Gate Research: Ethereum Leads Tokenized Commodities Issuance | Prediction Market Volume Hits New High

Summary

- BTC and ETH pulled back after recent rallies and entered a consolidation phase. Capital remains defensive, rotating toward relatively resilient sectors such as tokenized commodities/gold, payments, privacy, and DID.

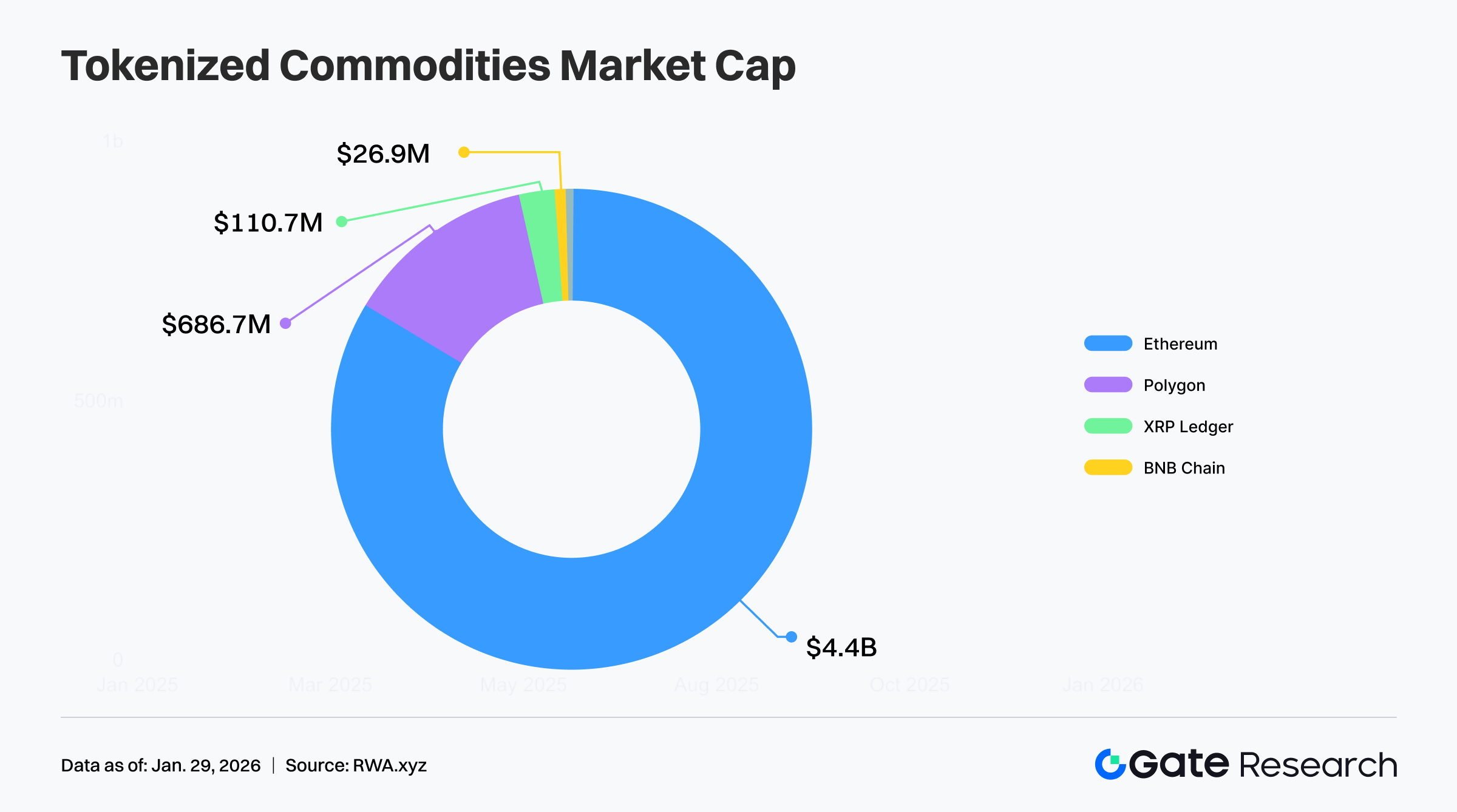

- Ethereum dominates the issuance of tokenized commodities, accounting for 85% of total market share.

- Long-term holders are accelerating distribution, and Bitcoin is facing its strongest selling pressure since August.

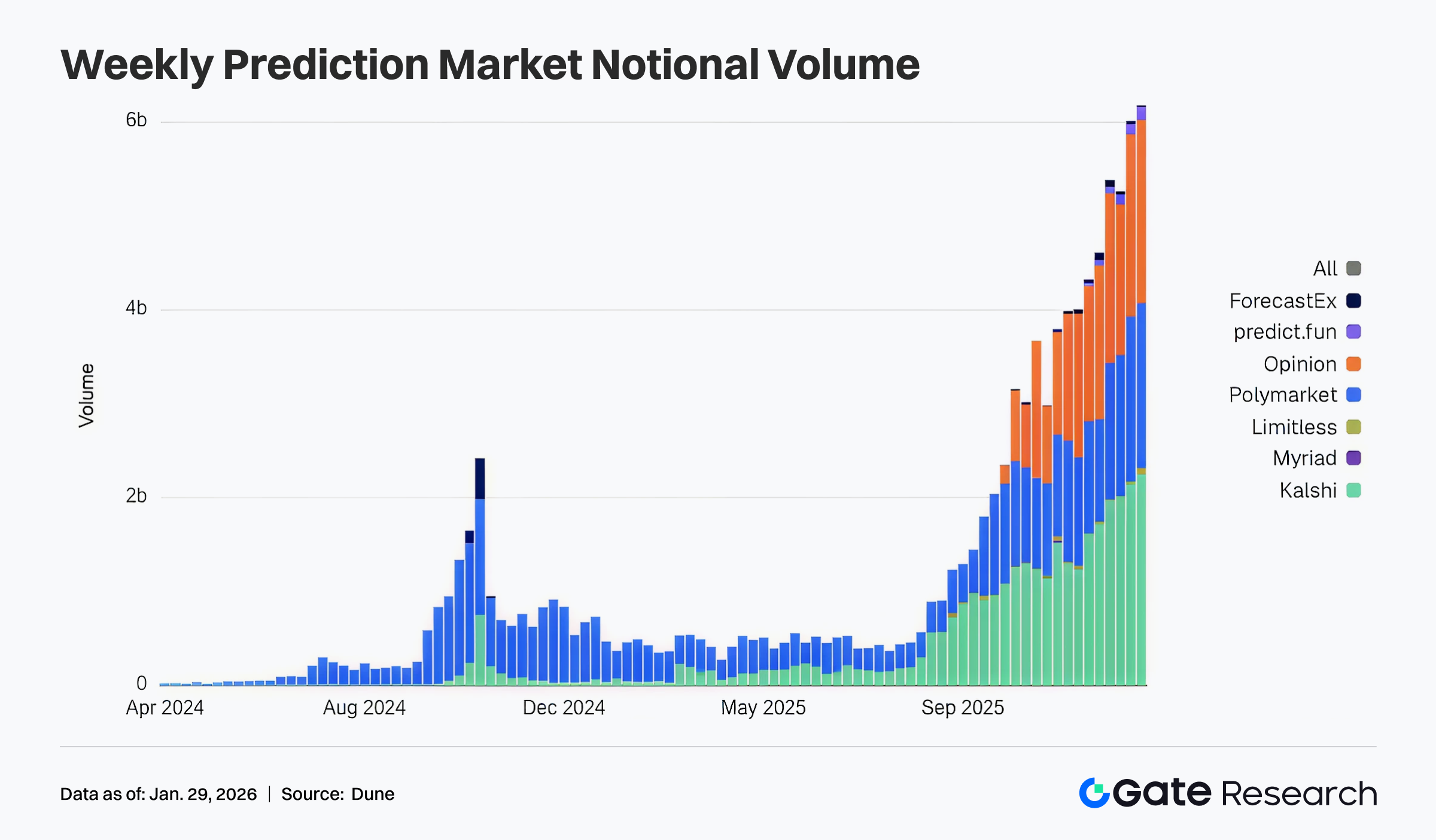

- Prediction market trading volume has reached a new all-time high, increasingly becoming the “on-chain expectation pricing layer.”

- Polymarket is driving a surge in USDC usage; Mizuho upgraded Circle’s rating and remains optimistic about its growth optionality.

- SUI will unlock approximately USD 60.94 million worth of tokens over the next 7 days, representing 11% of its circulating supply.

Market Overview

Market Commentary

- BTC Market Update — Over the past week, BTC rebounded from around USD 86,100 to near USD 91,200, but failed to hold at higher levels and has since pulled back to around USD 88,600, entering a weak consolidation phase. Short-term MA5 and MA10 have turned downward and tangled with MA30 before weakening further, with price falling back below the moving average cluster, signaling a shift from rebound to pullback. The MACD has rolled over near the zero line, histogram has turned green-to-red and expanded, indicating strengthening bearish momentum. In the near term, BTC is more likely to retest the key support zones around USD 88,000 and USD 86,100. If these supports hold, the market may digest selling pressure through range-bound consolidation.

- ETH Market Update — Over the past week, ETH rebounded from around USD 2,787 and rallied to near USD 3,045, but failed to stabilize above USD 3,000 and has since pulled back to around USD 2,993, forming a “pullback after breakout attempt” structure. MA5 and MA10 have converged with MA30 and started turning down, and price has fallen back below the moving average band, indicating short-term weakness. The MACD has also rolled over from positive territory, with the histogram turning negative, signaling fading bullish momentum and entry into a corrective phase. Key support lies in the USD 2,950–2,900 zone, while resistance remains near USD 3,045. Without a meaningful volume expansion, any upside is more likely to take the form of choppy upward consolidation rather than a clean breakout.

- Altcoins — Over the past week, capital has clearly tilted toward non-trading-oriented sectors. Tokenized commodities/gold, payment solutions, privacy infrastructure, and decentralized identity have shown relatively better resilience. Against the backdrop of choppy major assets, market style is shifting toward assets with real-world asset mapping, clearer compliance narratives, and stronger long-term application certainty, in order to reduce volatility driven by pure sentiment and high-leverage trading narratives.

- Stablecoins — The total stablecoin market capitalization currently stands at USD 308.0 billion, down USD 704 million over the past week, a decline of approximately 0.23%.

- Gas Fee — Ethereum gas fees have generally remained below 1 Gwei over the past week, with the highest single-hour peak at 1.97 Gwei. As of January 29, the daily average gas fee stands at 0.051 Gwei.

Trending Tokens

Over the past 24 hours, the overall crypto market has been weak, with most major assets pulling back. BTC is down approximately 0.67% and ETH down approximately 0.51%, forming the main drag on the index. XRP dipped about 0.20%, while SOL saw a deeper decline of around 2.12%. The stablecoin sector remains largely flat, indicating continued defensive positioning and no clear rebound in risk appetite. The market appears to be in short-term consolidation within a broader downward or sideways structure rather than entering a trend reversal.

Q Quack AI (+79.02%, Circulating Market Cap: USD 51.71M)

According to Gate market data, Q is currently priced at USD 0.032196, up 79.02% over the past 24 hours. Quack AI is building a “trust-minimized AI/Agent execution environment” around Q402, focusing on using cryptographic proofs and verifiable workflows to validate the reasoning and computational integrity of agents, and bringing this into on-chain execution scenarios. The system enables intent expression via a single verifiable signature, enforces strategy and risk checks during execution, and allows executors to sponsor gas and submit transactions, significantly reducing interaction friction and improving automation efficiency.

This rally is primarily driven by ecosystem expansion narratives. Recently, the team has emphasized integrations and collaborations with ecosystems such as Zypher and Kaia, embedding Q402’s trust-minimized execution capabilities into verifiable AI workflows and agent execution environments, while also extending use cases into stablecoin-native and capital-efficiency-focused on-chain contexts. As collaboration news continues to be released, the market is more inclined to interpret this as a signal of ecosystem resource inflow and potential adoption growth, driving concentrated capital inflows and amplifying price elasticity.

WMTX World Mobile Token (+21.76%, Circulating Market Cap: USD 44.08M)

According to Gate market data, WMTX is currently priced at USD 0.07095, up 21.76% over the past 24 hours. World Mobile Token is a DePIN project focused on telecom infrastructure, with a core narrative of expanding network coverage through a “shared network construction” model and incentivizing community and local operators to participate via the Network Builder mechanism.

This rally is likely driven by both ecosystem and fundamental catalysts. On one hand, the team has recently released user-side metrics such as 3 million daily active users, helping alleviate market concerns that DePIN is “concept-only with no real usage.” On the other hand, the continued improvement of Network Builder auctions and participation mechanisms strengthens expectations around network expansion and supply-side growth, driving a re-rating of the “telecom + DePIN” narrative.

SOMI Somnia (+20.38%, Circulating Market Cap: USD 50.68M)

According to Gate market data, SOMI is currently priced at USD 0.3058, up 20.38% over the past 24 hours. Somnia positions itself as an on-chain infrastructure project for applications and developers, with recent narratives centered around “Reactivity + Decentralized AI.” Through a “subscribe once, receive real-time events and bundled state updates” mechanism, it aims to provide low-latency data and state distribution for prediction markets, DeFi, and various event-driven applications.

This rally reflects a resonance between ecosystem progress and narrative catalysts. On one hand, roadmap updates and the articulation of “new primitives” have raised market expectations for its technical differentiation and developer adoption. On the other hand, continuous ecosystem exposure and application launches/previews reinforce the signal that “the network is expanding and apps are going live,” attracting concentrated short-term capital inflows.

Key Market Data Highlights

Validator Count Shrinks While Usage Stays Hot: Solana Shows Structural Divergence of “High Usage, Fewer Operators”

On-chain data shows that Solana’s daily active validator count has fallen below 800, down more than 65% from its early 2023 peak. At the same time, user-side non-vote transactions remain close to 100 million per day, indicating a clear divergence between network usage intensity and node participation. This usually implies that application-layer demand has not cooled, while the marginal cost/benefit structure for consensus participants has deteriorated, pushing some smaller operators out. In other words, “service output” remains high while the “supply side providing security and ordering” is shrinking.

More importantly is how this divergence affects security and resilience. A lower validator count theoretically increases centralization and coordination risks, and reduces censorship resistance and redundancy. However, risk does not depend solely on quantity, but also on staking distribution, node diversity, and whether key security metrics are deteriorating. Current explanations include incentive changes, rising voting-related costs and hardware thresholds becoming less friendly to small nodes, or a “cleansing” of low-quality or Sybil-like nodes. Going forward, key metrics to watch include staking concentration, changes in top validator shares, and whether the divergence between declining vote transactions and stable non-vote transactions leads to new trade-offs between performance and security.

Ethereum Leads Tokenized Commodities Issuance, Taking 85% Market Share

From the issuance distribution, tokenized commodities show a clear concentration on Ethereum, with about 85% of such assets issued on Ethereum. This reflects Ethereum’s role as the “default infrastructure” for asset tokenization, driven by a combination of mature smart contract and auditing ecosystems, deep DeFi liquidity and collateralized lending scenarios, higher integration with institutions and custody/compliance services, and stronger composability.

However, high concentration also brings structural risks and trend signals. On one hand, ecosystem advantages further reinforce the scale effect of leading chains, making new issuers more likely to continue choosing Ethereum. On the other hand, excessive concentration amplifies the spillover impact of a single chain’s costs, congestion, compliance, or technical roadmap changes on the entire sector, and increases the incentive for cross-chain expansion. Variables to watch include whether L2s absorb more new issuance and trading activity, whether other high-performance chains can divert share via lower costs and stronger distribution, and whether issuers’ trade-offs between “security/compliance control” and “cost efficiency/user reach” begin to shift.

Long-Term Holders Accelerate Distribution, Bitcoin Faces Strongest Selling Pressure Since August

According to Glassnode data, over the past 30 days, Bitcoin long-term holders (typically defined as holding for at least 155 days) have sold approximately 143,000 BTC, marking the fastest pace of distribution since August. This is also reflected in metrics such as long-term holder net position change: after a brief accumulation from late December to early January, long-term capital has turned back to net distribution, meaning higher-conviction, higher-cost basis coins are being released to the market.

In terms of price impact, concentrated selling by long-term holders often forms short-term upside resistance. It directly increases spot supply that needs to be absorbed and also weighs on market sentiment, making the market more prone to range-bound or corrective phases, especially when Bitcoin underperforms traditional assets. However, this does not necessarily imply a bearish long-term view; it may also represent profit-taking or portfolio rebalancing. The key lies in whether new demand can continuously absorb this supply (e.g., spot buying and institutional allocation). If absorption is sufficient, it may actually facilitate healthy coin turnover and set the stage for a cleaner supply structure ahead of the next trend.

Focus of the Week

Meta and Microsoft Double Down on AI Infrastructure: Bitcoin Miners’ “Compute Power Transition” Is Becoming a New Growth Engine

Meta and Microsoft have once again emphasized AI as a core strategic focus in their latest earnings reports. Microsoft CEO Satya Nadella stated that AI has already grown into a business comparable in scale to the company’s largest segments and is still in the early stages of mass adoption. Meanwhile, Meta expects 2026 capex to reach USD 115–135 billion, significantly above market expectations, mainly for building “superintelligence labs” and core AI infrastructure.

Against this backdrop, Bitcoin mining companies are accelerating their transition into AI and high-performance computing (HPC) infrastructure providers. As halving, rising costs, and intensifying competition compress traditional mining margins, miners are leveraging their advantages in power and data center infrastructure to provide compute services to cloud providers. Iren has signed a multi-year agreement with Microsoft, Cipher Mining has committed 300 MW of capacity to AWS, and Hut 8 and others are pursuing similar transformations. Capital markets are increasingly re-rating these companies as “compute infrastructure providers” rather than pure Bitcoin miners.

Prediction Market Volume Hits New High: Becoming the On-Chain “Expectation Pricing Layer”

Dune data shows that over the past year, weekly notional trading volume in prediction markets has undergone a structural surge, especially since the second half of 2025, accelerating sharply to nearly USD 6 billion per week. Platforms such as Polymarket, Kalshi, and Myriad are the main contributors, with newcomers like ForecastEx and predict.fun joining in, creating a multi-platform resonance effect.

This reflects prediction markets evolving from a niche crypto-native experiment into an on-chain “expectation pricing layer” covering politics, macroeconomics, technology, and social events. Against a backdrop of rising macro uncertainty, AI cycles, and geopolitical dynamics, demand for “expressing views with capital” is increasing. Prediction markets are beginning to take on part of the price discovery and expectation aggregation function, and may become another crypto application vertical with real-world narrative and scale effects after stablecoins and DeFi.

Polymarket Drives Surge in USDC Usage; Mizuho Upgrades Circle and Sees Growth Optionality

Mizuho Securities upgraded Circle’s rating from “Underperform” to “Neutral,” driving the stock up about 4%, citing rapid growth in USDC usage on Polymarket as a new demand engine. Analyst Dan Dolev estimates Polymarket’s annualized trading volume could reach around USD 50 billion in 2026, roughly three times that of 2025, and believes this could drive USDC market cap to grow by about 25% or more from current levels. Based on this, he raised his forecasts for USDC circulation and Circle’s revenue in 2026 and 2027.

Structurally, Polymarket is bringing a large number of non-crypto-native users on-chain through event trading, opening new use cases and demand channels for USDC. However, Mizuho remains cautious about Circle’s medium-term upside, citing rate-cut cycles, rising distribution costs, and intense competition from stablecoins like Tether, which may partially offset Polymarket’s positive impact. Its USD 77 price target implies only limited upside. This suggests that while USDC’s growth narrative has gained a new variable, it is not yet enough to fundamentally reshape the competitive landscape of the stablecoin sector.

Funding Weekly Recap

According to RootData, between January 22 and January 29, 2026, several crypto and related projects announced funding rounds or acquisitions, spanning blockchain infrastructure, payment networks, and asset management. The largest deals include:

BitGo

Announced the completion of an approximately USD 213 million IPO on January 22, valuing the company at around USD 2.08 billion, with participation from institutions including YZi Labs. BitGo is a US-based digital asset infrastructure company providing institutional-grade custody, security, trading, and lending services, aiming to deliver comprehensive custody and security solutions for institutions.

Superstate

Announced the completion of an approximately USD 82.5 million Series B round on January 22, led by Bain Capital Crypto and Distributed Global. Superstate is a blockchain-based government bond fund using Ethereum as a record-keeping layer, aiming to build compliant on-chain securities issuance and trading infrastructure and推动 capital market assets onto blockchain rails.

Mesh

Announced the completion of an approximately USD 75 million Series C round on January 27 at a valuation of around USD 1 billion, led by Dragonfly Capital with participation from Paradigm and Coinbase Ventures. Mesh is a global crypto payment network aiming to enable seamless cross-chain and cross-wallet payments through a unified payment layer, advancing interoperability in digital asset payments.

Next Week to Watch

Token Unlocks

According to Tokenomist data, several major token unlocks are scheduled over the next 7 days (2026.01.29 – 2026.02.05). The top three are:

- SUI will unlock approximately USD 60.94 million worth of tokens, representing 11% of its circulating supply.

- XDC will unlock approximately USD 32.45 million worth of tokens, representing 4.4% of its circulating supply.

- EIGEN will unlock approximately USD 12.25 million worth of tokens, representing 6.7% of its circulating supply.

References:

- Gate, https://www.gate.com/trade/BTC_USDT

- Farside Investors, https://farside.co.uk/btc/

- Gate, https://www.gate.com/trade/ETH_USDT

- Gate, https://www.gate.com/crypto-market-data

- CoinGecko, https://www.coingecko.com/en/cryptocurrency-heatmap

- CoinGecko, https://www.coingecko.com/en/categories

- DefiLlama, https://defillama.com/stablecoins

- Etherscan, https://etherscan.io/gastracker

- Rootdata, https://www.rootdata.com/Fundraising

- Tokenomist, https://tokenomist.ai/

- Coindesk, https://www.coindesk.com/markets/2026/01/28/meta-and-microsoft-continue-going-big-on-ai-spending-here-s-how-bitcoin-miners-could-benefit

- Dune, https://dune.com/datadashboards/prediction-markets

- Coindesk, https://www.coindesk.com/markets/2026/01/28/circle-shares-rise-after-mizuho-upgrades-stock-on-polymarket-driven-usdc-growth

- X, https://x.com/Cointelegraph/status/2016640620803096936?s=20

- RWA.xyz, https://app.rwa.xyz/commodities

- X, https://x.com/Cointelegraph/status/2016625054092517531?s=20

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

Exploring 8 Major DEX Aggregators: Engines Driving Efficiency and Liquidity in the Crypto Market

What Is Copy Trading And How To Use It?

What Is Technical Analysis?

How to Do Your Own Research (DYOR)?

12 Best Sites to Hunt Crypto Airdrops in 2025