Gate Research: One-Stop Macro Multi-Asset Coverage, Gate TradFi Connects Metals, FX, Indices, and Stock CFD

Gate TradFi is a one-stop macro multi-asset trading gateway launched by Gate, covering CFDs on precious metals, forex, indices, commodities, and popular U.S. stocks. These products allow users to trade on price movements rather than owning the underlying assets. The system uses USDx as the in-account display unit, pegged 1:1 to USDT, enabling users to participate in TradFi trading within the familiar USDT framework without currency conversion. Built on MT5, Gate TradFi enables synchronization between the Gate App and MT5 accounts and trade records. It also provides transparent rules on spreads, commissions, overnight fees, and liquidation mechanisms, helping traders perform multi-market rotation and hedging within a single account.Summary

- User trading demand is shifting from a single crypto focus to macro multi-asset strategies; TradFi provides CEXs with longer trading cycles, higher capital retention, and stronger hedging capabilities.

- Gate TradFi utilizes the MT5 trading system to support traditional asset CFDs, covering precious metals, stock CFDs, indices, forex, and commodities. It enables trading on price movements rather than asset ownership, with no expiry and no settlement required.

- Gate TradFi uses USDx as the accounting and display unit, backed 1:1 by USDT, allowing users to participate in TradFi trading within a familiar system without manual conversion.

I. Background: TradFi is the next growth curve for CEX

Over the past two years, user trading demand has shifted from a crypto-only focus to macro multi-asset allocation. The reason is that not all high-certainty opportunities occur in the crypto market. Volatility in forex, stock indices, gold, oil, and tech stocks often provides more direct trading signals and hedging tools during shifts in global risk appetite.

For CEXs, introducing TradFi multi-asset trading is about more than just adding a few categories. It also means:

- Extending the user trading lifecycle: When the crypto market enters a low-volatility phase or a unilateral uptrend ends, macro assets can still offer ongoing themes (e.g., the U.S. dollar cycle, risk-off demand, sector rotation), preventing a sharp drop in platform activity.

- Improving capital efficiency and user stickiness: Seamless switching across markets with a single account greatly reduces the cost of opening accounts, depositing funds, and learning new systems, allowing capital to remain on the platform longer.

- Truly unlocking hedging capabilities: Users can naturally upgrade their position management from pure directional bets to macro-perspective portfolio configurations, significantly increasing trading maturity.

Against this backdrop, Gate has launched the multi-asset trading portal Gate TradFi, emphasizing the core advantages of a unified account, one-stop access, and consolidated views of assets, reporting, and risk control—meeting the needs of both users and the platform.

II. Product Overview: What does Gate TradFi trade?

2.1 TradFi Contracts = CFDs on Traditional Assets

Gate TradFi covers gold, forex, indices, commodities, and popular U.S. stocks. TradFi contracts are CFD derivatives of these assets, meaning users trade on price movements rather than the underlying assets themselves. They have no expiration dates and require no physical settlement.

2.2 USDx Accounting, 1:1 Backed by USDT

In Gate TradFi, asset balances are shown using an internal unit of account called USDx, which is pegged 1:1 to assets denominated in USDT. USDx is not a fiat currency or a cryptocurrency; it is only used for accounting and display purposes. The underlying assets are fully backed by USDT. No manual conversion is needed, and there are no additional exchange fees or custody charges.

This design offers practical benefits. Crypto users can continue trading in the familiar USDT-based system. For the platform, integrating settlement units and risk assessment logic of TradFi as internal modules under a compliant and risk-controlled framework helps reduce product friction effectively.

2.3 MT5 Integration: Bringing a Professional Trading System into Gate

Gate TradFi uses MT5 as its core trading system. This creates a smooth connection between the all-in-one experience of the Gate app and the standard workflow used by professional traders. Gate TradFi provides trading services through MT5, and it synchronizes account data and trade records between the Gate app and the MT5 client. Users can switch between assets and trading environments within Gate, and also use the professional MT5 interface for order placement, market monitoring, and trade analysis.

2.4 TradFi Asset Pool

The CFD offerings of Gate TradFi include five main categories: precious metals, stock CFDs, indices, forex, and commodities.

- Precious Metals: Focused on price fluctuations in metals such as gold (XAU), silver (XAG), and platinum (XPT)

- Stock CFDs: Includes over 70 popular stocks

- Indices: Trading and hedging based on the prices of more than 15 major indices

- Forex: Price trading for over 45 major currency pairs

- Commodities: Includes trading and macro hedging for crude oil and other major commodities

III. Trading Mechanism: Differences from Perpetual Contracts

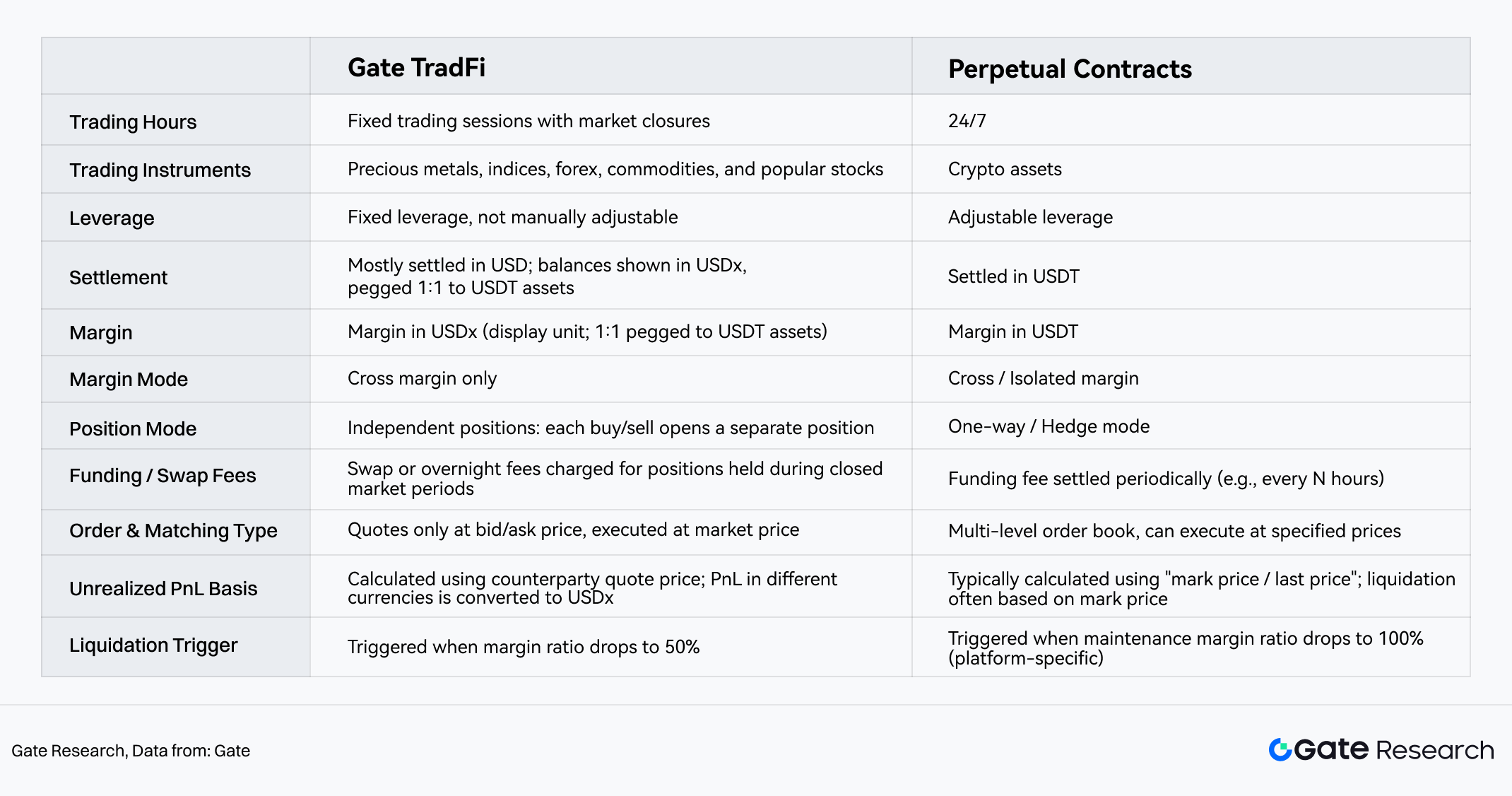

Gate TradFi differs significantly from standard perpetual contracts in several key aspects, including trading hours, leverage, margin and hedging, as well as execution and profit & loss calculation.

3.1 Fees and Costs

In simple terms, the cost of trading on Gate TradFi = spread + commission + overnight fee.

- Spread: This is the difference between the bid and ask prices. It reflects both platform and liquidity costs and affects the net value calculation of hedged positions with the same lot size.

- Commission: Varies by asset type. Gate TradFi uses different commission structures for precious metals, U.S. stock CFDs, indices, forex, and commodities. The fee is presented as “per lot” or “per side per lot,” making it easier to attribute costs within strategies. Gate VIP 5 and above users enjoy lower TradFi fees, which is a direct advantage for high-frequency or large-capital strategies.

- Overnight Fee: Usually incurred when holding positions overnight after the market closes. On Wednesdays, a triple overnight fee is charged to cover weekend holding costs, consistent with standard CFD market practices.

Gate has clearly disclosed the most easily overlooked yet most impactful long-term cost components in TradFi—spread, overnight fee, and commission—through formalized documentation. This reduces information asymmetry for users when moving from strategy backtesting to live trading.

3.2 Risk Control and Liquidation

Gate TradFi provides a clear description of its liquidation process. When the margin ratio falls to or below the threshold (50%), forced liquidation is triggered. The system will gradually close positions following rules such as prioritizing the one with the largest unrealized loss, and it will cancel related open orders during the process to free up margin.

IV. Strategy Scenarios: Common Use Cases of TradFi for Crypto Traders

The following are practical strategy transitions from a “crypto user perspective”:

- Hedging during shifts in risk appetite: When the market transitions from risk-on to risk-off, assets like gold, indices, or USD-related instruments tend to better reflect macro sentiment. TradFi enables users to hedge directly on Gate without needing to move to other platforms.

- Multi-asset rotation within a single account: Trade crypto assets during periods of high volatility. During macro event weeks (e.g. rate decisions, inflation data, non-farm payrolls), switch to forex or indices. This allows users to rotate between opportunities within the Gate platform account, rather than switching platforms.

- Transparent costs and replicable strategies: Gate TradFi provides clear spreads, commissions, and overnight fees. This allows users to assess holding periods and capital efficiency more like quantitative traders, rather than relying solely on directional bets.

V. Comparison with Common TradFi Approaches in the Industry

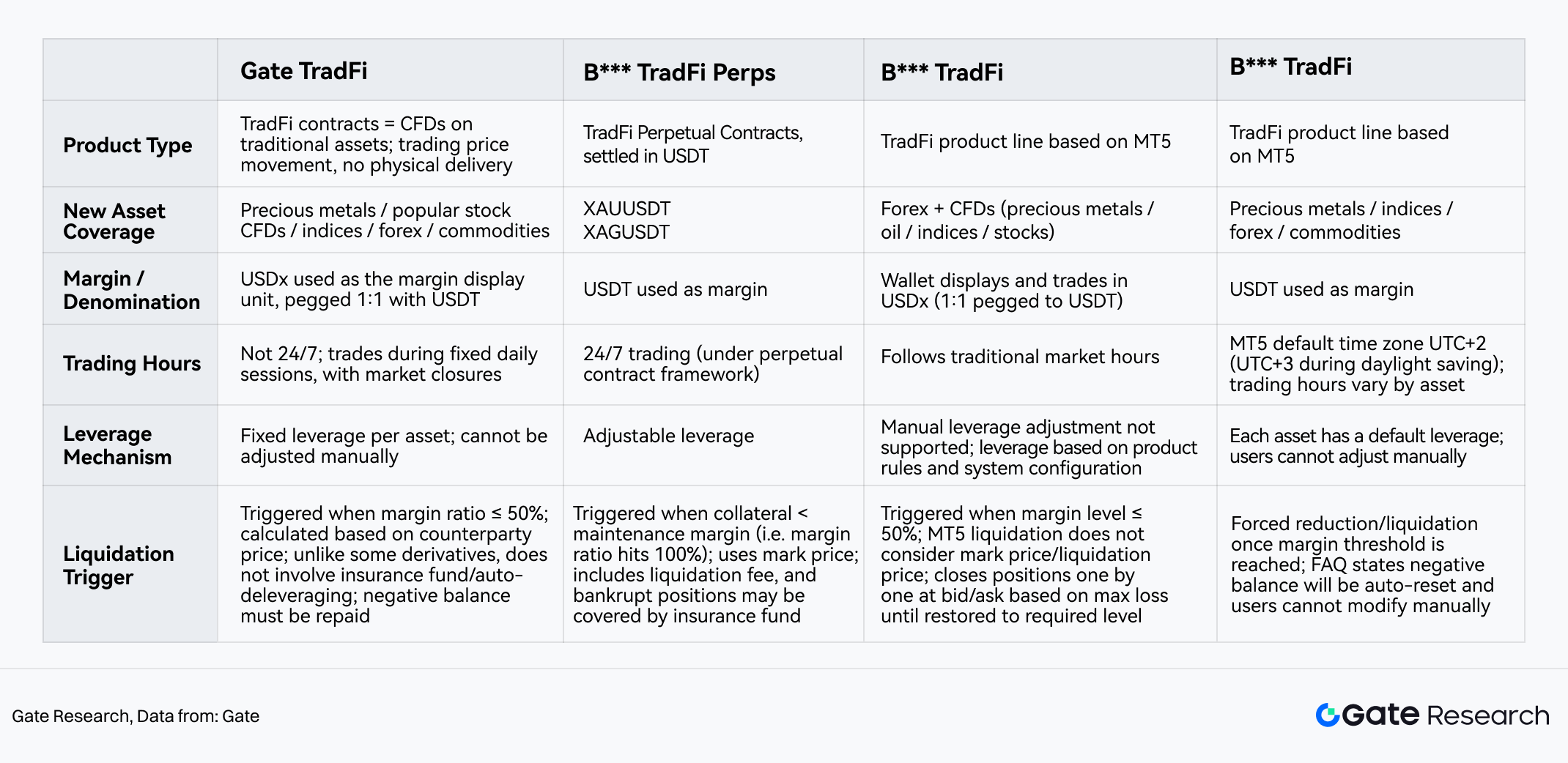

In the industry, the convergence of “Crypto and TradFi” generally follows two main paths:

- Tokenized stocks/tokenized equities: These use on-chain tokens to mirror stock prices, emphasizing fractional ownership, on-chain composability, and a more flexible trading experience. However, such products often differ from “real stocks” in terms of legal rights and ownership. Regulatory bodies and exchanges have repeatedly cautioned the market against equating them with shareholder rights, to avoid potential misunderstandings.

- CFDs on stocks/forex/precious metals: These are essentially derivatives that trade on price differences, with no need to own or settle the underlying asset. The focus is on capital efficiency and the utility of trading tools.

Gate TradFi follows the second path, adopting a professional trading model. TradFi contracts are CFDs based on underlying assets such as precious metals, forex, indices, commodities, and U.S. stocks. USDx is used as the margin display unit, pegged 1:1 to USDT. The trading experience is delivered through the MT5 system.

At the same time, Gate TradFi provides a reusable set of rules for risk control and cost transparency—such as 50% stop-out level for forced liquidation, clearly defined commission and overnight fee structures, and a tiered VIP fee model.

Overall, Gate TradFi follows a more traditional MT5 + CFD path. It not only offers price trading of TradFi instruments, but also integrates MT5 with its account system, making multi-asset trading a sustainable and reusable professional capability. In contrast, some other TradFi implementations mainly embed a small number of TradFi assets into the perpetual contract framework, providing price exposure while still relying on crypto derivative mechanisms such as funding rates, mark prices, and 24/7 trading. The real difference is not whether TradFi assets are included, but whether a genuine TradFi trading system and rule set have been implemented. From this perspective, Gate TradFi is closer to bringing a macro trading desk into a CEX.

VI. Conclusion

At its core, the value of TradFi for CEXs lies in guiding users from crypto-only trading toward longer-cycle macro asset trading. Even when crypto markets weaken or lack clear themes, TradFi offers tradable volatility and manageable risk exposure.

Gate TradFi has implemented this vision as a long-term, account-level infrastructure. It includes a multi-asset entry point under a single account, USDx accounting within the USDT framework, a professional trading workflow via MT5, and transparent rules for costs and risk management. This allows users to engage in macro trading without leaving the Gate platform, and shifts strategy migration from trial-and-error to rules-based reuse. In this sense, Gate TradFi functions as a foundational macro trading infrastructure embedded within Gate’s account system—serving current trading opportunities while extending the user lifecycle into the future.

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

Gate Research-A Study on the Correlation Between Memecoin and Bitcoin Prices

Gate Research: Web3 Industry Funding Report - November 2024

Gate Research: October Crypto Market Review