.5M more at $1B token valuation to build adaptive DeFi exchange https://www.theblock.co/post/387720/andre-cronje-flying-tulip-additional-funding-token-crypto

Related Articles

Gate Ventures Research Insights: The Bittensor Revolution – The Rise of AI’s Bitcoin and the New Economic Landscape

Gate Ventures Weekly Crypto Recap (November 3 , 2025)

Gate Ventures Weekly Crypto Recap (September 29, 2025)

Gate Ventures Weekly Crypto Recap (October 20, 2025)

Gate Ventures Weekly Crypto Recap (October 6, 2025)