Gate Stock Token Zone Explained: A New Way to Access Stock Price Movements on Crypto Platforms

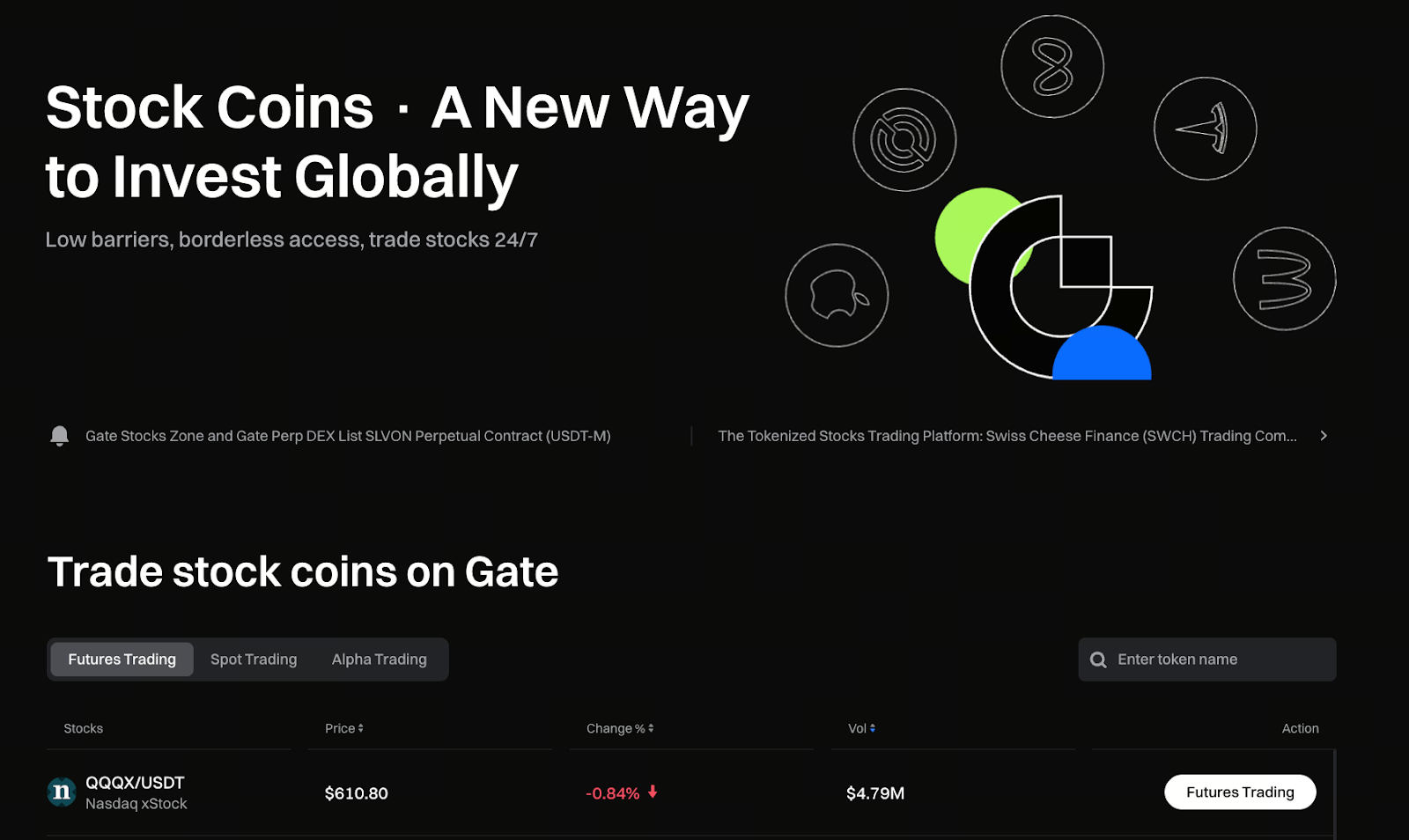

1. What Is the Gate Tokenized Stocks Zone?

Image: https://www.gate.com/tokenized-stocks

The Gate Tokenized Stocks Zone is a dedicated trading section on the Gate platform, designed to let users engage with traditional stock price movements in a crypto trading environment. Assets listed here aren’t shares issued directly by public companies; instead, they’re tokenized products pegged to the price performance of specific stocks. Price action typically mirrors the market trends of the underlying stocks.

2. How Gate Tokenized Stocks Work

Within the Gate Tokenized Stocks Zone, tokenized stocks are digital assets. All trading, settlement, and position management take place on the platform. When you buy or sell tokenized stocks, you’re participating in the price movements of the underlying stocks—not directly holding company shares or gaining shareholder rights. This structure simplifies the process compared to traditional stock market participation.

3. Gate Tokenized Stocks vs. Direct Purchase of U.S. Stocks

Unlike buying U.S. stocks through a securities account, Gate tokenized stocks don’t require opening accounts with traditional brokers, cross-border transfers, or complex clearing procedures. You don’t need to manage dividend distributions or corporate governance issues—your focus is solely on price volatility. However, tokenized stocks are not equivalent to spot stocks; their legal nature and rights structure are fundamentally different.

4. Key Features of the Gate Tokenized Stocks Zone

The Gate Tokenized Stocks Zone stands out for its trading model, which aligns closely with the habits of crypto users. You can manage these assets alongside other digital holdings on the platform, streamlining operations. Tokenized stocks also support small-scale participation, allowing users to access the price action of prominent public companies with a lower capital threshold.

5. Who Should Use Gate Tokenized Stocks?

If you’re already accustomed to trading digital assets on Gate, the Tokenized Stocks Zone offers a complementary asset allocation option. It’s best suited for users interested in short- or medium-term price movements and looking to diversify their investment targets—not for those seeking long-term equity ownership or dividend income.

6. Risks to Consider with Gate Tokenized Stocks

When using the Gate Tokenized Stocks Zone, it’s essential to fully understand the associated risks. Tokenized stock prices may temporarily diverge from the underlying stocks due to factors like liquidity and trading depth. Product rules, trading hours, and supported assets may change based on platform updates—always refer to official Gate pages for the latest information.

7. Why Gate Introduced the Tokenized Stocks Zone

From Gate’s perspective, the Tokenized Stocks Zone represents its commitment to multi-asset trading innovation. By bringing stock price-linked assets into the crypto trading ecosystem, Gate creates new opportunities to bridge traditional finance and digital asset markets, expanding the platform’s use cases.

8. Summary: A Rational Approach to Gate Tokenized Stocks

In summary, the Gate Tokenized Stocks Zone isn’t a substitute for traditional stock investing—it’s a blockchain-based tool for participating in price movements. For users who understand the mechanism and have a clear sense of their risk tolerance, tokenized stocks can serve as a supplementary asset in their portfolios. Clear recognition of product characteristics is key to responsible participation.

Related Articles

Gold Price Forecast for the Next Five Years: 2026–2030 Trend Outlook and Investment Implications, Could It Reach $6,000?

Crypto Future Profit Calculator: How to Calculate Your Potential Gains

Crypto Futures Calculator: Easily Estimate Your Profits & Risks

What is Oasis Network (ROSE)?

The $50M Crypto Scam Nobody Is Talking About