Gate Research: Kalshi Case Study, Brokerage Distribution Scales Centralized Prediction Markets

Summary

- Relying on its CFTC DCM qualification, Kalshi integrates event options into brokerage platforms like Robinhood, Webull, and IB for distribution, with Robinhood contributing over half of the trading volume in multiple periods.

- Since the start of the NFL and NBA seasons, the dense game schedule has boosted trading pace and user engagement through the high frequency, standardization, and continuous release of sports-themed options, helping Kalshi maintain a market share of over 50%.

- Kalshi is exploring tokenization on Solana, expanding access to wallets and aggregators, but faces uncertainty around state/federal regulatory boundaries, as well as consistency and risk control costs between off-chain primary markets and on-chain mappings.

1. Introduction

The essence of prediction markets lies in a type of event option or outcome-based derivatives, which express the probability of a future event occurring in the form of tradable prices.

1.1 Functional Positioning of Prediction Markets

The core functions of prediction markets can typically be broken down into three layers:

- The first layer is information aggregation and “probability pricing,” meaning the compression of dispersed information, opinions, and capital preferences into a continuously changing price or implied probability, used to observe and compare “how market expectations evolve over time”;

- The second layer is hedging and risk transfer. When event outcomes affect asset, business, or policy risks (such as interest rate paths, regulatory direction, or even elections), prediction markets can offer relatively more direct risk management tools, rather than merely serving as venues for “expressing opinions” through trading;

- The third layer, within the broader trend of financialization, involves standardizing “judgments about the future” into settleable options, allowing expectations previously scattered across public discourse and research reports to be quantified and priced within a unified trading mechanism.

1.2 Global Development Trends

Over the past year or more, the global trend of prediction markets has clearly shifted from a few crypto-native products to broader financial distribution channels and a larger user base:

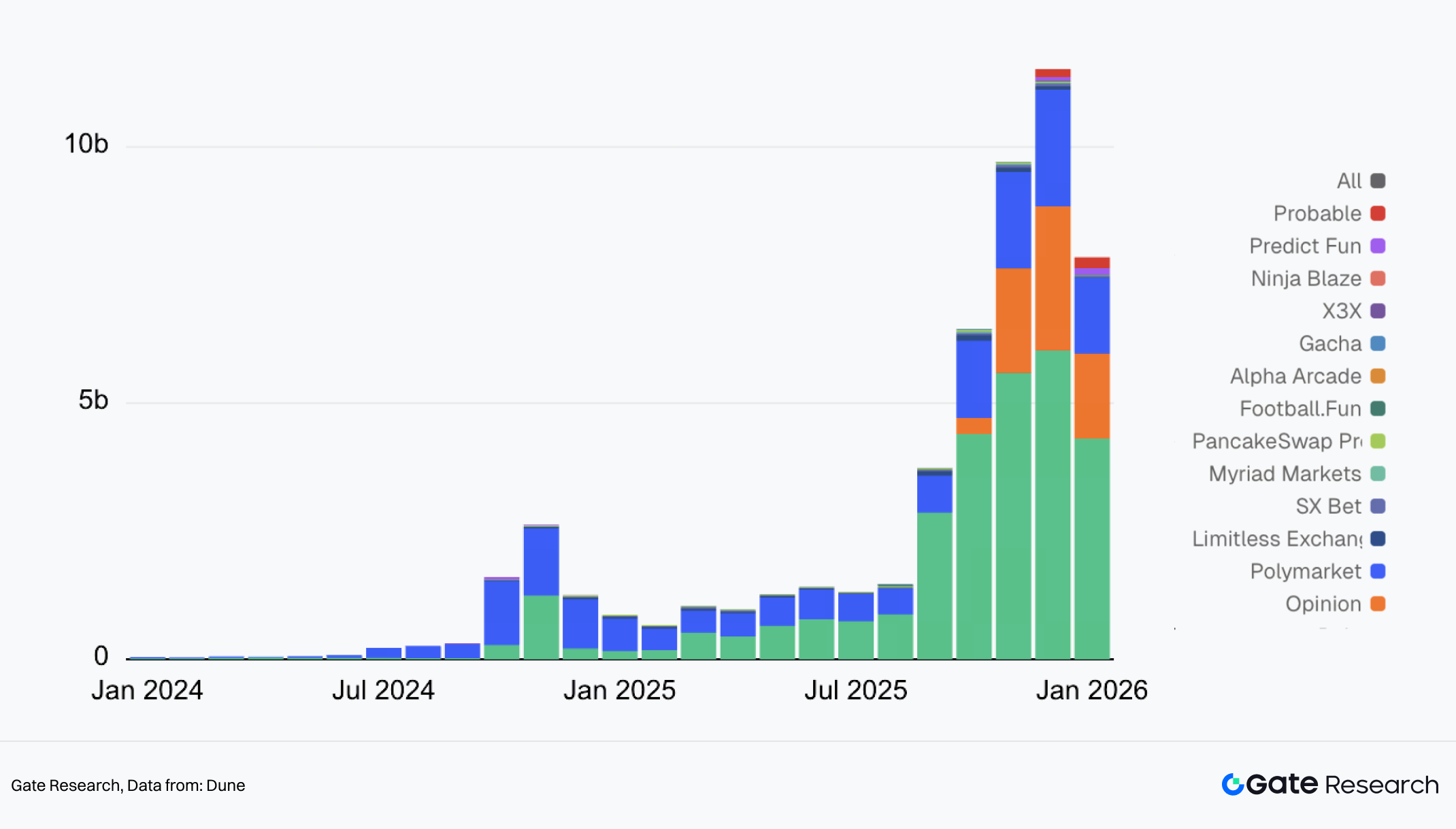

I. Monthly trading volume of prediction markets

- Scale and visibility have significantly increased: Monthly trading volume in the prediction market sector grew from a peak of around $2.3 billion in 2024 to over $11 billion at its highest point in 2025. Daily trading volume has stabilized at $400–600 million. Market participation has shifted from being dominated by Polymarket to a more competitive, multi-player landscape.

- Topics have expanded from politics to sports and macroeconomics: The trajectory from political-event-driven surges to sports becoming the mainstream theme is now relatively clear. Since the start of the NFL season in September and the NBA season in October, Kalshi has rapidly widened the gap with Polymarket in trading volume, with over 90% of its volume coming from sports events.

- Regulatory boundaries and compliance attributes are becoming key variables influencing industry development: Following the rapid expansion of high-frequency sports-related options, multi-level regulatory bodies have increasingly debated and negotiated how such options should be classified and what frameworks should be used to assess them. This presents both a constraint on business expansion and a critical challenge that must be addressed if prediction markets are to further institutionalize and enter the mainstream. Whoever gains an edge in compliance and distribution is more likely to attract new users and liquidity.

- Centralized vs. decentralized development paths: These two paths show systemic differences in regulatory frameworks, user demographics, and innovation boundaries—not just differences in technical implementation. In terms of compliance, centralized platforms (e.g., Kalshi) operate under clearly defined regulatory bodies like the CFTC, providing option legitimacy but facing strict content approval. Decentralized platforms (e.g., Polymarket) rely on on-chain options for global accessibility but face uncertain regulatory status. In user distribution, the former reaches traditional financial users via brokerage channels, while the latter depends on crypto wallets and the DeFi community. In trading infrastructure, centralized platforms use continuous matching and fiat settlement, with standardized high-frequency sports offerings, centralized market-making, and risk control mechanisms to build deep limit order books. Decentralized platforms use a hybrid structure of off-chain matching and on-chain settlement, resulting in more fragmented liquidity.

2. Kalshi Overview and Industry Positioning

2.1 Company and Product Introduction

Kalshi was founded in 2018 by Tarek Mansour (CEO, a former high-frequency trading engineer) and Luana Lopes Lara (Co-founder). The founding team comes from a combined background in technology and finance, with the core objective of standardizing “event outcomes” into tradable financial options, choosing from the outset to operate within a regulated framework. Compared to most crypto-native prediction markets, Kalshi has focused on regulatory compliance from its inception, designing around the legal nature of event options, trading rules, and clearing mechanisms.

In terms of regulatory qualifications, Kalshi obtained Designated option Market (DCM) status from the Commodity Futures Trading Commission (CFTC) in November 2020 and established an independent clearing entity under the commodity futures regulatory framework. The platform’s products are classified as event options, distinct from traditional futures or gambling options, and are listed, traded, and settled within a compliant framework. This regulatory structure also provides the institutional foundation for integration with traditional account systems, payment channels, and a broader user base.

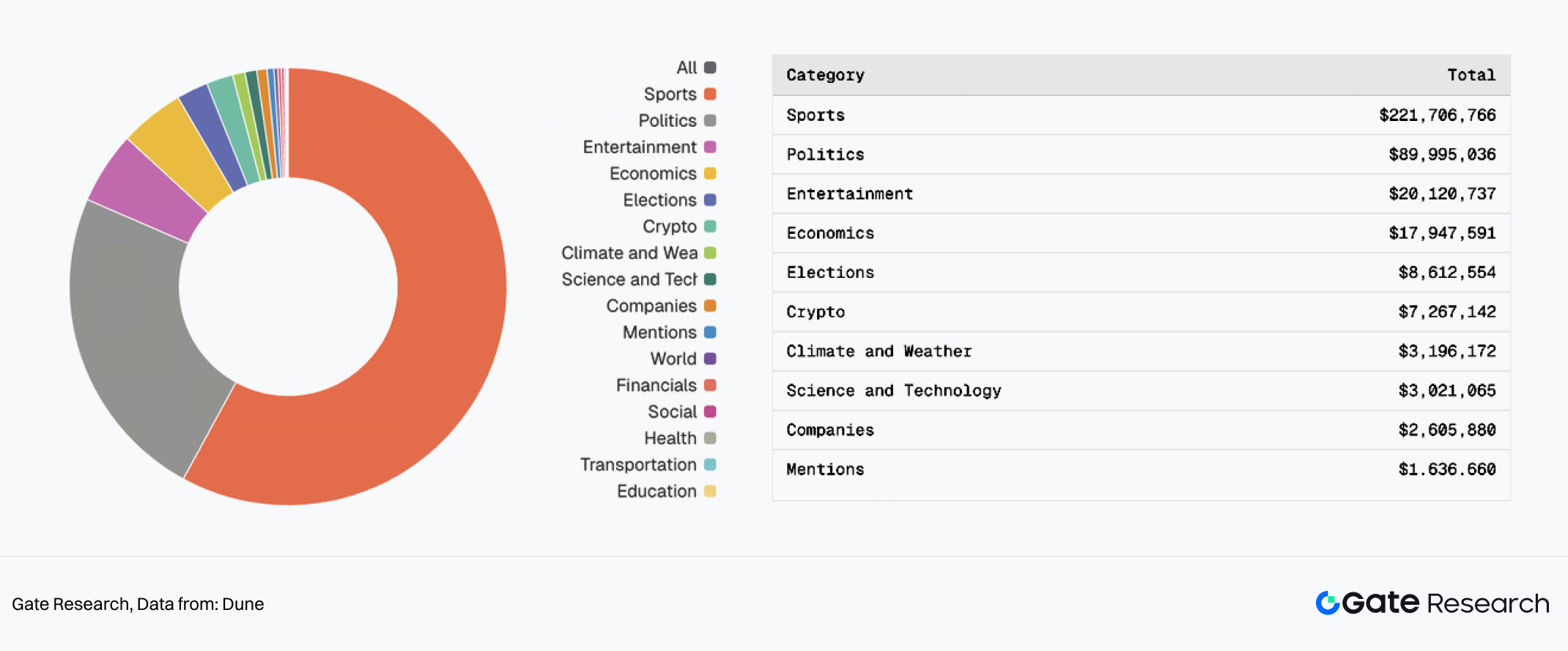

II. Kalshi Open Interest Distribution

The core trading categories primarily focus on two types of high-frequency, standardizable scenarios:

- Sports events such as individual game outcomes, season MVP, and top scorer, which have become the largest segment by trading volume due to dense schedules and objective results.

- Political events such as elections and summits, which attract risk managers and professional traders.

- Other categories like entertainment, economics, and crypto provide secondary or long-tail contributions.

Among them, sports-related options, with their high frequency, clear rules, and definitive settlement, have gradually evolved into Kalshi’s product line with the deepest liquidity and most significant scale effects, dominating its overall trading volume.

2.2 Market Status: Brokerage Distribution Model and Growth Structure

Kalshi’s unique moat lies in its brokerage-driven user acquisition strategy. Event options are not solely reliant on Kalshi’s own platform for user acquisition and conversion but are instead distributed as product offerings through brokerage apps, reaching a broader retail trading audience. Channel partnerships, particularly with platforms like Robinhood (as well as Webull and others), have played a key role in amplifying its trading volume.

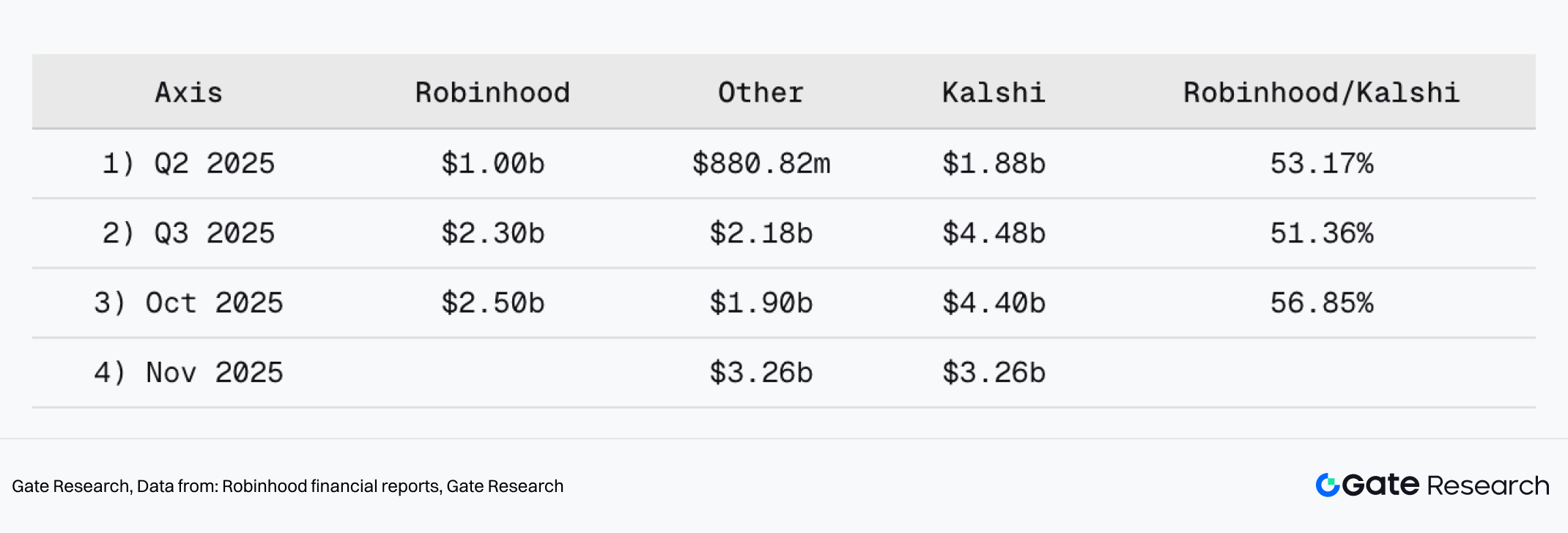

III. Robinhood accounts for over 50% of Kalshi’s monthly trading volume

According to disclosures from Robinhood’s financial reports, Robinhood contributed over half of Kalshi’s nominal trading volume across multiple periods:

- In Q2 2025, Kalshi’s quarterly trading volume was $1.88 billion, with Robinhood accounting for $1 billion, representing 53.17%.

- In Q3 2025, Kalshi’s quarterly trading volume reached $4.48 billion, with Robinhood contributing $2.3 billion, or 51.36%.

- In October 2025, Kalshi’s monthly trading volume was $4.4 billion, with $2.5 billion coming from Robinhood, accounting for 56.85%.

This data indicates that Kalshi’s growth is not solely the result of its own product strength, but is deeply tied to the distribution efficiency of brokerage channels. Once event options are embedded into brokerage account systems, prediction markets resemble a new asset class directly tradable by mainstream retail users, with significantly lowered entry barriers and simplified usage paths.

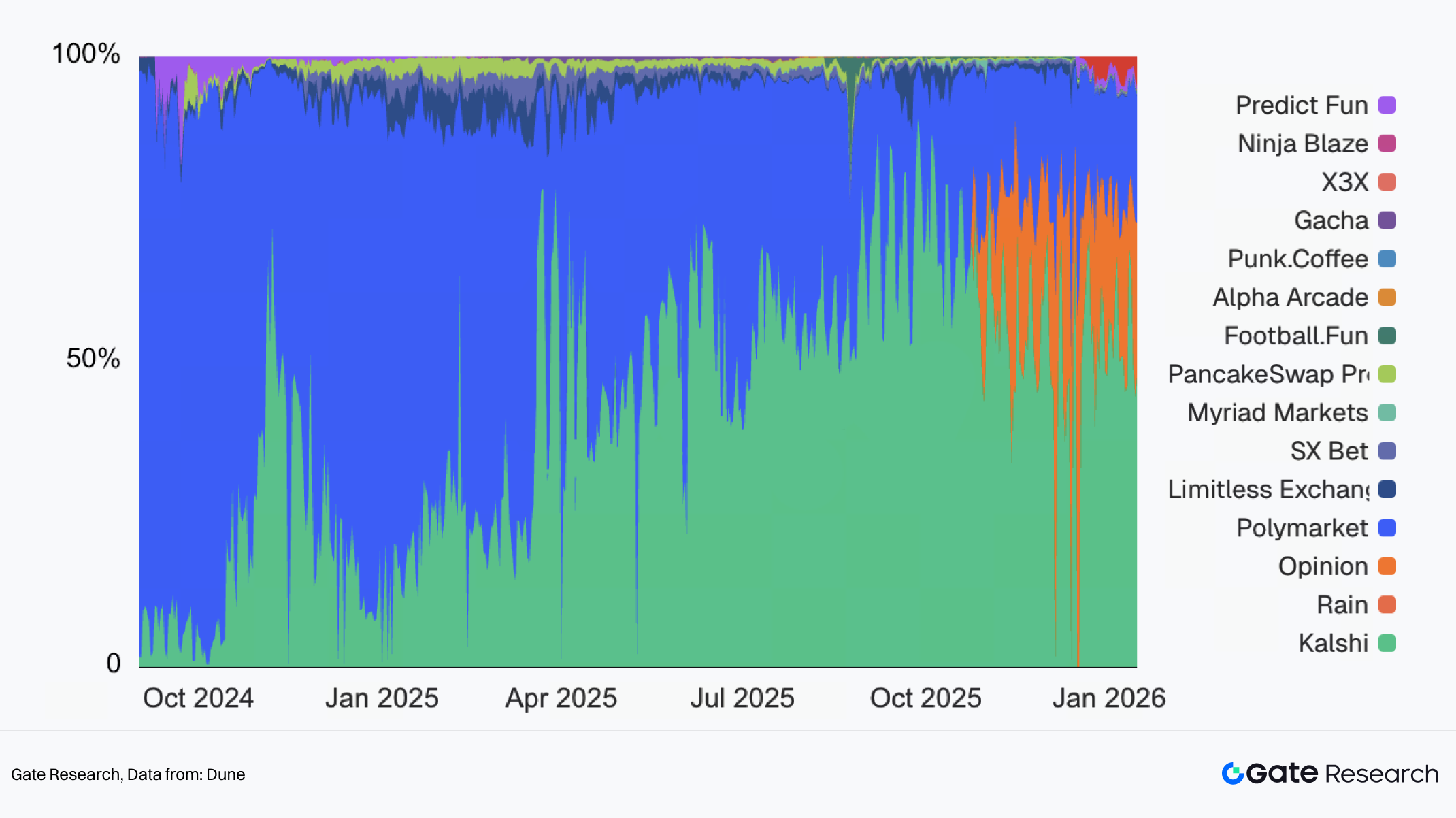

2.3 Market Share: Surging from 10% to Over 50% Within Just One Year

In terms of trading volume market share, Kalshi has achieved a rapid leap from low visibility to a dominant position in just over a year. From being a relatively lesser-known participant during the 2024 election window, Kalshi has grown to hold more than half of the total trading volume in the prediction market sector, even as the number of market participants has become more diverse.

IV. Market Share of Trading Volume in Prediction Markets

Kalshi’s growth trajectory can be broken down into three distinct phases:

- Q4 2024: Breakthrough Phase During the U.S. election-related trading window in November 2024, Kalshi’s monthly trading volume reached the billion-dollar level for the first time, demonstrating that event options can support large-scale trading activity under the current regulatory framework. However, in terms of real-world visibility, this period was dominated by Polymarket, which frequently appeared on the front pages of major mainstream media. While Kalshi posted solid trading volumes, its public presence and attention were significantly lower than that of Polymarket.

- H1 2025: Brokerage Distribution Deployment Phase In the first half of 2025, Kalshi leveraged its regulatory advantage to expand widely across traditional financial and brokerage institutions. As platforms like Robinhood gradually launched event option products, Kalshi’s nominal quarterly trading volume reached $1.88 billion in Q2 2025, with its market share continuing to rise and recovering from the post-election lull. On the thematic front, sports-related options became a major vehicle for trading activity, laying the foundation for the explosive growth in the second half of the year.

- H2 2025: Surge in Sports Supply Drives Market Share Growth

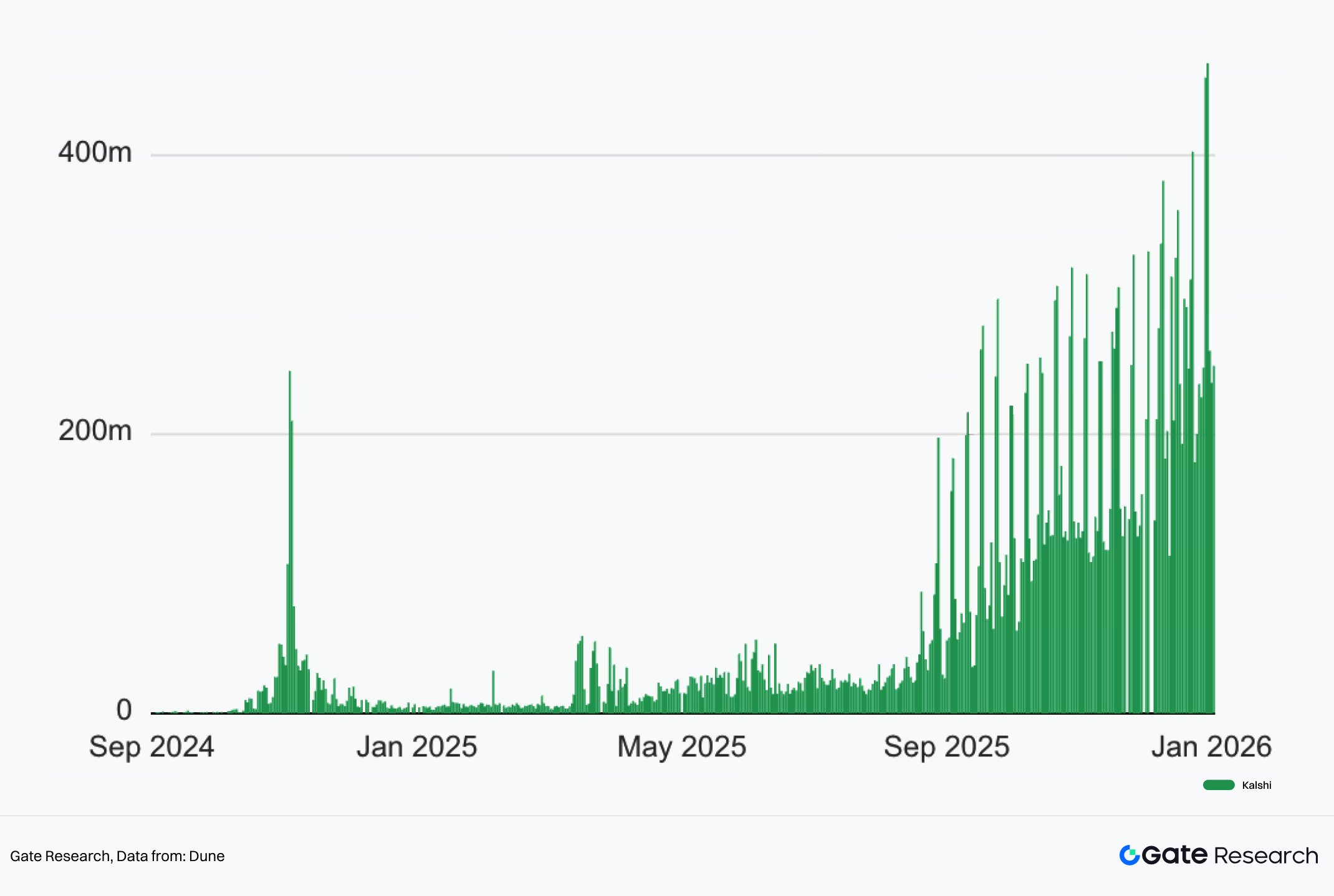

V. Kalshi Daily Trading Volume

In 2025, as the sports season entered a phase of dense supply, the NFL and NBA both kicked off in September and October, respectively. These two major leagues brought a continuous, high-frequency stream of options with highly standardized rules. Since most sports events take place over the weekend, this created a steady and consistent weekend trading rhythm for Kalshi, with weekend volumes significantly higher than on weekdays. On the weekend of January 11 and 12, Kalshi set a new historical record with trading volumes exceeding $450 million. As the seasons progressed, attention began to converge between the games and betting activity on Kalshi, further strengthening platform stickiness. Kalshi’s market share has since remained steadily above 50%.

3. On-Chain Exploration and Technical Strategy

3.1 Background and Motivation

After surpassing a 50% market share driven by brokerage distribution and high-frequency sports supply, Kalshi’s strategic focus remained unchanged: it continued to deepen its channel-based distribution while launching an on-chain exploration initiative. The goal was to expand trading access from off-chain fiat environments to on-chain liquidity networks.

Blockchain infrastructure naturally enables low-cost distribution. Once tokenized, event options can be seamlessly integrated into wallets, DEX aggregators, and DeFi protocols without complex KYC onboarding. Kalshi has publicly stated its intention to access on-chain liquidity through tokenized prediction markets, aiming to extend its sports options beyond brokerage channels and into the global crypto-native ecosystem.

Moreover, as the market grows and participants become more diverse, both users and integrators have shown increasing demand for verifiability in holdings, settlements, and position changes—especially in comparison to on-chain platforms like Polymarket. On-chain asset tokenization can more easily provide publicly verifiable status and settlement records from a technical standpoint.

It is important to note that going on-chain does not imply Kalshi is abandoning its existing compliance framework. Instead, the approach focuses on mapping part of its option exposure onto the blockchain in tokenized form, building on its compliant market base while expanding its distribution and integration boundaries.

3.2 Why Kalshi Chose Solana for Tokenization

Kalshi’s on-chain implementation is being built on Solana, with three main observable reasons for this ecosystem alignment:

- Network Performance and Cost Sports-related content inherently involves high-frequency trading and dense quoting, making it more sensitive to confirmation speed and transaction fees. Solana’s low costs and high throughput better support the execution experience required for real-time, high-frequency event options.

- Prediction Markets on Solana Are Still Small in Scale and Fragmented Within Solana’s ecosystem, several projects have explored the prediction market direction, but overall trading volumes remain significantly lower than on mainstream platforms. While Solana has active users and mature trading infrastructure, prediction markets have not yet formed entrenched monopolies. For Kalshi, this means lower entry costs.

- Tokenized Event options as a Sustainable Asset Issuance Model Kalshi positions “event option tokenization” as a sustainable way to issue tradable assets on-chain, creating a new stream of structured, modular financial products.

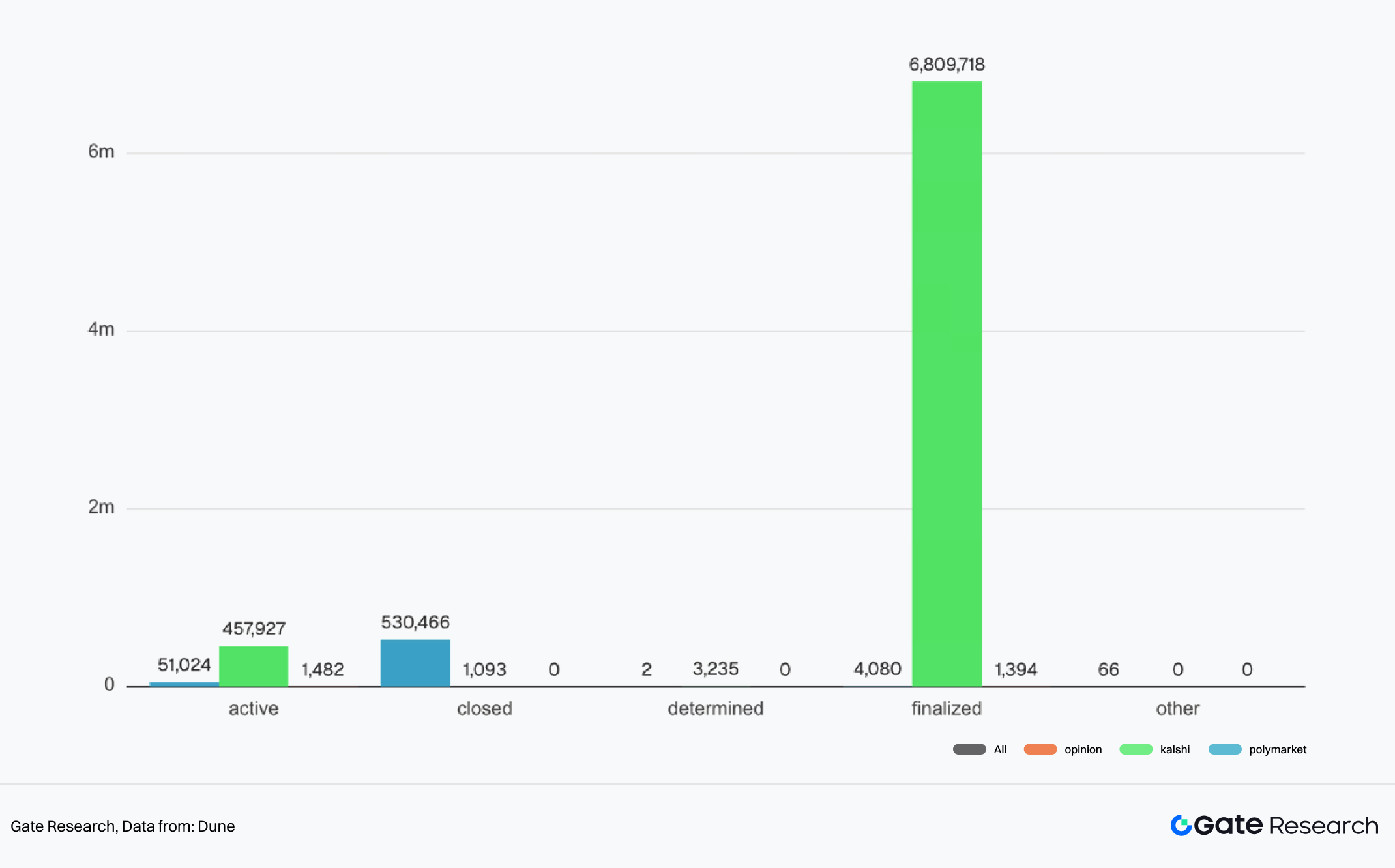

VI. Prediction Market Option Landscape

Kalshi’s event options are inherently suitable for standardization, mass generation, and strong time sensitivity. To date, Kalshi has “issued” over 7.2 million market options, of which more than 6.8 million have already reached expiration and been settled. If a large number of these short-duration event options are mapped on-chain as tokenized tradable positions, their distribution model may more closely resemble a continuously refreshed asset issuance system—rolling out around trending topics, with built-in expiration dates.

Solana, with its large base of meme token launchpads, trading tools, and active traders, is naturally aligned with this kind of high-volume asset issuance. Moreover, since event options have fixed expiration dates, capital is expected to roll over with contract maturity and the launch of new options. This could theoretically improve capital turnover efficiency and help alleviate the issue of long-term liquidity being trapped in low-activity assets, as often seen in the meme sector.

Within this framework, the on-chain competition around prediction markets goes beyond simply capturing trading volume from existing meme or other asset categories. It may evolve into a broader competition over the entry point for on-chain asset issuance and distribution—posing the question of whether event options can emerge as a new, scalable category of on-chain tradable assets. This, in turn, could push existing trading frontends to provide dedicated displays and trading sections for such contracts.

3.3 Key Developments

Kalshi’s on-chain progress can currently be summarized along three main lines:

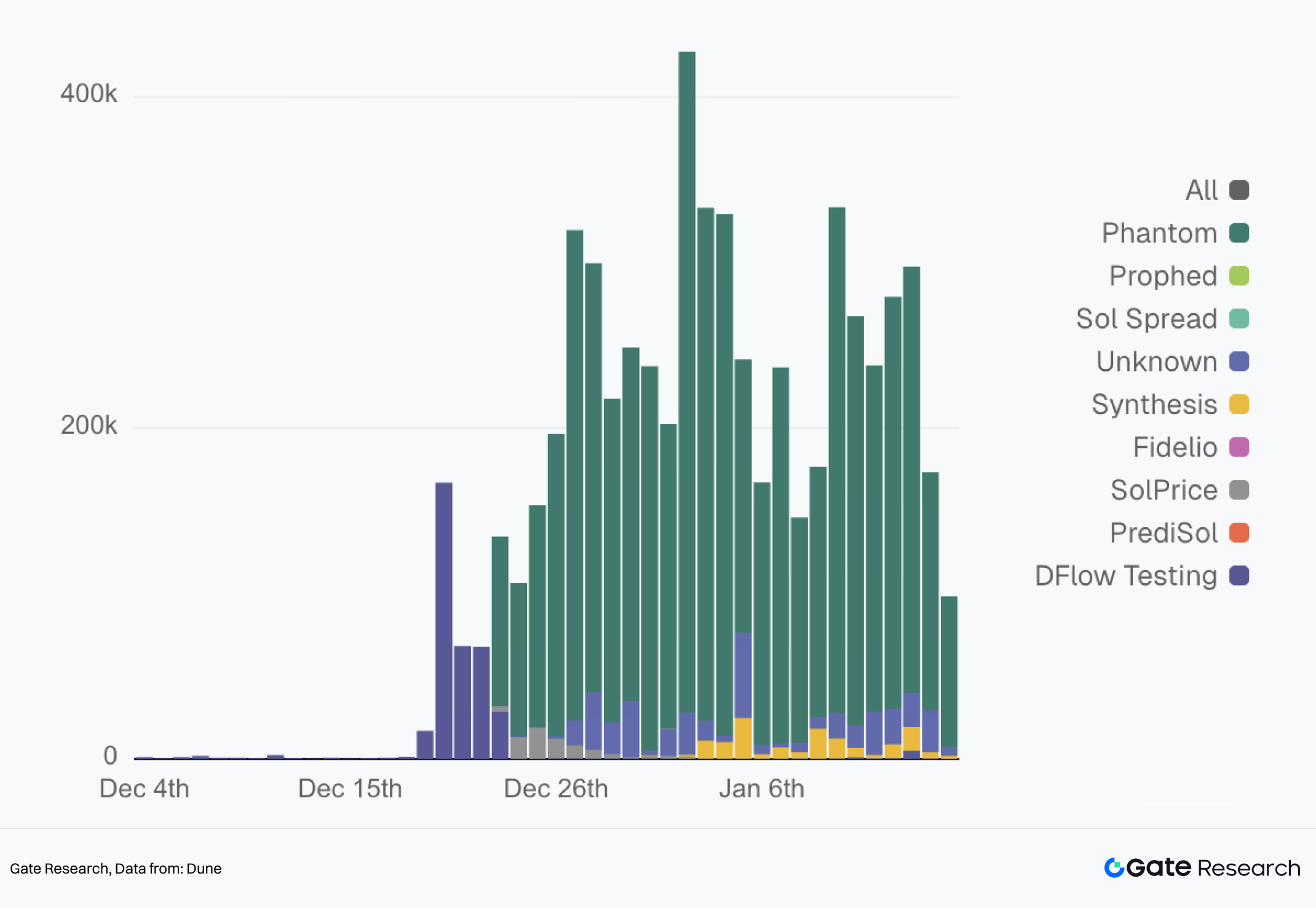

- Tokenized Event Options Launched on Solana In December 2025, Kalshi announced the launch of its Tokenized Predictions on Solana, enabling access to on-chain trading and integration scenarios through ecosystem components such as Jupiter and DFlow. Since mid-December, DFlow integrators have collectively processed over $6 million in trading volume, with average daily trading ranging between $200k and $300k.

VII. Daily Trading Volume Distribution of Kalshi-Supported DFlow Prediction Market API

- Modularization of Wallet-Side Distribution and Trading Experience In December of last year, Solana’s leading wallet, Phantom, also announced its integration with Kalshi’s prediction market (via DFlow API). This includes modules for market data display, trading, and community interaction, embedding event options into the wallet’s daily usage flow.

- Data, Oracle, and Interface Layer Development Kalshi is collaborating with RedStone to bring market data into a multi-chain environment, making it easier for third parties to read and integrate event option data across different blockchains.

3.4 Challenges and Constraints: Regulatory Adaptation and Hybrid Architecture Migration Costs

While tokenization has opened new distribution boundaries and ecosystem collaboration opportunities for Kalshi, it has also introduced two major higher-level constraints: one is the regulatory risk of reinterpretation, and the other is the engineering cost of migrating from a centralized system to a hybrid architecture combining on-chain distribution and mapping.

Uncertainty in Regulatory Adaptation

One of Kalshi’s core external challenges in recent years has been the conflict between state-level gambling regulators and the federal derivatives regulatory framework, especially regarding sports-related event options. State regulators tend to view some of these contracts as unlicensed sports betting or gambling variants, while Kalshi asserts that its event options, listed on a federally regulated Designated Contract Market under the CFTC, should fall under federal derivatives law with broader nationwide applicability.

Public cases illustrate the tensions. For example, the Massachusetts Attorney General filed a lawsuit against Kalshi, accusing it of “illegal and unsafe sports betting operations.” Similarly, Tennessee regulators issued a cease-and-desist order, which Kalshi responded to by filing a federal lawsuit. A federal judge temporarily halted Tennessee’s enforcement action. These incidents show that despite having federal regulatory credentials, the uncertainty of state-level enforcement can still impact Kalshi’s product rollout and market coverage.

In this context, tokenization adds further complexity to how the nature of event options is understood. Once tokenized and circulating on-chain, these contracts may draw more regulatory scrutiny around derivatives classification, payment and AML compliance, and gambling-related boundaries—especially when accessed across jurisdictions. A practical challenge for Kalshi is the need to continuously clarify product definitions, sales and distribution methods, and risk disclosures with regulators in order to reduce the risk of “reclassification.”Engineering Constraints of Centralized to Hybrid Architecture

Migrating from a centralized entity to partial on-chain distribution or tokenized exposure means transforming a closed and controlled trading system into a composable, integratable, and more variable open environment. This introduces significant engineering challenges. On-chain tokenized positions must maintain strong consistency with the off-chain main market to avoid cross-market arbitrage, pricing deviations, or risk mismatches. This consistency includes not only price anchoring but also contract specifications, expiry and settlement logic, and synchronization under extreme market conditions.

Additionally, centralized risk management systems struggle to achieve the same visibility and real-time control over on-chain wallets as they do within brokerage account systems. This raises new demands for Kalshi in defining permission boundaries, risk limits, and coordination mechanisms with key integrators and frontend platforms.

Taken together, the tokenization of centralized prediction markets is not a simple technical migration. It is a dynamic balancing act between regulatory certainty and the composability and distribution advantages of blockchain. Kalshi must avoid triggering regulatory redefinition of its products while ensuring that tokenization meaningfully enhances liquidity and distribution—without undermining its existing brokerage-driven scale.

4. Conclusion

4.1 Kalshi’s Long-Term Strategic Positioning

Kalshi’s long-term strategy follows a clear trajectory: using regulatory licensing and brokerage distribution as the foundation for growth, achieving scalable supply and volume through high-frequency sports themes, and then extending reach beyond brokerage accounts into on-chain liquidity networks via Solana-based tokenization.

With this, Kalshi is officially moving toward a dual-track development model—

- Off-chain: maintaining regulatory certainty, account systems, and efficient distribution;

- On-chain: emphasizing composability, integrability, and low-barrier distribution, with tokenized contracts enabling a more open and international participation structure.

However, it is also important to note that Kalshi’s compliance-driven distribution plus on-chain asset model is still in its early stages—and prediction markets as a whole remain early-stage, particularly regarding the regulatory clarity of on-chain activities. The sustainability of this model ultimately hinges on two conditions: whether the conflict between state-level gambling regulation and the federal derivatives framework can be effectively managed; whether on-chain trading can achieve meaningful scale without amplifying compliance risk or losing control over risk management.

4.2 Industry Insights

From an industry perspective, Kalshi’s path provides a reference framework for how centralized prediction markets might enter the on-chain space, with three key takeaways:

Distribution Power Often Outweighs Product Form in Early-Stage Growth

Prediction markets cannot scale through thematic innovation alone. Access to mature retail trading portals (brokerages, wallets, aggregators) directly affects liquidity and user growth. Kalshi’s case reinforces the reality that “distribution is product” and “channels are king.”High-Frequency, Template-Based Themes Are Key to Scalable Supply

Seasonal sports supply plays a crucial role in event options—it not only provides a constant stream of new events but also a stable trading rhythm and replicable listing mechanism. This makes prediction markets resemble an operational derivative supply system, rather than sporadic reactions to a few high-profile events.The Core Challenge of Centralized-to-On-Chain Migration Lies in Boundary Management

The hardest part is not tokenizing the contracts, but managing boundaries in an open environment: ensuring economic consistency between main markets and on-chain mappings, enforcing risk controls across entry points, and navigating compliance and product definitions. For the broader industry—and for more centralized entities with forecasting elements—hybrid on-chain/off-chain operations are a balancing process centered on permissions, limits, distribution, and product boundaries.

Overall, Kalshi’s case shows that scalable growth in prediction markets is largely driven by distribution channels and a high-frequency, standardized, and batchable supply mechanism. Brokerage distribution forms the backbone of Kalshi’s reach, while its on-chain exploration aims to extend that reach into blockchain ecosystems—without undermining the original strategy. Whether this model proves viable will ultimately depend on regulatory adaptability and the ability to govern its hybrid architecture effectively.

5. References

- Dune, https://dune.com/datadashboards/dflow-x-kalshi-prediction-markets

- Dune, https://dune.com/datadashboards/kalshi-overview

- Dune, https://dune.com/gateresearch/prediction-markets-overview

- Dune, https://dune.com/gateresearch/launchpad-but-prediction-market

Gate Research is a comprehensive blockchain and crypto research platform that provides readers with in-depth content, including technical analysis, hot insights, market reviews, industry research, trend forecasts, and macroeconomic policy analysis.

Disclaimer

Investing in the cryptocurrency market involves high risk. Users are advised to conduct independent research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such investment decisions.

Related Articles

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

DOGS Token Overview: Tokenomics and Airdrop Claiming (as of 2025)

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

Gate Research-A Study on the Correlation Between Memecoin and Bitcoin Prices

Grass (GRASS) — Decentralized AI Data Collection