Gate Research: Stocks and Gold Silver Pull Back Weighing on Crypto | Moltbook Sparks an Agent Wave Spilling Into Clanker

Crypto Market Overview

- BTC (-3.85% | Current Price: 75,523 USDT ): Amid a simultaneous decline in stocks and precious metals, BTC followed a pattern of “sharp drop – wick – weak rebound – low-level consolidation.” While there are no new systemic bearish catalysts, recurring mentions of the “1011” liquidity controversy have slowed confidence recovery. Although the price has reclaimed the MA5/MA10, the MA30 still acts as resistance, making the rebound appear more like a corrective move within a downtrend channel. Key levels to watch are support at $75,000 and resistance at $80,000. If support fails, BTC could retest MicroStrategy’s institutional cost basis and potentially seek support near $70,000.

- ETH (-9.9% | Current Price: 2,197.86 USDT): ETH has clearly underperformed BTC. Amid shrinking risk appetite, it first saw a sharp drop with high-volume bearish candles, followed by a wick rebound at $2,220, though the bounce was weak. It then shifted into low-level consolidation with a downward drift. The price remains below the MA5/MA10, with short-term moving averages forming resistance. The MA30 is trending downward and diverging from the price, with each rebound facing selling pressure. Key support to watch is $2,200—if it breaks, the next levels to monitor are $2,150 and the psychological threshold at $2,000.

- Altcoins: The Fear and Greed Index currently stands at 14, placing it in the “Extreme Fear” zone. This marks a significant drop from last week’s level of 20 and represents the lowest point recorded so far this year.

- Macro: On January 30, the S&P 500 Index fell by 0.43% to close at 6,939.03 points; the Dow Jones Industrial Average declined by 0.36% to 48,892.44 points; and the Nasdaq dropped by 0.94% to 23,461.82 points. As of 11:30 AM (UTC+8) on February 2, the spot price of gold is $4,715 per ounce, reflecting a 24-hour decline of 3.66%.

Trending Tokens

POKT Pocket Network (+52.79%, market cap: $29.24 million)

According to Gate market data, the current price of the POKT token is $0.0166, having risen over 50% in the past 24 hours. Pocket Network (POKT) is a decentralized blockchain API infrastructure project built for Web3 applications. It enables efficient data and request transmission across various blockchains through a distributed network of thousands of nodes.

POKT’s surge is mainly driven by network improvements and catalyst partnerships. Pocket Network recently implemented hard-coded deflationary tokenomics, including the PIP-41 proposal, creating a strong supply contraction effect as network usage increases. Additionally, the project has formed strategic alliances with platforms such as GetBlock and DevDAO.

LMTS Limitless (+68.68%, market cap: $16.32 million)

According to Gate market data, the current price of the LMTS token is $0.1232, having surged over 60% in the past 24 hours. Limitless (LMTS) is a prediction market platform built on the Base chain, focused on offering uninterrupted hourly and daily prediction markets. Users can make predictions on events related to cryptocurrencies, stock prices, esports, culture, politics, and more.

LMTS’s rise is mainly driven by an active buyback mechanism and milestone events in January. The Limitless team has implemented a $50,000 weekly LMTS buyback program, funded by protocol revenue, which directly absorbs market sell pressure and burns tokens. In January alone, a total of $400,000 worth of LMTS was bought back. Additionally, the January report showed that Limitless reached a record-high monthly trading volume of over $200 million, with more than 54,000 active traders.

AVA AVAAI (+25.91%, market cap: $10.19 million)

According to Gate market data, the current price of the AVA token is $0.0102, with a 24-hour increase of over 25%. AVA (AVAAI) is the flagship AI Agent project launched by Holoworld AI, a startup platform for creating audiovisual AI Agents through video.

AVA’s rise may be driven by ecosystem support and narrative momentum. The influence of well-known backers such as Arthur Hayes continues to have an impact, and collaborations with NFT brands like Pudgy Penguins have increased the project’s exposure. In addition, recent AI agent updates have reinforced its long-term potential, attracting investor accumulation.

Alpha Insights

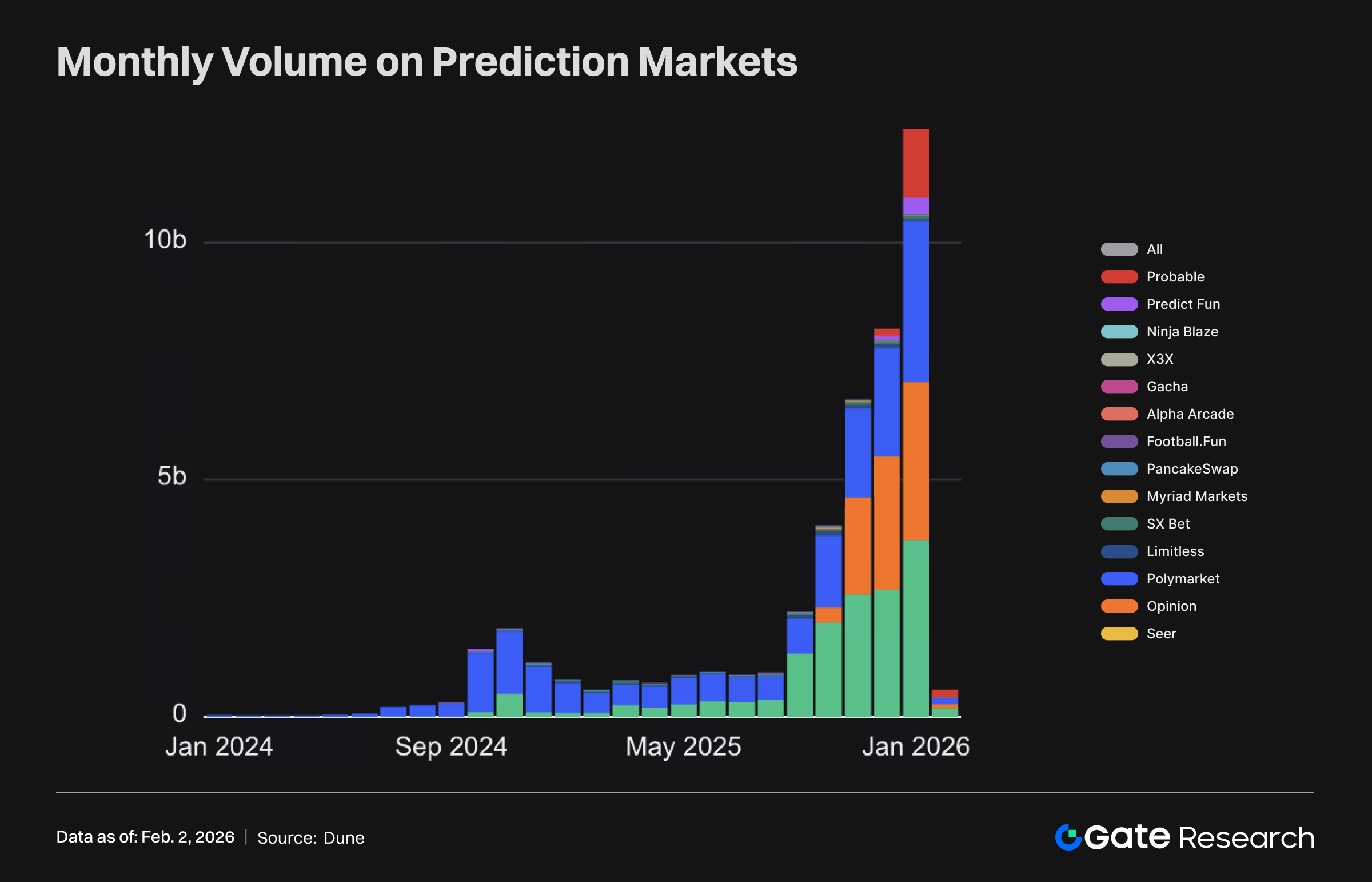

Prediction Market Monthly Trading Volume Exceeds $12 Billion in January, Hitting All-Time High

The prediction market sector continued its explosive growth in January 2026, with monthly trading volume reaching a record high of over $12 billion. The four major platforms—Kalshi, Polymarket, Opinion, and Probable—contributed $3.72 billion, $3.39 billion, $3.33 billion, and $1.46 billion respectively, highlighting strong user demand for forecasting political, economic, and entertainment events. This milestone not only reflects the deep integration of blockchain technology into real-world applications but is also fueled by a rise in global uncertainty events—such as elections and sports competitions—accelerating capital inflows and expanding the market.

At the same time, on-chain prediction market monthly fees surpassed $11 million, led by Opinion with $6.14 million (54.7%) and Polymarket with $2.62 million (23.3%). Predict Fun and Limitless also recorded $737,000 and $644,000 respectively. The prediction economy is rapidly becoming one of the core growth engines of the Web3 ecosystem.

Moltbook Fuels AI Agent Social Craze, Clanker Captures Token Launch Demand

Moltbook, the first social network specifically designed for AI Agents, quickly became a sensation after its launch in late January 2026, attracting over one million AI Agents and forming an independent digital society. These Agents, operating via the OpenClaw framework, autonomously post content, discuss philosophy, form virtual religions such as “Crustafarianism,” and even debate human privacy and autonomy—drawing global attention and raising safety concerns. Although some content is suspected to be human-generated, the platform’s growth has been steep, with thousands of posts and emerging communities, potentially marking a milestone in the evolution of AI Agents from tools to social entities.

This surge in attention rapidly spilled over into Launchpad infrastructure. On the Base network, Clanker emerged as a key beneficiary. On January 30–31, it saw over 13,000 tokens created per day, with daily trading volumes of these tokens exceeding $300 million and daily fees surpassing $3 million. In the short term, this reflects how the AI Agent narrative has directly bridged the social layer to the monetization layer. However, its long-term sustainability will depend on whether any of the massive wave of new tokens develop verifiable real-world use cases and user retention.

Meme Coin Crash: Notable KOL Murad Loses $58 Million in Six Months

Prominent meme coin KOL Murad Mahmudov has seen his investment portfolio plunge nearly 86% over the past six months, with total losses reaching approximately $58 million. From a peak of $67 million in July 2025, his holdings have dropped to just around $9.1 million—largely due to the collapse of meme coins such as SPX6900, highlighting the extreme risks in the meme market.

The incident has sparked widespread discussion within the crypto community. On one hand, some applaud Murad’s “diamond hands,” seeing his refusal to sell at the peak as a sign of conviction. On the other hand, many use this case as a cautionary tale about the speculative nature of meme coins. It also reflects the broader market downturn in recent months, reminding investors to carefully assess risk and avoid blindly following trends.

References

- Gate, https://www.gate.com/trade/BTC_USDT

- Farside Investors, https://farside.co.uk/btc/

- Gate, https://www.gate.com/trade/ETH_USDT

- Farside Investors, https://farside.co.uk/eth/

- Gate, https://www.gate.com/crypto-market-data

- Investing, https://investing.com/indices/usa-indices

- Investing, https://investing.com/currencies/xau-usd

- CoinGecko, https://www.coingecko.com/en/cryptocurrency-heatmap

- Dune, https://dune.com/gateresearch/prediction-markets-overview

- X, https://x.com/ashcrypto/status/2018058594344968390?s=46&t=EEJDyfyr6YAcI4XNraAtwQ

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

Exploring 8 Major DEX Aggregators: Engines Driving Efficiency and Liquidity in the Crypto Market

What Is Copy Trading And How To Use It?

What Is Technical Analysis?

How to Do Your Own Research (DYOR)?

12 Best Sites to Hunt Crypto Airdrops in 2025